Risk/Reward Rating: Negative

Tesla is by far the most extremely valued U.S. mega-cap stock in today’s market. The extraordinary valuation for what amounts to an auto OEM has no historical precedent. To make matters worse, the extreme valuation level is based on low quality earnings which are generated by selling government EV tax credits at 100% profit margins to other auto manufacturers.

These tax credit sales, with 100% profit margins, must be backed out of long-term valuation models as the Tesla business does not generate them. They are a short-term gift via government subsidies which will dissipate as all other auto manufacturers are rapidly transitioning to electric vehicle (EV) production of their own.

Valuation: 152x 2021 earnings estimates and 102x 2022 estimates. These estimates include the tax credit sales and the planned plant openings in Austin, Texas and in Germany. For comparison purposes, Ford and General Motors are currently valued at 8x 2022 earnings estimates.

Given the scalability constraint in the auto OEM business model, new growth requires new plants, large capital expenditures, and the associated high risks. This is in contrast to more deserving high valuation multiple businesses that scale on existing infrastructure investments such as software. This is a primary reason auto manufacturers do not receive high valuation multiples on their earnings and why Tesla’s is a warning sign.

Another warning sign recently is Tesla engaging in Bitcoin speculation. Bitcoin has no link or usefulness to Tesla’s businesses. Tesla sold some of their Bitcoin at a profit before the end of the last quarter in what can only be described as an end of quarter profit manipulation gimmick. This entire Bitcoin affair raises many corporate governance questions which have plagued Tesla throughout time.

Elon Musk and many of his acquaintances are known to have personally owned Bitcoin prior to the initial Tesla purchase. The announcement of Tesla’s purchase is widely viewed to have been the primary driver of the Bitcoin blowoff top move from $36,000 to $64,000. Given Bitcoin serves no business purpose, the conflicts of interest are front and center in regard to using corporate funds for personal gains.

This is similar in many respects to the purchase of Solar City several years back. Solar City was unprofitable, highly leveraged and near failure. The company offered no business synergies for Tesla nor practical upside. The business or a similar asset could have been purchased much more inexpensively in a bankruptcy or by other means. Elon Musk and his family members owned and controlled Solar City and were personally enriched by the Tesla buyout. Lawsuits are still pending on this matter.

Tesla is facing many challenges on the business front today. Recent examples included a massive recall of vehicles in China on safety grounds, the delayed plant opening in Germany, liability regarding claims of full self-driving capability, erratic new product roadmaps, rapid depreciation at their main California plant, rapidly escalating supply chain costs and constraints, a tsunami of global competition, and more. The current extraordinary valuation ignores these and the above issues.

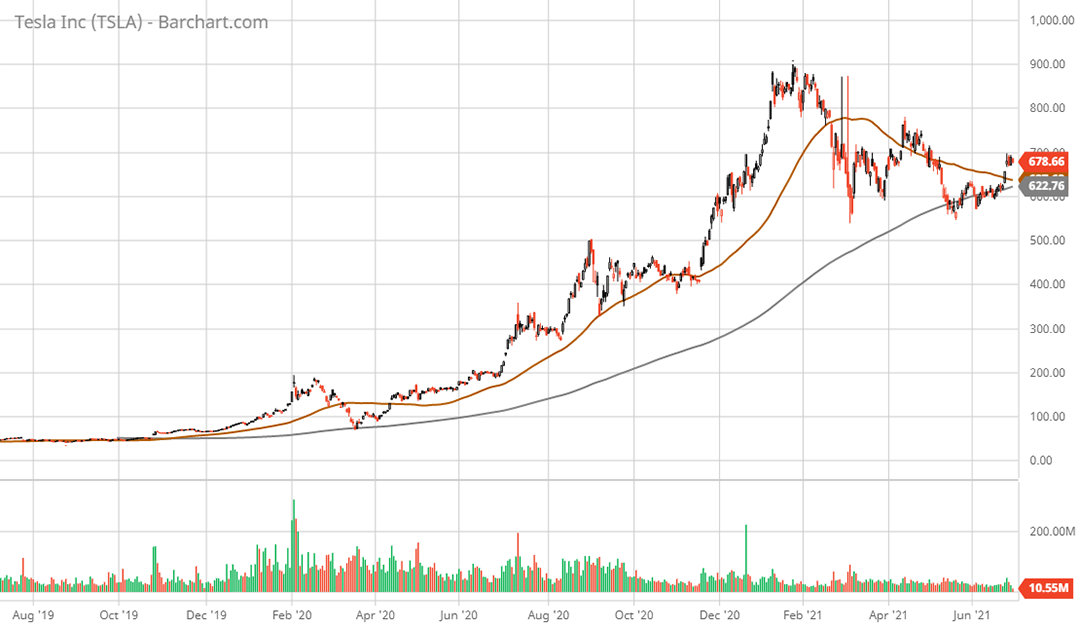

Technical backdrop: Tesla experienced a parabolic blowoff and a double top confirmation with the break of $800 in January and February of 2021. The resulting downtrend has formed a descending triangle pattern with a support base at $600. These patterns tend to break to the downside which is supported by the extreme valuation.

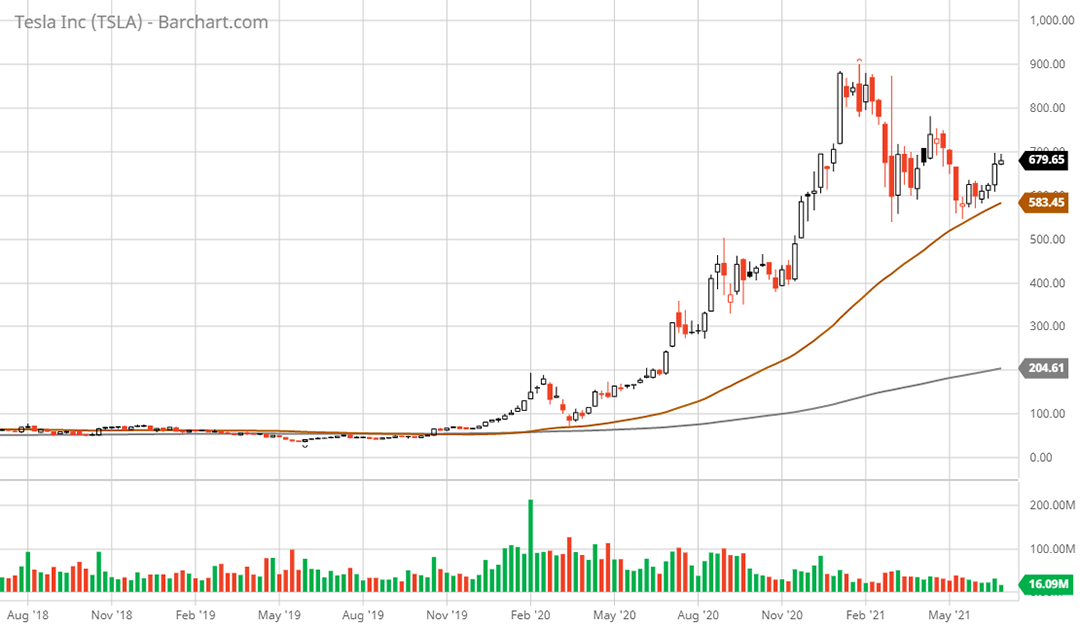

The 3-year weekly chart captures how technically overextended to the upside Tesla is with the 200-week moving average in the $200 range (grey line on the chart).

Technical resistance: $700 area.

Technical support: $600 area then the $420 area on a break below $600.

Price as of report date 6-29-21: $680

Tesla Investor Relations Website: Tesla Investor Relations