Risk/Reward Rating: Negative

Snap Inc. delivered 66% revenue growth in Q1 2021 and projects the trend to continue in Q2 after accounting for Q2 2020 COVID weakness. The revenue growth is a material acceleration from the 45% growth rate in the prior two years. The first quarter of 2021 also marked the first positive cash flow performance in the company’s history as a publicly traded stock. Given the positive trends, the investment decision revolves around the valuation of Snap.

Valuation: 314x non-GAAP 2021 earnings estimates and 103x 2022 estimates. On a revenue valuation basis, the company trades at 45x 2020 sales and 30x 2021 estimated sales. The valuation multiples on all counts are extraordinary compared to historical market norms. It should be noted that the company is not expected to be profitable under generally accepted accounting principles (GAAP).

The expected non-GAAP profitability is due to the exclusion of stock-based compensation expenses. These expenses are massive and have been historically. For example, Snap reported positive cash flow from operations of $137 million in Q1 2021 while Q1 stock-based compensation expense was $237 million (it is not a cash outflow). Shares of stock have real economic value. Thus, when used to compensate employees, they are a real economic expense for a company. These large expenses, which are ignored in most public earnings estimates, must be weighed by investors.

On the business front, Snap bills itself as a camera company. The camera app may be the onramp for Snap users; however, the camera company label may not capture the essence of the future opportunity. The opportunity set includes large and competitive markets such as social media, augmented reality, advertising technology, media creation, media distribution and more. The total addressable market opportunity is sizeable, however, the competition is intense.

The recent sales growth success suggests that the company is performing well, and clearly received a boost from the COVID lockdowns which drove people towards online platform engagement. The need to reach consumers in lockdown led companies to focus their advertising on platforms like Snap. Recent growth rates are likely to slow as life returns to normal and competition focuses on Snap’s recent success. The competition is fierce in mobile engagement and advertising and includes the largest technology firms such Apple, Google, Facebook, Twitter, TikTok, and more.

All told, the company is doing an excellent job with revenue growth but the valuation at current levels offers no margin for error. Any sign of slowdown or disappointment would expose new investors to substantial downside risks. Furthermore, with a current fully diluted stock market value of $114 billion, much of the foreseeable future success has already been priced into the shares. A material selloff could provide an entry point for high-risk investors.

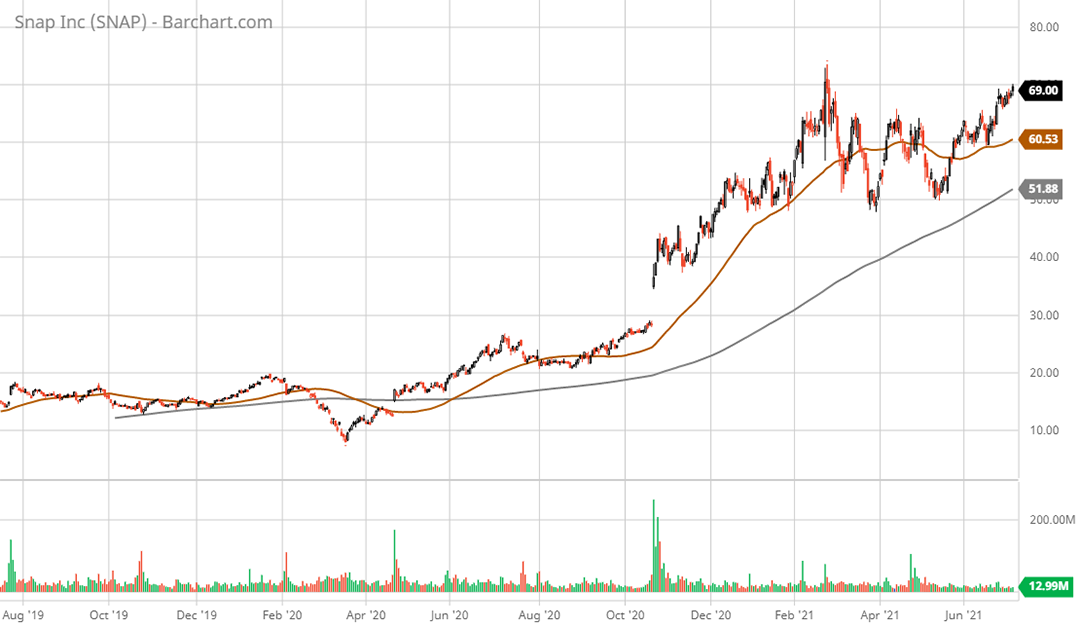

Technical backdrop: After reaching $30 on its first day of trading in February of 2017, Snap shares have traded lower and sideways.

The $30 price reached on the day of the IPO was surpassed for the first time in October of 2020 with a vertical gap higher to the mid $40’s. This gap higher was in reaction to the first signs that sales were beginning to accelerate during COVID. The $50 area has served as support throughout the sideways trading range in 2021 with $75 serving as the cap on the share price. The extreme valuation accounts for this sideways pattern and is likely to continue to restrict upward momentum.

Technical resistance: $75

Technical support: $50 then $40

Price as of report date 7-6-21: $70

Snap Investor Relations Website: Snap Investor Relations

All data in this report is compiled from the Snap investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.