Sensitivity to initial conditions is a fundamental principle underlying all systems. It applies on all scales ─ whether a fruit orchard planted in a desert, an investment opportunity, or the distribution of matter in the universe following the Big Bang. The initial conditions determine the underlying space-time fabric on each scale.

Translation: Systems and Initial Conditions

Investment opportunities can be thought of in terms of translating initial conditions and systems. On the systems side are the various investment strategies. The possible varieties of such tools are theoretically unlimited. While initial conditions are particular to each investment opportunity, they also include systemwide commonalities such as the stage of the economic cycle.

Passive Versus Active

It is not a stretch to say that the most heated system debate today is between passive and active investment strategies. In fact, the socioeconomic and market effects of passive versus active investing have been a prevalent topic in the media of late.

While the socioeconomic effects of one system of investing compared to the other are widely debatable, from an investor perspective, the question is one of initial conditions and systems. Which approach offers the most attractive risk/reward tradeoff for a particular investment opportunity and investor at any given moment?

Initial Conditions

To ask the question of which is better, passive or active investing, is to put the cart in front of the horse. We must first ask which is better for what, whom, and when? The whom can only be answered by each particular investor whereas the what and when is in broad view.

US Equities

Using the broad US equity market as the what, the investment system question today is especially interesting. The market has become dominated by a small group of mega cap companies, hence the label ‘Magnificent 7’ in referring to the US equity market. Year to date, they have accounted for the vast majority of the positive returns in market cap-weighted portfolios.

The question: are the initial conditions in effect today conducive to an active or passive investment system for the US equity market opportunity?

Valuations

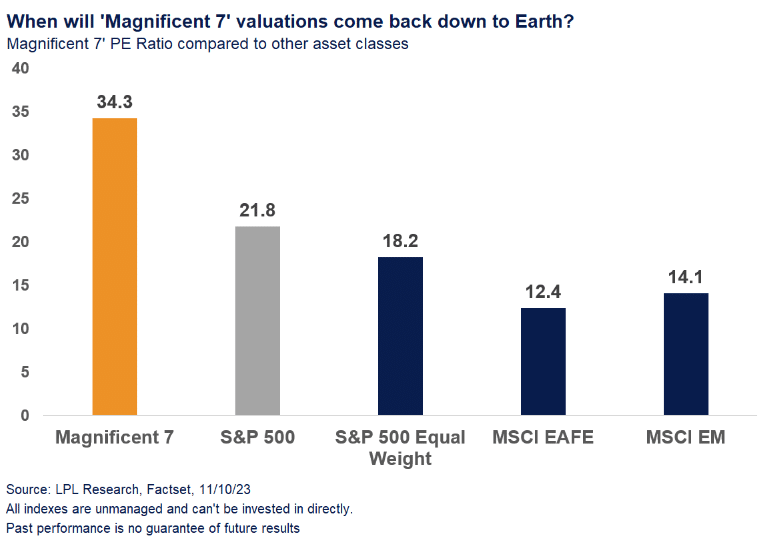

Starting with valuations across the US equity market, viewing the Magnificent 7 separately provides valuable information. The following image from LPL Research breaks out recent Mag 7 valuations and compares them to various measures of US and worldwide equity valuations.

What becomes immediately clear is that the Mag 7 are trading at valuations for which history would suggest there is a high probability of a poor outcome compared to investor expectations. The historical evidence points to substantial valuation compression risk for the largest US companies over the intermediate term.

The counter argument to valuation compression risk is the commercial dominance of the Mag 7 companies, excluding Tesla. In regard to current conditions, the dominance and/or popularity of the Mag 7 is not only visible to the entire investor universe, but to the entire world.

Given the current conditions of universal recognition, the question becomes whether it is even possible for the Mag 7 to outperform looking over the intermediate term? While possible given the platform nature and network effects of many Mag 7 companies, through the lens of equity market history, the probability appears to be rather low.

With widely divergent valuations across the US equity market, there is likely to be broad-based opportunity beneath the market cap-weighted equity surface. As such, given current conditions, an active strategy is likely to be a superior system choice over the intermediate term. This is not to say that passive tools are not in the tool box when implementing active strategies.

Economic Cycle

The possibility of broad-based opportunity under the market cap-weighted surface is supported by the stage of the economic cycle. A broadly applicable catalyst for US equity market opportunities over the intermediate-term horizon is the likelihood that investors may be out of sync with the stage of the economic cycle. By investors I am referring to the broad-based sentiment in the marketplace.

If we have already experienced an inflationary contraction, which I believe began in or around Q3 2022, a cyclical upturn is likely coming into view. In contrast, current conditions in broad market sentiment suggest that the spectrum of economic possibilities is between a soft economic landing and the early stages of a recession.

If the spectrum of broad market sentiment is in the ballpark, the possibility that we are nearing a cyclical upturn is in sync with a broad opportunity set being available beneath the US market cap-weighted surface. The wide valuation band across the US marketplace points to just this possibility.

Summary

As a fundamental principle underlying all systems, initial conditions determine the underlying space-time fabric on all scales. Using the intermediate term as the horizon, exploiting opportunities under the market cap-weighted surface in the US is likely to be a superior system choice. Sensitivity to initial conditions is a guiding principle for translating the future.