Risk/Reward Rating: Negative

Sea Limited (NYSE:SE) is a foreign holding company headquartered in the Cayman Islands with three principal business segments: Digital Entertainment (Garena), E-commerce (Shopee), and Digital Financial Services (SeaMoney). It should be noted that the company’s principal offices are located in Singapore and the Caymans headquarter location is primarily a legal and tax shell. All three business segments are in some of today’s popular, fastest revenue growth sectors.

Business Segments

The Garena Digital Entertainment segment is what many today would refer to as the metaverse. It features massive multiplayer games and virtual sports competitions. The company has produced a global hit game that has gone viral called Free Fire, which is largely responsible for the company’s recent success. The game has been downloaded over one billion times on Google Play alone. It should be noted that this business division is the only profitable one of the three business units. This profitability is due to the excellent economics of the business model (see the Roblox report for a comparison).

The Shopee E-commerce division is a diversified retail marketplace and is similar to Amazon’s marketplace. Shopee offers sellers a storefront and a full suite of value-added services such as marketing, payment processing, and integrated shipping and supply chain management. This division, like that of Amazon in earlier years, is highly unprofitable. The E-commerce marketplace business model is low margin and usually requires massive scale to become profitable. For example, Amazon’s net profit margins have been in the 5% range in recent years (see the Amazon report). It is unclear if Sea can achieve such scale with Shopee.

The SeaMoney segment is still young, and its results are not broken out separately in the company’s financial statements. Instead, the results are included in the other two segments. Given the high valuations placed on companies such as Square and PayPal, SeaMoney could evolve into a valuable standalone business unit with time. Alternatively, it may remain more of an overlay brand on top of other payment processors used primarily on Sea’s own platforms.

Financial Performance

The company posted extraordinary revenue growth in Q2 2021 of 158.6% versus Q2 2020. The E-commerce segment accounted for 55% of revenue while the Digital Entertainment segment accounted for 45%. Revenue in each unit grew at roughly the same rate. For the full year of 2021, the company slightly raised its guidance to 121.5% revenue growth in the E-commerce division and 44.4% bookings growth in the Digital Entertainment division.

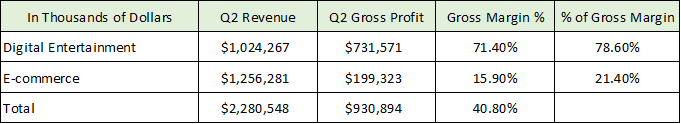

Bookings in the Digital Entertainment division can be thought of as future revenue growth for this segment. The 44.4% full year bookings growth projection suggests a rapid slowdown is unfolding compared to the division’s Q2 revenue growth of 167%. As this is the only profitable business segment, some caution is warranted given this rapidly unfolding deceleration. The following profit margin table highlights how dependent Sea is on the Digital Entertainment division in its quest for overall profitability.

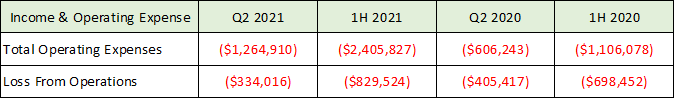

The Digital Entertainment division accounts for 78.6% of Sea’s total gross margin (revenue – cost of sales before operating expenses). While the gross profit margin of the E-commerce division is only 15.9% of sales. As a result, rapid growth in the E-commerce division generates little gross profit dollar growth for Sea, while decelerating growth in the Digital Entertainment division heavily impacts the growth rate of overall corporate profitability. As things stand, Sea is not profitable as can be seen in the following table. The table breaks out total operating expenses and operating losses before interest and taxes for Q2 2021 and the first half (1H) of 2021 compared to the same periods in 2020.

Valuation and Outlook

While the operating loss for Sea improved by $71.4 million in Q2 2021 compared to Q2 2020, the year-to-date operating loss widened by $131 million. Analyst estimates are for losses to continue in 2022. The loss generation creates some challenges for the valuation of Sea, leaving sales as the best gauge. The company is currently valued at $169 billion which equates to roughly 24x sales estimates for the full year of 2021. This is an extreme valuation multiple from a historical market perspective.

All told, the extreme valuation and lack of visibility regarding the profitability of Sea’s overall business model create extraordinary risk for investors. Furthermore, the valuation has priced in much of the foreseeable revenue growth success of Sea, leaving little excess return on the table for new shareholders. For aggressive growth, risk tolerant investors, Sea deserves a spot on the watchlist. It provides excellent exposure to digital growth in global markets, especially with its exposure to Southeast Asia and Latin America. Patience with a view towards opportunistically accumulating the shares on substantial price declines may be the most rewarding approach.

Technicals

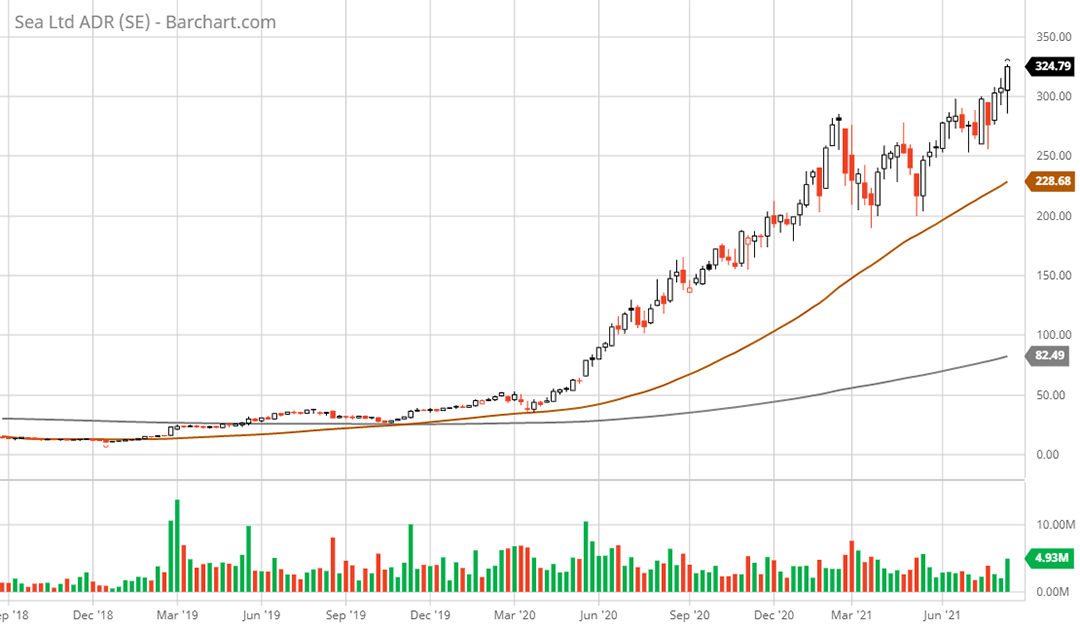

Technical backdrop: Sea’s stock has exploded since the first quarter of 2019, running from $11 to the current all-time high of $326. Prior to this vertical move, the stock had spent its history in a sideways trading range. The rally has left Sea materially overextended from its long-term moving averages. The 50-week moving average (brown line on the 3-year weekly chart) stands 30% lower at $228. The 200-week moving average (grey line on the weekly chart) stands 74% lower at $86. While the $86 area is unlikely to be tested, the long-term technical overextension combined with the extreme valuation suggests the $228 level and lower are very real possibilities.

Technical resistance: No resistance is visible given the stock is at all-time highs. However, given the extreme valuation, one would expect meaningful upward momentum from here to face stiff resistance and increasing volatility.

Technical support: The $280 and $260 levels are the first visible support zones on the weekly chart. This is followed by the 50-week moving average at $228, then the $200 level. $200 has served as bottom support throughout 2021 and may offer an accumulation level.

Price as of this report 8-18-21: $326

Sea Ltd Investor Relations Website: Sea Ltd Investor Relations

All data in this report is compiled from the Sea Ltd investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.