Risk/Reward Rating: Negative

Fortinet (NASDAQ:FTNT) traded down 16% on 8-4-22 following its Q2 2022 earnings report. The selloff follows an attempted breakout above the 200-day moving average the previous day. The rejection at such a critical technical moment creates a decidedly bearish technical picture. Given the elevated valuation at 69x trailing earnings, the technical breakdown suggests that time is required for the bearish trend to fully play out.

Most would agree that the cybersecurity industry offers one of the more robust long-term outlooks. This fact and Fortinet’s success to date, should place Fortinet on the watchlist of all growth stock investors. As a result, we are adding it to the dox it! list.

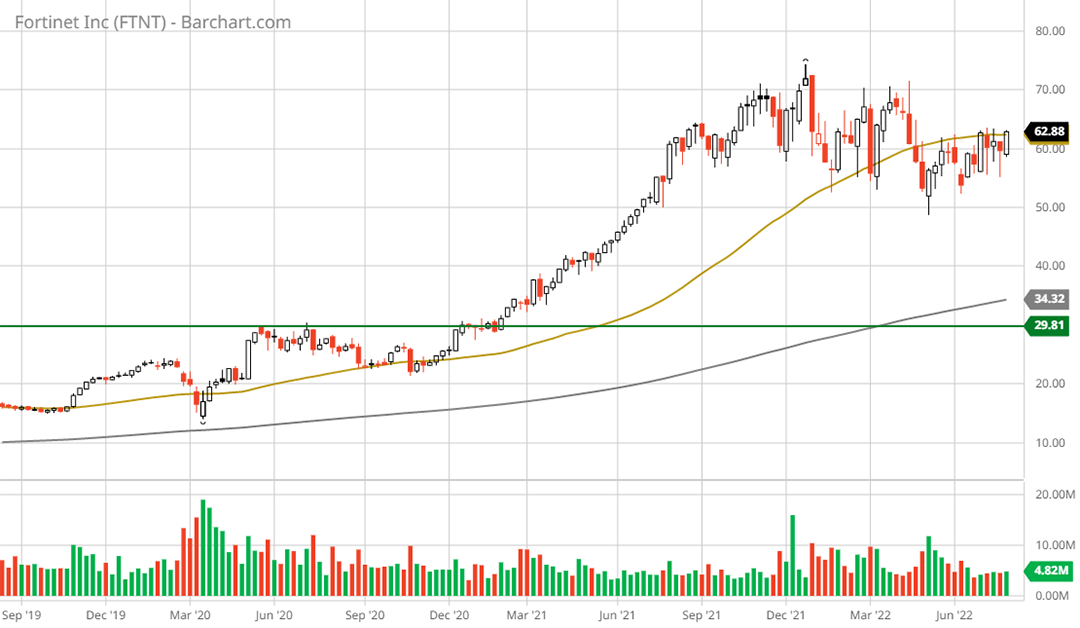

Technicals

The critical technical juncture mentioned above is captured well in the following 1-year daily chart which excludes today’s 16% selloff. Note that the 200-day moving average is the grey line while the 50-day moving average is the gold line.

The death cross on 5-10-22 hinted at the likelihood that a bearish trend was unfolding. The powerful rejection today immediately following a test of the 200-day moving average confirmed the death cross signal with prejudice.

We can establish a preliminary technical downside target by looking for the nearest major support level. The following 3-year weekly chart provides a look at the technical downside potential. The nearest major support level is highlighted by the green horizontal line.

With the shares closing at $52.61 today and major support near $30, there is substantial downside potential, technically speaking. From my perspective, the nearest support zone is most likely in the $30 to $40 range. I view these as potential target prices for a full dox.

Price as of this report: $52.61

Fortinet Investor Relations Website: Fortinet Investor Relations Website