The supply and demand disruptions resulting from COVID amplified commodity price signals, first down then up. This dynamic has amplified the noise level, thereby lowering the information value of prices. With a resumption of price volatility underway, it is a good time to step back and observe the fundamental and structural economic shifts that are underway. The key question for investors, which commodity opportunities are shorter cycle and which are longer cycle?

At the moment, the energy transition stands as the primary secular driver for commodities. There is no doubt in my mind that the world is on the brink of this transition at scale. As a result, there is likely to be a longer than normal upcycle for certain commodities, which could last into the next decade. Meaning, while commodities are and will remain volatile, there should be a structural uplift for the energy transition beneficiaries.

Copper & Industrial Metals

Copper is likely to have a secular tailwind into the 2030s. The thesis is quite simple, electrification requires copper. If society is broadly transitioning to electrification and away from hydrocarbons, copper is the “new oil” as they say. For those interested, I covered the structural shifts for key commodities in some detail in several of my recent reports.

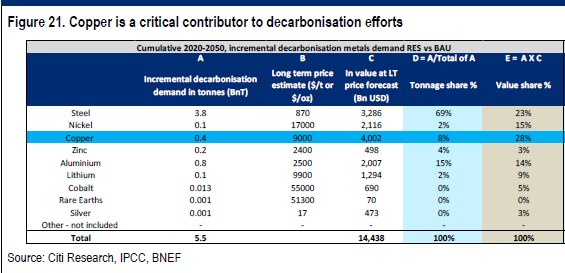

In Rio Tinto: Asymmetric Global Growth Opportunity (NYSE:RIO), I reviewed Citigroup’s outlook for key metals and the additional demand that is projected to result from decarbonization efforts between 2020 and 2050. The following image from the report captures the forecasted increase in metals demand resulting from decarbonization plans globally.

Incremental copper demand from decarbonization is expected to be roughly 0.4 billion tons. Over thirty years this averages out to roughly 13 million tons annually under the full global decarbonization effort scenario. Copper production is in the neighborhood of 21 million tons today. With production expected to grow at a 3% annual rate through 2030 and reach roughly 27 million tons, there looks to be a structural and material copper supply shortfall in relation to the world’s preferred decarbonization plans.

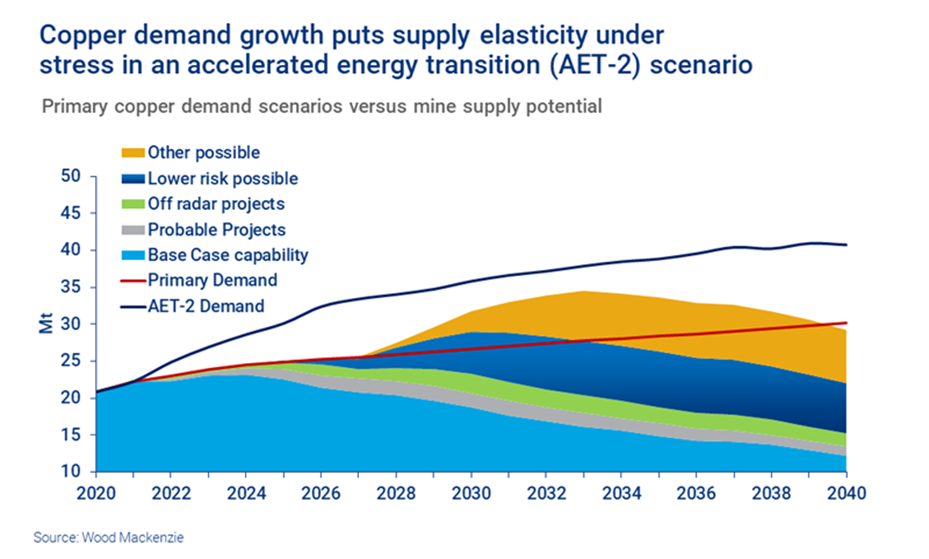

I covered the projected supply shortfalls through 2040 in Freeport-McMoRan: Doctor Copper Makes A House Call (NYSE:FCX). The following chart from this report displays the projected copper shortfall under the preferred global decarbonization plans.

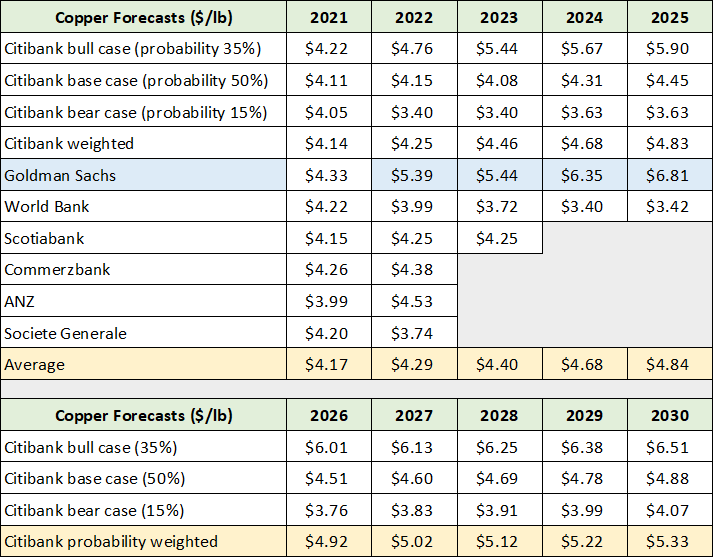

The key lines are Primary Demand and AET-2 Demand. Primary demand is base demand while AET-2 Demand includes the preferred decarbonization plans through 2040. With supply shortfalls forecasted for mid-decade onward as the energy transition progresses, and the difficulty of bringing new supply online, copper prices should remain well supported at generally higher price levels than has been the case in recent times. The following table displays recent copper price forecasts.

Copper is currently in the $3.50 range. The above forecasts are relatively mild from my perspective and leave room for upside surprises due to the forecasted tight supply conditions into 2030 and beyond.

China

In the two reports above, I also cover the China effect in some detail, which the market may be mispricing. In the Freeport report, I reviewed the primary risk to Chinese demand that the market fears, a deep real estate recession. Interestingly, the market may be overestimating the negative effects on commodity demand from China’s real estate correction.

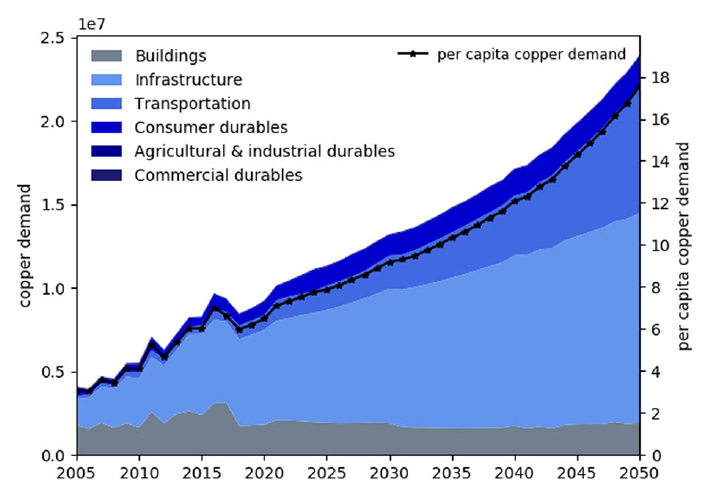

China operates on 5-year plus plans that lend themselves to reasonable estimates of the future. The study reviewed in the Freeport report projects copper demand by end use in China through 2050. The conclusion from the report, Chinese real estate is in the rear-view mirror in terms of copper demand. On the other hand, the energy transition is well engrained in China’s long-term plans and will dwarf any demand reduction from the real estate sector. The chart below from the report projects Chinese demand by sector through 2050.

The Rio Tinto report highlights the fact that China, and Asia generally, will remain by far the largest influence on commodity demand and pricing. While we hear little about China’s Belt and Road Initiative today, I have no doubt that some version of this plan will materialize. It is likely to feature China as the primary global infrastructure builder during the coming energy transition.

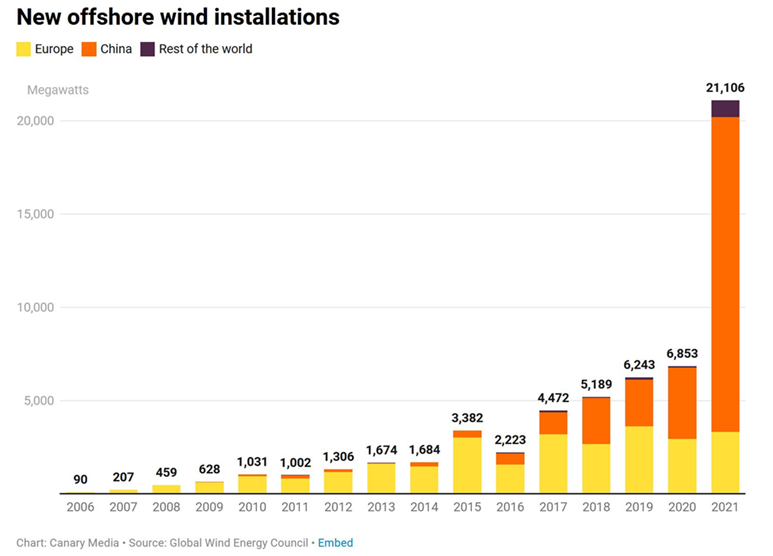

This is China’s competitive advantage, the ability to build infrastructure at scale in a condensed period of time. It is clearly on display in the yearly offshore wind installation chart in the Freeport report which is provided below.

China’s ability to ramp energy infrastructure is unmatched and will be needed to execute the energy transition on a global scale. The wind example above also highlights the robust demand outlook for other commodities, such as steel which requires iron ore.

Industrial Metals

Steel will play an important role in all renewables, including and especially solar and wind. Each new MW of solar power requires between 35 to 45 tons of steel, and each new MW of wind power requires 120 to 180 tons of steel. In fact, the Citigroup commodity demand estimates in the Rio Tinto report project that steel will account for 69% of the incremental commodity tonnage demand from decarbonization efforts and 23% of the total dollar value.

For comparison, copper is expected to account for 28% of the total dollar value of incremental commodity demand resulting from decarbonization plans. Interestingly, aluminum is projected to account for 14% of the total dollar value.

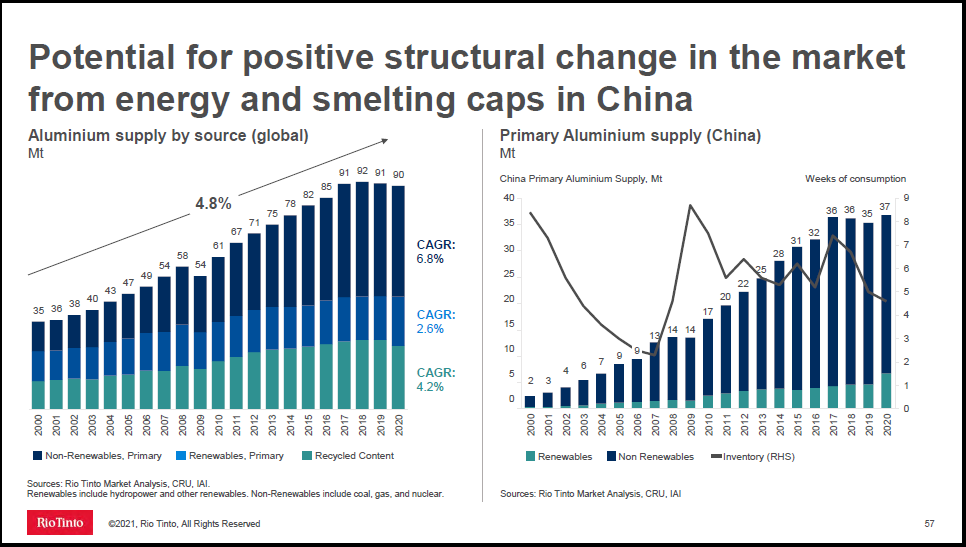

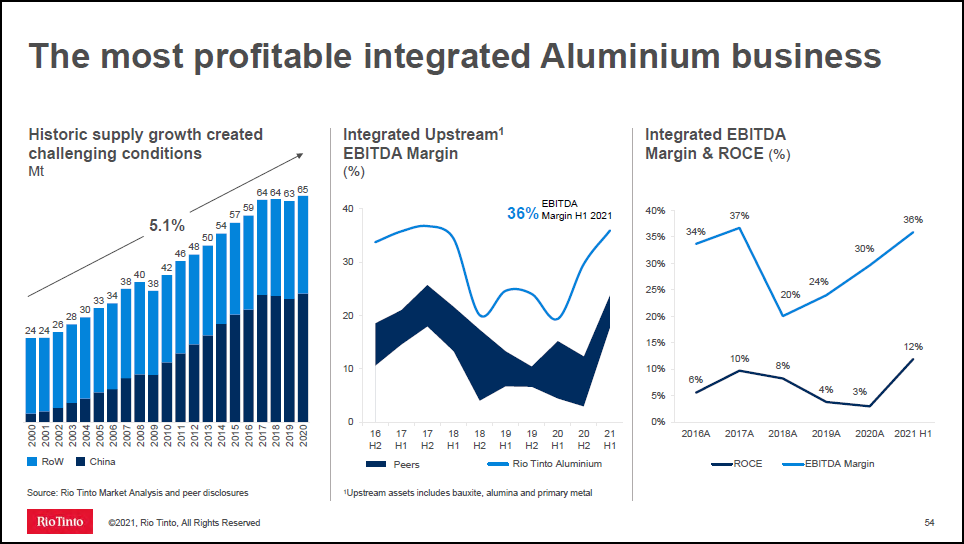

The secular thesis for aluminum is light weighting. This too is quite simple, lighter materials require less energy for production, transportation, and subsequent use. Aluminum also has the benefit, if you will, of being dirty to produce. With China agreeing to carbon reduction targets, the country has capped its aluminum production in recent years, which I covered in the Rio Tinto report. This looks to be a structural or secular shift which should support aluminum prices into the 2030s. The following two images from the report capture the shift and Rio Tinto’s aluminum superiority.

Source: Rio Tinto’s October 2021 Investor Seminar

Of note, Rio Tinto has arguably the highest quality aluminum business in the world and may be the single best positioned company to capture the commodity growth opportunity resulting from decarbonization. Demand for all three of these primary commodities (copper, iron ore, and aluminum) should remain robust.

What About Gold?

Gold and more specifically gold miners are timely and a high conviction idea, from a portfolio perspective. I have run many Monte Carlo simulations over my career in order to view optimal portfolio allocations under various assumptions. What I can say with certainty is that the most efficient portfolio allocation to gold is almost always vastly higher than what is implemented in practice.

Today, I see studies showing that institutions have a 0.5% weighting to gold in their portfolios, on average. Portfolio optimization points toward something many multiples of this. From my perspective, the relative underinvestment in gold is a source of potential energy (investment inflows) should traditional asset returns continue to revert to the mean. Additionally, we have entered a higher volatility regime than has been the case in some time, which further supports fund flows toward greater diversification. Gold is a top choice for diversification, hence my Barrick report title: Barrick Gold Is On The Efficient Frontier (NYSE:GOLD).

Barrick is now back beneath its levels of December 2021 when the above-mentioned report was published. In the interim, Barrick rallied 46% into April 2022 and served one of its primary roles in a portfolio, diversification. Barrick is sitting on what should be an extraordinarily strong long-term support level. Agnico Eagle Mines (NYSE:AEM), another blue-chip gold miner, is in a similar position. As two of the highest quality miners in the world, they are natural high conviction choices today for a diversified portfolio, delivering high beta exposure to gold.

The technical setup for gold is one of the more bullish long-term setups in the market today. When combined with the fundamentals of likely strengthening investment demand, increasing geopolitical tensions, and discounted stock prices, the risk/reward setup for the gold miners is decidedly positive. The added benefit of materially increasing portfolio diversification is a unique and undervalued feature.

What About Energy?

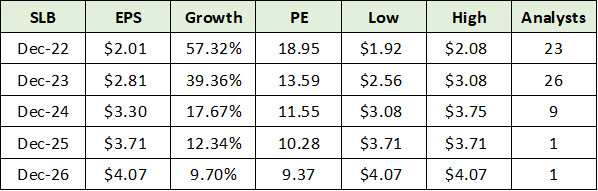

With the energy transition in mind, a top choice in the energy sector is Schlumberger, which I covered in the following reports: Schlumberger: An Asymmetric Opportunity With Supercycle Potential (NYSE:SLB) and Schlumberger: A Top Choice For Cyclical Growth Through 2023.A look at forward earnings growth rates and the PE multiple on each, points to a growth company trading at a discounted price. The consensus growth rate for each year through 2025 is 57%, 39%, 18%, and 12%, respectively, as can be seen in the following table compiled from Seeking Alpha.

This is exceptional growth in today’s environment. The PE multiple at each growth rate through 2025 is 19x, 14x, 12x, and 10X, respectively. There is a substantial multiple expansion opportunity as is evidenced by Schlumberger’s 5-year average PE multiple of 32x.

It is likely that supply capacity in the energy service industry will be inelastic nearer term. The industry will most likely add capacity with a lag given the prolonged recessionary conditions faced before the recent cyclical upturn. As a result, the energy services sector looks ideally positioned for margin expansion, which could add material upside potential to consensus growth estimates.

Finally, there are extraordinary growth opportunities looking across the broad energy services sector. Schlumberger’s active growth programs include lithium mining technology, nickel-hydrogen battery technology, electrolyzer technology for hydrogen production, and building-scale geothermal energy technology, to name a few. The broad energy service sector looks to be entering a secular growth phase in response to the aforementioned global energy transition planned through 2050. Schlumberger’s valuation places little to no value on these growth opportunities.

Summary

Returning to the key question, which commodity opportunities are shorter cycle and which are longer cycle? With the energy transition as the secular driver of commodities, copper, iron ore, and aluminum look to be beneficiaries and represent exceptional risk/reward opportunities.

Freeport McMoRan is a top-quality choice for direct leverage to electrification, copper. Copper may in fact become the “new oil.” Of note, Rio Tinto offers top tier copper growth and has arguably the highest quality aluminum business in the world. When combined with its leadership position in iron ore, Rio Tinto may be the single best positioned company to capture the commodity growth opportunity resulting from decarbonization.

Gold and more specifically gold miners are timely and a high conviction idea, from a portfolio perspective. The relative underinvestment in gold by institutions represents a source of upside energy via future fund flows. Given the small market capitalization of the gold mining sector, institutions will gravitate to the blue chips. Barrick Gold and Agnico Eagle Mines are top choices.

Finally, in the energy sector, Schlumberger’s growth projections are exceptional in today’s environment. It is likely that supply capacity in the energy service industry will be inelastic nearer term, opening the door to margin expansion and upside surprises. Schlumberger’s active growth programs include lithium mining technology, nickel-hydrogen battery technology, electrolyzer technology for hydrogen production, and building-scale geothermal energy technology, to name a few. With the global energy transition to come, the energy services sector offers some of the more robust growth opportunities in the market.