In the recent report, “Is the sun setting on energy stocks?”, I noted that Exxon and Chevron account for 43% of the energy sector as represented by the Energy Select Sector SPDR® Fund (NYSE:XLE). When combined with each company’s premium valuation to the sector, I concluded the following:

Outside of the capitalization-weighted sector fund, there are many asymmetric risk/reward opportunities in the energy space… As a result, a market capitalization-weighted energy portfolio is likely to underperform a more opportunistic approach.

Risk/Reward Rating: Positive

The XLE is trading at 8x next year’s consensus earnings estimates. An excellent representation of the broader energy sector is the SPDR® S&P® Oil & Gas Exploration & Production ETF (NYSE:XOP). State Street reports the PE of the XOP to be 5x next year’s earnings estimates.

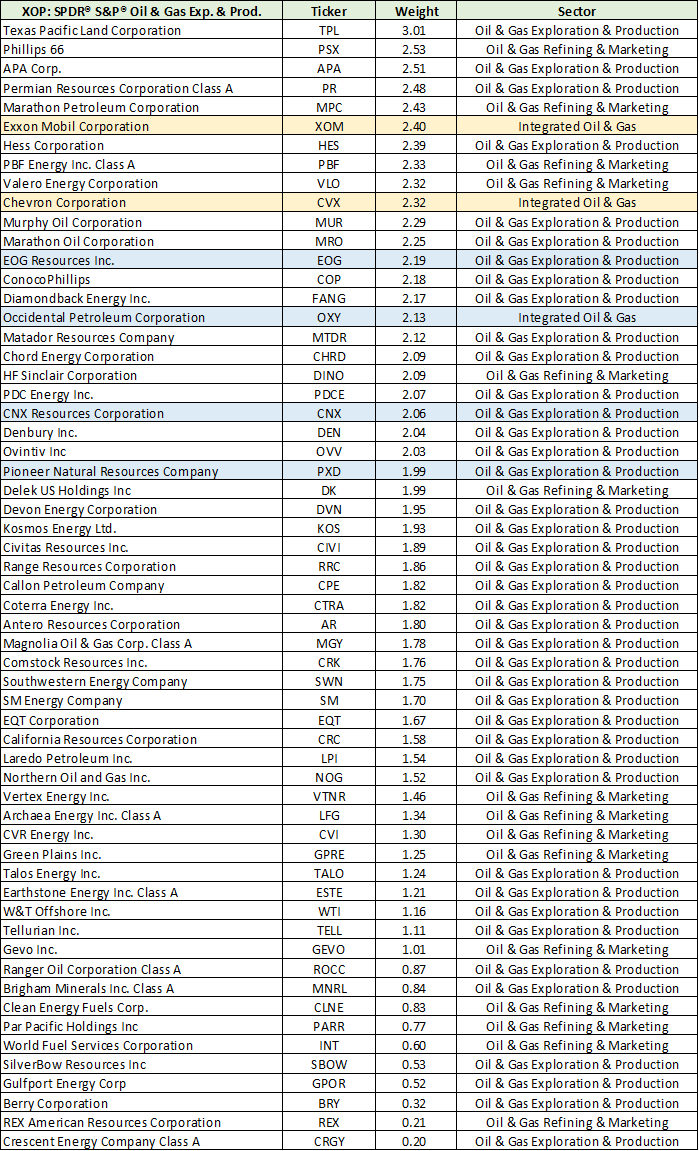

As the six companies highlighted in my last report suggested, valuations across the broader energy sector are deeply discounted compared to the largest firms. Four of the six companies are members of the XOP and are highlighted in blue in the following table. Of note, the XOP does not include energy services and equipment stocks. This is a benefit as the XOP does not overlap with what is “A top sector choice for the coming cycle,” thus enabling greater portfolio control.

A cursory glance at the holdings of the XOP confirms a broad and diversified portfolio in comparison to the XLE (a market cap-weighted portfolio) in which Exxon and Chevron have a 43% weighting. Exxon and Chevron account for just 4.7% of the XOP. The following table displays the XOP companies and their weightings.

For commodity producers, relative valuations are especially relevant given the uniform nature of the product. While premiums are often deserved, they shift throughout the sector across cycles. With the broad sector trading at 5x earnings or a 38% discount to the XLE, equal-weighted approaches such as the XOP offer material upside asymmetry based on multiple expansion alone.

Continue reading this report with a stoxdox membership.