Risk/Reward Rating: Negative

Uber Technologies, the most successful brand name of the past decade in personal mobility, has yet to turn its brand awareness into a profitable business model. In fact, the company has been hemorrhaging cash and continues to do so. The past decade featured little in the way of roadblocks for Uber, but the road ahead features structural challenges for the company and the valuation of its stock.

Valuation: $91.75 billion market value, not profitable. Uber is also cash flow negative as evidenced by negative operating cash flow of -$611 million in the first quarter of 2021.

The company uses adjusted EBITDA as a cash flow proxy (earnings before interest, taxes, depreciation, and amortization). Based on this measure, Q1 2021 saw a -$359 million adjusted EBITDA loss or -$1.436 billion annualized. The prior three full years saw adjusted EBITDA losses of -$2.528 billion, -$2.725 billion, and -$1.847 billion, respectively.

Structural headwinds include the categorization of Uber drivers as employees in many jurisdictions. This trend will add further cost pressure to the already unprofitable business model. In addition to wage inflation, supply chain inflation is picking up throughout the service and goods side of the transportation ecosystem.

After a decade long free pass on profitability, the benefit of the doubt period is over, and Uber will have to prove it can become cash flow positive and then grow cash flows in a sustainable manner. The current valuation is extreme in this light and is more indicative of a high margin, highly profitable company.

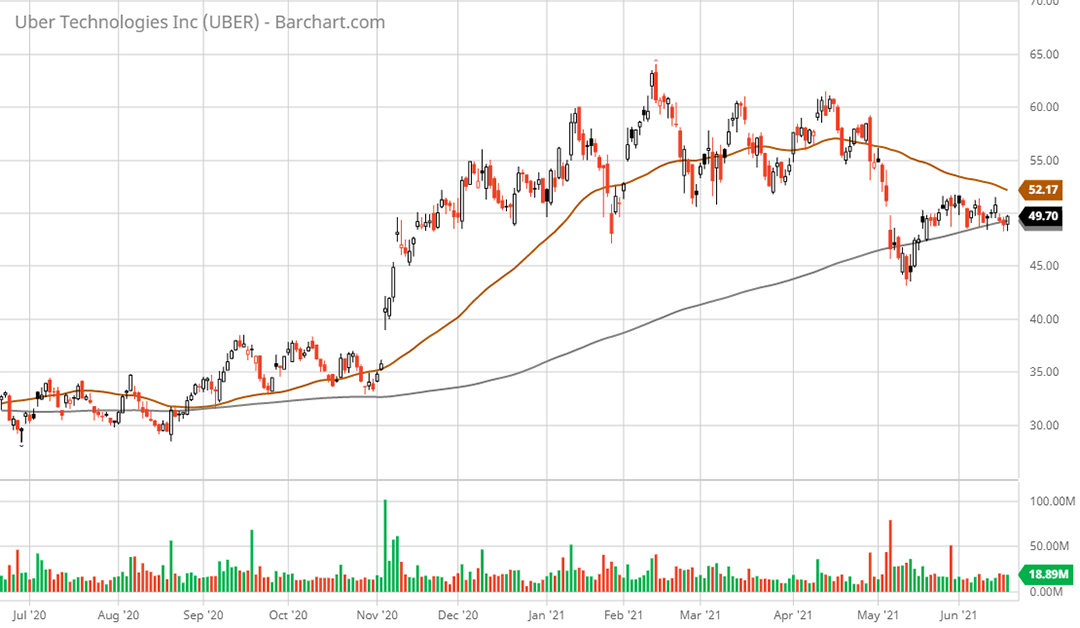

Technical resistance: $50 to $55 area which is the broken support zone from the Q1 2021 topping pattern. Additionally, the stock is currently battling the 200-day moving average at $49.50.

Technical support: $37 area, after which no support is visible given the brief trading history

Price as of report date 6-18-21: $49.37

Uber Technologies Investor Relations Website: Uber Investor Relations Website