The symbol for psychology is the 23rd letter of the Greek alphabet, “psi” (Ψ). According to the article “The Story of the Psychology Symbol (Ψ),” by psychologist Valeria Sabater, “psi” (Ψ) came to represent psychology through its own metamorphosis:

In ancient Greek, the word psyche meant butterfly. This insect was also a symbol for the breath of life, a breeze, a life-giving wind… Little by little, thanks to the Roman Empire’s influence, the word ended up symbolizing the human soul. What they saw it as was our life-force, also known as “ka” in Egyptian culture…For them, butterflies represented light, change, and hope.

The above picture is in fact that of a butterfly, in the end. I presume it is called a caterpillar in the above stage of life due to the fact that it looks nothing like a butterfly. It undergoes a complete metamorphosis and in doing so became a symbol of the soul and of the field of psychology.

The butterfly offers a robust mental model for viewing the present and the future as it unfolds. Applying the butterfly model to investment opportunities is especially powerful. After all, an investor’s job is to clearly see the present (a caterpillar) while keeping sight of the vast possibilities (a butterfly).

Planting Seeds

Planting investment seeds when companies appear to be caterpillars opens the door to asymmetric risk/reward opportunities, as the butterflies inevitably materialize. While at the same time, keeping in mind that there will be many moths along the way. Though generally harmless, moths continue to devour things once in flight, such as capital in our investment analogy.

On the other hand, planting investment seeds when companies are obviously butterflies can lead to disastrous results. If everyone knows a company is a beautiful butterfly, it is highly likely to be priced as such. As a result of being priced for perfection, the risk/reward asymmetry is often deeply skewed to the downside.

Furthermore, unlike actual butterflies, companies can morph into moths or caterpillars at any time. If this occurs after one paid a top butterfly price, the risk/reward asymmetry can become extreme to the downside.

Conversely, if one paid a caterpillar price for a company that is likely to become a butterfly, the risk/reward asymmetry is often decidedly skewed to the upside. In this instance, the worst case scenario is that the company remains a caterpillar or becomes a moth. As one paid for a caterpillar, the investment results can often be satisfactory even if a company does not become a butterfly.

What is Priced In?

In the end, what is priced in is perhaps the most important question all investors must ask themselves.

Today, the dispersion across the various segments of the stock market in terms of what is priced in is quite broad. Much of the upside dispersion in valuations (butterflies are priced in) and downside valuation dispersion (caterpillars are priced in) are backward-looking. This dynamic was discussed in the report “Technology outlook for 2023”:

A defining feature of market cycles is sector leadership changes. The largest bull market in history ended in January 2022 and it was led by the technology sector. From a cycle perspective, it would be unusual and even unnatural for the technology sector to lead the next cycle. While qualitative in nature, there is reason to believe that the sector will face relative headwinds.

If we have entered a new cycle with new leadership, as I believe to be the case, the backward-looking valuation dispersions represent a broadly applicable asymmetric risk/reward opportunity. If so, the winners of the last bull market are likely to become laggards of the new cycle. Similarly, previous cycle laggards are likely to become the leaders of the next bull market.

The Next Bull Market

It is highly likely that the lows reached by the broad market averages in 2022 will mark the low point of the recent bear market cycle, within a reasonable margin of error. Much of this interpretation rests on the market dominance of the largest firms in the US. Many of which operate in monopoly-like conditions.

That said, many of the largest firms are also priced as if they are the rarest of butterflies. As a result, the valuations create headwinds for the establishment of a new bull market in the market averages.

Butterflies

There are many examples of today’s butterflies covered in the piece “A review of stoxdox negative risk/reward rated stocks.” NVIDIA (NASDAQ: NVDA) is an excellent example of a butterfly, as it sufficiently captures the underlying theme of backward-looking valuation dispersions.

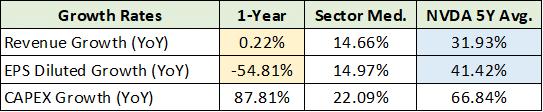

NVIDIA is universally recognized as the leading semiconductor-based technology company and as being in the AI pole position. The following table displays various growth rates for NVIDIA over the past year and compares them to the sector median and Nvidia’s actual 5-year average growth rate.

I have highlighted in blue the backward-looking performance and in yellow the present performance for NVIDIA. Revenue growth paused after an explosive 5-year growth period, while earnings were halved. Importantly, notice that Nvidia has been severely underperforming the sector over the past year.

Interestingly, the company is growing its capital requirements quite rapidly, with 88% growth of capital expenditures last year. The 5-year-average capex growth rate of 67% is quite high.

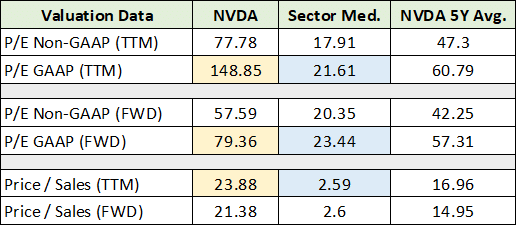

Turning to valuations, the following table displays current data for NVIDIA, the sector, and NVIDIA’s average valuation over the past five years.

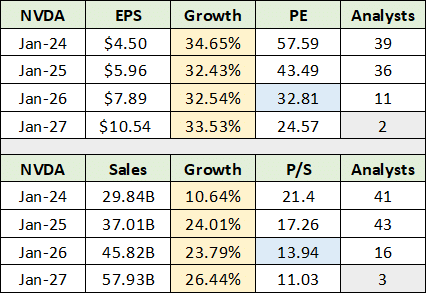

I have highlighted the extreme valuation dispersion to the sector for ease of comparison. Using NVIDIA’s most recent financial performance, the company is being valued not just as a butterfly, but as the rarest of the species. Turning to forward-looking growth estimates in the table below, notice that the consensus is for growth to reaccelerate in the immediate future (highlighted in yellow).

As the number of analyst estimates beyond 2026 is minimal, viewing the current valuation on 2026 estimates provides the longest-term perspective in which to view the consensus outlook.

If NVIDIA were to immediately reaccelerate to 30%+ earnings growth and 20%+ sales growth over the next three years, an investor today is paying 14x 2026 sales and will receive a 3% earnings yield in 2026. Furthermore, achieving such an optimistic growth outlook is far from guaranteed, leaving the 3% potential yield in 2026 subject to material risk.

In essence, there is little margin for error in achieving what are extraordinary growth rates when paying 14x 2026 sales estimates. If growth estimates are achieved, or even surpassed, today’s valuation is pricing it in as a near certainty. Finally, even if consensus growth estimates are a certainty, the valuation on 2026 estimates exposes one to substantial multiple compression risk at 14x sales.

Complicating matters for NVIDIA is the fact that it has well-above average profit margins compared to the sector. As the US and global semiconductor expansion attests, competition is likely to become quite intense into mid-decade as compared to the competitive environment of the past five years.

If margin compression were to occur into mid-decade, the valuation extremes outlined above will be amplified to the downside as the denominator underlying the valuation contracts alongside the multiple. In summary, at NVIDIA’s valuation, there is no room for it to be anything but the rarest of butterflies well into the future.

Summary

Today, there are many obvious and longstanding butterflies at valuations which offer limited sustainable upside return potential. As a result, they expose investors to a heightened degree of sustainable downside risk.

On the other hand, there is a broad set of asymmetric risk/reward opportunities in caterpillars in the current environment. This broad set of opportunities is largely due to the cycle change dynamics discussed above. Many industries have been in various stages of recessionary conditions over the past decade and are priced for such conditions to persist into the future.

While the butterflies of today have been flying high for some time, the caterpillar opportunities will eventually become either moths or butterflies. Either way, the risk/reward asymmetry for such companies remains decidedly skewed to the upside.