Risk/Reward Rating: Negative

Snowflake and its Data Cloud offering have been in hypergrowth mode in recent years with sales growing 174% in 2019, 124% in 2020, and a projected 93% in 2021 (the company is currently in its fiscal year 2022 which ends January 31, 2022). Snowflake affirmed the current 93% growth expectation for the year when it reported Q2 2022 earnings the evening of August 25, 2021. When companies are in a hypergrowth stage, valuations often become stretched creating extreme challenges for investors.

Business Performance and Projections

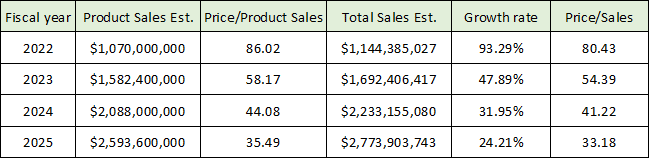

At the current quarterly run rate of new business, the incredible revenue growth in recent years is set to decelerate sharply over the coming years which brings the valuation of the company into focus. The following table extrapolates the current revenue growth run rate into the future to give a sense of the business trends currently in effect.

The company grew its product revenue by $40.8 million in Q2 versus Q1 2022. The guidance for Q3 is for $30.4 million growth over Q2 2022 and then $31.6 million growth in Q4 compared to Q3 2022. Snowflake provides product revenue guidance rather than total sales guidance, which accounts for 93.5% of total sales in recent times. In the above table, total sales are projected assuming product sales comprise 93.5% of the total.

The table is an extrapolation of the near-term product sales growth guidance of $31.6 million each quarter compared to the preceding quarter. This is a simplified approach to illuminate the speed at which annual revenue growth decelerates at this current quarterly growth rate. Actual company results may be greater than or less than these figures. It should be noted that the $31.6 million per quarter growth rate is in a decelerating trend from $40.8 million in the recently completed Q2. This suggests a downward growth trajectory may be more realistic than assuming a steady quarter-over-quarter growth rate for the current business operations as shown in the above table.

Valuation

From a valuation perspective, the price-to-sales ratio is extreme at 80.43 in comparison to historical stock market valuation norms. This is especially the case when one notes the rapid deceleration trajectory of revenue growth from fiscal 2022 to fiscal 2025 at the current run rate of new business. The hyper-valuation of the stock establishes a high bar for future stock price appreciation.

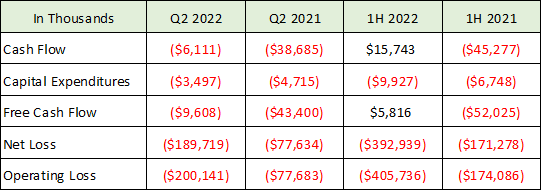

The price-to-sales ratio is the most appropriate valuation metric as the company continues to produce large operating losses which are growing rapidly compared to last year. The operating loss through the first half of fiscal 2022 (1H) came in at -$405 million compared to -$174 million in the prior year. The following table breaks down the company’s performance across key profitability metrics.

On the bright side, through the first half of fiscal 2022 the company has eked out $5.8 million of free cash flow from operations in comparison to negative free cash flow of -$52 million in the prior year. The large discrepancy between cash flow and operating loss is primarily due to stock-based compensation expense which is a non-cash expense. Stock-based compensation is the outflow of shares or company ownership instead of cash. Nonetheless, it is an economic expense that needs to be weighed by investors as the shares represent cash value and could be sold by the company for cash rather than transferred to employees as compensation.

Company Summary

As a reminder, the company’s Data Cloud offering is an ecosystem where Snowflake customers, partners, data providers, and data consumers can break down data silos and derive value from rapidly growing data sets in a secure, governed, and compliant manner. The company generates revenue based on data usage on its platform. The challenge long-term is that the technology industry is extremely competitive, and the price of data usage and compute power is likely to be driven lower over time by competition. This has been the case for most technologies throughout time excluding quasi-monopoly segments of the technology industry.

All told, the extreme valuation combined with what looks to be rapidly decelerating revenue growth going forward, questionable profitability, and intense competition creates an extraordinary level of risk for investors.

Technicals

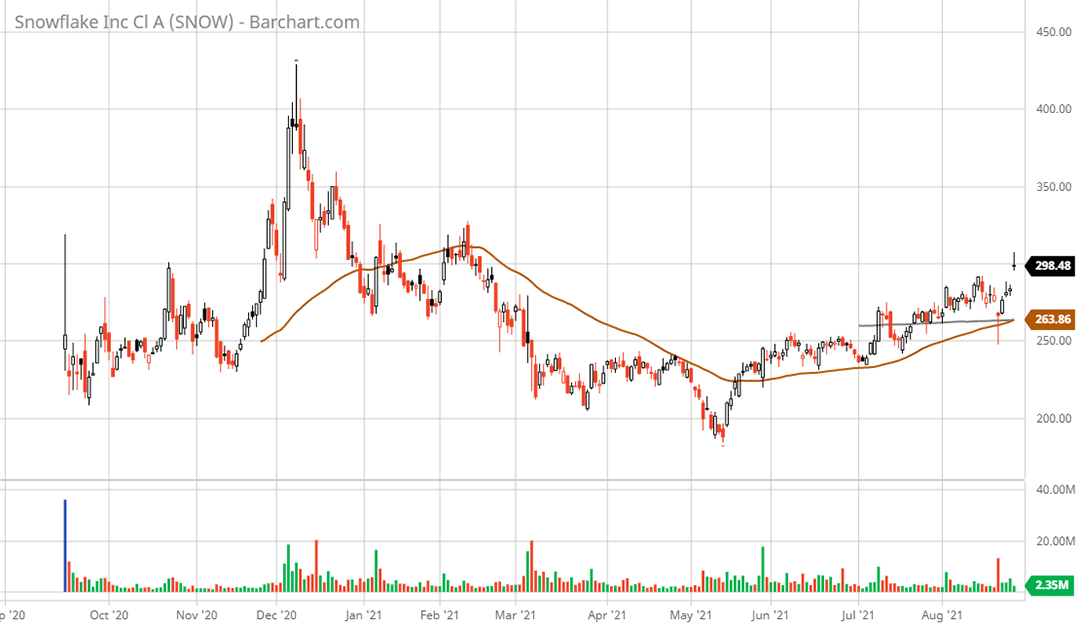

Technical backdrop: Snowflake came public at an incredible valuation nearly one year ago on September 16, 2020. The questionable valuation at the IPO is evidenced by the wide trading range on the first day which ranged from $232 to $320 before closing in the $253 area. The stock proceeded to a speculative blowoff top at $430 over the next six weeks before it collapsed to a low of $187 on May 13, 2021.

Since the low in May, the stock has been trying to reestablish an uptrend as the 50-day moving average (brown line on the 1-year daily chart below) is now reconnecting with the 200-day moving average (grey line on the daily chart). The 50-day moving average being beneath the 200-day moving average is indicative of a downtrend. Furthermore, with the extreme valuation in place, a resumption of sustainable upward momentum is likely to face stiff headwinds. It is likely that the stock will be confined to a large and volatile trading range given the current valuation, as evidenced since the IPO.

Technical resistance: The $310 area should offer stiff resistance as this was the first broken support after the blowoff top in December of 2020. This level proved to be resistance on the rally attempt in February of 2021.

Technical support: The nearest support is in the $267 area which served as resistance in July 2021 and was a key support area that failed in Q1 2021. Stronger support should be found between $237 to $250 which served as the sideways trading range between March and July of 2021. A retest of the all-time low at $187 is the next support zone. A retest of the low cannot be ruled out given the extreme valuation.

Price as of this report 8-26-21: $303.77

Snowflake Investor Relations website: Snowflake Investor Relations

All data in this report is compiled from the Snowflake investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.