Risk/Reward Rating: Negative

Workday, a leading software provider of enterprise cloud applications for finance and human resources, faces stiff competition as evidenced by a recent high-profile loss of Amazon business to Oracle. The competitive landscape was already becoming evident in Workday’s slowing sales growth. Sales for the current year (fiscal 2022 ending 1-31-22) are projected to grow 15%. This is in comparison to 19% growth in 2021 and 28% growth in 2020. The high-profile Amazon loss (Amazon remains a client) in addition to rapidly decelerating growth will make the upcoming Q2 2022 earnings report on Thursday, August 26 a key event for current and prospective shareholders.

Valuation and Heightened Risk

Of critical importance is that Workday has exited its hypergrowth phase, yet its current valuation multiple is consistent with that of a hypergrowth company. Decelerating growth combined with an elevated valuation creates heightened downside risk for the stock price should the earnings report and growth trajectory disappoint. Workday is valued at 81x non-GAAP (generally accepted accounting principles) earnings estimates for fiscal 2022 and 13x expected sales. These are elevated valuation multiples from a historical market perspective. The company is valued at 67x 2023 non-GAAP earnings estimates which are projected to grow 19% compared to 2022. This remains extreme in a historical context.

It should be noted that Workday is not profitable under generally accepted accounting principles (GAAP). This is due to the stock-based compensation expense which is material and recurring in Workday’s case. For example, the expense amounted to $265 million in the last quarter on a reported $38 million loss.

Trends and Outlook

The company continues to press forward with growth plans. In the Q1 fiscal 2022 earnings report, Workday announced plans to grow its employee count by 20% in the current year. The employee growth exceeds the current revenue growth rate, which would lead to the likelihood of lower profit margins and productivity.

Growth through acquisitions often coincides with and confirms decelerating organic revenue growth potential for corporations. In the first quarter, Workday acquired Peakon ApS for over $700 million. Peakon offers an employee success platform that converts employee feedback into actionable insights. Employee feedback is likely to be a much lower margin offering as it is not mission critical and would appear to be filling a gap in the current Workday feature set, rather than enabling a reacceleration of revenue growth.

As mentioned in the opening paragraph, Workday recently lost business with a high-profile client, Amazon, to Oracle. This competitive loss was reportedly related to inferior performance and scalability on the Workday platform. The intense competition coming from Oracle and other enterprise software providers is likely to place pressure on profit margins going forward. Additionally, replacing organic growth with growth through lower margin acquisitions like Peakon, is also likely to pressure the underlying profitability of Workday. Finally, the growth rate of employees and related expenses in excess of the revenue growth rate also points toward reduced margins going forward.

Valuation Compression Risk

Reduced growth rates combined with reduced profit margins create a heightened risk for valuation compression. If the 81x expected 2022 earnings valuation multiple gravitates towards historical norms, upward price momentum for the shares will be difficult to achieve. Furthermore, valuation compression could amplify downward share price momentum. For comparison, Oracle trades at just over 19x 2022 earnings estimates.

Technicals

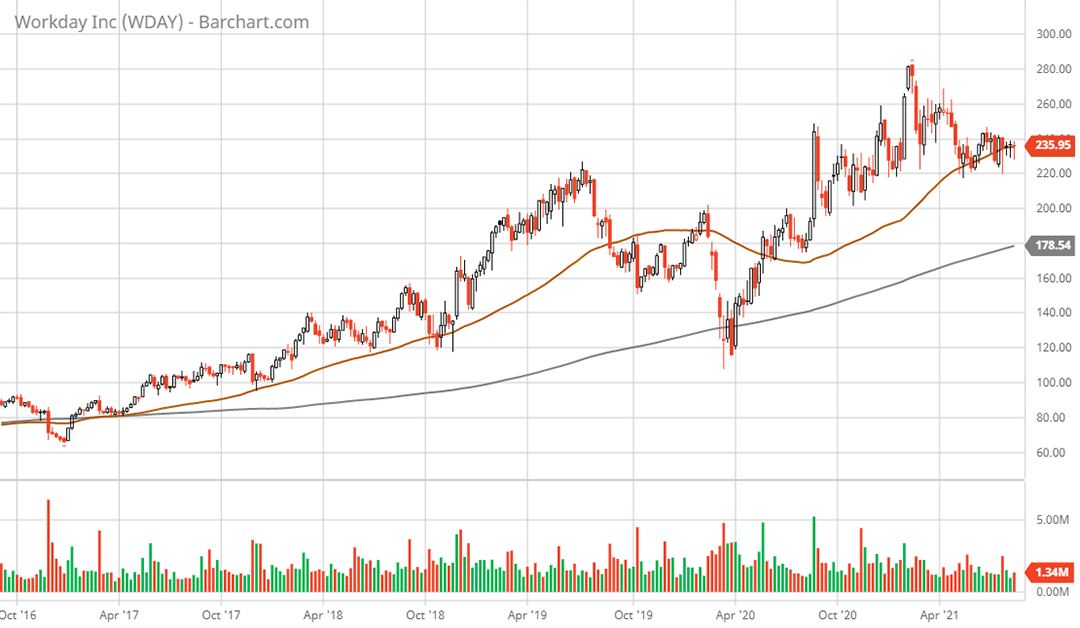

Technical backdrop: Workday stock has lost upward momentum and is unchanged over the past year as can be seen on the 1-year daily chart below. This sideways movement over the past year has carved out several ominous technical patterns. A classic head and shoulders top pattern with an upward sloping neckline (trendline drawn on the daily chart) formed in Q1 2021 and served as the rejection level of around $250 in June 2021. The left shoulder occurred in January 2021 and is at the $220 level. The right shoulder formed in March 2021 and is in the $230 area. The head peaked out at $283 in February 2021, as did the most speculative aspects of the current bull market.

Confirming a potential head and shoulders top is a death cross which developed on July 1, 2021, as the 50-day moving average (brown line on the daily chart above) crossed beneath the 200-day moving average (grey line on the daily chart). The death cross occurred immediately after the late June rejection at the upward sloping head and shoulders neckline. The stock is currently trading in a tight range between these two moving averages ($235 is the 50-day average and $239 is the 200-day).

Zooming out to the 5-year weekly chart (below), Workday is sitting just above the high reached in the middle of 2019 at $220 which has served as lower support throughout 2021. The weekly chart confirms the loss of upward price momentum. The share price is currently hugging the 50-week moving average (brown line on the weekly chart). The 200-week moving average (grey line on the weekly chart) stands at around $180.

Technical resistance: Resistance is at current levels just under $240, which coincides with the 200- and 50-day moving averages. There should be heavy resistance up to $250-$260 which is near the upward sloping head and shoulders neckline, and served as the rejection level in July 2021.

Technical support: $220 has been critical support throughout 2021 on both the daily and weekly charts. Next lower support is in the $200 area, then the 200-week moving average near $180. Further down is the $140 to $150 area. Given the valuation, should earnings disappoint, a test of these lower tiers cannot be ruled out.

Price as of report date 8-22-21: $235.94

Workday Investor Relations Website: Workday Investor Relations

All data in this report is compiled from the Workday investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.