In reviewing opportunities across the media landscape, Salvador Dali’s Metamorphosis of Narcissus comes to mind and serves as an actionable metaphor for investors. Dali’s painting depicts the Greek myth of Narcissus, which is summarized by Wikipedia as:

The goddess Nemesis, taking pity on Echo, convinced Narcissus to gaze into a pool. Upon seeing his own face reflected in the water, Narcissus fell in love with his own reflection. Because he was unable to embrace his own reflection, Narcissus too wasted away and in his place grew the flower that bears his name, the narcissus.

Metamorphosis of the Media

As value in the media industry is largely comprised of intellectual property, the search for opportunities in the industry is essentially a search for brand equity potential. I am speaking of the content creators rather than the platforms which deliver media, such as The New York Times and The Wall Street Journal rather than Google and Facebook.

The Financial Media

As stoxdox, Inc. is a financial media company, I am particularly interested in that subsector. Having personally and professionally used and observed the financial media over many decades, what is most notable is the lack of metamorphosis.

I do not intend the Dali metaphor as an insult as it is used literally to depict petrification. As this is a common failure of companies across all industries, the Dali metaphor is universally applicable. When the petrification of the financial media is placed on the canvas of a decades-long information revolution, the image created is both fascinating and perplexing, Daliesque even.

News Corporation

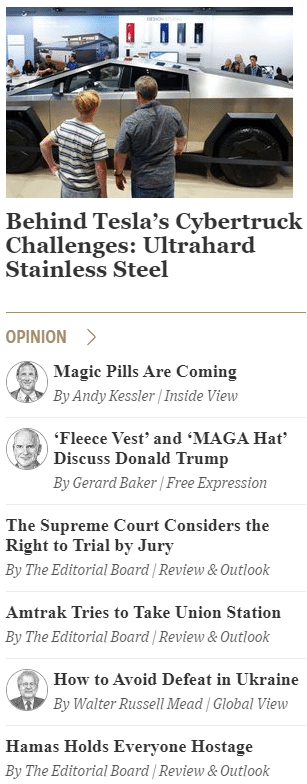

A clear leader in the financial media is News Corporation, the owner of The Wall Street Journal, Barron’s, Investor’s Business Daily, and MarketWatch. I view the first three to be the leaders, possessing material brand equity growth potential.

The Wall Street Journal is the industry leader by a wide margin with approximately 4 million subscribers. For perspective, I estimate the total global addressable financial media market to be 288 million people with a purely subscription-based business model.

If in the ballpark, the growth opportunity for News Corporation’s portfolio of brands is enormous. That said, there are currently no signs of a growth inflection developing.

Dali and the Three Amigos

Returning to what I described as fascinating and perplexing, the petrification of the financial media during an information revolution. The industry is quite literally reflecting upon itself. For example, the following bullet points were extracted from The Wall Street Journal’s news mission statement:

- We are the definitive source of news and information… and are key to understanding it… being the first read and the last word.

- We have an important social purpose. Society benefits from a common set of verifiable facts… Providing those facts informs debate and contributes to the greater good.

- Our audience is anyone…

What you will notice is that the mission statement is inward-looking, reflecting on itself as the authority and purveyor of facts. The audience appears to be an afterthought.

Mirror Mirror

From a mission standpoint, the question is how many subscribers beyond 4 million will pay each year to receive The Wall Street Journal’s authority on a wide range of topics?

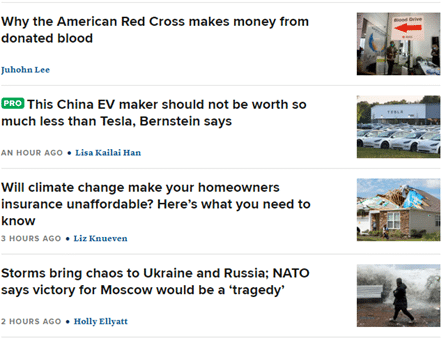

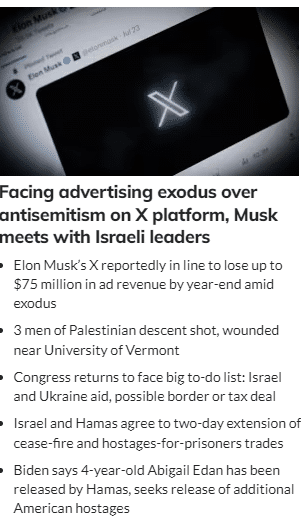

To answer that question, I conducted a cursory comparison of three financial media websites: The Wall Street Journal, CNBC, and MarketWatch. The following screenshots are from the main page of each company’s website on November 27, 2023. They are a small sample from each and are representative of the information provided.

The entire sample of content in the screenshots from each company’s main page depicts similar information themes, broad subject matter coverage, high frequency “news,” and nonactionable information, from the perspective of an investor. Interestingly, the information structure of each company’s content is a mirror image of the physical newspaper, digitally delivered.

Regarding the media industry reflecting upon itself, I would go a step further and say that they are all indistinguishable from each other. As such, though it is the leader, it is difficult to envision News Corporation competing for the 288 million subscriber opportunity using its existing brands as the flagship.

Summary

The question: who will capture the 288 million subscriber opportunity in financial media? Given the petrified state of the legacy financial media, it is highly unlikely that any of today’s leading brands can do so.

That said, many of today’s brands have significant equity growth potential as part of various larger content platforms. Though such platforms do not currently exist, segmenting information delivery along subject matter lines could spur brand-changing growth without cannibalizing the core product.

In the deluge of the information age, media brands would be well served by turning their mirrors outward. A metamorphosis is needed to grow.