I am assigning CrowdStrike Holdings (NASDAQ:CRWD) a negative risk/reward rating based on its extreme valuation, rapidly decelerating sales growth, and indications of intensifying competition and pricing pressure. Budding growth deceleration combined with CrowdStrike’s extraordinary valuation at 46x estimated sales manifest as an acute risk of multiple compression. The potential multiple compression is substantial and on a scale that is unusual from a historical market context. As a result, the shares offer an exceedingly negative risk/reward asymmetry.

Risk/Reward Rating: Negative

I last updated CrowdStrike following the company’s Q2 2022 earnings report on August 31, 2021. Since that time there were two notable analyst reports on CrowdStrike. The analysts at Morgan Stanley and BTIG each offered cautionary ratings based on industry checks which point toward an increasingly competitive environment in CrowdStrike’s core IT security end markets. Of primary concern is the resulting pricing pressure. A summary of the Morgan Stanley and BTIG analyst reports is provided by Seeking Alpha.

Of particular note, the endpoint security market is beginning to cool after receiving a large boost from the COVID lockdowns and the resulting need to secure a distributed workforce globally. As the rapid growth has attracted increasingly sophisticated competition, pricing pressures appear to be surfacing. The analyst reports of increasing competition and pricing pressure ring true. On the Q2 2022 earnings conference call, management acknowledged that it has been competing on price recently to secure new business.

For a flavor of the breadth of competition, CrowdStrike reported in its Q2 2022 10-Q filed with SEC that Fair Isaac Corporation (NYSE:FICO) has filed a petition before the Trademark Trial and Appellate Board at the U.S. Patent and Trademark Office. Fair Isaac is seeking to cancel the registration of the company’s “CrowdStrike Falcon” trademark and is opposing the registration of its “Falcon OverWatch” trademark. While Fair Isaac is best known for its FICO credit scores, the company competes broadly in the area of fraud, identity management and risk mitigation under its Falcon brand. As the distinctions within cyber security become more blurred and a broad group of companies seek to compete for the security growth opportunity, it is reasonable to expect CrowdStrike’s sales to continue the trend toward rapid deceleration.

Overview

CrowdStrike has become a leader in the IT security market in recent times. On the Q2 conference call, the CEO George Kurtz, described the company as being in the “pole position” as the only cloud native, zero trust security provider offering protection across all three primary threat vectors: workloads, endpoints, and identity management. Furthermore, the company emphasized its competitive positioning in threat detection and breach prevention, instead of just malware prevention as its key differentiator. This rings true in an age of massively distributed computing in which half of all security incidents involve the breaching of IT systems rather than the insertion of malware. The competitive positioning also speaks to the broadening competitive landscape as highlighted by the Fair Isaac trademark litigation.

Recent Earnings Report

CrowdStrike reported strong fiscal Q2 2022 earnings after the market closed on August 31, 2021. The shares responded by selling off over 4% the following day as the results were not enough to reignite upward momentum for the stock. As of today, the shares remain relatively unchanged since this initial negative reaction. Of primary concern is the negative share price reaction in response to the impressive 70% revenue growth over last year’s Q2 coupled with the company raising its full year revenue guidance to 61% growth over fiscal 2021.

Financial Performance and Valuation

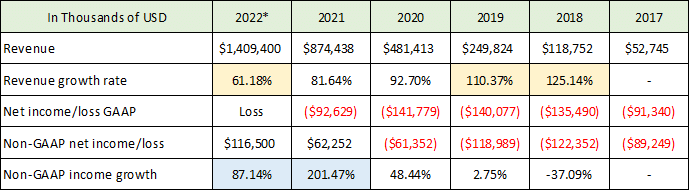

Given the muted stock reaction to the excellent financial results and competitive positioning, the market is signaling that the current valuation of CrowdStrike has priced in much of the good news. Reviewing the financial results and valuation supports this priced in thesis. The following table provides a breakdown of key profitability metrics compiled from the Q2 2022 8-K and the 2021 10-K filed with the SEC. Please note that the 2022* column represents the high end of the company’s guidance for fiscal 2022 which ends 1-31-2022.

Source: Created by Brian Kapp, stoxdox

The most pressing feature of the historical financial performance is that revenue growth is beginning to noticeably decelerate. While 61% growth is impressive, it is now roughly half the growth rate achieved as recently as fiscal years 2018 and 2019. Of note, the company is not profitable on a GAAP basis (generally accepted accounting principles). The reported non-GAAP profitability is due to the exclusion of large stock-based compensation expenses which are included in the reported GAAP net income figures. The non-GAAP income growth is also decelerating rapidly at an estimated 87% growth for the current year compared to 201% in fiscal 2021. The financial performance story is one of impressive yet decelerating growth rates.

Valuation

While growth rates are decelerating, they remain at hypergrowth levels. Given excellent growth and competitive positioning, the CrowdStrike investment thesis hinges on valuation as the company is clearly well positioned and is executing nicely.

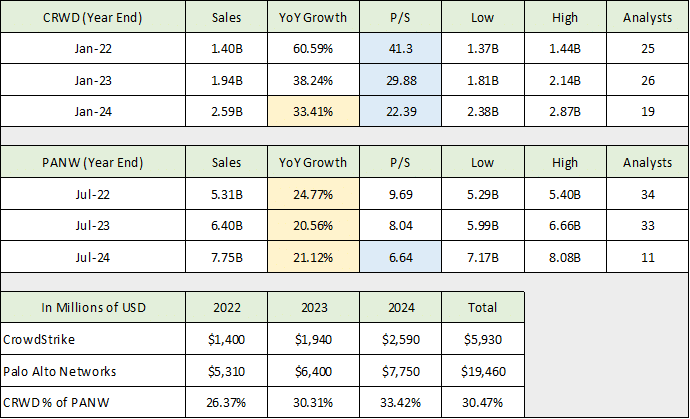

The following table was compiled from Seeking Alpha and displays the consensus earnings estimates for CrowdStrike through 2024. I have included the same estimates for Palo Alto Networks (NASDAQ:PANW) which serves as an excellent comparable company. Palo Alto Networks is a successful IT security company that is further along in its growth trajectory than is CrowdStrike. Adding a comparison company illuminates several opportunities and challenges for CrowdStrike going forward. When viewing the tables, please keep in mind that the market value of CrowdStrike is 113% that of Palo Alto Networks.

Source: Created by Brian Kapp, stoxdox

CrowdStrike is trading at an incredible valuation based on consensus earnings estimates through 2024 (highlighted in yellow). 548x the current year earnings estimate is extraordinary for a company with a $63 billion valuation (using the non-GAAP diluted share count). Looking out to 2024, the 187x PE multiple remains well outside of any historical market norms. Importantly, there is little evidence that companies in the IT security industry can achieve mega-cap status. The rapid speed of change and consistently intense competition has historically placed a ceiling on the size potential of companies in this industry.

The orange highlighted row compares CrowdStrike’s total earnings estimate each year and the total of all three years to that of Palo Alto. The percentage shown is CrowdStrike’s earnings in relation to Palo Alto’s earnings. Recall that CrowdStrike is valued at 113% of Palo Alto’s valuation while it is expected to generate only 14% of Palo Alto’s earnings in the current year. Over the entire three years, CrowdStrike is expected to generate less than a quarter of the total earnings estimated for Palo Alto Networks.

I have highlighted the earnings estimates for 2024 in blue. CrowdStrike is expected to continue to produce a very impressive 69% earnings growth rate compared to 20% for Palo Alto. This figure looks to be aggressive for CrowdStrike given that the revenue growth estimate for 2024 is only 33%.

The following table compares the consensus revenue estimates for each company through 2024, in order to provide a relative valuation view of CrowdStrike based on sales. The data was compiled from Seeking Alpha.

Source: Created by Brian Kapp, stoxdox

At the current share price of $262.50, CrowdStrike is valued at an incredible 41x sales estimates for the current year (highlighted in blue). The price-to-sales multiple jumps to 46x sales using the non-GAAP diluted share count. This is an extreme valuation from a historical market perspective. It is especially excessive given the rapidly decelerating growth rates and increasing competition discussed above.

I have highlighted the critical expected sales growth rates in yellow. Notice that CrowdStrike is expected to grow revenue by 33% in 2024 compared to 21% for Palo Alto. The growth rates of the two companies look to be rapidly converging which points toward a high likelihood of the valuation multiples converging as well. This is the primary risk facing CrowdStrike and is a major red flag.

Furthermore, Palo Alto produces nearly 4x the sales of CrowdStrike and is expected to produce 3.3x more in total sales through 2024. This reality makes it incredibly difficult to reconcile the current valuation of CrowdStrike. Palo Alto does demonstrate that CrowdStrike has plenty of growth runway on the horizon and highlights the excellent opportunity in front of the company. On the other hand, Palo Alto is valued at 10x expected sales compared to 46x for CrowdStrike.

The price-to-sales multiple comparison highlights the key risk theme running throughout the CrowdStrike valuation story: multiple compression. As CrowdStrike’s revenue growth decelerates from 61% towards Palo Alto’s 25%, the valuation multiple on sales will contract rapidly from 46x sales towards Palo Alto’s 10x sales (using non-GAAP diluted shares for each company). The magnitude of this valuation contraction is enormous and may weigh heavily on the share price.

Even if CrowdStrike is wildly successful and grows its earnings by 6x the current level and sales by 4x, the share price may actually be lower than it is today as demonstrated by the Palo Alto comparison. Adding potential insult to injury, this incredible hypothetical 6x growth in earnings and 4x growth in sales may take well over 5 years to accomplish. The risk of multiple compression is acute for CrowdStrike’s stock price.

Technicals

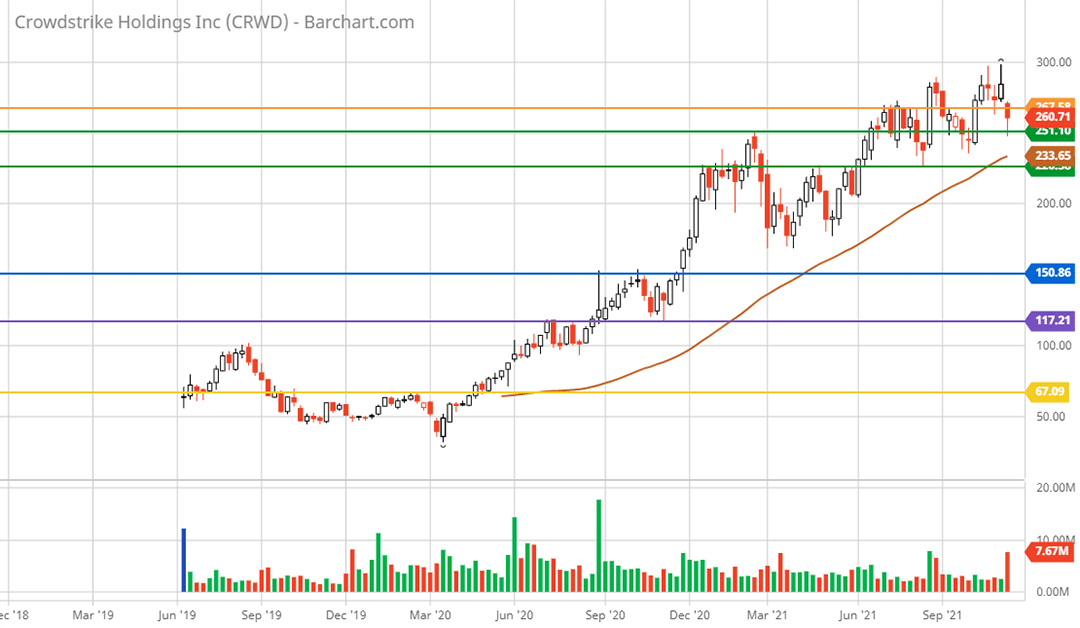

CrowdStrike came public in June of 2019 near $64. It proceeded to trend down before reaching a bottom at $34 during the COVID market crash in March 2020. Since this bottom the stock has staged an incredible run peaking at nearly $300 in the past week. Stepping back to look at the 3-year weekly chart, the majority of the gains (76%) from the incredible rally occurred by December of 2020 (the lower green line on the weekly chart below). Since December 2020, the upward momentum has largely stalled.

CrowdStrike 3-year weekly chart. Created by Brian Kapp using a chart from Barchart.com

The momentum stall zone at the green line on the weekly chart near $225 represents the nearest support level for CrowdStrike. This is where the shares found a bottom as recently as August 16, 2021. Given the valuation extreme, this level is likely to be tenuous support. The upper green line represents the beginning of the support zone.

The next lower support level is at the blue line on the weekly chart near $150. This represents key resistance levels from August through November of 2020. CrowdStrike moved vertically higher after breaching this level in December 2020 through the second week of January 2021. The 71% advance over this brief period has left little support. When combined with the aforementioned valuation reality, a test of the $150 area is a strong possibility.

The next lower support level is at the purple line on the weekly chart near $117, which was key resistance in July of 2020. A retest of this level cannot be ruled out due to the valuation extremes. Zooming into the daily chart, all three support levels are shown.

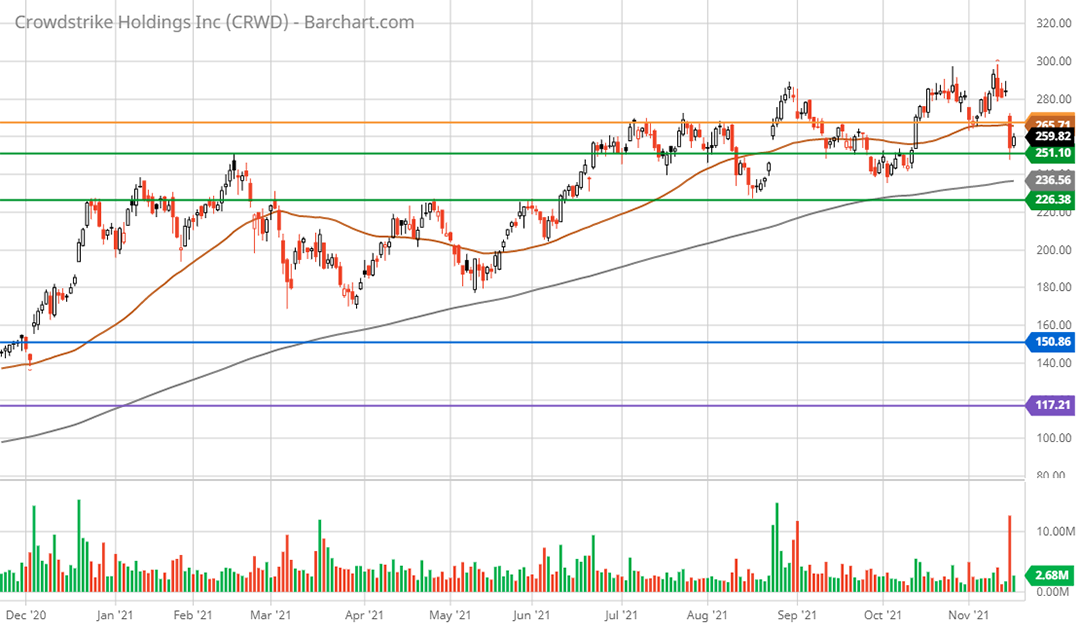

CrowdStrike 1-year daily chart. Created by Brian Kapp using a chart from Barchart.com

Confirming the momentum stall since December of 2020, the current share price is not overly extended below the 50-day moving average (brown line on the daily chart) or above the 200-day moving average (grey line on the daily chart). The 50-day moving average is at $265 and the 200-day moving average stands at $236. Given the alignment with the critical support level near $225, the 200-day moving average reaffirms this area as the nearest support zone.

Looking at each of the three critical support levels represented by the horizontal lines, the price-to-sales valuation at each of these levels is 39x (green), 26x (blue), and 20x (purple). For investors looking to accumulate the shares, the lowest support level at 20x sales may offer the first potentially attractive risk/reward opportunity.

In terms of technical resistance to the upside, all-time high resistance is represented by the orange line near $267. This level was just breached to the downside in response to the analyst downgrades discussed above. With the shares trading just 2% lower than this major resistance level, the upside potential appears to be minimal. The following 1-month intraday chart provides a closer view of the recent technical breakdown.

CrowdStrike 1-month intraday chart. Created by Brian Kapp using a chart from Barchart.com

The recent rally attempt following the 13% breakdown is occurring on increasingly weak volume. This suggests that the rally attempt may have run its course. A meaningful test of lower prices from here looks highly likely.

Summary

CrowdStrike is a great company performing at the top of its game, however, the valuation reflects this and then some. As a result, the risk/reward tradeoff facing current and prospective shareholders is heavily skewed toward risk, with little realistic reward left on the table in the foreseeable future. The company should be placed on a watch list for high-risk, high-reward investors as a substantial share price decline could open the door to future opportunities.

Price as of this report 11-16-21: $262.51

CrowdStrike Investor Relations Website: CrowdStrike Investor Relations Website