Ferdinand Magellan led the first successful circumnavigation of the earth between 1519 and 1522. It was an impressive accomplishment considering the knowledge of the period. Society still questioned whether the earth was spherical. To set sail into uncharted waters during such a period required both navigational skill and adaptive mental models for observing and responding to the unfolding world.

Navigating Uncharted Markets

The defining feature of today’s markets is the heightened level of uncertainty resulting from increasing cross currents throughout the global economy as we traverse a global phase change. When cross currents are elevated, it is helpful to have mental models for processing opportunities as the future unfolds. Magellan’s voyage is a fitting metaphor.

The Other Magellan

Peter Lynch was the famed portfolio manager of the Fidelity Magellan fund from 1977 through 1990. During his tenure, the Magellan fund achieved an incredible return record of over 29% per year. The similarities and differences today compared to the period in which Lynch produced these results led me to review his mental models. From our recent report, “2023 economic outlook”:

We are at a critical juncture for the US economy. The current cycle shares many similarities with the 2000 bubble pop and labor participation reversal in addition to similarities with the 1970’s inflationary episode. As the saying goes, while history may not repeat, it often rhymes.

Most investors associate Peter Lynch with the term 10-baggers. What may surprise many is that Lynch’s strategy at Magellan featured the opposite, extraordinary portfolio turnover. At times, it was over 300% per year. Far from the stereotypical buy and hold growth investor of recent times, Lynch was replacing his entire portfolio 3x per year. In the process, he produced returns that place him amongst the greatest investors of all time.

Mental Models

Lynch’s mental models are well suited for periods which feature fundamental phase changes in the economy and markets. The mental models are unrelated to portfolio turnover.

During his first five years at Magellan, Lynch faced an inflationary environment with rising and highly volatile interest rates. There are clear similarities today. Following his first five years, he encountered what was to become the greatest secular bull market of all time, beginning in 1982.

The primary lesson I draw from Lynch’s tenure at Magellan is that investment strategies are cycle dependent, excluding true growth companies that fall into the potential 10-bagger category. Investors must adjust their portfolio strategy to the times, which requires having adaptive mental models.

One of Lynch’s mental models was to place individual stocks into six categories. He categorized stocks by the type of opportunity that they represented:

-

- Fast growers

- Stalwarts

- Slow growers

- Cyclicals

- Turnarounds

- Asset opportunities

Today, most investors think about stocks as a binary choice between growth and value. Lynch’s mental model is more robust. Each of the above categories has a fundamentally different potential return spectrum. This is not true of the growth/value categorization. Companies regularly transition between the growth and value categories as market prices change. In contrast, companies transition infrequently between Lynch’s six categories.

Fast Growers

Fast growers are firms that grow aggressively, with earnings growth often above 20% per year. The past cycle was unusual due to the larger size of many fast growers. The fast grower category offers the widest potential return spectrum and the most upside potential, including 10-baggers.

One of the more extreme risks during the current phase transition is fast growers transitioning to other categories from extreme valuation levels. For many it remains a question of valuation and whether they can remain fast growers. Notable examples of negative risk/reward-rated fast growers over the past 18 months are included in these reports:

Risk in fast growers is at its most extreme when they trade at extreme valuation multiples and begin transitioning to another category. Multiple contraction can exert a powerful and lasting downside force.

The current environment favors seeking out smaller or earlier stage fast growers that will become the large fast growers of the future. As the bear market completes, there should be ample opportunities to acquire emerging fast growers.

Stalwarts

Many fast growers of the past cycle are transitioning to stalwarts during the current phase transition. These are larger companies that continue to grow earnings at above-average rates. Earnings growth is generally over 10% per year while blue-chip type companies populate the group.

The potential return spectrum is more modest, though opportunities can be quite large. For larger opportunities, it is usually a matter of buying during a period of reasonable to lower valuations. This is the mirror image of the multiple contraction risk discussed above.

Our Netflix reports are an excellent case study on how to approach stalwarts. At the time of the first report in June 2021, “Netflix faces COVID hangover,” Netflix (NASDAQ:NFLX) was trading at an extreme valuation while growth was set to slow dramatically. The risk/reward asymmetry was extremely negative as the company was transitioning from a fast grower to a stalwart.

After falling 63%, Netflix became an attractive opportunity given its discounted valuation and still above-average growth potential. As a result, in May 2022, it received a positive risk/reward rating in “Netflix: Show me the money.” Finally, after a 60% gain in only six months, the risk/reward turned neutral to negative, which was recently covered in “Netflix is dancing in the rain.”

Stalwarts are likely to offer many such opportunities over the coming year.

Slow Growers

As Netflix matures, it will become a slow grower at some point in the future. Slow growers are fairly boring companies that grow slightly faster than the overall economy. A usual feature of such companies is a regular and above-average dividend yield. Given the upside return limitations due to slow growth, the price paid is critical for achieving attractive returns.

While the potential return spectrum is normally less than stalwarts, the income stream creates a total return profile compared to the first two categories. Comcast (NASDAQ:CMCSA) is an excellent example of such a company, which was recently covered in “Comcast is riding the information wave.”

Comcast highlights the relative nature of opportunities across the six categories. At the time of the December Comcast report, it was trading at one-third of Netflix’s valuation with a similar earnings growth profile and a 3% dividend yield. Like Netflix in May 2022, Comcast’s potential return spectrum includes 85% upside potential over the intermediate term.

Given macroeconomic conditions, there should be exceptional opportunities in slow growers over the coming year. The relative attractiveness of stability could lead to multiple expansion. For Comcast to hit the above upside potential, it needs to trade at its historical 15x PE multiple while hitting consensus estimates over the intermediate term.

Cyclicals

Historical valuations play a significant role in managing cyclical stocks. These companies experience regular expansions and contractions following economic and industry cycles. As a result, it is critical to be aware of where these companies are in relation to their particular cycle. This is important in order to place earnings estimates and valuations into a full cycle context.

A great example of a cyclical opportunity is Schlumberger. I first covered Schlumberger in the December 21, 2021 report “Schlumberger is a top choice for cyclical growth through 2023.” At the time, Schlumberger (NYSE:SLB) had just reported its second consecutive quarter of year-over-year revenue growth. This marked an inflection point following a 6-year bear market for the energy services and equipment sector. Schlumberger was on the brink of a new growth cycle. From the report:

Given the early stage of the nascent energy services growth cycle, Schlumberger represents an intriguing cyclical growth opportunity as the global leader in the space.

The Schlumberger case also highlights a common error when dealing with cyclical stocks. When they are industry leaders, investors often confuse them with stalwarts and pay too high a price. Schlumberger is in fact the industry leader and offers a well-above-average earnings growth profile through mid-decade. Nonetheless, it is important to remember that growth in the sector is cyclical in nature which requires investors to be mindful of inflection points.

In terms of the potential return spectrum, cyclicals can offer exceptional upside and downside potential in a condensed period of time. They often move very quickly once the market discovers that the cycle has turned. The key lies in identifying the turning points and buying or selling near such moments.

Once the cycle turning point is identified, the primary challenge turns to discerning the length and nature of the cycle, as they vary in time and amplitude. The following quote from the December 2021 Schlumberger report summarizes my view of the unique nature of the energy services and equipment upcycle:

More optimistically, Schlumberger is an industry leader entering a stable, long-duration cyclical uptrend in global energy development while trading at an incredible discount to comparable growth stocks.

In my April 2022 update, “Schlumberger is an asymmetric opportunity with supercycle potential,” the trend toward a long-duration upcycle was confirmed by the company’s CEO, Olivier Le Peuch, in Schlumberger’s Q4 2021 8-K filed with the SEC:

Looking ahead into 2022, the industry macro fundamentals are very favorable… These favorable market conditions are strikingly similar to those experienced during the last industry supercycle.

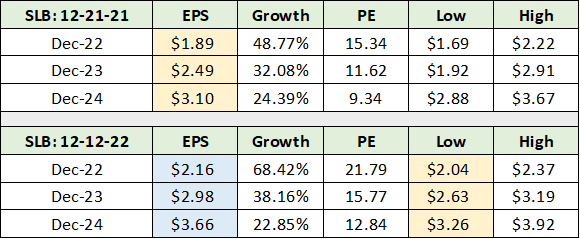

Finally, in the December 2022 energy sector update, “Is the sun setting on energy stocks?,” consensus estimates for Schlumberger were confirmed to be trending in line with a strong upcycle. The lower section of the following table is from the report while the upper section displays consensus estimates as of the December 2021 report.

Notice the material increase in estimates as of December 2022 compared to 2021. Additionally, comparing the yellow highlighted cells, the low analyst estimates for each year as of December 2022 are now solidly above the consensus estimates as of 2021.

The Schlumberger opportunity showcases the need to monitor the stage of the cycle as well as the fact that each cycle is unique. Of note, Schlumberger regularly traded at 24x earnings during the industry upcycle between 2009 and 2014. At 16x 2023 estimates and earnings growth estimated at 38%, all signs point to the energy services and equipment industry being in the first quarter of what looks to be a strong upcycle.

Turnarounds

One of the most unique opportunities of the six categories is turnarounds. These are usually companies that have gone ex-growth and face structural challenges requiring reorganization or repositioning. Similar to cyclicals, the potential return spectrum features exceptional upside and downside potential in a condensed period of time.

The unusual return potential results from the stock having already crashed and the investment community questioning the company’s survival. As many do not survive, the risk is a complete loss of capital. From a portfolio perspective, these opportunities are uncorrelated with markets and thus offer diversification benefits.

Turnaround opportunities are likely to expand materially over the coming year as is evidenced by the widespread share price collapses of recent times. Examples of turnaround contenders that I covered over the past 18 months with a negative risk/reward rating include:

-

- “Peloton is pushing itself to the limit”

- “Robinhood will see the forest for the trees”

- “GoodRx needs a transformation script”

- “Beyond Meat is beyond profitability”

- “Teladoc Health needs a wellness check“

- “Etsy’s profit margins are hanging by a thread”

- “Lyft is stuck in traffic”

- “Is the boom over for Zoom?”

While each of these companies now has a more neutral risk/reward profile, it is unclear whether they will survive longer term. There are likely to be many opportunities in turnarounds during 2023.

Asset Opportunities

The final category offers many timely opportunities today. Asset opportunities exist when there is a disconnect between market prices and the value of identifiable assets within a company. These opportunities can be found across all sectors offering diversification potential. The attractiveness of asset opportunities lies in the fundamental downside protection created by the identifiable asset values.

The potential return spectrum is usually less than that of other categories. This is not always the case as was highlighted in “CNX Resources: The Saudi Arabia of natural gas.” CNX (NYSE:CNX) is an excellent example of an asset opportunity today. The company’s assets are easily identifiable and represent some of the highest-quality natural gas assets in the world.

With the equity trading 50% below the 2021 PV-10 using $3.5 gas, and manageable debt levels, the downside is fundamentally well protected. CNX is generating a mid-teens free cash flow yield, is hedged, and has no debt maturities until 2026. The fundamentals and technicals suggest the possibility of it reaching the $40 range over the intermediate term. At $16 today, CNX’s potential return spectrum is heavily skewed to the upside.

Summary

Lynch’s system is ideally suited for uncertain times. Categorizing stocks by the type of opportunity they represent creates an actionable framework for managing each stock through time and space. It has the added benefit of being more robust and intuitive than a growth/value lens.