When lightning passes through the atmosphere it rapidly heats the air and causes it to expand. The temperature in the lightning channel can reach a level that is five times hotter than the surface of the sun before quickly cooling. The sound wave that we call thunder is created by this rapid expansion and contraction of the air in the lightning channel.

The interesting feature of thunder and lightning is that the light produced has little to no information value to an observer. It is the sound of lightning, the effect, which carries the actionable information, such as how far away the storm is.

In regard to lightning, “noise” or light travels at 186,282 miles per second whereas the actionable information, sound, travels at only 4.69 miles per second. Counterintuitively, the actionable information (sound) travels much slower than the noisy information (light).

As a result, thunder and lightning serve as an excellent mental model for investors.

Thunder and Lightning

Turning to mental models and the thunder and lightning metaphor, as investors, one can think of price action as the lightning. The price action is instantaneously observable, it literally travels at the speed of light. While an investor can infer “good” or “bad” causes and effects from price action alone, all one knows instantaneously is that there is a storm.

Even though there is little to no information content in price action alone, many investors choose to take a purely technical approach. The primary pillar supporting this investment approach is the belief in efficient markets.

In essence, it is the belief that market prices reflect all available information. If it is true that market prices are efficient, why waste resources researching investments? Afterall, according to the efficient market hypothesis, current prices embed all available information.

Riders on the Storm

The logical absurdity of the efficient market hypothesis should be obvious. If the market were always efficient, no one would research investments. Rather, they would simply pay or accept the market prices each day. The end result of this process of market efficiency, logically speaking, would be inefficient prices as no research would be conducted.

The popularity of this belief system is self-evident in the explosion of passive investing, which is a pure manifestation of the efficient market belief system: a market of price takers. As such, passive investors and those that closely track passive strategies are quite literally riders on the market storm.

Using a formulaic expression to describe these riders on the market storm: higher prices = “good” and lower prices = “bad.” If the absurdity is not yet clear, ask yourself the following questions. In which economic endeavors do I prefer higher prices to lower prices for the same good or service? In which economic endeavors do I ignore the price-to-value proposition?

I will venture an answer: there are zero such economic endeavors of any consequence.

Thunder Road

This is not to say that markets do not oscillate between efficient and inefficient pricing, they do so just like a pendulum. It is to say that one, as a matter of fact, cannot know or reliably infer the degree of market efficiency based on prices alone. For that information one must conduct or acquire research, thereby traveling down thunder road, in sticking with our metaphor.

While all investors are riders on the market storm, following thunder road is the only way to navigate the storm, to put up one’s sails rather than accept whatever fate is to be metered out. While overused perhaps, I believe Warren Buffett’s “Mr. Market” metaphor, attributed to Ben Graham, captures the essence of market efficiency. The following quote is from “The Timeless Parable of Mr. Market” published by Farnum Street:

Mr. Market is there to serve you, not to guide you. It is his pocketbook, not his wisdom, that you will find useful. If he shows up some day in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under his influence.

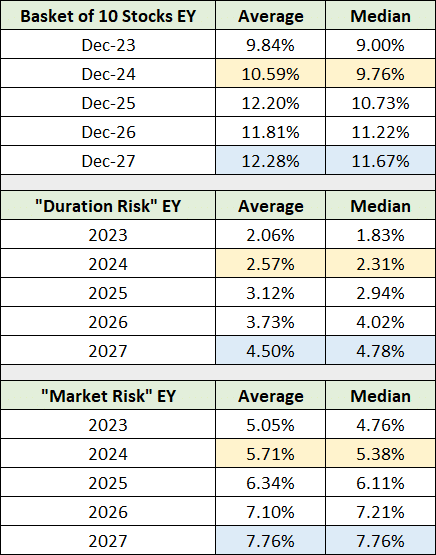

It is my professional view that the market is rather inefficiently priced today, generally speaking. The essence of today’s market inefficiencies are captured in the following table from “A bird in the hand.” The table displays the earnings yield of the top ten companies in the S&P 500 divided into two groups: “Market Risk” and “Duration Risk.” The “Basket of 10 Stocks” is a sampling of ten stocks from the broader market.

Using earnings yield dispersions across the US equity market into mid-decade as a measuring stick, the inefficiencies are quite extreme under the market-cap-weighted surface.

The Upside Down

Turning to the upside down, a Twitter/X article by Brett Caughran of FundamentalEdge offers excellent background and perspective on the hedge fund industry’s practices today. Most interesting is the industry’s need to largely restrict its activities to the largest and most liquid stocks on purely mechanical grounds: liquidity needs.

When combined with the explosion in market-cap-weighted passive investing, one gains invaluable context into two of Mr. Market’s dominant marginal price setters today. In essence, the yield dispersions on display in the above table from ”A bird in the hand” are precisely what one would expect following a long period of marginal price dominance by passive investing and hedge funds.

Furthermore, passive and hedge funds are joined by many other large capital pools favoring market-cap-weighted approaches. They are all, in essence, price takers to various degrees. Many others restrict their opportunity set to the largest companies on purely mechanical grounds alone, such as the need for sufficient liquidity.

Summary

The end result of these dynamics is what I refer to here as “the upside down.” The structural forces at play in the capital markets have driven professional investors as a whole into what is in essence the same strategy, market-cap or price-weighted strategies. The upside down is succinctly captured in my quote of Caughran’s tweet:

Great read by Brett. Key takeaway for me: individual investors have structural advantages given the current passive/HF market structure. In a nutshell, individual investors have structural advantages across three key vectors: time, agility, and the size of the opportunity set.

In summary, most professional pools of capital are restricted to the “Duration Risk” and “Market Risk” opportunity sets in the earnings yield table above. As many professionals cannot participate in “The Basket of 10 Stocks,” which is a sampling of a much larger opportunity set, I dare say that the professional community inevitably played a large causal role in creating today’s inefficiencies. Mr. Market, indeed.