At risk of dating myself, the above image is of Wile E. Coyote and the Road Runner, a famous Looney Tunes cartoon. Throughout the cartoon series, the coyote employs all manner of absurdly complicated devices and strategies to capture the road runner. The failure of the “Rube Goldberg” contraptions provides for the underlying comedy while offering a valuable lesson for investors, keep it simple stupid, or KISS.

The storyline and lesson come to mind when viewing the footwear industry. With respect to footwear, the KISS strategy is particularly attractive given persistent industry fragmentation and shifting consumer tastes. The most successful company in the industry, Nike, shines a light on the essence of the KISS strategy, brand equity.

The Footwear Industry

The footwear industry is one of brands, pure and simple. For example, Nike and its competitors use many of the same contract manufacturers to produce their products and are not product manufacturers. As a result, the quality of footwear is quite homogenous in relation to the wide discrepancy in pricing between the various brands.

The common cost and quality structure of the industry renders brand equity the primary vector of competition, as Nike has proven. In the case of Nike, it generally targets the higher end price points in the market thus maximizing its profit potential.

Industry Dynamics

It is interesting that valuations in the industry correlate with the price point targeted in the marketplace. Those targeting the high end of the market generally receive higher valuations than those targeting the middle to low end of the market.

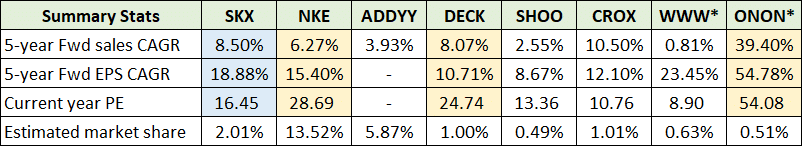

The correlation can be seen in the following table which displays the expected earnings and sales growth rates, valuations, and estimated market share of the top publicly traded footwear companies. I have highlighted the companies targeting higher end price points in yellow and Skechers in blue. Skechers is one of the most successful brands targeting mass market price points.

The companies and their ticker symbols are as follows: Skechers (NYSE:SKX), Nike (NYSE:NKE), Adidas (OTCQX:ADDYY), Deckers Outdoor (NYSE:DECK), Steven Madden (NASDAQ:SHOO), Crocs (NASDAQ:CROX), Wolverine World Wide (NYSE:WWW), and On Holding (NYSE:ONON). *Note that the expected growth rates for Wolverine World Wide and On Holding are for the next three years rather than five.

Excluding On Holding, a young, fast-growing firm at the high end of the market, the high price point stocks trade at a substantial premium to Skechers while exhibiting lower earnings and sales growth rates. Currently, premium brands receive a premium valuation.

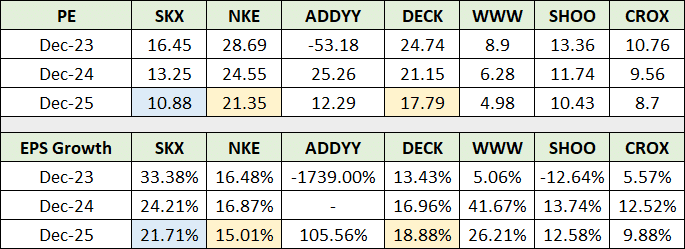

The following table compares the consensus earnings growth rates for each company through 2025 and the resulting PE ratios using the same highlighting scheme, excluding On Holding.

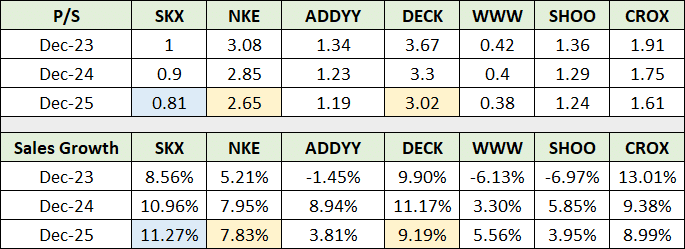

Skechers’ superior earnings growth rate and substantially lower valuation are quite attractive relative to the premium brands when viewed from an expected earnings growth and PE lens. The following table compares consensus sales growth estimates for each company through 2025 and the resulting price-to-sales ratio using the same highlighting scheme as in the above tables.

Once again, Skechers offers a superior or comparable growth rate combined with a substantially lower valuation multiple through 2025. Using sales as the valuation denominator, Skechers trades at an incredible discount to Nike and Deckers, valued at 1x sales versus Nike at 3x and Deckers at 3.7x 2023 sales estimates. As we will see in the discussion of profit margins, there is reason to expect this valuation dispersion to converge into mid decade.

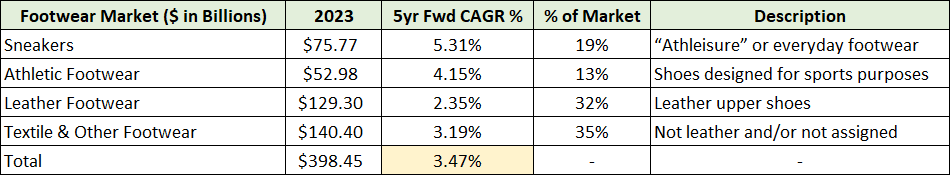

The sales growth rates above may be compared to expected industry growth rates, which are displayed in the following table compiled from Statista. Statista breaks down the footwear industry into four primary segments.

Looking out to 2025, Skechers, Nike, and Deckers are expected to grow sales at roughly 3x, 2x, and 2.5x the growth rate of the industry, respectively. They are expected to be the growth stocks of the group. Adidas, Wolverine World Wide, and Steven Madden are expected to grow in line with the industry and are thus mature companies. Finally, Crocs is expected to grow at roughly 2.5x the industry’s growth rate. Crocs is excluded from direct comparability herein given its highly specialized products.

Skechers

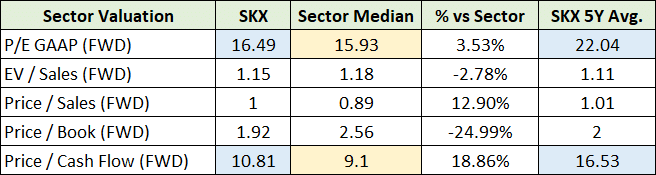

Quantitatively speaking, based on consensus earnings and sales expectations and the resulting valuations, Skechers stands out as the top opportunity within the footwear industry. Zooming out, the footwear industry is part of the consumer discretionary sector. The following table compares Skechers’ current and historical valuation (highlighted in blue) to the larger sector (highlighted in yellow).

Recall that Skechers is expected to grow its sales at 3x the industry rate through 2025, or 10.26% per year on average versus 3.47% for the industry. For reference, Skechers grew its sales at 12.5% per year since 2019 and at 19% per year between 2013 and 2019. Skechers is and has always been a growth stock. In comparison, Nike grew its sales by 7% per year during each period while trading at a massive valuation premium.

The fact that Skechers’ valuation is in line with the larger consumer discretionary sector is unusual for a well-above average growth stock. The company’s historical performance combined with its robust growth outlook suggests a premium valuation is in order. In this respect, notice that Skechers is also trading at a steep discount to its 5-year average valuation using earnings and cash flow.

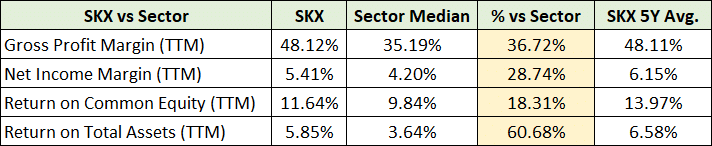

A premium valuation is further supported by Skechers’ well-above-average profitability compared to the sector, as can be seen in the following table. I have highlighted in yellow Skechers’ profitability in relation to the sector across several metrics.

In addition to its enhanced profitability, Skechers’ margins are slightly below its 5-year averages, and thus the company is not currently “over earning” and has room for margin improvement.

Segments

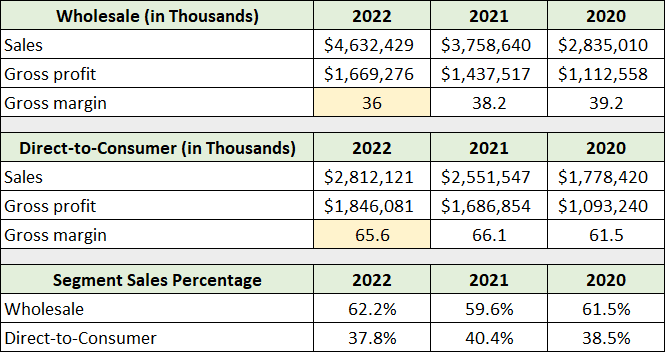

The potential for margin improvement is illuminated in Skechers’ segment sales and gross margins. The following table breaks out Skechers’ sales and gross margins across its two reportable segments, Wholesale and Direct-to-Consumer. It was compiled from the company’s 2022 annual report filed with the SEC. I have highlighted in yellow the gross margin in each segment for ease of comparison.

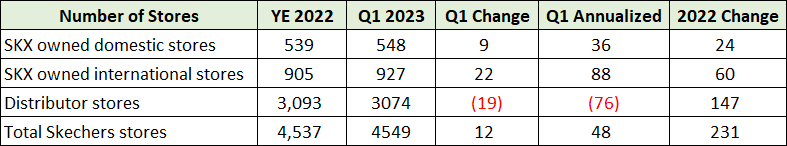

With a nearly 30% difference in gross margin between the two segments, Skechers can materially increase its overall profitability via Direct-to-Consumer growth in relation to Wholesale growth. This is exactly the strategy on display in the company’s Q1 2023 earnings report filed with the SEC. The following table was compiled from the report and displays Skechers’ store count change in Q1 2023 compared to 2022.

In Q1 2023, Skechers opened 31 company owned stores (Direct-to-Consumer) and terminated 19 distributor store relationships (Wholesale). For reference, if Q1 is annualized to estimate the change for the full year 2023, Skechers would open 50% more Direct-to-Consumer stores in 2023 versus 2022, while reducing the number of Wholesale stores.

While annualizing Q1 2023 is not a true estimate for the full year of 2023, the Q1 2023 store trend points toward a higher margin future for Skechers given the focus on Direct-to-Consumer sales. Using the industry leader as reference point, Nike’s sales mix is roughly 44% Direct-to-Consumer and 56% Wholesale. Additionally, Nike’s profit margin was 9.9% in 2022 compared to 5.4% for Skechers.

Margin Expansion

With only 38% of its sales being Direct-to-Consumer in 2022, Skechers has material profit margin expansion potential. Furthermore, it is not clear that Nike’s segment sales breakdown represents the upper limit of Direct-to-Consumer sales for Skechers. At minimum. one could easily envision a 50/50 mix between Direct-to-Consumer and Wholesale sales for Skechers over time.

Nike has averaged just above a 10% profit margin over the past ten years, in line with its 2022 performance. While such margins are likely unachievable for Skechers, given Nike’s focus on higher end price points, there is material improvement potential for Skechers.

Over the past ten years Skechers’ has averaged a 5.8% profit margin compared to 5.4% in 2022. With an average expected annual earnings growth rate through 2025 of 26.4% compared to an expected sales growth rate of 10.26% per year, analysts are expecting significant margin expansion in Skechers’ future.

KISS

Multiple expansion, amplified by the effects of above-average sales and earnings growth and profit margin expansion, is the very definition of KISS when looking for asymmetric risk/reward opportunities.

In terms of the footwear industry, Skechers’ strategy is the epitome of KISS, or keep it simple stupid. On the capital investment front, Skechers is focused on expanding its Direct-to-Consumer business and expanding its brand internationally. The execution of this strategy is visible in the store count data in Q1 2023.

These strategic priorities are simple and offer the greatest potential for both margin expansion and top line growth. Furthermore, the company’s mission and product strategy are fully aligned with its KISS approach. Skechers’ slogan is “The Comfort Technology Company.” When it comes to footwear, comfort is the number one priority for most consumers.

On the product design front, in addition to comfort, Skechers targets style, innovation, and quality. Consistently delivering on these product priorities at a value price point is what sets Skechers apart from the competition.

As Skechers’ quality is on par with premium brands and its pricing strategy targets the mass market, there is a compelling case to be made for Skechers capturing significant market share over time. For reference, Skechers is expected to generate $9 billion of sales in 2024 compared to $54 billion for Nike and $25 billion for Adidas.

Skechers’ KISS strategy is well aligned with the dynamics and opportunities available in the footwear industry. If Skechers comes close to analyst estimates through mid decade, trading at 11x the consensus earnings estimate for 2025, there is significant upside return potential given Skechers’ 5-year average PE of 22x. Furthermore, Nike’s and Deckers’ valuations of 29x and 25x current year earnings estimates suggest there is significant valuation expansion potential for Skechers trading at 16x estimated earnings.

Technicals

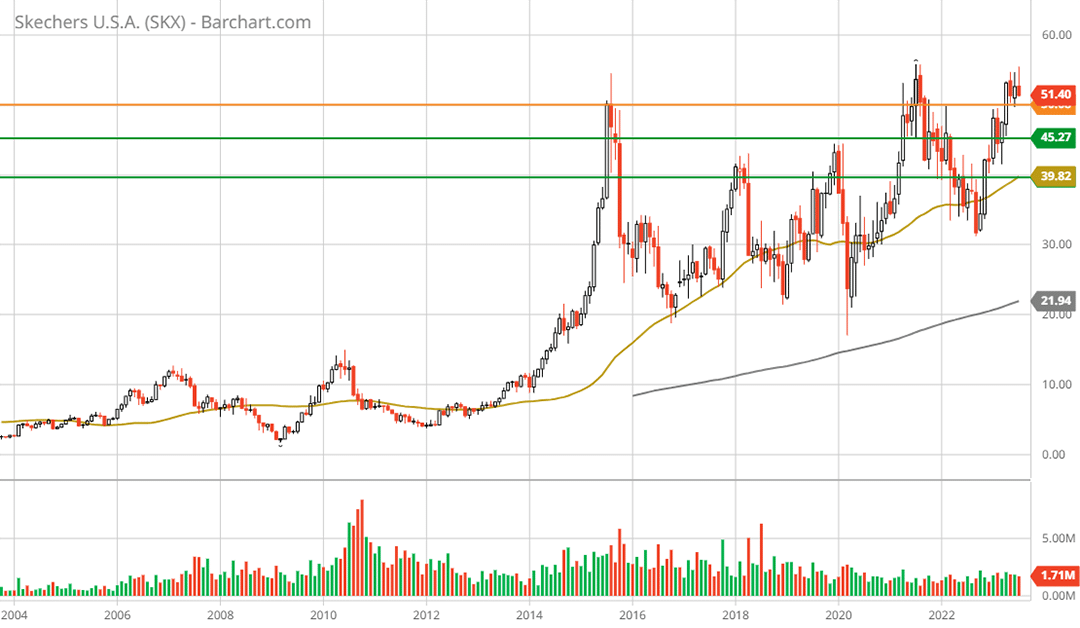

Technically speaking, all-time highs after a lengthy consolidation phase is as bullish as it gets, using an intermediate to longer-term lens. This describes the technical backdrop for Skechers as can be seen in the following 20-year monthly chart. The shares are attempting to sustain a breakout above the highs set in July of 2015.

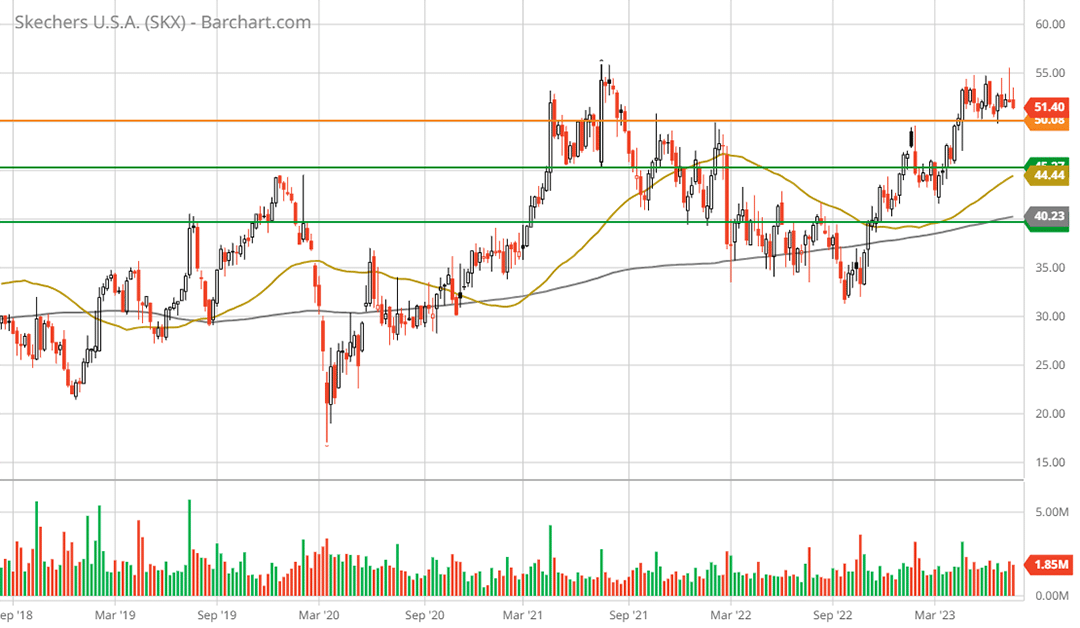

The 5-year weekly chart below provides a closer look at more recent price action.

Skechers is in a well-established, if subdued, uptrend. The orange horizontal line represents the primary resistance at all-time highs while the green lines represent the primary support zone. A retest of the support zone would offer an ideal accumulation opportunity.

Summary

Looking intermediate to longer term, Skechers is a top opportunity in the footwear industry and larger consumer discretionary sector. As such, a retest of support would offer an ideal accumulation window. Longer term, Skechers has been and looks to remain a leading consumer growth stock and an asymmetric risk/reward opportunity, KISS.

Price as of this report: $51.11

Skechers investor relations website