Risk/Reward Rating: Positive

Recently, Berkshire Hathaway Inc. (NYSE:BRK.B) received approval to increase its stake in Occidental Petroleum Corporation (NYSE:OXY) from 20% to 50%. The question for investors is what does Warren Buffett’s firm see in Occidental Petroleum?

We will look to answer this question more fully by constructing a full research report for stoxdox members in the future. In the interim, given that Berkshire appears to be interested in the entirety of Occidental, it is worthwhile to formulate an initial mosaic of the Occidental investment case. As a result, we are adding Occidental to the dox it! list for stoxdox members.

Why Occidental?

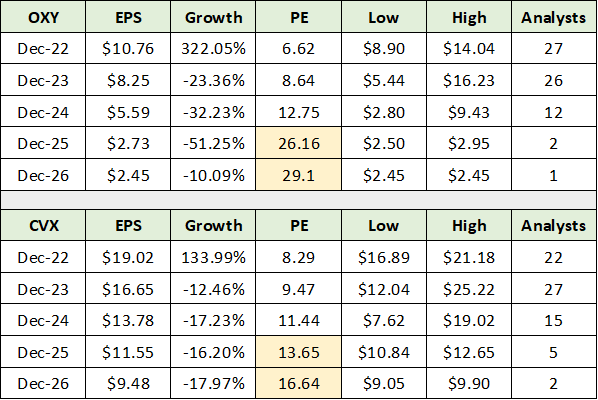

This is the key question in choosing Occidental over alternative investment opportunities in the energy sector. In the following tables, I compare consensus earnings estimates across a number of companies in the energy sector to those of Occidental. The consensus earnings data was compiled from Seeking Alpha.

The first table compares Occidental to Chevron (NYSE:CVX), which is a direct comparable company in the same industry, Integrated Oil and Gas. In the second table, I display consensus earnings estimates for three energy companies with different industry classifications from Occidental. These companies currently carry a positive risk/reward rating in the stoxdox research universe.

I have highlighted in yellow the consensus estimates for 2025 and 2026. This is the period in which the expectations for Occidental and Chevron materially diverge. Occidental is expected to experience extreme downside earnings volatility in relation to Chevron.

While some of this downside could reflect equity dilution, it is unlikely that Berkshire would be interested in acquiring 50%, and potentially all of Occidental Petroleum, if it viewed the above estimates as being a high probability. Paying 26x the 2025 earnings estimate and 29x the 2026 estimate for a commodity producer appears quite unattractive.

A logical conclusion is that Berkshire views Occidental’s business prospects to be much more favorable than those priced into Occidental’s shares. The following table displays consensus earnings estimates for EOG Resources (NYSE:EOG), Pioneer Natural Resources (NYSE:PXD), and Schlumberger (NYSE:SLB). I have highlighted in yellow consensus estimates for 2025 and 2026 for ease of comparison with the above table.

The above companies are more directly tied to oil and gas prices, with EOG and Pioneer being pure producers and Schlumberger providing the services. You will notice that the earnings growth estimates for EOG and Pioneer through 2026 are much more stable than those for Occidental.

With EOG and Pioneer being pure oil and gas producers, expectations are for a rather stable environment for oil and gas prices through 2026, generally speaking. Consensus expectations through 2026 for Schlumberger reflect a robust upturn for the service side of the energy sector. Schlumberger remains a top choice for cyclical growth.

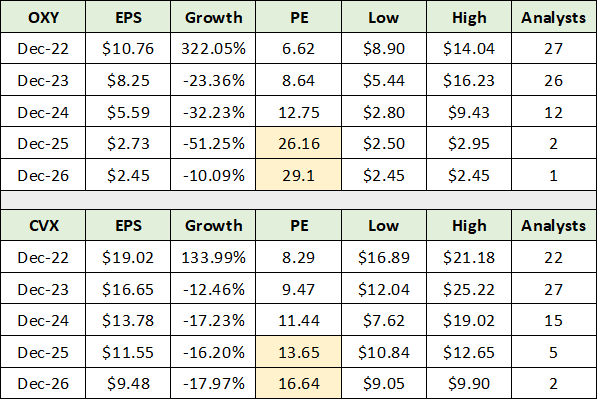

Occidental, like EOG and Pioneer, operates top quality oil and gas assets in the US. The US assets account for just over 80% of Occidental’s total production as can be seen on the left-hand side of the following presentation slide. All slides here are from Occidental’s Q2 2022 Investor Presentation. The Permian, Rockies, and GoM (Gulf of Mexico) represent the US asset base.

With similar quality US assets, Occidental’s oil and gas business should track that of EOG and Pioneer closely. Occidental has the added benefit of a robust set of international growth opportunities. As a result, the large earnings declines forecasted for Occidental beginning in 2025 are not projected to result from its oil and gas production operations. Due to the above, it is highly likely that Berkshire has a more favorable outlook than the market for Occidental’s business prospects outside of oil and gas production.

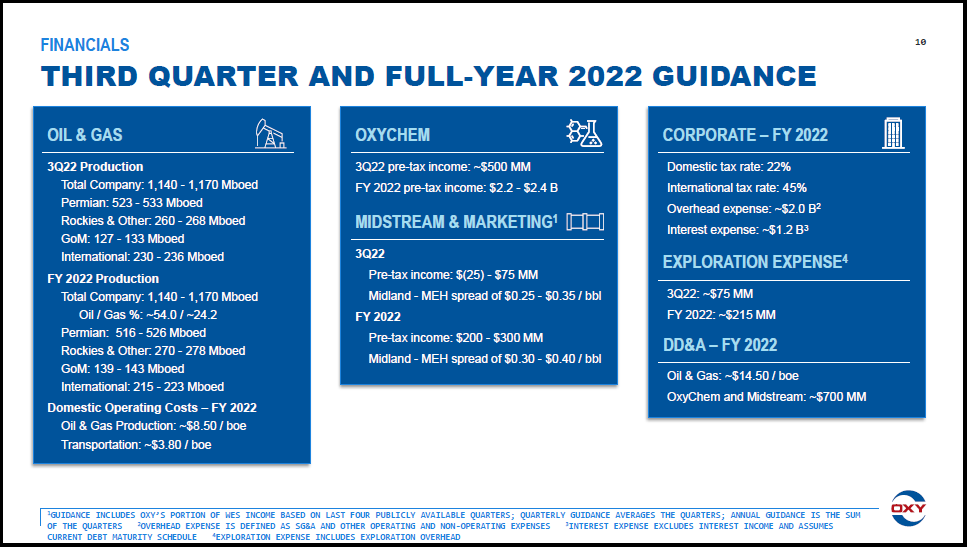

OXYCHEM

As can be seen on the slide below, the profitability of Occidental’s chemical business is growing rapidly. Occidental is a top chemical producer in each of the markets in which it participates. Berkshire may view the chemical business outlook much more favorably than the market. From an economic cycle perspective, the outlook for the chemical business looks more attractive than it has in some time.

Carbon Capture

In addition to being a leader in chemicals, Occidental is leading the market in carbon capture. The following project news from the IEA website, “The world’s first million-tonne Direct Air Capture plant,” confirms that Occidental is a leader in the carbon capture market. I have paraphrased the news below, emphasis added.

When it begins operations in 2024, DAC 1 is set to become the world’s largest direct air capture or DAC facility. This landmark project is an important development that can help demonstrate the valuable and unique role of DAC for meeting net zero goals. DAC 1 is being financed and developed by 1PointFive, a development company created by Oxy Low Carbon Ventures, OLCV. It will be located in the Permian Basin of the United States.

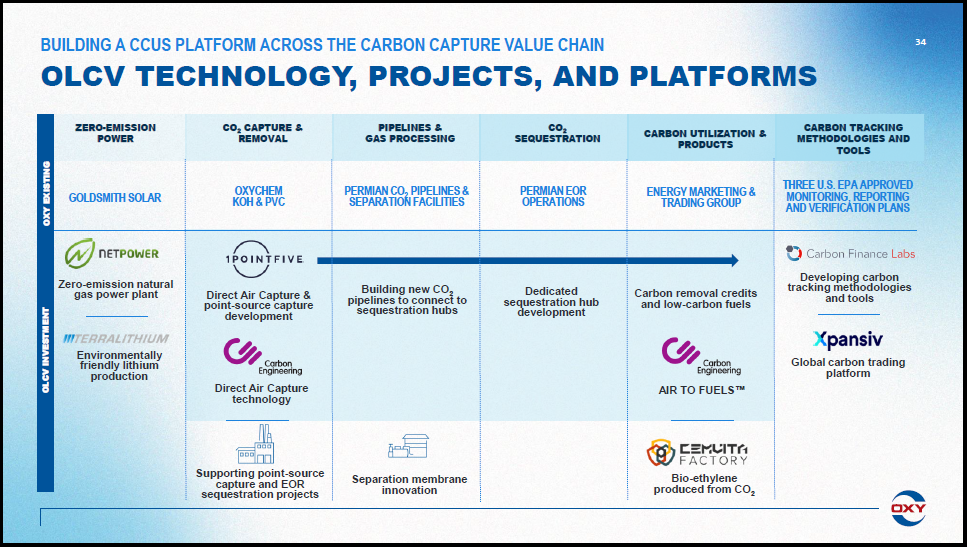

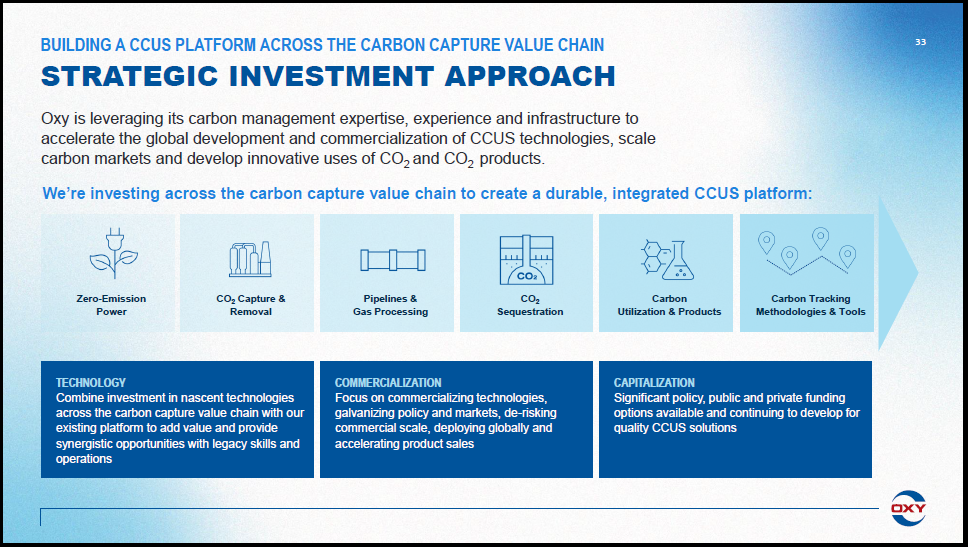

The following image provides an overview of Occidental’s CCUS or Carbon Capture, Utilization and Storage platform.

Occidental benefits from the carbon capture itself and the various productive use cases for the storage of the sequestered carbon dioxide, such as EOR (Enhanced Oil Recovery). Occidental is a leading EOR producer thus creating synergies with the carbon capture business. With the world’s largest direct air capture facility coming online in the Permian Basin around 2024, Occidental should have organic growth opportunities into 2025 and onward. This differs materially from expectations into 2025 and 2026.

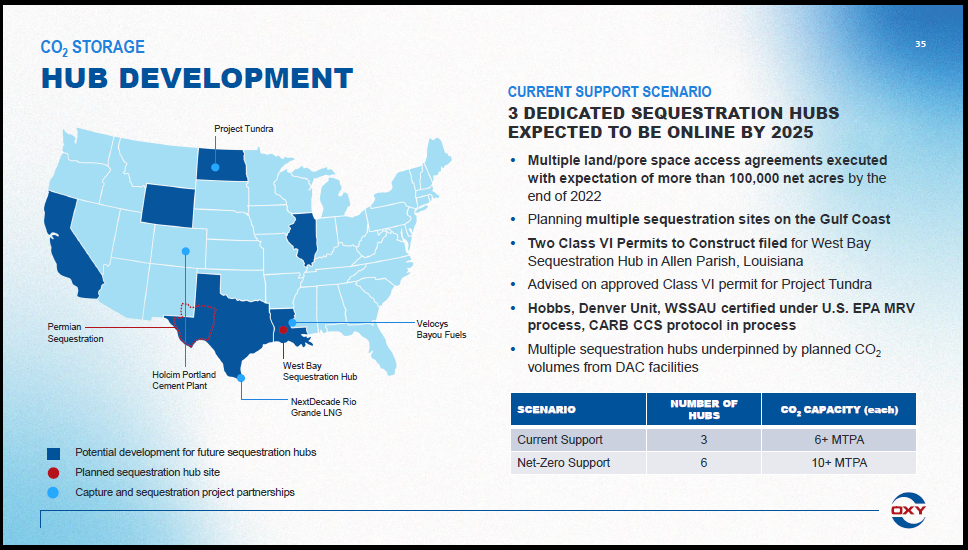

The following two slides provide an overview of the carbon capture business and Occidental’s US plans in particular.

US Carbon Capture Plans

With Berkshire showing great interest in Occidental and the possibility that market expectations into mid-decade are too bearish, the price action offers important context.

Technicals

The technical mosaic is bullish on all time frames. On the 1-year daily chart below, notice that Occidental is attempting to breakout from a 6-month base. This is an ideal technical setup as the stock is not overextended in the short term, while remaining in a bullish primary trend.

The following 5-year weekly chart confirms the new bull market is occurring after a deep cyclical trough. Fundamentally and technically speaking, from a cycle perspective, we could be relatively early for Occidental and the energy sector more broadly.

The following 20-year monthly chart provides a bird’s eye view. Occidental is back to 2007 levels, a brutal period for the shares. There is unlikely to be much in the way of technical resistance to the upward price trend after such a long period of sideways to lower price action.

The $100 area looks to be a high probability price target over the nearer term. A successful breakout to new all-time highs above $100 would likely signal the beginning of the next leg of the bullish trend.

Summary

Occidental has a high probability of outperforming expectations into mid-decade. The oil and gas production business operates world-class assets which should perform inline with or above the leading peer group. Occidental has the added benefit of a robust set of international growth opportunities. The OXYCHEM business offers above-average organic growth potential against a favorable cyclical backdrop. Finally, the nascent carbon capture business represents an extraordinary secular growth opportunity while offering incredible synergies with Occidental’s top-notch oil and gas assets. With the support of Berkshire, the risk/reward skews decidedly positive.

Price as of this report: $71.29

Occidental Petroleum Investor Relations Website: Occidental Petroleum Investor Relations