Market Updates

New bull market or a bear market bounce?

As the market remains in a primary downtrend, and the trend is your friend, go with the cash flow.

The miners are looking up

Tactical and technical strategies take front stage as the commodity bull market resumes.

Shipping and recession: To be or not to be?

Shipping volume is a pure measure of economic activity and removes inflationary effects.

A new copper bull market takes shape

Chinese copper demand is forecasted to triple through 2050 with potential supply shortfalls by mid-decade.

Magellan and navigating uncharted markets

The system is ideally suited for uncertain times, an actionable framework for managing stocks through time and space.

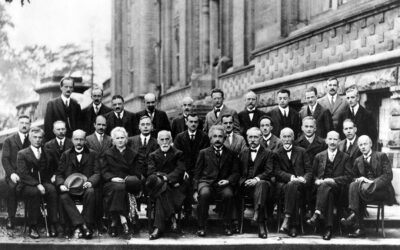

2023 economic outlook

The 2000 stock market crash and labor participation reversal collide with the 1970’s to illuminate a uniquely high-risk environment.

Technology outlook for 2023

The market may underappreciate the high-powered nature of capital flows in the tech sector.

Relative opportunities in energy for 2023

A nine-month consolidation within a bull market trend combines with deeply discounted valuations to create opportunity.

Is the sun setting on energy stocks?

OPEC forecasts the need to invest $12.7 trillion through 2045 and find an additional 38 million barrels of daily oil production.

Market Outlook: Risk-on risk-off

A phase change is in progress as returns and diversification potential return to the bond market creating opportunity.

FedEx and the recession

While the unfolding recession has yet to be widely accepted, FedEx’s share price has been pricing it in for 18 months.

Gold is on the efficient frontier

Gold and a uniquely asymmetric risk/reward opportunity for optimizing portfolios, high beta exposure to an uncorrelated asset class.