Risk/Reward Rating: Positive

Stagnation underlies consensus expectations for Toll Brothers, Inc. (NYSE:TOL) over the coming years. With the shares trading at 1x book and under 5x earnings, the market is pricing in sizeable downside earnings surprises versus consensus estimates through 2024. The concern in the market is that a significant real estate downturn has begun, hence the incredibly low valuation.

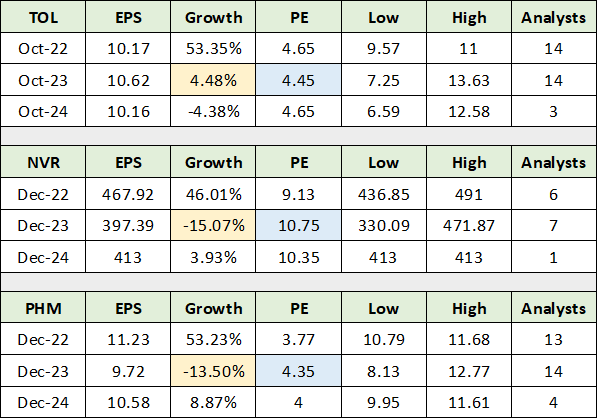

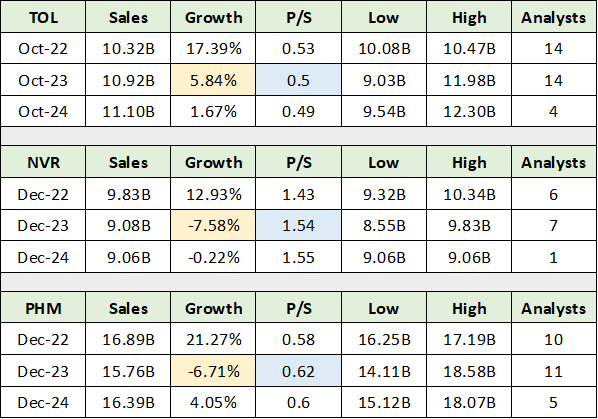

Peer Comparison

Toll’s valuation is compared to its leading peers, NVR (NYSE:NVR) and PulteGroup (NYSE:PHM), in the following tables. The peer comparison provides relative reference points. The consensus estimate tables below were compiled from Seeking Alpha.

The first table displays consensus earnings estimates and the second table displays consensus sales estimates for each company. For ease of comparison, I have highlighted in yellow the growth estimates for next year and highlighted in blue the associated valuation.

At 4.45x the 2023 earnings estimate, Toll’s share price is likely pricing in half to two-thirds of the current consensus estimate. Either way, the current share price appears to factor in a rather negative outlook for the luxury end of the real estate market.

While the near term is likely to be volatile, the future looks generally bright for the high-end segment. With the negatives largely priced in, Toll’s risk/reward setup skews positive barring an unusually deep US real estate price correction.

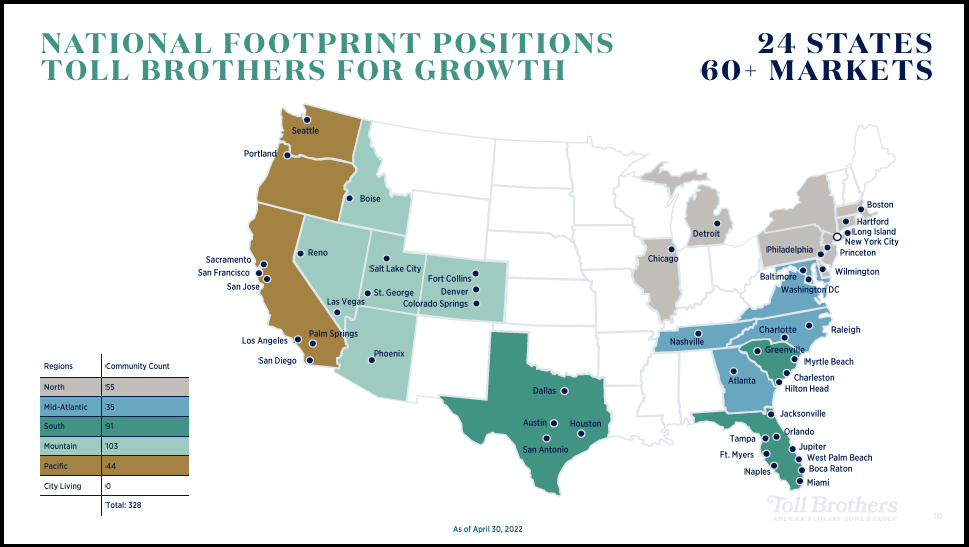

Target Markets

The following slides are from Toll Brothers’ April 2022 Company Overview presentation. The first slide highlights the attractive geographic positioning of the company. The second image provides detail on Toll’s strategy in the apartment living segment. Toll is actively probing growth opportunities throughout the various segments of the luxury marketplace.

Luxury Segment

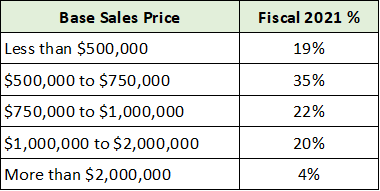

The high-quality geographic positioning is ideal for targeting the luxury end of the market. Toll’s home sales by various price ranges are displayed in the table below, which was compiled from Toll’s 2021 10-K filed with the SEC.

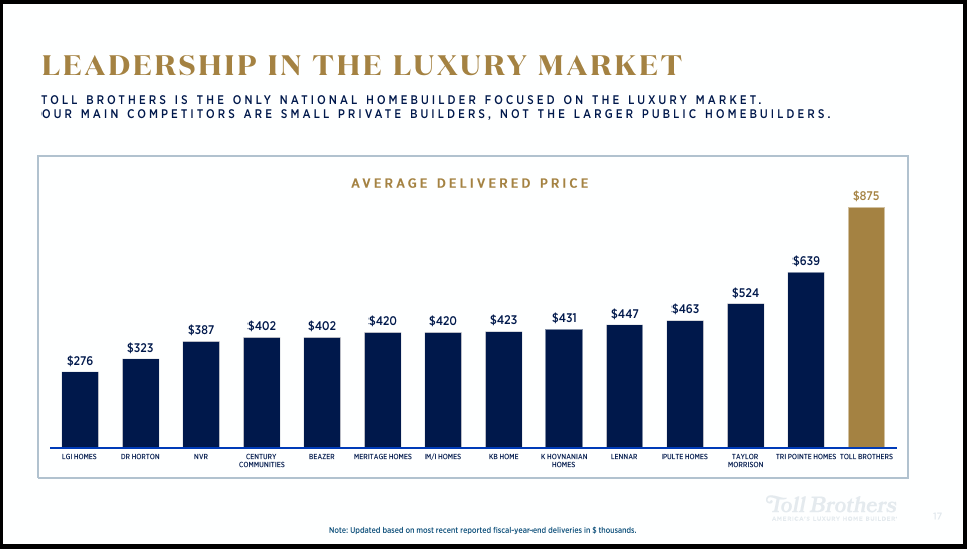

The following image compares Toll’s average selling price to its primary competitors. Toll is clearly the leader at the high end of the luxury market.

Financials

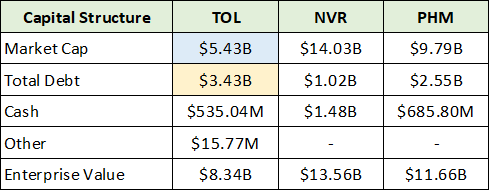

One risk for the Toll Brothers investment case is that the company is the most leveraged of the leading homebuilders discussed here. The following table was compiled from Seeking Alpha and displays the summary capital structure for Toll, NVR and PulteGroup. I have highlighted Toll’s equity capitalization and debt level for ease of reference.

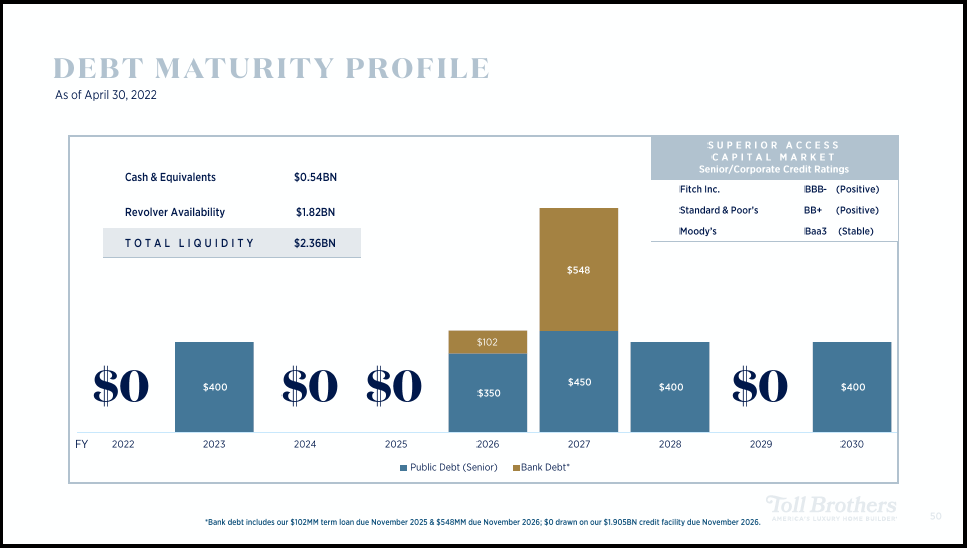

While leverage creates risk, the real estate sector lends itself to the productive use of debt. Additionally, the luxury end of the market should continue to offer attractive collateral for income investors. All told, Toll Brothers’ use of leverage looks quite reasonable with the added benefit of having no major debt maturities until 2027 as can be seen in the following slide.

The lack of near-term debt maturities creates capital optionality for Toll over the coming years. In fact, Toll has an active share repurchase program as can be seen in the next slide. With the shares trading near book value, share repurchases should continue into the future and provide additional support.

Technicals

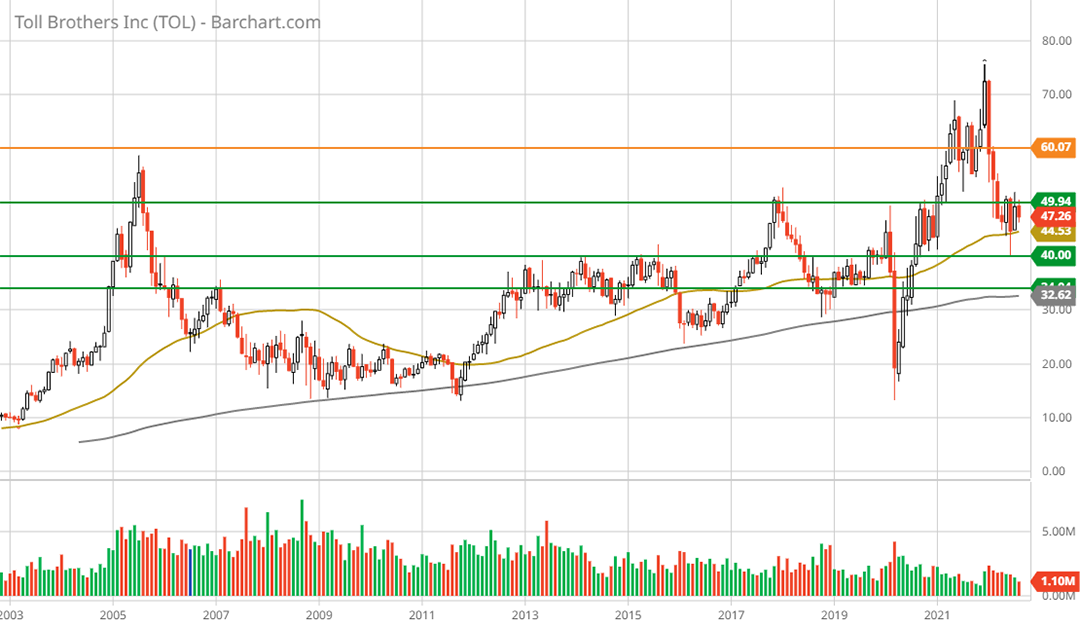

The technical backdrop for Toll also points toward the likelihood of strong support near the current price level. Toll Brothers’ technical mosaic is well defined by strong long-term support levels combined with minimal upside technical resistance. The green lines on the 20-year monthly chart below represent the primary support levels. Notice that the shares are currently testing the first and second support zones.

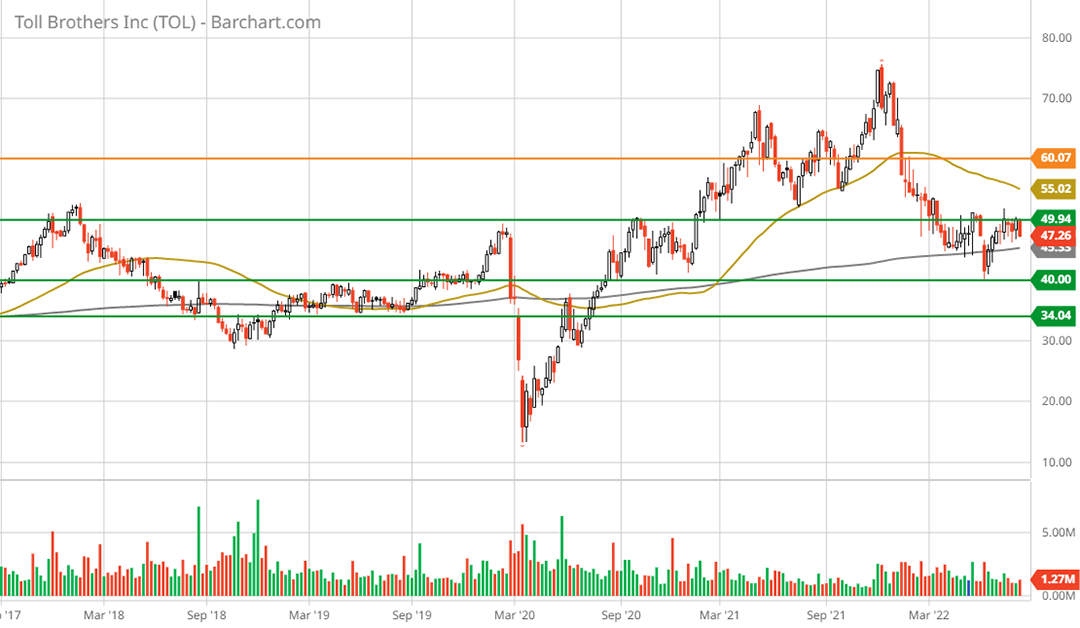

Given the deeply discounted valuation, the shares should have extraordinarily strong technical support nearby. The 5-year weekly chart below provides a closer look.

With the shares trading in the area of $46, the middle support level near $40 represents 13% downside. $34 looks to be a worst-case scenario barring an unusually deep bear market for real estate prices.

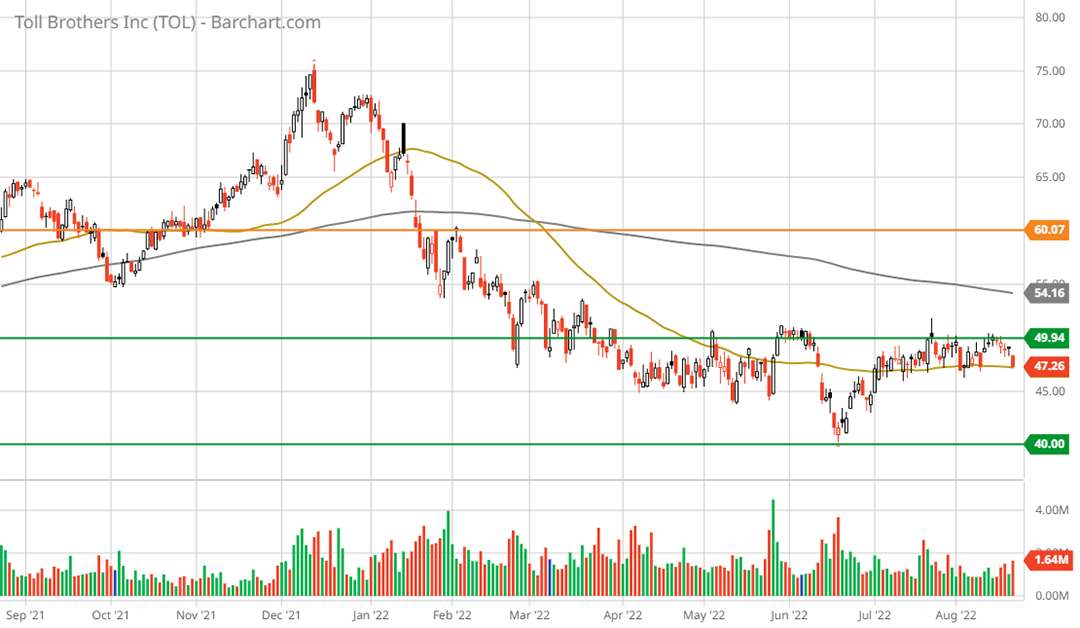

Zooming in to the 1-year daily chart, the $60 area is the lone primary resistance level. This is a natural price target in the nearer term and represents 30% upside potential. The initial upside target is also well supported on valuation grounds.

If the luxury real estate market avoids a deep recession and the secular uptrend resumes, the lack of resistance above $60 is supportive of a more robust bull market once new highs are reached.

Summary

Toll Brothers looks to be an asymmetric risk/reward opportunity. The shares are unbounded to the upside while the downside is well anchored by a deeply discounted valuation and long-term technical support. While the luxury end of the market can become quite cyclical at times, the long-term outlook continues to look positive. As the leader in the luxury home market, Toll Brothers is a top choice in the real estate sector.

Price as of this report: $46

Toll Brothers Investor Website