Risk/Reward Rating: Negative

Teladoc Health is a leader in comprehensive virtual healthcare services. The COVID pandemic provided a shot in the arm to the existing trend towards leveraging technology for the delivery of healthcare. The lockdowns and social distancing requirements were a perfect environment for Teladoc’s business. The conditions created an immediate need for greater consumer trial and use of virtual care, and hence an increased adoption by employers, health plans, hospitals, health systems, and health care providers.

Like many of the largest beneficiaries of the extreme COVID conditions, there remain questions about Teladoc’s sustainable organic growth rate as things return to normal. Teladoc may have provided a hint regarding its ability to grow late last year with its $14 billion acquisition of Livongo Health and its regular acquisitions of smaller firms. Growing through acquisitions is lower quality growth than growing organically, all things being equal.

In the case of Livongo Health, the acquisition price was at an incredible valuation of 57x the annual sales run rate of Livongo. The acquisition was largely paid for with Teladoc shares creating sizeable Teladoc shareholder dilution. Adding in the smaller acquisitions, Teladoc now carries $16.4 billion of intangible assets (price paid over assets received in an acquisition) on its balance sheet or 93% of all assets. Removing these intangible accounting entries, Teladoc has a negative tangible book value of -$700 million. It should be noted that the company has plenty of liquidity at the moment with $785 million of cash on the balance sheet.

Paying extraordinary prices for acquisitions can be a sign that a company foresees slower organic growth in its future. In the recent Q2 2021 earnings report, Teladoc provided uninspiring revenue guidance for the second half of the year. The guidance suggests that the sequential quarterly growth rate for the remainder of the year will be in the low single digits (2.5% range). This growth rate is not much different than that of the economy as a whole and is a far cry from the hypergrowth during the pandemic period.

Making matters worse, Teladoc trades at an extraordinary valuation of 12x estimated sales for 2021 of just over $2 billion. The company is projected to lose over half a billion dollars in 2021 on a GAAP basis (generally accepted accounting principles). The GAAP loss includes a substantial amount of stock-based compensation expenses. The company is not expected to be profitable in 2021 or 2022 on both a GAAP and non-GAAP basis.

Teladoc has generated $34 million of cash flow from operations through the first six months of 2021 or $64 million annualized. However, after subtracting capital expenditures (including capitalized software development expenses) and small acquisitions (a recurring form of capital expenditures) the company generated -$48 million of cash outflows through the first six months. The negative earnings and free cash flow create substantial doubt in regard to the profitability of Teladoc’s business model.

On the bright side, the future of virtual healthcare delivery offers tremendous growth potential and Teladoc is a relative first mover. The company has relationships with many industry participants and providers and claims to work with half of the fortune 500 companies in some manner. On the downside, the high growth potential will continue to attract intense competition from many healthcare, technology, and venture capital industry participants. Given the current trends in Teladoc’s business fundamentals and the extreme valuation, the risks outweigh the potential rewards as things stand.

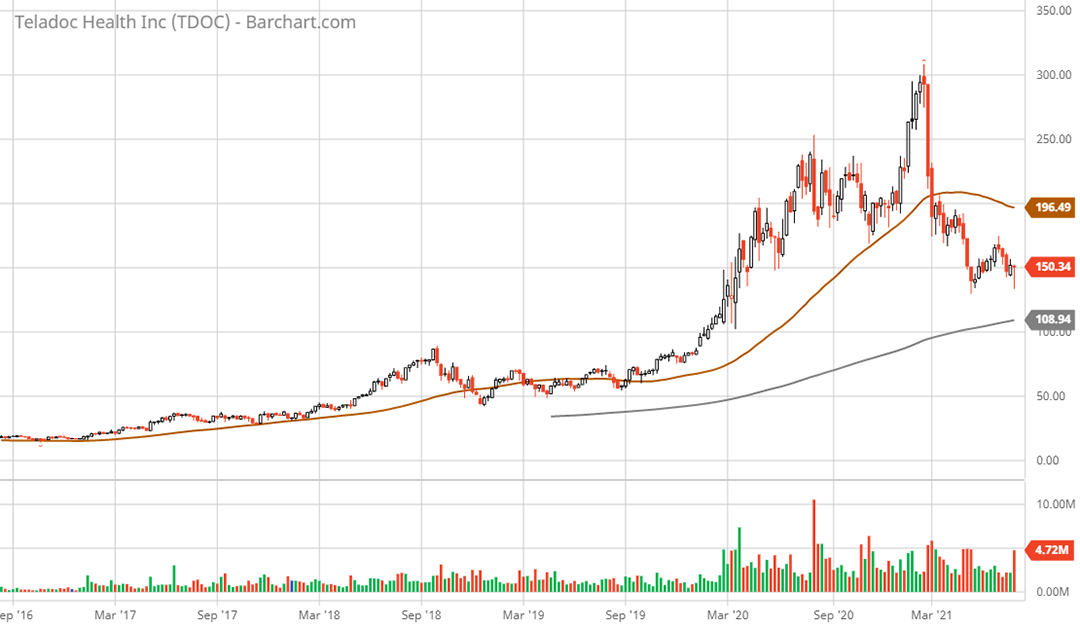

Technical backdrop: Teladoc stock came public in July of 2015 in the $30 range. A dynamic uptrend began coincident with the global COVID outbreak in January 2020, with a move from $80 to a peak just over $300 in February of 2021 (coincident with the global vaccine rollout). The 200-week moving average currently stands at $108 (grey line on the 5-year weekly chart).

A large blowoff top and reversal occurred in the first quarter of 2021. The current downtrend was confirmed on April 20, 2021, when the 50-day moving average (brown line on the 2-year daily chart) crossed beneath the 200-day moving average (grey line on the 2-year daily chart). This crossover is referred to as a death cross. The 200-day moving average stands at $193 and the 50-day moving average is at $153.

Technical resistance: The current level offers resistance at the descending 50-day moving average of $153. Next up is the $173 area, which should offer stiff resistance. This area was the broken support level in Q1 2021 of the right shoulder of the large head and shoulders blowoff top pattern.

Technical support: Next lower strong support levels look to be near the 200-week moving average at $108 then $90, which was the initial gap higher in January 2020 in response to the COVID outbreak.

Price as of report date 7-28-21: $151.20

Teladoc Health Investor Relations Website: Teladoc Health Investor Relations

All data in this report is compiled from the Teladoc Health investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.