Risk/Reward Rating: Negative

Zoom Video Communications (Zoom) reported strong earnings and revenue growth for Q2 of fiscal 2022 (the period ending July 31, 2021) after the market closed on August 30, 2021. The stock price responded by plunging over 16% the following day as future growth is forecasted to decelerate rapidly from the COVID-inspired business boom. In fact, the forecast for Q3 of 2022 is for stagnating sales compared to Q2 with the possibility of declining sequential revenue in Q4. It should be noted that the company was one of the largest beneficiaries of the COVID lockdowns as businesses and consumers scrambled for video communications solutions to accommodate work from home and social distancing requirements.

Business Results and Outlook: Income Statement

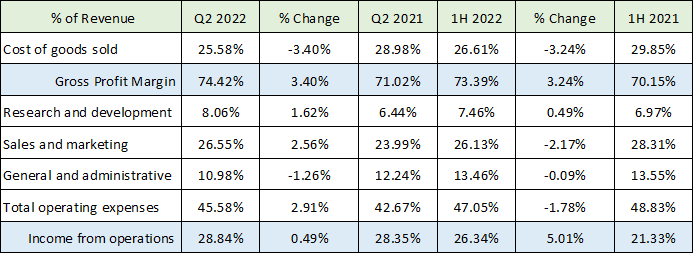

The results for Q2 2022 were impressive. Zoom reported revenue growth of 54% compared to the prior year with matching earnings growth of 57% on a GAAP basis (generally accepted accounting principles) and 53% on a non-GAAP basis. The most impressive aspect of the business model in recent times has been the extraordinary profit margins. The table below breaks down the company’s operating profitability and expense categories as a percentage of revenue for Q2 and the first half (1H) of 2022 and the same periods in the prior year. The data is calculated from Zoom’s income statement in the Q2 earnings release (8-K filed with the SEC).

While the income from operations margin is superb at just under 30%, there are some trends to take note of looking forward. For example, the operating margin in Q2 2022 was up only 0.49% compared to Q2 2021 while it was up 5.01% in the first half of 2022 compared to 2021 (last row). This implies that margin expansion was strong in Q1 of 2022 and subsequently reversed back to being almost unchanged in Q2 2022 compared to 2021.

The primary driver of this margin reversal in Q2 compared to Q1 can be found in the sales and marketing expense which expanded 2.56% (of revenue) in Q2 2022 while declining 2.17% in the first half of 2022. According to the company’s Q2 conference call, this large uptick in sales and marketing expense in Q2 is likely to persist. In fact, the company’s CFO, Kelly Steckelberg, stated that customers are returning to “more thoughtful and measured buying patterns.” This is in comparison to the past eighteen months in which customers were buying quickly “just trying to keep the lights on.”

The sales cycle is now returning to more normalized and longer time frames as customers have time to conduct greater cost-benefit analysis, conduct competitive comparisons, and possibly bidding processes among several vendors. For these reasons and others, the uptick in sales and marketing expenses may also be the beginning of an upward trend for sales and marketing expenses in absolute terms and as a percentage of revenue.

As stated in the opening paragraph, the company is forecasting stagnant to declining sequential sales in Q3 and Q4 of 2022. At the same time, Zoom is now focusing on winning larger enterprise customers. Targeting large corporate customers may become extraordinarily competitive and will require an increasing investment in Zoom’s global sales force as well as supporting this effort with increased advertising and marketing spending.

The other contributor to the Q2 margin reversal is the 1.62% of revenue increase in research and development compared to just 0.49% for the entire first half of 2022. Management stated on the conference call that this expense category is likely to gravitate toward 8-10% of sales long term. Based on the highly competitive environment for large enterprise customers, I believe this is more likely to trend toward the high end of this estimate and may need to surpass 10% materially in order to compete for and retain these enterprise customers. As an example, Salesforce spends 16% of revenue on research and development which is double the rate of Zoom and is based on a sales number which is 6x that of Zoom.

It should be noted that enterprise communications tools do not generally have the same high switching costs (business disruption and control risks) that other enterprise software systems have. For example, Salesforce’s suite of offerings may entail exceedingly high switching costs for a customer to replace Salesforce with another vendor. With Salesforce’s recent acquisition of Slack, the company may begin to compete aggressively with Zoom for the added communications and collaboration budgets of their clients who may prefer to give this business to Salesforce to limit their vendor relationships for efficiency purposes. Salesforce may even offer extraordinary terms initially to win this added business. In summary, Zoom is likely to have to spend more aggressively on research and development in order to outcompete the many large competitors that it will face for enterprise communications and collaboration budgets.

Business Results and Outlook: Cash Flow

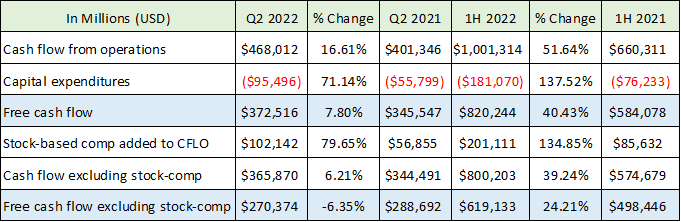

The increasing cost trends and business trends identified in the margin analysis of the income statement above may be beginning to show in Zoom’s cash flow from operations. For example, reported GAAP and non-GAAP income grew in line with the revenue growth rate in Q2 near 54% as mentioned earlier. This reported income is not matched by the growth in cash flow from operations in Q2. The table below is constructed from the cash flow statement provided in the 8-K filing with the SEC (earnings release). The final two rows are the removal of stock-based compensation expense (which is a non-cash expense that is added back to net income to arrive at the cash flow from operations). I review the cash flows with and without stock-based compensation expense because it is an expense, just paid for with stock instead of cash.

The reported cash flow from operations grew at 16.61% in Q2 which is a fraction of the reported net income growth near 54% while the reported free cash flow registered just 7.8% growth compared to Q2 2021. Excluding stock-based compensation, the growth of cash flow from operations is further reduced to 6.21% in Q2 and free cash flow excluding stock-based compensation registered a contraction of -6.35% compared to Q2 2021.

The much-reduced cash flow figures compared to reported income were heavily impacted by material declines in deferred revenue in Q2 and the first half of 2022 compared to 2021. In Q2 the decline was -56% and in the first half of 2022 the decline was -43%. Deferred revenue is the cash collection of future revenue that is not yet recognized as such on the income statement. Essentially, deferred revenue is customers prepaying for services to be delivered in the future. It is not clear what is driving such a large decline. It is worth watching as it could signal a shift in the willingness of customers to commit funds to Zoom’s services in advance, and may speak to the “more thoughtful and measured buying patterns” referenced by the CFO on the Q2 conference call.

Zoom to Acquire Five9

Lending some credence to the slowdown and profitability concerns above was the announcement by Zoom on July 18, 2021 of its intent to acquire Five9 for $14.7 billion. Five9 is a provider of intelligent cloud contact center solutions. The red flag regarding the acquisition is the incredible purchase price which is to be paid for entirely with Zoom stock.

On the date of the acquisition announcement, the purchase price amounted to 26x the current annual sales run rate for Five9 and 292x the annual cash flow from operations run rate (this information is from Five9’s most recent 10-Q). Five9 is not profitable under GAAP and is operating near free cash flow break even through the first half of 2021. The valuation is so extreme that it suggests a level of desperation on the part of Zoom to buy revenue and gain a firmer foothold in the enterprise market.

In my experience and opinion, the extreme valuation offered for Five9 is a negative signal from Zoom regarding its standalone growth capabilities and prospects. The other read through from the extreme valuation is that Zoom views its own stock as extremely valued and that paying such a high premium for Five9 with 100% Zoom stock makes business sense as a result. Either way, this is historically a red flag.

Valuation

Zoom is currently valued at $89 billion which amounts to just over 22x expected sales for fiscal 2022. This is extreme in a historical context. It is especially extreme given that sequential sales are projected to stagnate in Q3 2022 and may then sequentially decline into Q4. The sequential revenue stagnation then sets up fiscal 2023 to be an exceedingly difficult year for year-over-year growth comparisons. Using non-GAAP earnings estimates, the company is valued at 60x 2022 analyst estimates and 60x 2023 estimates. These too are extreme valuations for a company no longer growing let alone using non-GAAP earnings estimates which exclude large stock-based compensation expenses.

Summary

All told, Zoom is one to put on a watch list for high-risk, high-reward investors. There remains a large market opportunity if the company can parlay its sudden popularity from COVID into a sustainable business in the enterprise market as well as find ways to monetize individual and smaller users. Given the red flags discussed above, the near-term sales stagnation, the likely margin contraction, and the extreme valuation, the risks outweigh the potential rewards as things stand.

Technicals

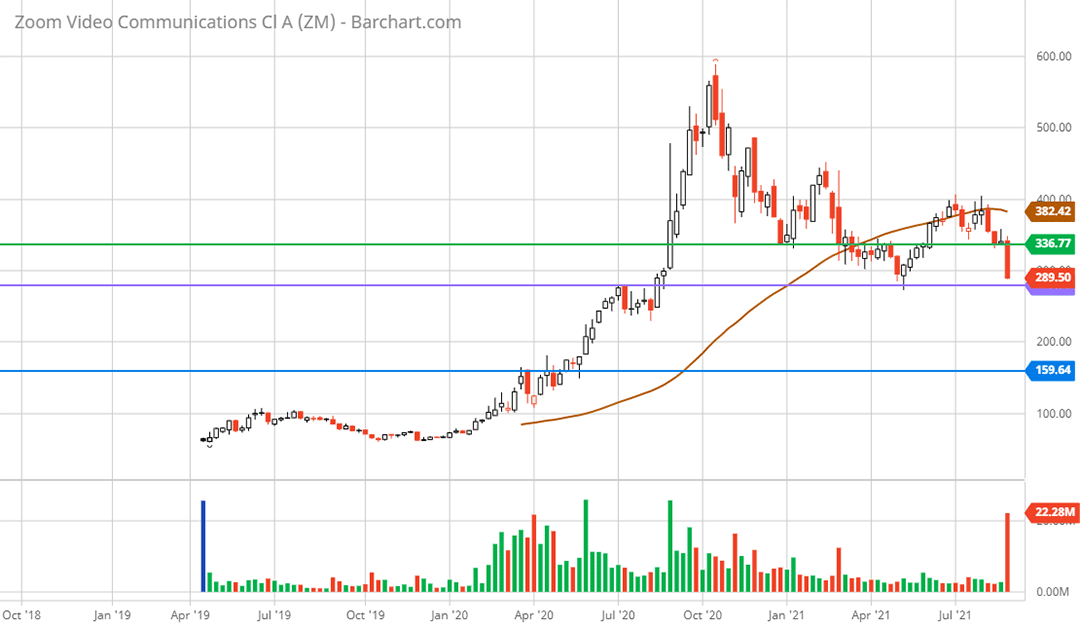

Technical backdrop: Zoom came public in April of 2019 in the $61 range and proceeded to trade sideways until the onset of the COVID pandemic. The stock then went on a parabolic speculative run with a final blowoff top at $590 in October 2020. The stock is now down 51% from the peak and is approaching a key weekly support area near $280 which is the low for 2021 and a key resistance area from July 2020 (see the purple line on the 3-year weekly chart below).

If the $280 key support fails to hold, the next lower weekly support zone is near $160 (blue line on the weekly chart) which was key resistance through April and May 2020. The 16% plunge on the Q2 earnings report on August 31, 2021, occurred at a key support area (green line on the weekly chart) in the $337 area which will offer stiff resistance for any rally attempts.

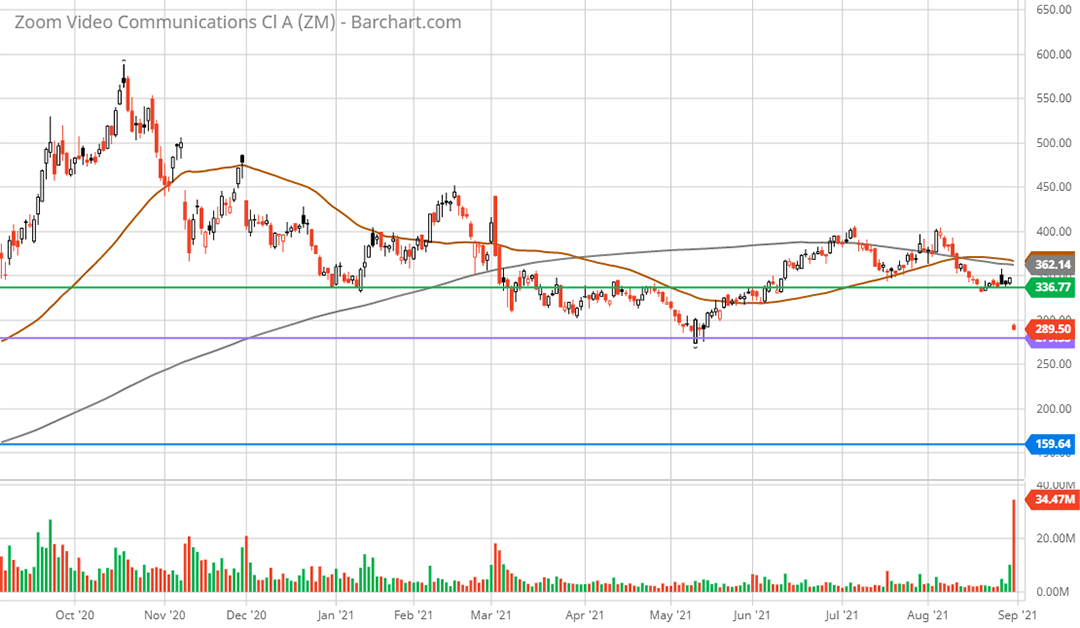

Zooming into the 1-year daily chart (below), a primary downtrend was signaled by a death cross on March 31, 2021, when the 50-day moving average (brown line on the daily chart) crossed beneath the 200-day moving average (grey line on the daily chart). On August 12, 2021, the 50-day moving average barely crossed back above the 200-day moving average and will now plunge back beneath after the 16% fall today reconfirming the primary downtrend. The three key technical levels from the weekly chart are all visible on the daily chart.

Technical resistance: The $337 area should offer very heavy resistance with additional resistance from current levels up to $337 which is the gap down today in response to the Q2 earnings report.

Technical support: The first support level is the $280 area which may prove tenuous over the short term. The next lower support level is in the $160 area which is likely to offer solid support. Given the fundamental backdrop, a test of this lower support zone is on the table.

Price as of this report 8-31-21: $290

Zoom Video Communications Investor Relations Website: Zoom Investor Relations

Zoom Video Communications SEC Filings

Data in this report is compiled from the Zoom Video Communications investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.