There are these two young fish swimming along and they happen to meet an older fish swimming the other way, who nods at them and says “Morning, boys. How’s the water?” And the two young fish swim on for a bit, and then eventually one of them looks over at the other and goes “What the hell is water?”

This is Water

The above quote is from David Foster Wallace‘s commencement speech to the 2005 graduating class at Kenyon College. It illuminates a fundamental risk that we all face and is arguably the most critical to manage if one is to achieve investment success. The following is a summary quote from the speech (emphasis added):

The point of the fish story is merely that the most obvious, important realities are often the ones that are hardest to see… the really significant education in thinking that we’re supposed to get in a place like this isn’t really about the capacity to think, but rather about the choice of what to think about… I’d ask you to think about fish and water, and to bracket for just a few minutes your scepticism about the value of the totally obvious…

He goes on.

…the exact same experience can mean two totally different things to two different people, given those people’s two different belief templates and two different ways of constructing meaning from experience… a huge percentage of the stuff that I tend to be automatically certain of is, it turns out, totally wrong and deluded. I have learned this the hard way, as I predict you graduates will, too.

The Science: Thinking, Fast and Slow

Daniel Kahneman is the preeminent expert in the field of decision making and the winner of the Nobel Prize in Economic Sciences.

In his book, Thinking, Fast and Slow (Farrar, Straus and Giroux, 2011) he explores the essence of decision making and illuminates two primary modes of thought. He refers to these two modes as System 1 and System 2 thinking:

- System 1 operates automatically and quickly with little or no effort.

- System 2 allocates attention to mental activities that require time and effort.

Each mode of thinking has strengths and weaknesses. System 1 thinking is a flow state requiring little to no effort or time. Operating in System 1 mode enables maximum productivity as your most valuable resource is maximized, time. It is the mode that is engaged most of the time by the vast majority of human beings. This mode of thinking is comparable to the two young fish swimming along in Wallace’s story.

Conversely, System 2 thinking requires attention, or time, and is easily disrupted if attention is diverted. It is engaged when System 1 is unable to provide a solution for a given situation. In Wallace’s fish analogy, the two young fish briefly engaged System 2 and wondered “What the hell is water?”

The risk when operating in System 1 mode is that there are numerous and well-documented cognitive errors that reoccur, as Kahneman outlines in the book. It is a feature of operating in a maximal flow state, not a bug. To quote Kahneman:

We are often confident even when we are wrong, and an objective observer is more likely to detect our errors than we are.

Wallace’s commencement message is well supported by scientific evidence.

Why It Matters

I was reviewing Kahneman’s book recently when an article by Josh Brown, chief executive officer of Ritholtz Wealth Management and a frequent on-air contributor to CNBC , was shared with me. Given Brown’s broad reach, and the fact that those who shared the article are successful and well informed, I decided to review the piece.

Brown’s article analyzes the US government’s stimulus response during the pandemic and the repercussions for inflation and policy today and into the future. My critique or commentary on the article is not meant to be critical of Brown in any way. Brown likely has a writing style with which I am unfamiliar and is not to be taken too literally.

The importance of reviewing the article is that it is a real-time opportunity to view the current framing of reality by those that are deeply connected within the investment community and financial elite. This is especially important at this moment in time as the economy and financial markets are undergoing a fundamental transition. Our decisions today, and how we frame reality, have never been more important. We must frame the investment landscape as objectively as possible.

The Article

“You weren’t supposed to see that” is the title of Brown’s article that was published October 2 on the Reformed Broker. It begins with the following quote:

I’m going to tell you a quick story in the order in which it happened. You were there. You will be familiar with the sequence of these events. But you may not have reached the shocking conclusion that I have. At least not yet.

In Kahneman’s book, he discusses the Narrative Fallacy in the chapter “The Illusion of Understanding.” The following is a summary quote of Kahneman:

A compelling narrative fosters an illusion of inevitability… You build the best possible story from the information available to you, and if it is a good story, you believe it… The core of the illusion is that we believe we understand the past, which implies the future should also be knowable, but in fact we understand the past less than we believe we do.

It is critical for investment success to filter all narratives. They are by definition stories that may or may not be an accurate representation or framing of reality. Brown includes many facts in his article which I will summarize shortly. For now, we will start with his conclusion. The following summary quote captures the essence of his conclusion regarding lessons learned from the pandemic stimulus programs:

Widespread prosperity, it turns out, is incompatible with the American Dream. The only way our economy works is when there are winners and losers. If everyone’s a winner, the whole thing fails. That’s what we learned at the conclusion of our experiment. You weren’t supposed to see that. Now the genie is out of the bottle. For one brief shining moment, everyone had enough money to pay their bills and the financial freedom to choose their own way of life.

And it broke the [expletive] economy in half.

He goes on.

Everyone is scrambling to undo the post-pandemic jubilee. It was too much wealth in too many hands. Too much flexibility for too many people. Too many options. Too much economic liberation… the whole system is now imploding because of it…

The Facts

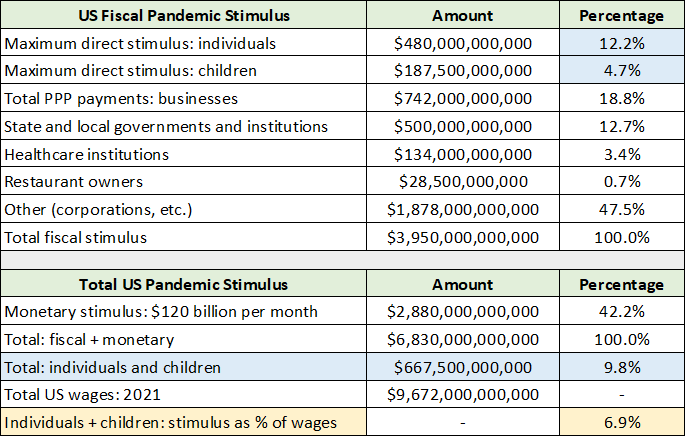

Brown provides various pandemic stimulus facts to support his conclusions. Upon a cursory review, the facts appear to be in the ballpark. I will use rounded numbers here as they capture the gist while removing unnecessary detail. The following table summarizes the fiscal and monetary stimulus programs implemented by the US in response to the pandemic.

The stimulus amounts in the above table are taken directly from the article. I have also included total US wages for 2021 compiled from the IRS in the second-to-last row. This addition provides a reference point for the size of the stimulus programs directed toward individuals in relation to annual wages for all Americans.

I have highlighted in blue the direct fiscal stimulus payments to individuals and children. Notice that they amounted to roughly 17% of the total US fiscal pandemic stimulus. When monetary stimulus is included in the total, stimulus payments to individuals and children accounted for 10% of the total pandemic stimulus. The stimulus amounted to roughly 7% of annual wages in the US.

Regarding the relative size of stimulus payments to individuals (10% to 17% of the total), interestingly, Brown also notes the following at the beginning of his story when summarizing the past decade:

It was the best of times, it was the best of times. The tail end of a decade of uninterrupted asset price appreciation for the top decile of American households who own 89% of the US stock market and 70% of all of the wealth.

Fiscal stimulus to individuals was quite small in relation to the other stimulus beneficiaries. From this view, ordinary people received about 10% to 17% of the stimulus money, which is in line with the wealth inequality that Brown highlights.

This is not to say that the stimulus to individuals was not inflationary, it certainly was. People received disposable cash in addition their regular paychecks. The median household income in the US is roughly $70,000, for which the stimulus checks were a nice bonus payment. With supply chains shut down, it was an explosive inflationary backdrop. This was the true transitory inflation effect as the stimulus was a one-time event.

Going back to Brown’s conclusions regarding the pandemic stimulus and what it entails for inflation and future policy: Was there too much wealth in too many hands? Was everyone a winner? Did everyone have enough money for financial freedom?

What the Hell Is Water?

Brown’s conclusions may be biased by personal experience and perspective; keeping in mind that he is likely to have a writing style which is not to be taken too literally. Either way, financial insiders and the elite may not know that they are swimming in water, to use the opening analogy.

The War on Inflation™ is the new War on Drugs. In the 1980’s they were willing to sacrifice entire cities and communities to the War on Drugs… Today they’re willing to sacrifice the stock market, the bond market, housing values, anything… Over $10 trillion in wealth wiped out this year, a sacrifice on the part of wealthy Americans…

Equating the Fed’s very recent monetary policy tightening with the War on Drugs is quite the narrative, as is using “sacrifice” to describe recent asset price declines given the extreme valuation starting point.

You’re hearing the term “normal” a lot these days or normalization. Normal is 2019, where the rich had unlimited options… The working poor had no options in this world but had lots of obligations… This kept the economy humming on an even keel. It was necessary. It was “normal.”

Is normal when the rich had unlimited options and the working poor had no options? Is this what keeps the economy humming? Is this the “normal” that US fiscal and monetary policy are aimed at achieving TODAY?

Every time you hear a Federal Reserve official use the word “pain”… they are actually referring to people losing their jobs so that wage gains return to a “slower trajectory.” You are being [expletive] around with, assaulted with the English language and all its inherent trickery.

What Inflation Is Policy Targeting?

While I too have biases and personal preferences, I make every effort to limit and ideally remove them and their effect on my analysis. 26 years of experience has taught me that maintaining an objective perspective is the only pathway to investment success. My conclusions, based on the data, are the polar opposite of Brown’s.

In fact, the excesses that fiscal and monetary policy tightening are targeting look to be wholly outside of the general labor market, in which the bottom 90% exist. As Brown mentions in his article, the labor market has been under stress for a long time and has faced prolonged wage stagnation. The pandemic stimulus transferred the equivalent of 7% of annual wages to workers. This does not appear to be extreme under the conditions and could be viewed as a rational response to a complete economic shutdown.

On the other hand, as Brown notes, the stock market doubled within a year following the first stimulus injections. On the real estate front, housing prices skyrocketed roughly 40% while rents began growing in the mid-teens annually. Private equity and venture capital valuations became extraordinary, and by all accounts remain well above what market prices suggest being the case today. Asset price inflation is intimately tied to monetary policy and interest rates.

The largest beneficiaries of this stimulus, which amounted to roughly $3 trillion, is the top 10% of society which owns 90% of stocks. Additionally, the corporations and businesses which the top 10% own received much more stimulus than did individuals overall.

Speculation driven from within the financial elite entered a hyperinflationary trend. Stock option compensation exploded along with sham companies, resembling the extremes of the dot com era on steroids. Thousands of cryptocurrencies, most mathematically identical to a Ponzi scheme, were “printed” out of thin air creating trillions of dollars of perceived wealth. The richest man in the world was literally pumping the price of something called “dogecoin” on Twitter.

The vast majority of the speculative inflation gains flowed to insiders. They are in the same top 10% of society that owns 90% of the stock market, while the vast majority of the gains were likely confined to the top 1%. Most of the losers in the speculative frenzy, for which a wealth transfer occurred, were the same wage earners that received a 7% stimulus bonus.

The question: which of the above groups would you target if you were a policy maker trying to reign in excesses?

Market Outlook

In terms of monetary policy, my interpretation of the situation remains unchanged and is summarized in the following passage from the August 29 Market Outlook: Where we go after Jackson Hole

As a result, my interpretation of the Fed’s stern Jackson Hole message is that the Fed views the mild inversion of the risk-free yield curve to be out of sync with inflation trends over the intermediate term. Meaning, a 3% yield on the 10-year plus end of the bond curve is viewed as being too low.

A second interpretation of the Fed’s message is that there remains excessive risk taking in the leveraged finance sector generally and the shadow banking system in particular. Excesses are on display in the shadow banking system with the ongoing cryptocurrency implosions. On the leveraged finance front, the derivatives market remains a systemic risk as excessive leverage here is often not visible until funding markets become stressed.

The Federal Reserve signaling its willingness to take short term rates toward 4% and keep them there for some time, thereby further inverting the risk-free yield curve, speaks directly to the excesses the Fed is targeting. If this approach is taken, it would have the effect of causing stress in the short-term funding markets for highly leveraged financial products and operators.

In summary, the Fed looks to be walking longer-term interest rates higher while attempting to cap the excesses in leveraged finance generally and the shadow banking system in particular. One thing the Fed is not trying to do is create a systemic event by destroying asset values broadly. That would take them back to the zero-interest rate and QE quagmire, which I view as a worst-case scenario that they are likely to avoid as best they can.

Summary

Market rates have largely priced in the current interest rate hiking cycle, as was reviewed in the September 15 Market Outlook: The recession is here, filter the noise. This remains the case regardless of the Federal Fund rate’s near-term machinations, as market prices are moving ahead of the Fed, by a lot in some cases. While some market participants are likely to face increasing stress, the rate shock has already occurred for the vast majority of economic participants. Remaining excesses will be drained while incredible opportunities for the next cycle are born.

What is water?