I am assigning Zoom Video Communications (NASDAQ: ZM) a negative risk/reward rating due to an elevated valuation in the face of rapidly decelerating revenue and cash flow growth, as well as initial signs of margin pressure. That being said, if Zoom can parlay its COVID-era success into sustainable growth in the enterprise communications market, the company could become an attractive investment opportunity. In this article I break down Zoom’s financial performance through the first half of 2022 to illuminate the business trends then review the company’s valuation and technical backdrop to formulate an investment strategy for the shares.

Risk/Reward Rating: Negative

Zoom reported strong earnings and revenue growth for Q2 of fiscal 2022 (the period ending July 31, 2021) after the market closed on August 30, 2021. The stock price responded by plunging over 16% the following day. It is now down 19% since the report as future growth is forecast to decelerate rapidly from the COVID-inspired business boom. In fact, the forecast for Q3 of 2022 is for stagnating sales compared to Q2 with the possibility of declining sequential revenue in Q4. It should be noted that the company was one of the largest beneficiaries of the COVID lockdowns as businesses and consumers scrambled for video communications solutions to accommodate work from home and social distancing requirements.

Business Results and Outlook: Income Statement

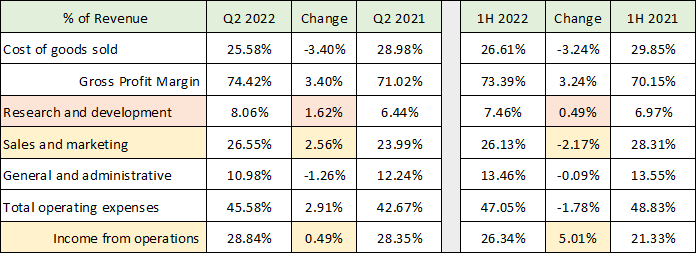

The results for Q2 2022 were impressive. Zoom reported revenue growth of 54% compared to the prior year, with matching earnings growth of 57% on a GAAP basis (generally accepted accounting principles) and 53% on a non-GAAP basis. The most impressive aspect of the business model in recent times has been the extraordinary profit margins. The table below breaks down the company’s operating profitability and expense categories as a percentage of revenue for Q2 and the first half (1H) of 2022, and the same periods in the prior year. The data is compiled from Zoom’s income statement in the Q2 earnings release (8-K filed with the SEC).

Source: Created by Brian Kapp, stoxdox

While the income from operations margin is superb at just under 30% in Q2 2022 (last row), there are some trends to take note of looking forward. For example, the operating income margin in Q2 2022 was up only 0.49% compared to Q2 2021, while it was up 5.01% in 1H 2022 compared to 1H 2021 (last highlighted row). This implies that margin expansion was strong in Q1 2022 and subsequently reversed back to being almost unchanged in Q2 2022 compared to Q2 2021. Operating leverage (increased profit margins) looks to have peaked out in Q1 2022.

The primary driver of this margin reversal in Q2 compared to Q1 can be found in the sales and marketing expense. It expanded by 2.56% of revenue in Q2 2022 while declining 2.17% in the first half of 2022 (first yellow shaded row). According to the company’s Q2 conference call, this large uptick in sales and marketing expense in Q2 is likely to persist. In fact, the company’s CFO, Kelly Steckelberg, stated that customers are returning to “more thoughtful and measured buying patterns.” This is in comparison to the past eighteen months in which customers were buying quickly and “just trying to keep the lights on.”

Outlook

The sales cycle is now returning to more normalized and longer lead times as customers no longer have the immediate urgency to purchase Zoom’s services. Customers are now back to more normal operating conditions and have time to conduct greater cost-benefit analysis, conduct competitive comparisons, and pursue normal bidding processes among several vendors. For these reasons and others, the uptick in sales and marketing expenses may be the beginning of an upward cost trend in absolute terms and as a percentage of revenue (margin contraction).

As stated in the opening paragraph, the company is forecasting stagnant to declining sequential sales in Q3 and Q4 of 2022. At the same time, Zoom is focusing on winning larger enterprise customers. Targeting large corporate customers may become extraordinarily competitive. It will require an increasing investment in Zoom’s global sales force as well as supporting this effort with increased advertising and marketing spending.

The other contributor to the Q2 margin reversal is the 1.62% of revenue increase in research and development expense compared to just 0.49% for the entire first half of 2022 (orange highlighted row above). Management stated on the conference call that this expense category is likely to gravitate toward 8-10% of sales long term. Based on the highly competitive environment for large enterprise customers, I believe this expense is more likely to trend toward the high end of this estimate. It may need to surpass 10% materially in order to compete for and retain these customers. As an example, Salesforce (NYSE: CRM) spends 16% of revenue on research and development. This is double the rate of Zoom’s spend and is based on a sales number which is 6x that of Zoom.

It should be noted that enterprise communications tools generally do not have the same high switching costs (business disruption and control risks) as other enterprise software systems. For example, a Salesforce customer may face exceedingly high switching costs to replace Salesforce with another vendor. With Salesforce’s recent acquisition of Slack, the company may begin to compete aggressively with Zoom for their clients’ communications and collaboration budgets. These clients may prefer to give this business to Salesforce to limit their vendor relationships for efficiency purposes. Salesforce may even offer extraordinary terms initially to win this added business.

The landscape for communications and collaboration software is extraordinarily competitive. Salesforce is the most recent blue-chip competitor to enter the market. Other major players include industry bellwethers such as Microsoft, Google, and Cisco Systems to name just a few.

In summary, Zoom is likely to have to spend much more aggressively on sales and marketing as well as on research and development in order to outcompete the many large competitors that it will face for enterprise communications and collaboration budgets.

Business Results and Outlook: Cash Flow

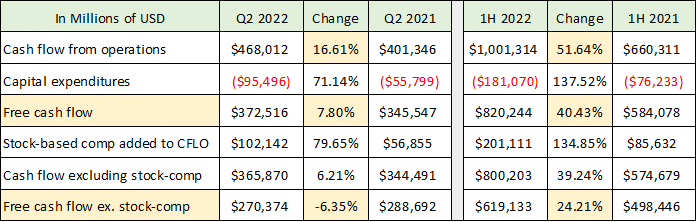

The increasing competition and cost trends identified in the margin analysis of the income statement above may be beginning to show in Zoom’s cash flow from operations. For example, reported GAAP and non-GAAP income grew in line with the revenue growth rate at about 54% in Q2 as mentioned earlier. This reported income is not matched by growth in cash flow from operations in Q2. The table below is constructed from Zoom’s cash flow statement provided in the 8-K filing with the SEC. The final two rows do not include stock-based compensation expense. Stock-based compensation is a noncash expense that is added back to net income to arrive at the cash flow from operations. I review the cash flows with and without stock-based compensation expense because it is an expense, just paid for with stock instead of cash.

Source: Created by Brian Kapp, stoxdox

The reported cash flow from operations grew at 16.61% in Q2 (first highlighted row) which is a fraction of the reported net income growth of 54%. Q2 cash flow growth is also a rapid deceleration in comparison to cash flow growth of 52% for the entire first half of 2022. The year-over-year Q2 cash flow growth decelerated rapidly from that of Q1 2022.

The reported free cash flow registered a similar trend with just 7.8% growth in Q2 2022 compared to Q2 2021. This is down from 40% growth for 1H 2022 compared to 1H 2021 (second highlighted row). Excluding stock-based compensation (a non-cash expense added back to income to calculate cash flow), the growth of cash flow from operations is further reduced to 6.21% in Q2. Free cash flow excluding stock-based compensation registered a contraction of -6.35% compared to Q2 2021 (final row shaded).

The much-reduced cash flow growth figures compared to reported income growth were heavily impacted by material declines in deferred revenue in Q2 and the first half of 2022 compared to the same periods in 2021 (not shown in the table above). In Q2 2022 the decline was -56% compared to Q2 2021 and the 1H 2022 decline was -43% compared to 1H 2021.

Deferred revenue is the cash collection of future revenue that is not yet recognized as such on the income statement. Essentially, deferred revenue represents customers prepaying for services to be delivered in the future. It is not clear what is driving such a large decline in deferred revenue. It is worth watching as it could signal a shift in the willingness of customers to commit funds to Zoom’s services in advance. This rapid decline in deferred revenue may speak to the renewed competitive environment and the “more thoughtful and measured buying patterns” of customers referenced by the CFO on the Q2 conference call.

Zoom to Acquire Five9

Lending some credence to the slowdown and profitability concerns above was the announcement by Zoom on July 18, 2021 of its intent to acquire Five9 (NASDAQ: FIVN) for $14.7 billion. Five9 is a provider of intelligent cloud contact center solutions. The red flag regarding the acquisition is the incredible purchase price which is to be paid for entirely with Zoom stock.

On the date of the acquisition announcement, the purchase price amounted to 26x the current annual sales run rate for Five9 and 292x the annual cash flow from operations run rate (this information is from Five9’s most recent 10-Q). Five9 is not profitable and is operating near free cash flow break even through the first half of 2021. The valuation is so extreme that it suggests a level of desperation on the part of Zoom to buy revenue and gain a firmer foothold in the enterprise market.

In my experience and opinion, the extreme valuation offered for Five9 is a negative signal from Zoom in respect to its standalone growth capabilities and prospects. The other read-through from the extreme valuation is that Zoom views its own stock as extremely valued, and as a result paying such a high premium for Five9 with 100% Zoom stock makes business sense. Either way, this is historically a red flag.

Valuation

Zoom is currently valued at $89 billion which amounts to just over 21x expected sales for fiscal 2022. This is extreme in a historical context. It is especially extreme given that sequential sales are projected to stagnate in Q3 2022 and may then sequentially decline into Q4. The sequential revenue stagnation then sets up fiscal 2023 to be an exceedingly difficult year for year-over-year growth comparisons. For a price-to-sales valuation comparison, Salesforce is currently valued at 9.31x estimated sales for 2022 which is a discount to Zoom’s valuation of 57%.

Using non-GAAP earnings estimates, the company is valued at 58x 2022 analyst estimates and 59x 2023 estimates. These too are elevated valuations for a company no longer growing, let alone using non-GAAP earnings estimates. Adding further pressure to the 58x non-GAAP earnings valuation is the unfolding trend of lower profit margins. Given the sales stagnation, this will put downward pressure on future earnings estimates.

For a current relative valuation comparison, the market averages are valued between 22x and 32x 2022 earnings estimates (S&P 500: 22x, Nasdaq 100: 29x, and Russell 2000: 32x). The market averages are trading at similar discounts to Zoom as in the price-to-sales comparison above using Salesforce.

Given the elevated valuation as well as the negative revenue and margin trends, the charts will be helpful in formulating a potential accumulation strategy for Zoom stock should the opportunity arise.

Technicals

Zoom came public in April of 2019 in the $61 range and proceeded to trade sideways until the onset of the COVID pandemic. The stock then went on a parabolic speculative run with a final blowoff top at $590 in October 2020. Zoom is now down 53% from the peak and is at a key weekly support area near $280. This is the low for 2021 and a key resistance area from July 2020 (see the purple line on the 3-year weekly chart below). The fundamental backdrop suggests the $280 support level is tenuous.

Zoom Video Communications 3-year weekly chart. Source: Created by Brian Kapp using a chart from Barchart.com

If the $280 key support fails to hold, the next lower weekly support zone is near $160 (blue line on the weekly chart). This was key resistance through April and May 2020 and equates to 12x 2022 expected sales. This level looks to be the first accumulation area offering a more attractive risk/reward entry point.

It should be noted that the 16% plunge in response to the Q2 earnings report on August 31, 2021, occurred at a key support area near $337 (green line on the weekly chart). This level should offer stiff resistance on any rally attempts.

Looking at the daily chart below, a primary downtrend was signaled by a death cross on March 31, 2021, when the 50-day moving average (brown line on the daily chart) crossed beneath the 200-day moving average (grey line on the daily chart). On August 12, 2021, the 50-day moving average barely crossed back above the 200-day moving average and has now reversed following the recent selloff reconfirming the primary downtrend. The three key technical levels from the weekly chart are all visible on the daily chart (the colored horizontal lines).

Zoom Video Communications 1-year daily chart. Source: Created by Brian Kapp using a chart from Barchart.com

Summary

All told, Zoom is one to put on a watch list for high-risk, high-reward growth investors. There remains a large market opportunity if the company can parlay its sudden popularity during COVID into a sustainable business in the enterprise market. The company also has a large opportunity in the small to midsized business segment and the individual user market if it can find ways to monetize them economically. Given the red flags discussed above, the near-term sales stagnation, the likely margin contraction, and the elevated valuation, the risks outweigh the potential rewards as things stand. The $160 area looks to offer the first attractive opportunity to accumulate the shares.

Price as of this report 9-21-21: $281

Zoom Video Communications Investor Relations Website: Zoom Investor Relations