stoxdox: Primary Research Reports

Primary research reports anchor the stoxdox service. The reports feature a comprehensive fundamental analysis, a broad technical overview, and a potential return spectrum with associated price targets when appropriate. A key feature of our primary research is the risk/reward rating which can be either positive, neutral, or negative. Or 1, 2, and 3 in the stoxdox – Portfolio Tool, respectively.

The primary research reports are constructed as an intermediate-term foundation and are designed to be an extended framework for approaching each investment opportunity through time, thereby serving as a decision support tool. We call each of our primary research reports a “dox,” hence our slogan: “You’ve got to dox your stocks!”

I will guide you through a primary research report below while relating the various use cases back to the stoxdox – Portfolio Tool.

Pfizer is an excellent example of the stoxdox platform design. We serve the entire risk/reward spectrum, from conservative/income-oriented investors through aggressive/growth-oriented investors. Enabling maximum use cases across the investor universe. All investors prefer higher return potential with lower risk, Pfizer is an opportunity for the entire universe of investors.

Pfizer is unique in that it scores a 1 across the board in the stoxdox – Portfolio Tool. It offers a positive risk/reward rating (1), below average risk or ē (1), and above average income potential or Ʃ+ (1). Please note that ratings of (1) through (3) are always from best (1) to worst (3).

Pfizer Inc.

Report date: October 17, 2021

Risk/Reward Rating: Positive

Price as of the report: $41.75

Price at 12-20-21 peak: $61.71

stoxdox first price target: $67.38

Price today, 7-22-22: $51.12

Asymmetric risk/reward opportunity:

- Maximum upside since report: 48%

- Maximum downside since report: 0%

Report Excerpts and Use Cases (italics added):

Excerpt: The completion of Pfizer’s business transformation significantly strengthened the company’s financial position and investment capacity…

I deconstruct Pfizer’s underlying performance and business drivers thereby creating a framework for viewing the Pfizer investment case…

Revenue Growth

Pfizer posted incredible revenue growth of 92% in Q2 2021 and raised the top end of its earnings guidance…

the obvious question is why does Pfizer receive such a low valuation?…

Use Cases: In the stoxdox – Portfolio Tool, sorting first by ē or risk (ascending), then by RRR or the Risk/Reward Rating (ascending), and then by Ʃ+ or income potential (ascending) would produce a list of opportunities similar to Pfizer, which appeals to the universal investor. All investors prefer below-average risk, above-average income, and above-average return potential.

Excerpt: Portfolio Detail

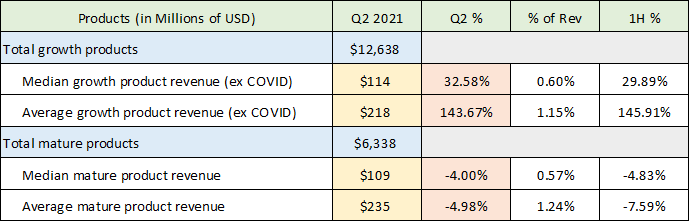

I breakdown Pfizer’s product sales into two categories: growth products and mature products… I summarize the product portfolio details and draw out the important characteristics of Pfizer’s current drug portfolio…

The most important characteristic of the overall portfolio is the diversification, excluding the COVID vaccine (yellow highlighted cells in each table). Across the portfolio the average product only comprises 1.15% to 1.24% of total sales. The median product accounts for a mere 0.57% to 0.60% of Pfizer’s total sales. This raises the safety level of the portfolio overall…

…the growth products in the portfolio are growing much more rapidly than the mature products are declining (the orange highlighted cells in the table above). The median growth product is growing at 33% annualized while the median mature product is declining by only 4%…

Geographic Growth Opportunities

The international outperformance is being driven by COVID vaccine sales and should continue into 2022. Vaccine sales are likely to open the door to closer business ties internationally and accelerate non-COVID related sales in the future…

Use Cases: The excerpt above speaks directly to Pfizer’s below-average risk rating or ē in the stoxdox – Portfolio Tool. One of the challenges in the biotech and pharmaceutical industries is the reliance on a few large product successes. Pfizer’s drug portfolio is extraordinarily well diversified.

This is somewhat ironic in that Pfizer has just executed the single most successful product launch ever with its vaccine portfolio. While many fear investing in Pfizer due to the inevitable reversal of a large part of its recent vaccine success, stoxdox members are informed of Pfizer’s sustainable prospects. Given the question above “why does Pfizer receive such a low valuation?” stoxdox readers know that Pfizer’s incredible vaccine success is not priced into the shares.

Excerpt: Cash Flow

The potential for amplified growth opportunities presents itself at an opportune time for Pfizer…

Annualizing Pfizer’s first half 2021 free cash flow produces a run rate of $29.5 billion for 2021. For reference, this is in the neighborhood of Amazon’s (NASDAQ: AMZN) all-time peak annual free cash flow…

The rapid advancement in technology is likely to open many doors to incredible speed and scale of discovery. Pfizer is in the enviable position of having…

Balance Sheet Strength

Over the past year Pfizer has improved its tangible balance sheet position by $25 billion…

Pfizer now possesses all the ingredients needed for an explosive growth investment cycle…

Financial Performance and Guidance

The extraordinary free cash flow generation and large established growth capital position in one of the most dynamic sectors of the future calls into question the low valuation multiple of 10x…

…there is substantial room for Pfizer to surpass the consensus earnings estimate for…

Use Cases: In the above excerpt, a growth story begins to unfold in the primary research. With Pfizer shares trading at only 10x earnings, the market is clearly not pricing growth into Pfizer’s future. This is an ideal situation for investors: low expectations and a low valuation combined with a solid, low-risk growth opportunity offering above-average income. Pfizer has universal investor appeal.

In the stoxdox – Portfolio Tool, sorting first by RRR or the Risk/Reward Rating (ascending), then by ē or risk (ascending), and then by dox % ∆ or the stock performance since that last primary research report (ascending) would produce a list of opportunities similar to Pfizer. The final sort by worst performance to best produces an actionable opportunity set for value-oriented investors.

Changing the final sort dimension above, dox % ∆, to descending order would produce an actionable opportunity set for momentum-oriented investors (best performers to worst). Regardless of the investment objective or type of investor, all investors prefer below-average risk, above-average income, and above-average return potential.

Excerpt: High Multiple Profit Margins

Pfizer’s profit margins are exceptional by all standards and suggest a premium valuation multiple on earnings is in order… hinting at significant upside potential for the shares…

Upside Revenue Surprise Potential

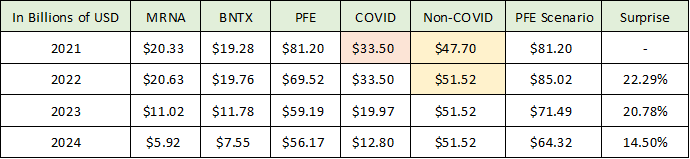

A perfect storm could be created for a materially higher share price… The following table was compiled from consensus revenue estimates…

The resulting revenue forecast based on these assumptions (PFE Scenario column) offers considerable upside surprise to current consensus estimates (PFE column)…

The Upside Scenario

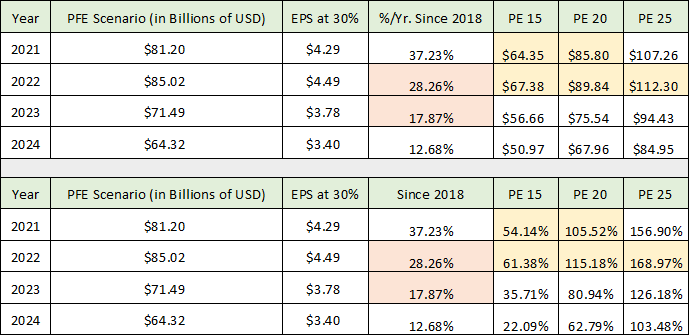

In the following table I transform the Pfizer revenue scenario above into an estimate of earnings… These growth rates would easily support each of the future PE scenarios outlined below…

Under these conditions Pfizer offers 54% upside on the low end (PE 15 on 2021 EPS) and 169% upside on the high end (PE 25 on 2022 EPS)…

Valuation

The well-below-average risk level implied by Pfizer’s current valuation receives strong confirmation from the charts…

Use Cases: In the above excerpt, the case for a premium valuation is combined with Pfizer’s low valuation and growth story to reveal material upside surprise potential. Upside surprises are a powerful catalyst for stocks. This is especially the true when starting from a low valuation point, which is the case for Pfizer.

This section also highlights the importance of integrating the primary research reports and the stoxdox – Portfolio Tool. The primary reports provide invaluable context for viewing and sorting within the stoxdox – Portfolio Tool.

For example, the potential upside return spectrum of 61% to 169% above provides critical information for viewing Pfizer in the stoxdox – Portfolio Tool. A foundation is laid and an extended framework is created for approaching the Pfizer investment opportunity through time. The positive risk/reward rating is transformed into an actionable opportunity through time for the entire universe of investors.

Excerpt: Technicals

The technical backdrop for Pfizer speaks to the incredible stability of the shares and the building of a long-term support foundation. The support foundation is well defined by the blue line…

Each of these support levels represents minimal downside risk…

The move above the orange line… suggests that Pfizer is beginning to probe an upside breakout… The more vibrant character change is clearly visible on the following…

This type of share price vibrancy is out of character for Pfizer… The character change is very bullish and suggests an increasing probability of a budding bull market…

The current share price offers an excellent entry point from a technical perspective on all time frames…

Use Cases: This excerpt speaks to the essence of the stoxdox platform. We curate the most asymmetric, relevant, and timely risk/reward opportunities of our times. stoxdox is designed for all investors in search of the highest quality, unbiased, professional analysis delivered in an actionable format.

The technical analysis section of our reports becomes animated when combined with the fundamental analysis which precedes it. A common error many make is to view only fundamentals or only technicals when weighing an investment opportunity.

The use cases for technical analysis cover the entire investor spectrum and every investment decision. All investors must consider the price behavior of each opportunity as it contains the message of the market at any given moment. That said, price behavior on its own is meaningless for all but pure trading use cases. Even here, traders who are informed by the fundamentals in addition to the technicals have a distinct competitive advantage.

This is the competitive advantage offered through the stoxdox platform. Our information is designed to be actionable for those with longer-term holding periods as well as those with shorter-term holding periods as the shelf life of our primary stock reports is intended to be long. The primary research reports are constructed as an intermediate-term foundation and are designed to be an extended framework for approaching each investment opportunity through time, thereby serving as a decision support tool for all investors.

Excerpt: Summary

When one combines Pfizer’s incredible free cash flow generation and powerful balance sheet with the vast opportunity set on display in biotechnology, a compelling growth story emerges. Pfizer is on the cusp of a historic growth investment cycle…

Pfizer offers a rare asymmetric growth opportunity. The shares are unbounded to the upside while the downside is anchored by strong fundamentals, an incredibly low valuation, and long-term technical support.

Use Cases: The universal investor. We have designed our full suite of services, in addition to the primary reports, to offer members an incredible value proposition. This is a competitive advantage offered through the stoxdox platform. We empower members with a continual stream of opportunities, from current income through extraordinary growth companies, curating top opportunities for all market cycles.

The primary research reports and snapdox summary reports underpin the stoxdox – Portfolio Tool. It is designed to empower you by providing a continuous stream of actionable information across our entire research universe. Please let us know if you have any questions, it is an invaluable tool for maximizing your membership value.

You have the power.