The discussion of the Founding Fathers of the enlightenment in “Flying Jefferson airlines“ serves as an excellent launch pad for a second piece in the “Metamorphosis of the media“ series. Recalling Thomas Jefferson’s foundational concept from “Flying Jefferson airlines” sets the stage:

I have sworn upon the altar of God eternal hostility against every form of tyranny over the mind of man.

Given the above conceptual model, it is no surprise that the Founding Fathers of the enlightenment had an unquenchable thirst for information across all subject matters, and devoured books accordingly. The reason for this and the connection to Jefferson’s foundation model is perfectly captured in the book Fire and Light: How the Enlightenment Transformed Our World (James MacGregor Burns, 2013), which is attributed to John Adams’ ideas:

He arrived at a general law that human beings in “a State of Ignorance” tended to be enslaved while those “enlightened with Knowledge” lived in freedom. Moreover, knowledge “monopolized, or in the Possession of a few, is a Curse to Mankind.” It should be dispersed among all ranks, with equality preserved.

The critical difference between the pursuit of knowledge in 2024 compared to the age of the enlightenment centuries ago rests in the means by which information is gathered, stored, retrieved, and transformed.

Wiley

In terms of investment opportunities tied to a broad-based pool of information and knowledge, book publishers immediately come to mind. John Wiley & Sons, Inc. (NYSE:WLY), also known as Wiley, is just such a company. It is a leading pure play in the publishing space with a focus on educational, technical, and professional information across many domains of knowledge.

In fact, Wiley describes itself as “The Knowledge Company” which “enables the creation of new knowledge and its application in science, learning, and innovation,” in the introduction to its December 6, 2023 investor presentation. As knowledge is the investment opportunity under consideration, Wiley earns a spot on the watchlist for investors.

Warning

Before going any further, it should be noted that I am not an expert on the inner workings of the publishing industry as it stands today. Based on my observations, the inner workings appear rather quirky, or nuanced if one prefers. This appears to be especially the case for academic, technical, and professional publishers.

The quirky nature of the publishing industry is reflected in the stagnation of Wiley’s sales over the past decade. Due to Wiley’s stagnation, and the industry conditions which fostered it, we must first take a step back to view the source of the troubles. In this way we can better understand when and if Wiley will come off the investor watchlist and enter the arena of opportunity.

Spintronics

When viewing the stagnation of the publishing industry, spintronics immediately comes to mind when conceptualizing both the problem and the solution. In layman’s terms, spintronics is the field of knowledge which deals with electron spin. The spin of an electron is distinct from its orbital motion around a nucleus. Specifically, in the field of electronics, Wikipedia summarizes spintronics as follows (emphasis added):

The field of spintronics concerns spin-charge coupling in metallic systems… Spintronics fundamentally differs from traditional electronics in that, in addition to charge state, electron spins are used as a further degree of freedom, with implications in the efficiency of data storage and transfer.

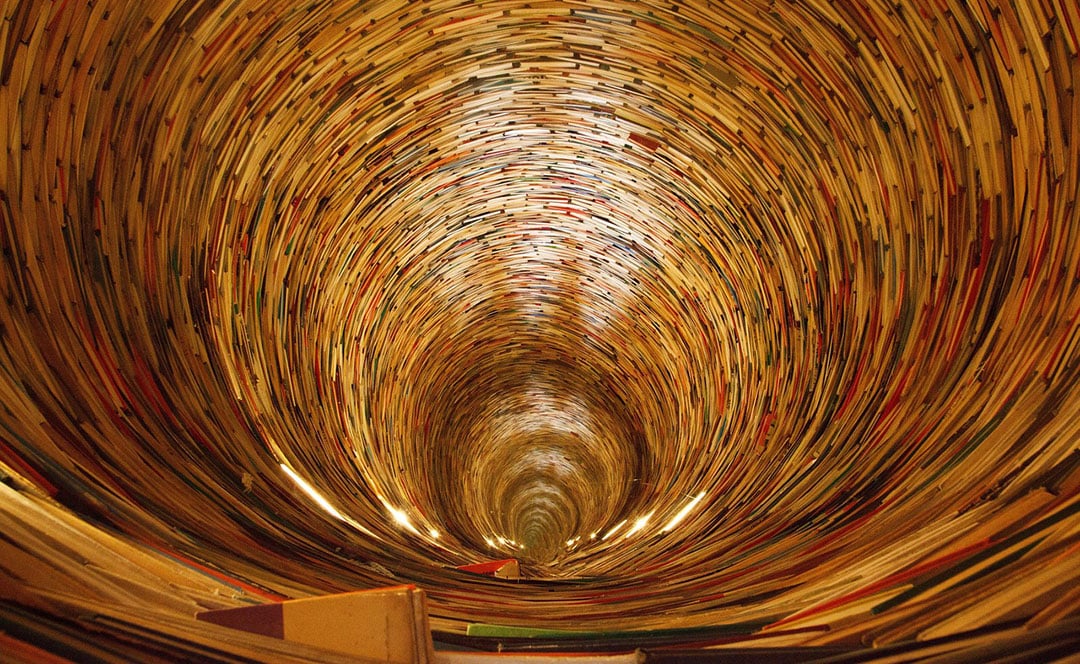

Thinking in terms of electrons and wider conceptual models, we can view Wiley’s current condition as being in the charge state of traditional electronics, or publishing as it were. In this traditional industry charge state, Wiley is trapped in a vortex of stagnation.

Generally speaking, Wiley is now confined to selling books and publications to students, professionals, and field experts at price points which are well beyond the reach of the general population, hence the lack of growth. As such, the critical question for investors monitoring Wiley on the watchlist is whether or not Wiley can “spin up” and create the additional degrees of freedom required to escape the industry stagnation vortex.

Can Wiley Spin Up?

From the perspective of current conditions and the long record of stagnation, one would have to answer no, Wiley cannot spin up. At minimum, one would conclude that it is very unlikely given the longstanding trend of no growth. On the other hand, stepping back to take a fresh look at the industry as if it were a blank slate, the answer would most certainly be yes, Wiley can spin up.

Metamorphosis of the Media

Current conditions in the educational, technical, and professional publishing industry closely resemble those in the financial media industry, which was covered in “Metamorphosis of the media.” The Dali metaphor introduced in the report is directly applicable to Wiley and the publishing industry. The following passage is from the summary section (emphasis added):

That said, many of today’s brands have significant equity growth potential as part of various larger content platforms. Though such platforms do not currently exist, segmenting information delivery along subject matter lines could spur brand-changing growth without cannibalizing the core product.

The bolded section in the above passage holds the key for Wiley to turn the lock and open the door to greater degrees of freedom.

In essence, what is needed in the media sector, broadly speaking, are larger content platforms from which to monetize or equitize the intellectual property of both publishing firms and content creators. The architecture of such future platforms would need to be both sustainably accessible to the broader population of the world as well as being functional given the specific platform use case, such as one for investors.

For example, in “Metamorphosis of the media,” I estimated the addressable target market in the financial media industry to be 288 million people globally, using a subscription-based model priced at $360 per year. In just this one use case, from an investor perspective, many categories within Wiley’s content library would prove to be quite valuable.

In addition to existing content lines being of great value to investors, such larger platforms would incentivize all manner of new content ideas and content creators for publishers. As demand for information would grow exponentially on the larger content platforms, so too would the supply of content creators, information, and publishers.

If such platforms materialize, Wiley’s degrees of freedom could expand quite rapidly, thus freeing it from the stagnation vortex in which it and the industry find themselves.

Investor Example

To provide further color regarding what I have in mind when speaking of the possibility of future content platforms and the use cases (and thus degrees of freedom that they enable), an example is in order. In the report “Top commodities for the energy transition,“ I utilized a research report from Wiley’s Journal of Industrial Ecology in analyzing the mining industry and mining companies from the perspective of an investor.

Though the report focused on the ecological effects of Chinese demand for base metals through 2050, the information was directly applicable across a broad spectrum of the investment universe. This illuminates the nature and dynamism of larger media platforms. Network effects are the mechanism of action towards ever increasing degrees of freedom, and thus change.

Industry research in all manner of subjects, such as the ecological effects of Chinese base metal demand, is a common academic and professional pursuit. As industries are comprised of individual companies, industry research is directly relevant to the investment universe. As such, much of Wiley’s content offers direct value for the universe of investors.

Counterintuitively, in terms of the architecture of larger content platforms, much of the information in any particular piece of Wiley published content is of no use. In the ecological research report example, from an investor perspective, the ecological discussion at the core of the report has no practical use case for an investor. Though investors have no use for most of the information in such reports, they do have a great deal of use for specific pieces of information, assuming an investor can search for such pieces.

This is a key distinction to be made from the perspective of a media company. The primary risk is cannibalizing one’s existing business lines. Larger content platforms which are built around extremely specific, but widely shared use cases reduce this risk to a negligible level.

In essence, the larger content platforms envisioned here would be structured opposite of Wiley’s structure. Wiley provides highly technical information pertaining to specific subject matters for educational and professional purposes. Wiley’s existing business model, or its charge state (incorporating the spintronics metaphor), produces a small number of highly sophisticated and specialized end users.

Summary

The architecture of larger content platforms, if they materialize, is entirely complimentary for publishing companies such as Wiley. Importantly, an investor platform is but one of a theoretically infinite number of larger content platforms from which media companies may monetize or equitize intellectual property.

As these larger conceptual content platforms are complimentary and do not yet exist, stagnation appears to be a choice, whether or not consciously made. In this regard, the educational, technical, and professional publishing industry shares much in common with the financial media industry.

Wiley can spin up if it chooses.