Following up on the bullish copper and Freeport reports, “A new copper bull market takes shape” and “The miners are looking up,” Rio Tinto (NYSE:RIO) stands out as an asymmetric risk/reward opportunity.

Rio Tinto

In terms of copper, Rio Tinto offers one of the most robust profiles with over 100% production potential visible into 2030. The company is unique in the mining sector in that it operates world-class assets across three commodities: copper, aluminum, and iron ore. Rio’s portfolio is covered in the following reports:

- “Rio Tinto is a perfect portfolio diversifier”

- “Rio Tinto is an asymmetric global growth opportunity”

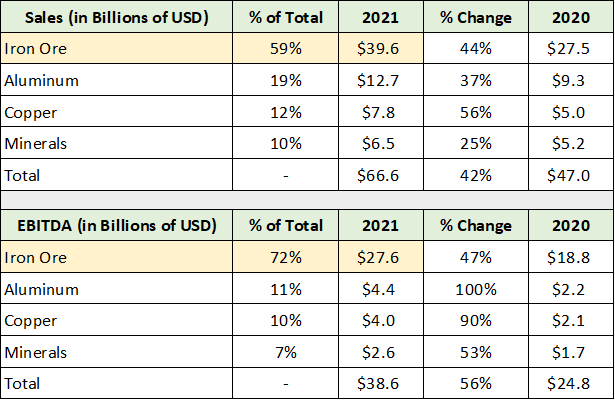

As the previous reports reviewed Rio in detail, and the fundamentals remain unchanged, I will focus on the tactical considerations here. The following table from “Rio Tinto is a perfect portfolio diversifier” provides a recent breakdown of Rio’s business mix by commodity for reference.

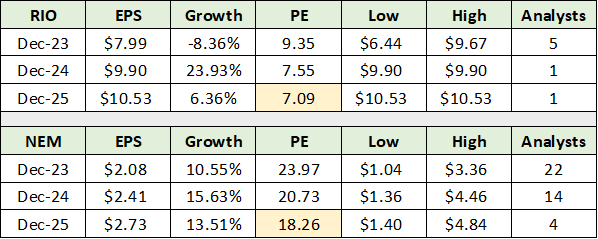

Iron ore is and will remain the primary driver of Rio’s results, with 2021 EBITDA near $28 billion. The company’s total EBITDA near $40 billion is quite impressive. Rio’s leadership position in iron ore is similar to Newmont Corporation’s (NYSE:NEM) leadership in gold. As a result, using Newmont as a valuation comparable quantifies the size of the relative opportunity.

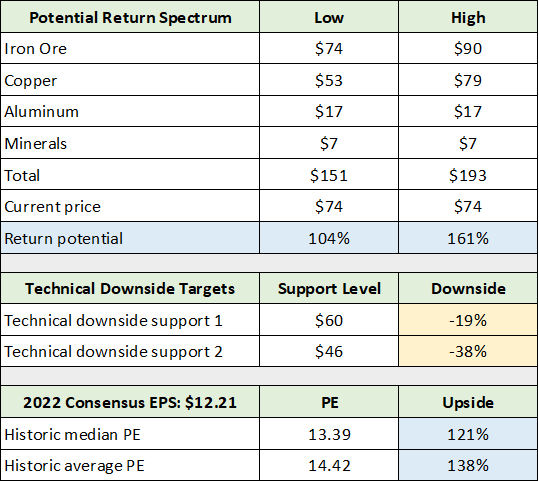

As Rio offers peer-leading copper growth potential, an industry leading aluminum portfolio, and arguably the top iron ore assets in the world, a valuation in line with Newmont is a reasonable expectation. Based on this, the upside using 2025 consensus estimates is 160% or $192 per share. That would place Rio at the top of the potential return spectrum that was estimated in “Rio Tinto is a perfect portfolio diversifier.” The potential return spectrum from the report is below.

The blue highlighted cells remain valid upside targets for Rio, especially in light of Newmont’s valuation. As we will see in the technicals, the $60 downside potential now looks to be a floor.

Technicals

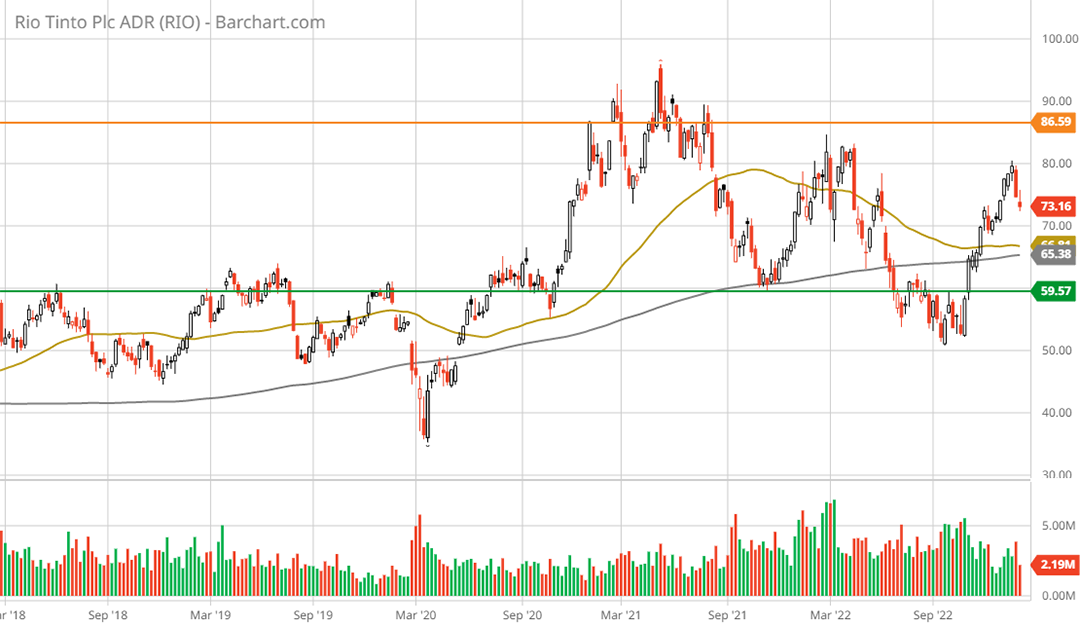

Looking at the 20-year monthly chart below, the $60 support level is highlighted by the green line. This support level dates back nearly 20 years and served as resistance during the decade-long commodity bear market.

The only visible resistance level is highlighted by the orange line. Importantly, Rio has rarely traded above $60 since 2008. In essence, there is nearly zero technical resistance and incredibly strong support to the downside. The strength of the downside technical support is reflected in the deeply discounted valuation. The 5-year weekly chart below zooms in on the strong support and to a potential breakout towards new all-time highs.

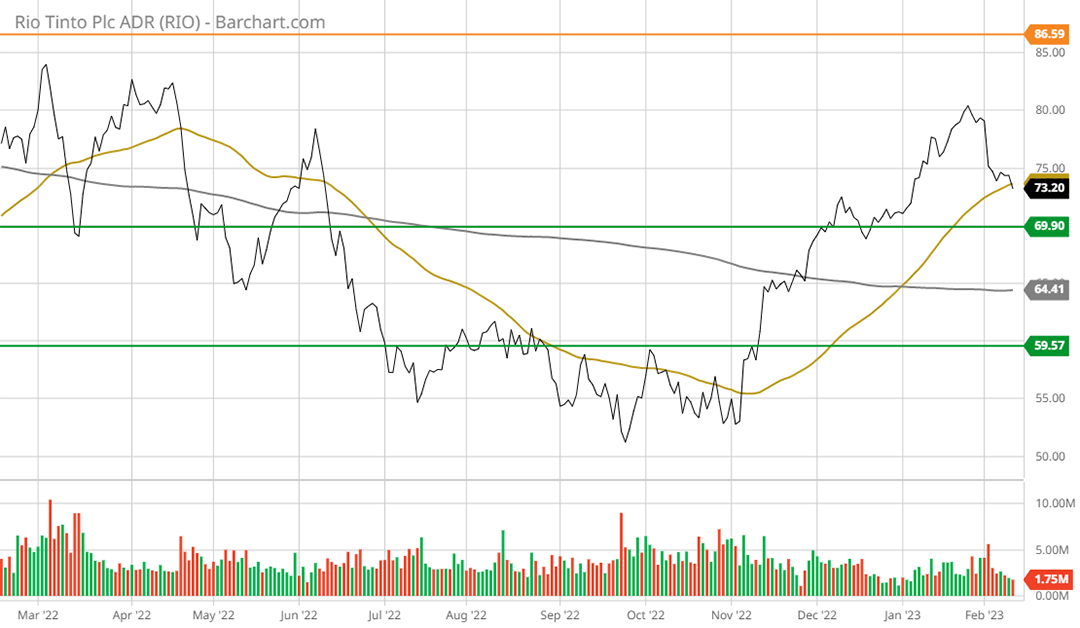

Notice the 50-week moving average (the gold line) remains above the 200-week moving average (the grey line). Rio is in a bull market, if muted at the moment.

Supporting the upside trend, the 1-year daily chart below displays the golden cross that occurred in early January. The current correction should find strong support near $70, which is between the 50-day and 200-day moving averages, near $73 and $65 respectively.

Summary

Using the 200-day moving average at $65 as the likely low end of the price range, and $190 as the maximum upside potential, the potential return spectrum is -11% to 160% looking into 2025. A dividend of between 5% to 10% per year on the current price appears highly likely if results near the consensus estimates are achieved. The dividend further reinforces the $60 floor, leaving the risk/reward asymmetry skewed decidedly to the upside.

Price as of report: $73

Rio Tinto Investor Relations Website: Rio Tinto Investor Relations