Retail is one of the final two among the top eight industries covered in the report, “Sector strategies for navigating 2023.” Before diving in, the following is a summary of current market conditions from the prior sector report:

…valuation compression remains the primary risk… As a result, the relative opportunities in the stock market reside in those segments and sectors which are trading at discounted valuations. These opportunities are prevalent in the small to mid-cap value segments of the US market and stretch into the large-cap segment.

Retail

As discussed in “Sector strategies for navigating 2023,” the drawback to using the 11 primary sectors of the S&P 500 as the opportunity set is that they are dominated by a few large companies. As a result, they can materially reduce diversification in market-cap-weighted portfolios.

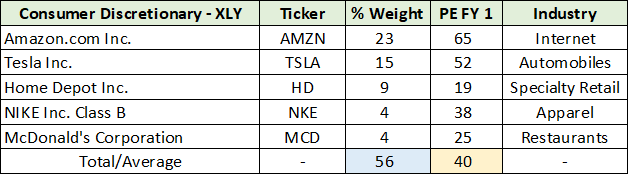

For example, the consumer discretionary sector in the S&P 500, as defined by the Consumer Discretionary Select Sector SPDR® Fund (NYSEARCA:XLY), includes the retail industry. The following table displays the top five companies and their weightings.

I have highlighted in blue the percentage weight of the top five companies in the consumer discretionary sector. At 56% of the index, it is fair to say that it is a concentrated portfolio within the sector and its various industries. The average PE multiple of 40x forward earnings estimates (the yellow cell) highlights the exposure of this group to today’s primary risk, multiple compression.

Expanding the view using the SPDR® Portfolio S&P 1500® Composite Stock Market ETF (NYSEARCA:SPTM) triples the total opportunity set. Viewing by industry rather than sector doubles the number of opportunity vectors.

Continue reading this report with a stoxdox membership.