Risk/Reward Rating: Negative

The market value of Square is extraordinary compared to its underlying size and profitability. Financial services, payment processing, and fintech are some of the most competitive industries in the world today and are attracting ever increasing competition from venture capital funding.

It is unlikely that Square can capture abnormal rates of return in such highly competitive markets thus limiting the top end of a realistic valuation multiple. The valuation is extreme from a historical market perspective and using reasonable expectations for the business.

Valuation: 19.5x estimated 2021 sales, 154x 2021 non-GAAP earnings estimates, 109x 2022 non-GAAP earnings estimates, and 2,755x 2021 GAAP earnings estimate. Share-based compensation is a large expense for Square and is ignored in non-GAAP earnings estimates.

Bitcoin revenue has been removed from the sales multiple above as it is an economically misleading categorization of Bitcoin. Square books gross Bitcoin sales as revenue. A net Bitcoin revenue number (price paid for Bitcoin by Square minus the sale price to customers) would be more meaningful but the sustainability of Bitcoin in Square’s business is questionable and is thus ignored here for valuation purposes.

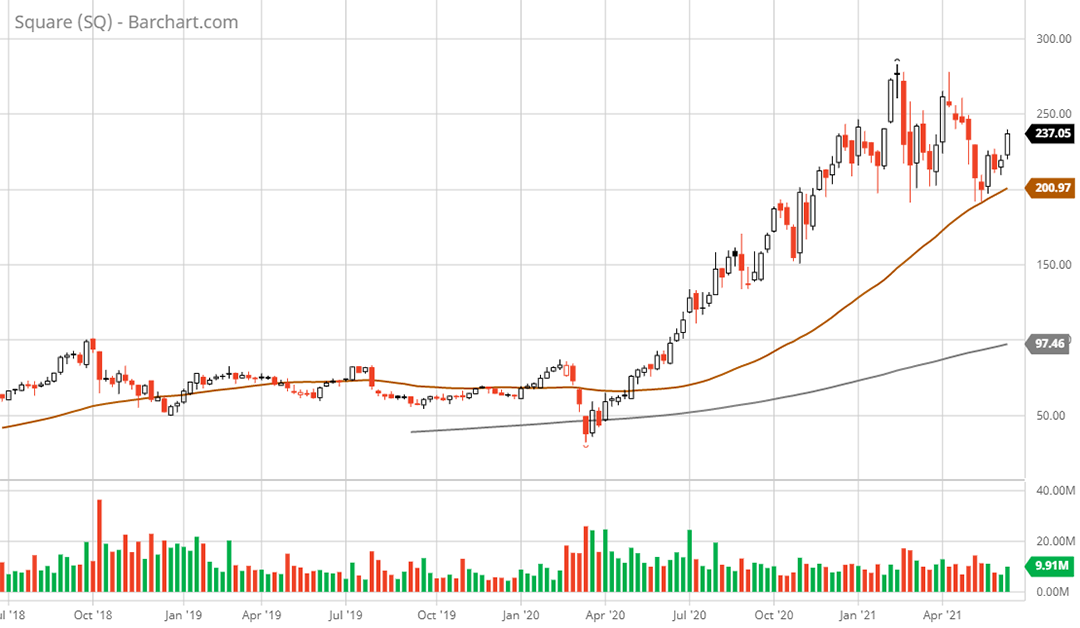

Technical backdrop: The 3-year weekly chart features a head and shoulders pattern with a neckline in the $215 area. This potential breakdown zone has been defended repeatedly over the past six months as the stock chops sideways. In the context of the extraordinary valuation, the overall pattern in recent months appears to be a broad topping pattern.

A similar head and shoulders pattern has formed on the 1-year daily chart. The neckline is in the $200 area. The $200 daily and the $215 weekly price levels are being testing with increasing frequency signaling the probability of a downside break is increasing.

Technical resistance: $240 area

Technical support: $200 has been lower support during the past six months. The next lower support levels are $150 and $100 which are reasonable possibilities to consider given the valuation context.

Price as of report date 6-20-21: $236.60

Square Investor Relations Website: Square Investor Relations