In “Has the magic returned to Disney?” I observed that much of Walt Disney’s (NYSE:DIS) future value will be determined by its success in going DTC, or direct-to-consumer, via streaming services. As this remains the fulcrum on which the Disney investment case rests, I will begin with a review of Disney’s recently reported Q3 2023 DTC results. To set the stage, the following quote is from “Has the magic returned to Disney?” (emphasis added):

In the mid-decade timeframe, Disney estimates that it will reach 230 to 260 million Disney+ subscribers. Adding Hulu and ESPN+, total DTC subscribers are likely to approach 300 to 350 million globally by mid-decade. As these estimates appear achievable, pricing will be a key indicator going forward.

Direct-to-Consumer

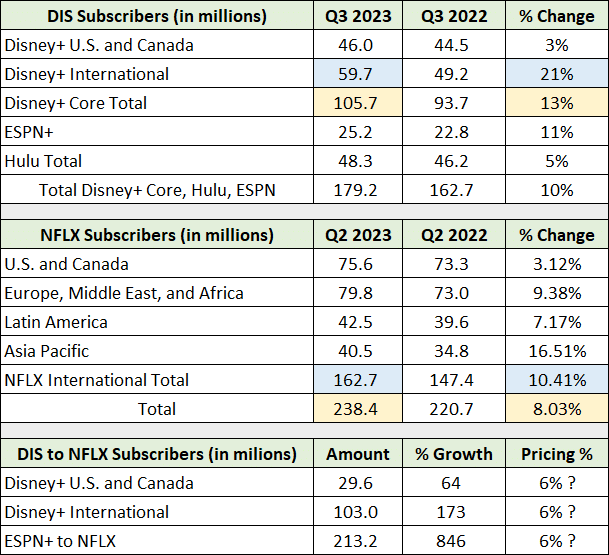

To gauge Disney’s success in the DTC market, Netflix’s performance serves as an excellent measuring stick as it is the most successful streaming company. In the following table, I compare the number of Disney subscribers to that of Netflix (compiled from each company’s most recent quarterly filings with the SEC) and show the number of members Disney could add if it mirrored Netflix’s subscriber number success. The lower section shows the number of subscribers needed to attain Netflix’s subscriber count for Disney+ and ESPN+.

I have highlighted in yellow the number of total subscribers reported for Disney+ and Netflix in each company’s just completed quarter. The 13% growth rate that Disney achieved in its Q3 2023 is well above the 8% rate reported by Netflix. Of note, Netflix’s Q2 2023 growth rate was on top of a rather weak 5% membership growth rate in Q2 2022. In contrast, Disney’s growth rate in Q3 2023 follows an exceptional growth rate of 32% in Q3 2022.

I have highlighted in blue the number of international subscribers. Here, Disney+ is growing at twice the rate of Netflix, 21% compared to 10%. This is impressive as Disney’s Q3 2023 growth rate follows 48% international growth in Q3 2022. Netflix’s 10% growth in Q2 2023 follows a similar 10% growth rate in Q2 2022.

Recall from the quote above that Disney is targeting 230 to 260 million total Disney+ subscribers globally. In respect to Netflix’s 238 million members and Disney’s performance to date, the estimates for Disney+ are certainly achievable and within the company’s control.

If achieved, as shown in the lower section of the table, Disney+ offers 64% subscriber growth potential in the US and Canada and 173% growth potential internationally. This growth potential ignores pricing power which I estimate in the 6% per year range over the longer term, as discussed below.

Unlike Netflix, Disney has two additional brands which can be large successes in their own right: ESPN+ and Hulu. ESPN+ grew 11% in Q3 2023, which followed exceptional membership growth of 53% in Q3 2022. While the sports market is hyper competitive on the content acquisition front, it is conducive to Netflix-like subscriber numbers globally over the longer term. The ESPN brand is a natural front runner in the DTC sports market globally.

In terms of Hulu, though it does cannibalize Disney subscribers in many markets, it continues to grow while offering content packaging optionality outside the Disney brand. As a result, Hulu enables greater market segmentation, and thus penetration potential for Disney.

When ESPN+ and Hulu are added to Disney+, Disney possesses all the ingredients necessary to be the global streaming leader. As a result, I view my estimate of 300 to 350 million total streaming customers as achievable and within Disney’s control over the intermediate to longer term.

Pricing

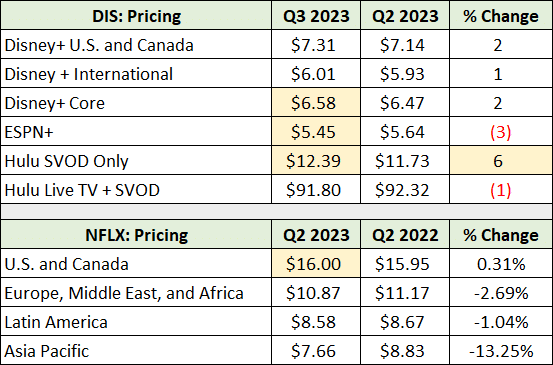

The above discussion focused on subscriber growth, for which Disney offers material growth potential in relation to the market leader, Netflix. In the following table I compare the most recent monthly pricing reported by Disney and Netflix. I have highlighted in yellow Disney+, ESPN+, Hulu SVOD, and Netflix US and Canada.

In comparing the yellow highlighted cells, Disney’s streaming services are priced well below those of Netflix. As a result, Disney should have substantial pricing power going forward. Furthermore, with ad-supported streaming becoming more prevalent, Disney’s extensive experience with ad-supported media could become a competitive advantage.

Hulu’s $12.39 per month pricing is in line with my estimate of Netflix’s average global pricing, as outlined in “Has the magic returned to Disney?”. Notice that Hulu grew pricing by 6% quarter-over-quarter in Q3 2023. The following quote from the May 24, 2022 report “Netflix: Show me the money” places Disney’s pricing potential in context:

…for the years 2018, 2020, and 2021, the average price increase for all markets averaged 10% per year. This is an incredible level of pricing power which will become increasingly important as membership growth slows going forward.

Netflix’s average 10% pricing power in recent years renders my 6% annual pricing power estimate for Disney quite conservative. The following quote from “Netflix: Show me the money” is how I summarized the pricing situation facing Netflix going forward:

…the pricing growth runway could be long and steady. While 10% annually is unlikely to persist, mid- to high single digits looks to be realistic over the coming five to ten years.

I continue to view mid to high single-digit pricing power as being realistic for Netflix going forward. As Netflix’s current pricing is roughly double that of Disney, the pricing power of Disney should be material over the nearer term as it reaches parity with Netflix. This should then be followed by mid-single-digit pricing power over the intermediate to longer term. The following quote from “Has the magic returned to Disney?” remains my view of Disney’s positioning and pricing power:

Given Disney’s deep and diverse content assets, attaining prices like those of Netflix should be a matter of content packaging, market segmentation, and execution. Meaning, the company is likely to control its own destiny. If this is correct, Disney should have strong pricing power for the foreseeable future.

Consensus Estimates

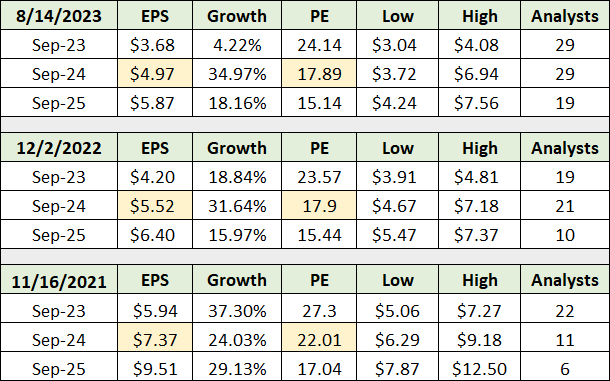

The importance of pricing power for Disney’s streaming services is evident when reviewing the trend in consensus earnings estimates into mid-decade. In the following table I compare consensus earnings estimates today to the consensus estimates at the time of my last two Disney reports: “Has the magic returned to Disney?” on December 2, 2022 and “Disney battles to retain the content king crown” on November 16, 2021. The risk/reward rating at the time of each report was neutral and negative, respectively.

I have highlighted in yellow the consensus earnings estimate for 2024 across the three Disney reports. The downward earnings revision trend continues. That said, the rate of decline in consensus earnings estimates is slowing substantially, from -25% from November 2021 to December 2022 to -10% today compared to December 2022.

As a result, it is becoming increasingly likely that earnings estimates are nearing a trough for Disney. For reference, from “Disney battles to retain the content king crown,” Disney’s peak central earnings tendency was in the $5.70 per share range between 2017 and 2019. With this historical tendency near the consensus estimate for 2025, Disney offers upside earnings surprise potential into mid-decade.

Technicals

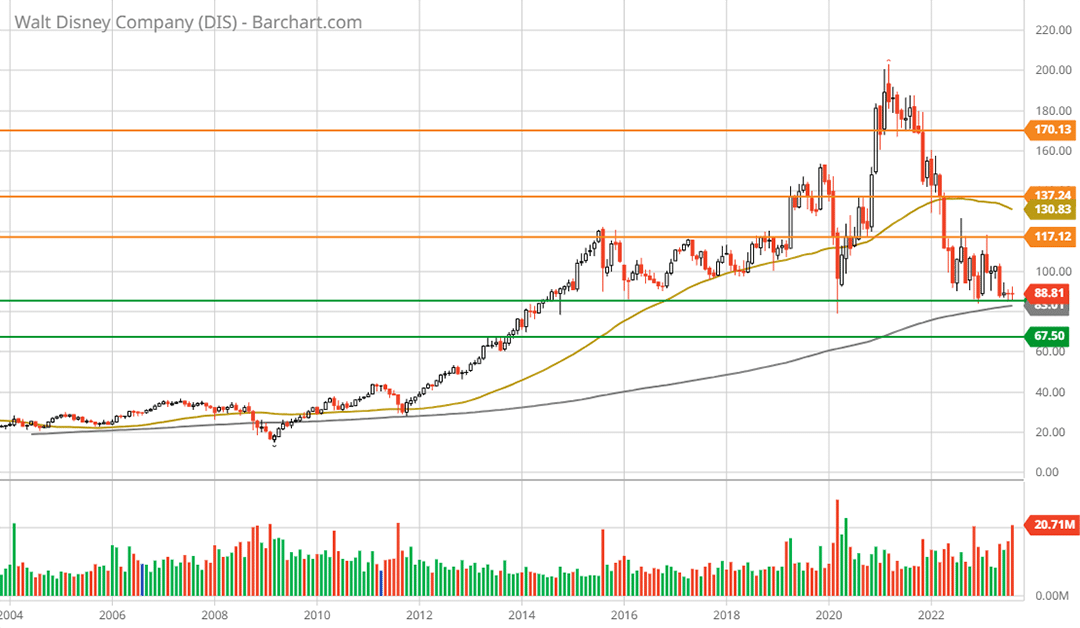

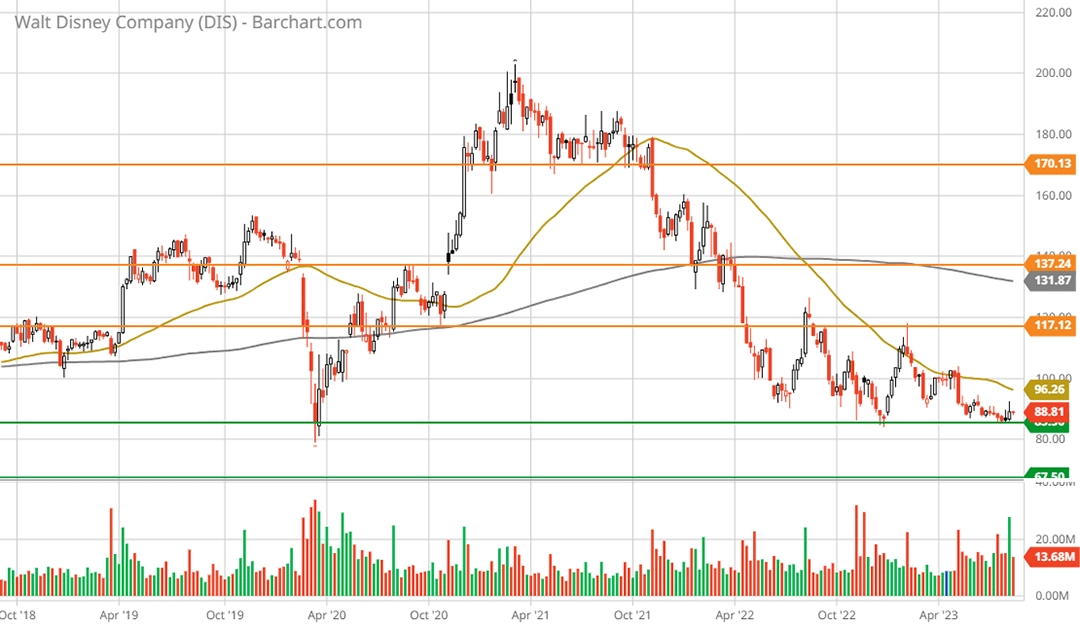

In regard to earnings estimates nearing a bottom, the technical backdrop is a mirror image of the fundamental backdrop. The following long-term monthly chart provides a bird’s eye view. Note that the green lines represent primary support levels while the orange lines represent the resistance zones. Additionally, the grey line is the 200-period moving average and the gold line is the 50-period moving average.

Notice that Disney is testing levels last reached in 2014 and is nearing a decade of stagnation. On a monthly closing basis, the shares have undercut the COVID-panic lows of March 2020. Furthermore, Disney is sitting on top of its 200-month moving average (the grey line) which has served as a bottom going back to the early 2000s. The following 5-year weekly chart provides a closer look at the price action.

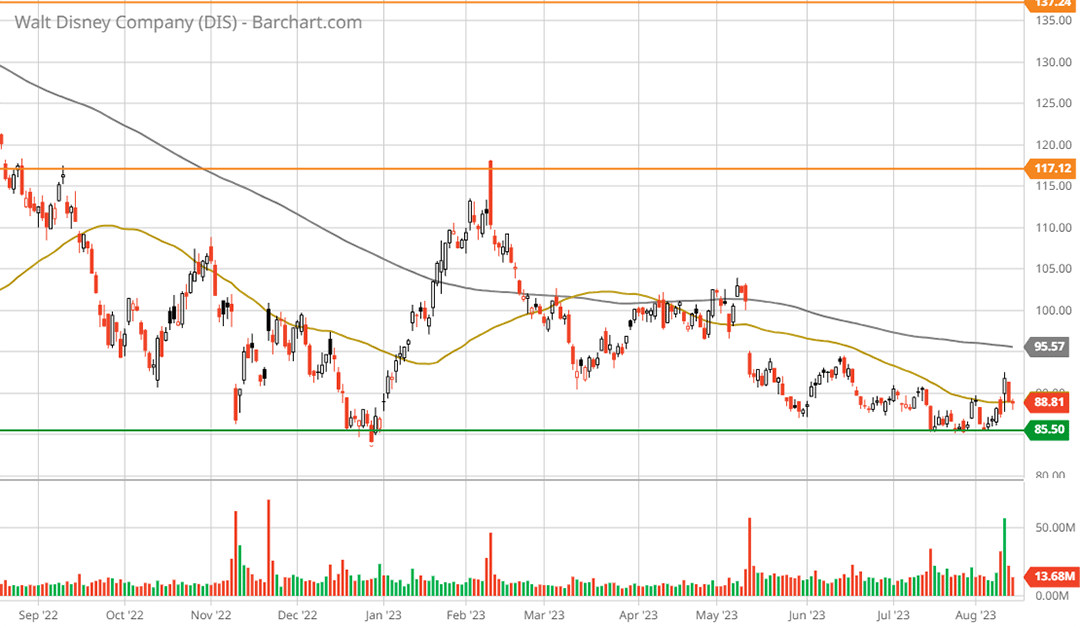

What is most interesting in the above chart is the complete lack of vigor following Disney’s August 9, 2023 Q3 earnings report. Notice that the 200-week moving average stands at $132 per share while Disney is just below the 50-week moving average near $96. Additionally, on a weekly basis, Disney is currently testing its COVID-panic low of March 2020. The following 1-year daily chart provides a closer look at the bounce attempt following the August 9, 2023 earnings report.

While the rally attempt following last week’s earnings report was barely visible and extraordinarily weak on the weekly chart, it can be seen on the daily chart above. Given the depths reached by Disney’s shares, the weak rally could be seen as a negative signal, technically speaking.

That said, Disney’s shares did react positively and not negatively to the Q3 2023 earnings report. The positive reaction occurred once management discussed material price increases on the earnings call, which are summarized below:

As of Oct. 12, Disney+ Premium (with no ads) will jump 27%, rising from $10.99 to $13.99/month for U.S. customers. Hulu without ads will increase 20%, from $14.99 to $17.99/month.

As pricing power is a key performance indicator for the streaming business, the subdued rally attempt following the Q3 2023 earnings report is likely to be a function of Disney’s share price being washed out, technically speaking. The disinterest evident in Disney’s share price action is also likely to be a result of the company being unattractive to both growth and value investors given recent profitability struggles.

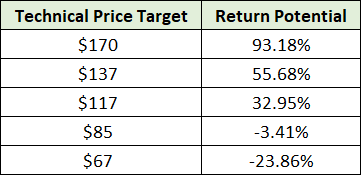

Nonetheless, the evidence supports Disney’s share price nearing a bottom. This comes with the caveat that a final washout towards the lower support level in the high $60s is a very real possibility. If lower support is tested, it is likely to be short lived. The following table displays the return potential to each of the five technical targets outlined in the above charts.

I view the risk/reward spectrum in the above table as capturing the most likely potential return spectrum for Disney’s shares into mid-decade.

Summary

The Disney investment case boils down to just one question: Is it the Magic Kingdom or a dead mouse bounce? While the bounce was meager following Q2 2023 results, in line with the dead mouse bounce interpretation, the future looks decidedly bright for Disney, the Magic Kingdom.

Given the increasing attractiveness of the shares near decade-low levels, an accumulation strategy should be top of mind for investors. As the possibility of a lower test into the high $60s remains a real possibility in the near term, the most promising strategy is to stake a position at current levels while leaving room for additional purchases. For example, one could purchase 25% to 50% of the intended position at current levels while leaving room for exceptional upside potential in the event of a final washout.

Either way, Disney offers a uniquely asymmetric risk/reward opportunity in one of the world’s greatest consumer brands. While the current bounce may in fact represent a dead mouse bounce in the short term, in the long term, Disney is highly likely to remain the Magic Kingdom for investors.

Price as of report date: $87.06

Disney Investor Relations Website