UPS’s (NYSE:UPS) Q4 2022 earnings results were released today making this an ideal time to review the most important economic question of the day: Will there be a recession? How investors navigate the unfolding answer will have wide-ranging portfolio consequences over the coming years.

Will There Be a Recession?

FedEx (NYSE:FDX) reported its fiscal Q2 2023 results on December 20, 2022. As a result, we now have the top two shipping firms in hand to directly take the pulse of the economy. As shipping is a coincident economic activity, it serves as an excellent real-time indicator of the stage of the economic cycle.

Shipping Volume

A great signal of the real economy is shipping volume. It is a pure measure of real-world economic activity and removes inflationary effects. Keeping it simple has a certain elegance in the daily barrage of information.

In reviewing the shipping volumes of UPS and FedEx below, it will become clear that there is a broad-based decline in the volume of economic activity. In terms of shipping volume, economic contraction is a multi-quarter, well-established trend.

Volume Contraction

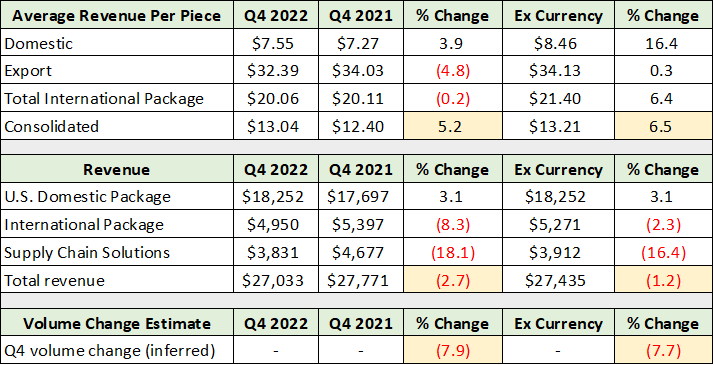

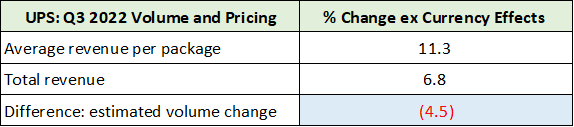

In the case of UPS, I infer its shipping volume change by netting out the percentage change in pricing and the percentage change in overall sales. Pricing is reported on a per piece delivered basis. In the table below, I have highlighted these percentage changes in yellow. The table was compiled from UPS’s Q4 2022 earnings release.

By this approximation, volumes contracted by nearly 8% in Q4 2022 on a year-over-year basis. The shipping contraction is in stark contrast to the first estimate of US GDP growth for Q4 2022 at 2.9%.

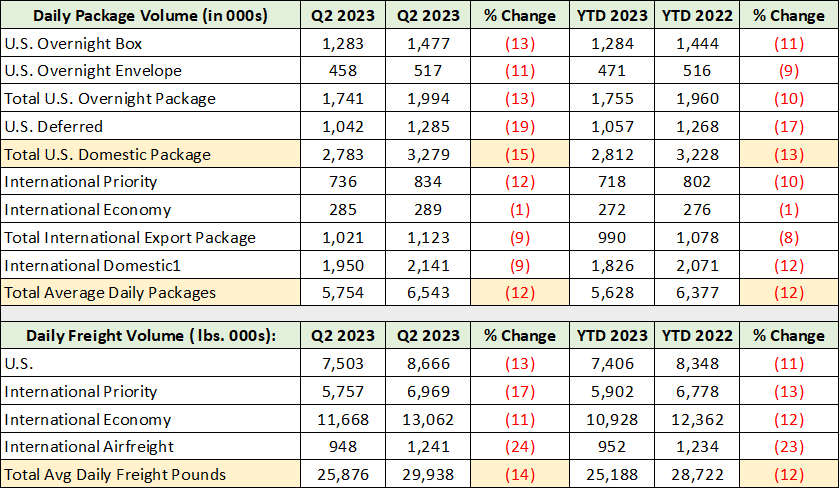

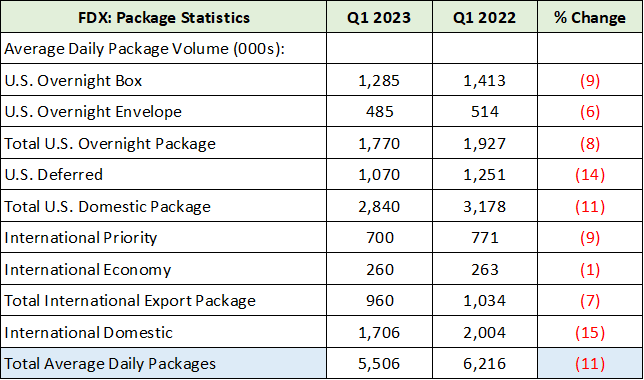

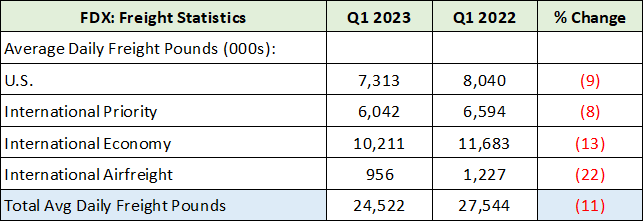

Though my approximation is a rough calculation, it receives strong support from FedEx’s package volume contraction of 12% and its freight contraction of 14%. FedEx’s reported results are displayed below and are from its Q2 2023 earnings release.

FedEx’s shipping volumes across its segments contracted in the range of -9% to -24% during the quarter that just ended. Using UPS as the bottom of the contraction range and FedEx freight as the top, shipping volumes contracted in the range of -8% to -14% across the industry.

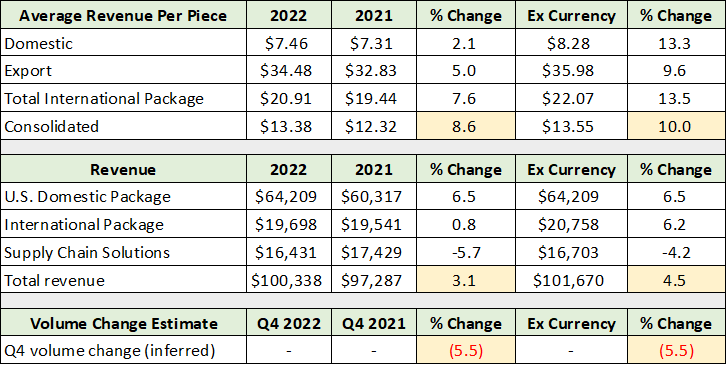

Interestingly, using the same calculations for UPS’s full year results, volumes for the full year were down an estimated 5.5%. The following table was compiled from UPS’s Q4 2022 earnings release. I have highlighted in yellow the percentage changes in pricing and total sales.

The full year volume contraction estimate suggests recessionary conditions have been in place for several quarters. This is supported by FedEx’s prior quarterly contraction, which I reviewed in “FedEx and the recession.” The following table from the report highlights that FedEx’s volume contraction of 14% has accelerated from 11% last quarter.

Last quarter, FedEx’s segments contracted in the range of -6% to -22%. UPS’s volume contraction last quarter was 4.5%, as can be seen in the following table from the prior FedEx report. Note that the recent quarter contraction of 7.9% is a marked acceleration.

To Be or Not To Be?

From a volume of economic activity lens, recessionary conditions have been in place for several quarters. I summarized the October 2022 “FedEx and the recession” report with the following (emphasis added):

While the unfolding recession has yet to be widely accepted, FedEx’s share price has been pricing it in for 18 months. The downtrend is likely nearing a phase transition as the bottoming process completes and the stage is set for a resumption of the long-term uptrend.

The bolded sections above capture the essence of the recession debate. FedEx’s share price was pricing in a recession for 18 months prior to the October report, whether a recession is officially declared or not. This is how I concluded the October report:

Fundamentally, FedEx is trading at a discounted valuation on a material earnings reduction of 30%. With the shares trading near long-term technical support at the 200-month moving average, the risk/reward asymmetry for FedEx is decidedly positive.

UPS and FedEx

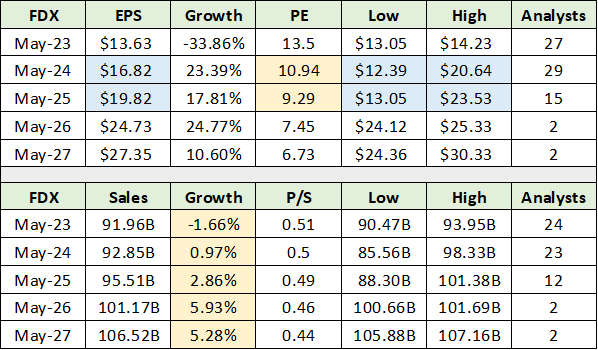

UPS and FedEx each receive a positive risk/reward rating. The underlying theme of the risk/reward asymmetry is multiple expansion potential as a recovery in volumes takes hold and the next upcycle is priced in. There is the added benefit of upside surprises into mid-decade as consensus sales growth estimates appear to be quite conservative.

Consensus estimates for UPS and FedEx are provided below. I have color coded the key comparable cells. The low PE multiples and conservative sales growth estimates are highlighted in yellow. For FedEx, the wide range of earnings estimates is highlighted in blue. FedEx clearly has the greatest surprise potential of the two and trades at a steep valuation discount to UPS looking into mid-decade.

Summary

Returning to the most important economic question of the day: Will there be a recession? The current economic climate features real-world volume contraction at the heart of economic activity, shipping. It has been ongoing for several quarters, and it has been priced into FedEx and UPS for some time.

In this respect, the question of an official recession declaration is a moot point. FedEx priced in a recession over the past 18 months. It was trading $157 per share at the time of the October 28, 2022 report and is now trading near $192, for a gain of 22% over three months.

I believe it is best to remain focused on navigating the unfolding opportunities as they are presented, rather than on the semantics of the opportunity set. All cycles are idiosyncratic, some more so than others. As we appear to be entering a more volatile and uncertain cycle, how one navigates it will have wide-ranging portfolio consequences for many years to come.