Following up on the bullish copper and Freeport reports, “A new copper bull market takes shape” and “The miners are looking up,” Rio Tinto (NYSE:RIO) stands out as an asymmetric risk/reward opportunity.

Rio Tinto

In terms of copper, Rio Tinto offers one of the most robust profiles with over 100% production potential visible into 2030. The company is unique in the mining sector in that it operates world-class assets across three commodities: copper, aluminum, and iron ore. Rio’s portfolio is covered in the following reports:

- “Rio Tinto is a perfect portfolio diversifier”

- “Rio Tinto is an asymmetric global growth opportunity”

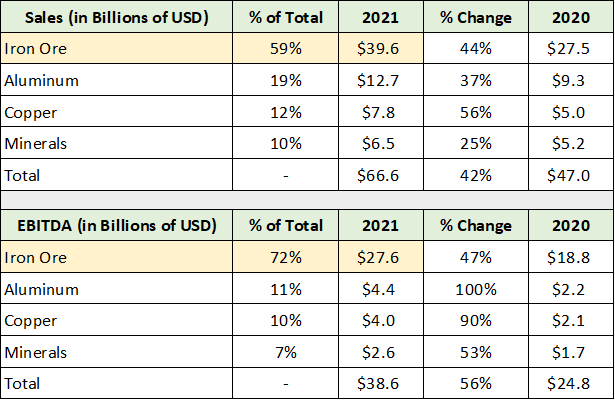

As the previous reports reviewed Rio in detail, and the fundamentals remain unchanged, I will focus on the tactical considerations here. The following table from “Rio Tinto is a perfect portfolio diversifier” provides a recent breakdown of Rio’s business mix by commodity for reference.

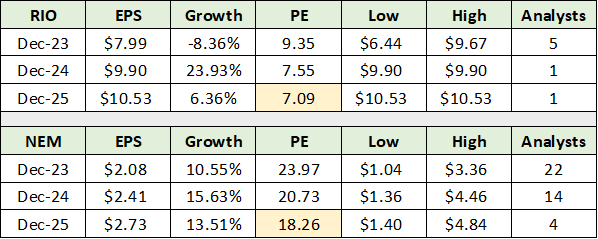

Iron ore is and will remain the primary driver of Rio’s results, with 2021 EBITDA near $28 billion. The company’s total EBITDA near $40 billion is quite impressive. Rio’s leadership position in iron ore is similar to Newmont Corporation’s (NYSE:NEM) leadership in gold. As a result, using Newmont as a valuation comparable quantifies the size of the relative opportunity.

As Rio offers peer-leading copper growth potential, an industry leading aluminum portfolio, and arguably the top iron ore assets in the world, a valuation in line with Newmont is a reasonable expectation. Based on this, the upside using 2025 consensus estimates is 160% or $192 per share.

Continue reading this report with a stoxdox membership.