I am assigning Peloton (NASDAQ: PTON) a negative risk/reward rating based on a heightened level of execution risk over the coming year, an elevated valuation, and initial signs of balance sheet pressure which may cause further shareholder dilution. In this article, I quantify these risks, outline the investment case, and develop a strategy for accumulating the shares utilizing fundamental valuation that is well supported by technical analysis.

Risk/Reward Rating: Negative

Peloton reported its Q4 and full fiscal year 2021 results (fiscal year ended June 30, 2021) after the market closed on August 26, 2021. The company provided disappointing guidance for the coming quarter and fiscal year 2022. The forecast provided for the current quarter is revenue of $800 million which was 20% below expectations. In reaction, the stock fell 8.5% the following day and remains at this level despite a brief rally attempt following a private label clothing line announcement.

Adding to concerns for the future was the announcement of a $400 price cut (21% decrease) to $1,495 for its original Bike. This follows a price cut for the Bike from $2,245 to $1,895 in September of 2020. As a result, the total price reduction over the past year now stands at 33%. With rapidly accelerating costs throughout its supply chain, slashing product prices will continue to pressure gross profit margins and lead to reduced profitability.

In fact, the company is projecting an adjusted EBITDA (earnings before interest taxes depreciation and amortization) loss of -$325 million for the coming 2022 fiscal year (year ends June 30, 2022). The adjusted operating loss estimate comes at a time of rapid expansion plans for Peloton as the company projects capital expenditures to be $600 million in fiscal 2022. This follows heavy investment in capital expenditures and acquisitions in 2021 which led to a -$1.09 billion cash outflow for the year. As a result, 2022 is shaping up to be the second straight year with roughly -$1 billion of net cash outflows for Peloton. The company is clearly going all in on growth which creates a heightened level of execution risk going forward.

Balance Sheet Risk

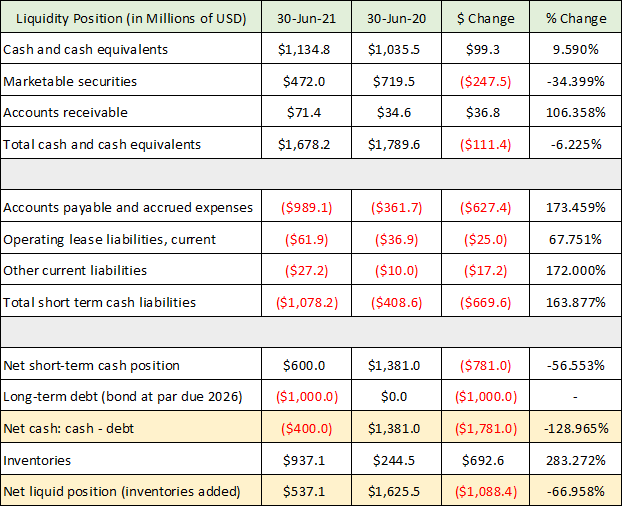

Execution risk is most acute as it relates to Peloton’s balance sheet as it may start to feel the strain from these elevated cash outflows. The company has ample liquidity at the moment with $1.6 billion of cash and cash equivalents. However, this liquidity cushion could quickly dwindle as 2022 is setting up for a potential -$1 billion plus of negative free cash flow. The following table was compiled from data in Peloton’s recently filed annual 10-K report with the SEC. The data is from the balance sheet and is intended to illuminate Peloton’s liquidity position.

Source: Created by Brian Kapp, stoxdox

I have highlighted the most important rows in yellow which present Peloton’s net liquid position. The company has a negative net cash position of -$400 million which is a -$1.781 billion swing from one year ago. It includes $1 billion of new debt that comes due in 2026. Including inventories, the swing was a less severe -$1.088 billion over the past year, leaving the company in a positive $537 million liquidity position at year-end 2021. This is down from the $1.625 billion net liquid position at the end of fiscal 2020.

Peloton guided its capital expenditures for fiscal 2022 to $600 million alongside an expected -$325 million adjusted EBITDA loss. Based on this guidance, Peloton will be approaching another -$1 billion of cash outflows for the second straight year. If this transpires, it will lead to a material degradation in the company’s liquidity profile as outlined above.

Peloton took on $1 billion of debt over the past year to absorb the liquidity drain in 2021. The debt is a convertible bond with a conversion price of $239.23 per share of stock (4.1 shares for each $1,000 bond). With the share price at $104, the convertible feature of the bond is well out of the money and is pure debt at the moment. If needed, the company also has access to an undrawn $285 million credit line as of year-end 2021.

Financial Performance: Cash Outflow and Revenue Deceleration

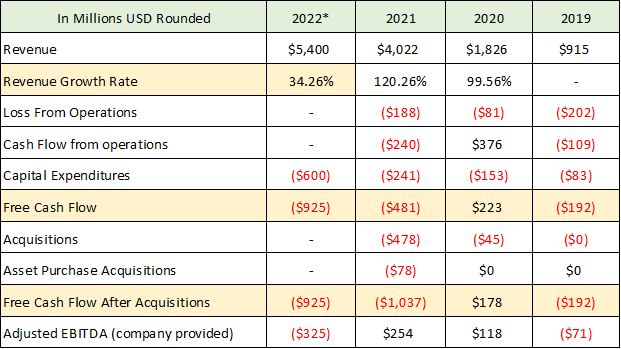

Peloton stated on the Q4 earnings conference call that it will continue to prioritize growth over profitability for the foreseeable future. At this time, the company expects to return to positive adjusted EBITDA in fiscal 2023. The following table breaks down key profitability metrics from the annual 10-K report filed with the SEC. For 2022*, please note that revenue, capital expenditures, and adjusted EBITDA are company provided estimates while free cash flow is extrapolated. The company’s adjusted EBITDA and capital expenditure estimates are added together to arrive at a free cash flow estimate of -$925 million. It should be noted that adjusted EBITDA may not be a good estimate of cash flow from operations as it excludes many actual expenses (see the notes section at the end of this report for the definition of adj. EBITDA).

Source: Created by Brian Kapp, stoxdox

Looking at the 2021 data, we can break down the nature of the -$1.088 billion reduction in the company’s net liquidity position. Acquisitions were the largest source of liquidity drain at 54% or $556 million (important acquisition detail can be found in the notes section at the end of this report). The remainder is split evenly between negative cash flow from operations and capital expenditures.

In respect to 2022, capital expenditures look to account for 65% of the cash drain, with negative cash flow from operations (assuming no further acquisitions) accounting for the remainder. Peloton is building out manufacturing capacity with a new $400 million production facility in Ohio. This is on top of the capacity that was added in 2021 with the $412 million Precor acquisition and the Tonic Fitness Technology acquisition in fiscal 2020 (Taiwan manufacturing capacity). Additionally, Peloton is making a $200 million investment in technology and other infrastructure such as warehouses and last mile delivery. The estimated -$325 million of adjusted EBITDA rounds out the estimated cash drain for 2022.

The largest change on deck for 2022 looks to be the reduction of revenue growth to an estimated 34% gain, which is down from 100% plus over the prior two years. It should be noted that the revenue guidance for the current fiscal Q1 of $800 million represents only 6% growth over Q1 2021. To achieve the 34% growth target for the full year, the company will need to generate 41% revenue growth over the remaining three quarters of fiscal 2022. In order to achieve this growth, Peloton will need to substantially increase sales and marketing expenditures. In fact, on the Q4 conference call, the company stated that it will indeed substantially ramp up marketing expenditures.

Revenue Deceleration Risks

If the revenue deceleration were to continue it could create an elevated operational risk for Peloton. The risk is amplified given the aforementioned heavy investments in expanded production and distribution capacity alongside the rapid weakening of the company’s liquidity profile. If sufficient demand growth does not materialize in response to increased sales and marketing expenditures over the coming year, Peloton may need to raise additional capital. This would likely require further share sales and hence shareholder dilution to shore up the balance sheet.

For example, if free cash flow comes in at -$1 billion for 2022, the net liquidity position of Peloton will turn negative when one includes the $1 billion debt maturity in 2026. This debt may need to be repaid in cash if the share price remains below $239.23. As things stand, the company is putting its energies into growth in the near term. It will need to get the share price above the stock conversion price in the convertible debt to alleviate potential strains on the company’s financial position. Peloton is at a critical juncture in all respects.

Valuation

As discussed above and can be seen in the Loss from Operations in the profitability metrics table, Peloton is not profitable, nor is it projected to be profitable. At the same time, it is generating extraordinary levels of negative free cash flow. This operational reality renders a valuation difficult and dependent on a multiple of sales with acute attention paid to the balance sheet.

The company is currently valued at $31.2 billion using the diluted share count. This leaves the current valuation at roughly 6x sales. This is a high valuation given the currently unprofitable business model. For example, Nautilus (NYSE: NLS) is a direct competitor and is valued at only 0.65x sales. It should be noted that Nautilus was profitable last year and is trading at 6x last year’s earnings, compared to Peloton at 6x sales estimates.

Peloton clearly has greater brand equity than its competitors. Therefore, a direct comparison to the valuation of Nautilus and similar types of companies is not exactly an apples-to-apples exercise. The fitness hardware manufacturing business model historically has been a difficult one from a profitability standpoint. This is evidenced by Nautilus gyrating between earnings and losses throughout its history.

The Peloton vision and business model is more expansive than just selling hardware like treadmills and stationary bikes. In fact, the future of the company will depend heavily on its success in generating and retaining premium monthly Connected Fitness Subscription customers. Essentially, Peloton is looking to become a sort of premium Netflix (NASDAQ: NFLX) for fitness with live and on demand visual, audio, and interactive content. The company is also creating a bridge between its platform and the healthcare insurance market which could open the door to other possibilities.

Comparable Valuation Approach

A comparable company valuation technique is a good approach for Peloton because the economics of the subscription business are much more valuable than that of the hardware manufacturing business. We can compare Peloton’s valuation to that of a comparable hardware company and a comparable subscription-based company with similar economics to Peloton. In the case of hardware, Nautilus works well for a comparable, keeping in mind that Peloton would receive a premium for its brand. For the subscription side of the business, Netflix serves as a high-quality comparison.

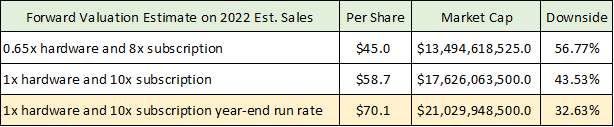

The following table summarizes the results of valuing Peloton in this manner. Nautilus is valued at 0.65x current sales and Netflix is valued at 8x current revenue. I value Peloton on each of these sales multiples (1x estimated 2022 hardware sales and 8x estimated 2022 subscription sales) for a direct comparison. This is followed by two premium valuation multiples applied to Peloton given its added brand equity in the fitness market (1x and 10x then at 1x and 10x the year-end 2022 subscription run rate).

Source: Created by Brian Kapp, stoxdox

Based on this comparable valuation approach, Peloton’s current share price of $104 is priced well above each of the valuation estimates. The downside ranges from 33% to 57%. I have highlighted what I believe to be the best estimate for a comparable valuation price target. In the Technicals section, we will see that the valuations arrived at by this comparable company approach align well with key support levels for Peloton.

The comparable valuation approach highlights the relative value embedded in the share price of Peloton which is assigned to each of its two primary business lines. The subscription revenue business valuation accounts for roughly 80% of the total Peloton valuation in each of the three scenarios above.

Subscription Business Model

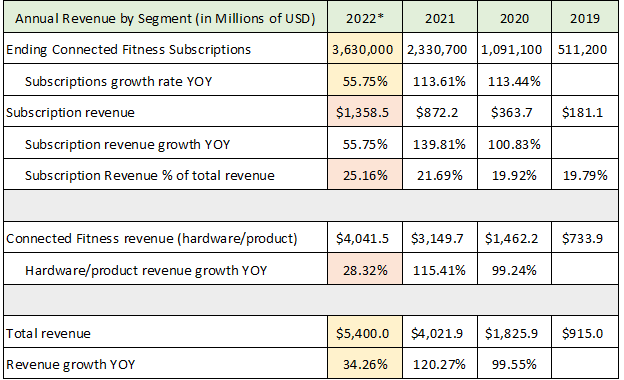

The sales estimates used for the above valuation of Peloton are shown in the next table under 2022* (the historical data is compiled from the 2021 10-K). They are my estimates for hardware and subscription sales and are based on management’s guidance for the full year. The guidance is for $5.4 billion of revenue in 2022 and 3.63 million subscription customers at year-end 2022. I assume subscription revenue for 2022 grows at the same rate as management’s subscription growth guidance. In the final scenario (highlighted in yellow in the table above), I assume that subscription revenue is $39 per month per subscriber at year-end 2022 and annualize this revenue run rate for the sales estimate.

Source: Created by Brian Kapp, stoxdox

Subscription revenue is estimated to grow 56% for the year and make up 25% of revenue in 2022. As a result, 25% of estimated sales accounts for 80% of Peloton’s valuation. The 25% of revenue figure would be a material increase compared to prior years. Hardware sales are estimated to slow to 28% growth in contrast to 100% growth in prior years. If subscription sales are tightly correlated with hardware sales, the higher subscription growth rate estimate may be at risk.

The monthly subscription business model for fitness is largely untested. In the September 2020 Investor and Analyst Day Presentation, management estimated the total potential household market opportunity to be 15 million for Connected Fitness Subscriptions (North America, UK, and Germany). Peloton did not provide any estimates for how the most recent hardware price cut of 21% would affect the 15 million addressable market opportunity, except to say that they believe it will expand the total addressable market size.

The reduced pricing strategy on the original Bike is likely an attempt to expedite market penetration of the company’s hardware in the existing target market of 15 million. This would open the door to upsell high margin subscription plans as well as fill the growing production capacity the company is acquiring and building. The 20% below consensus revenue guidance for Q1 2022 of $800 million implies a 15% decline in hardware sales compared to Q1 2021.

Another attempt to expedite subscription sales is by selling treadmill hardware. The company believes the treadmill market is 2-3x the size of the stationary bike market. Recently, the company had to issue a product recall due to consumer injuries and one death related to its treadmills.

The recall has delayed market penetration and been more costly than originally expected as customer treadmill returns have exceeded estimates. This underestimation of the cost suggests some potential damage to the Peloton brand. Peloton has little brand recognition in the treadmill space and expects 50% of near-term treadmill sales to be to existing customers. This would lessen the impact on subscription growth as the core Peloton brand loyalists are likely subscription members already.

Finally, the company is rolling out extended payment plans (43 months with 0% financing) as a strategy to rapidly grow the user base and pull forward subscription sales. The new payment plan strategy along with the hardware price decrease will reduce the total monthly cost from $78 to $59 over the financing period.

The aggressive pricing strategy is a clear signal that Peloton is going all in to reaccelerate growth over the near term. It may also signal that the majority of the target market of 15 million households is at a lower price point than originally expected and that the number of early brand enthusiast adopters may have been exhausted.

Technicals

As mentioned in the valuation section, the first downside price target is near $70. The valuations arrived at by this comparable company approach align well with key technical support levels for Peloton.

Peloton came public two years ago in September of 2019 in the $27 range and traded sideways until the onset of the COVID pandemic. The pandemic caused sales to soar as gyms were shut down and people scrambled for workout equipment. The price of Peloton exploded as a result, running from $27 to a speculative blowoff top of $170 in January of 2021. Since this peak, the shares have fallen 40%, and in the topping process have carved out a large head and shoulders top as can be seen on the 3-year weekly chart below.

Peloton 3-year weekly chart. Source: Created by Brian Kapp using a chart from Barchart.com

The ascending neckline of the head and shoulders top (green line on the weekly chart) was breached in the first week of August. It served as the rejection zone on August 27 in response to the Q4 earnings report and weak guidance. The neckline is currently at the $115 area and should serve as stiff resistance going forward as was seen with the rejection last week.

While Peloton found support near $83 in May of 2021, the blue horizontal line near $70 is likely to form a stronger support area as it was a weekly resistance zone in 2020. The $70 level also aligns closely with the comparable valuation levels between $59 and $70 outlined in the above valuation section. The purple line near $47 should represent a floor as it was the initial resistance area after the bounce off the COVID bottom. This level also aligns closely with the lowest comparable valuation estimate ($45) found above.

Another potential head and shoulders top is forming on a daily price basis. As seen on the 1-year daily chart below, the neckline is currently near $100 (orange line) and has served as a critical support level throughout the past year.

Peloton 1-year daily chart. Source: Created by Brian Kapp using a chart from Barchart.com

In fact, after falling 8.5% on the weak guidance for 2022, the stock found support at this line once again as it sits just above it at $104. Support here looks tenuous as a death cross has been in place since May 2021. The 50-day moving average (brown line on the daily chart) crossed beneath the 200-day moving average (grey line) which signals a primary downtrend is in place. If this support level breaks, the door is opened to retesting the daily lows of May 2021 near $80.

The blue line (from the weekly chart) remains the next lower major support level near $70. This is likely to be tested given the bearish technical backdrop, elevated valuation, and rapid revenue deceleration. For those looking to accumulate the shares, this would be a natural target area.

Summary

The key strength of Peloton has been its brand which remains the critical fulcrum on which its future success will be determined. The company’s CEO, John Foley, confirmed this message at the end of the Q4 conference call. He stated that Peloton is building one of the most powerful brands in fitness and possibly across all categories. In fact, the CEO referenced a third-party survey which ranked Peloton as the number one global brand.

I couldn’t agree more that Peloton is all about the brand. Creating and sustaining a great brand requires heavy advertising and marketing expenditures in addition to consistent business execution. Peloton has demonstrated its marketing savvy by generating 100% revenue growth in the past several years and creating valuable brand equity in the core fitness market. On the other hand, business execution has proven to be more challenging in recent times as evidenced by the large cash outflows and product recall.

All told, Peloton could be an excellent long-term investment opportunity if the connected fitness market can support the premium monthly subscription business model. There remains extraordinary risk across multiple time horizons. In the long term, the ultimate size of this premium subscription market opportunity remains highly uncertain. In the short to medium term, as outlined in the financial and valuation discussion, there are acute business execution risks which will be amplified if the near-term market opportunity is less than anticipated. Finally, the COVID lockdowns may have pulled forward much of the short-term growth opportunity amongst the core fitness market and brand loyalists. If this is the case, Peloton will face a lower growth trajectory and a higher customer acquisition cost over the coming 1-3 years.

In conclusion, Peloton deserves to be placed on the watch list for high-risk, high-reward growth investors. The most rewarding strategy is likely to be one of accumulation on substantial price pullbacks which would better compensate investors for the level of risk being taken. The technical picture combined with the valuation analysis offer more attractive entry points with the nearest in the $70 area.

Price as of this report 9-20-21: $104

Peloton Investor Relations Website: Peloton Investor Relations

Note on the Peloton acquisitions in 2021

Given the large cash out flows from capital investments as discussed above, it is important to take note of the cash uses to gauge whether funds are being allocated efficiently and in alignment with stated objectives.

The largest acquisition in 2021 was Precor which sells an entire suite of exercise equipment into the institutional markets such as gyms and corporations. The price of the acquisition was $412 million in cash (about the cost of building the new Ohio manufacturing facility). The notable aspect of the acquisition is that Precor does not align well with Peloton’s limited product strategy (which is a few core products or SKUs) and focus on premium household subscriptions.

The company does sell globally whereas Peloton has little international exposure at the moment (90% of Peloton’s sales are in the US). The acquisition may aid international penetration for the brand which may be more skewed toward institutional settings compared to the US. The purpose of the acquisition according to the 10-K is: “The Company acquired Precor to establish its U.S. manufacturing capacity, boost research and development capabilities with Precor’s highly-skilled team and accelerate Peloton’s penetration of certain commercial markets.”

The Precor acquisition did cause Peloton’s auditors to raise a red flag in the 10-K report. They found a material weakness in Peloton’s accounting controls in regard to the identification and valuation of inventory. Anytime auditors report a material accounting weakness it is unusual, and it is wise to take note. This may be a signal of more meaningful corporate control weaknesses or may simply reflect the inexperience in the field of larger acquisitions on the part of Peloton.

Nonetheless, as can be seen in the comparable valuation analysis, the majority of Peloton’s current and future market value rests on the success of the subscription business model rather than manufacturing and selling physical equipment. It is not clear how this acquisition materially furthers the subscription business. The primary avenue would appear to be through commercial relationships and corporate wellness programs exposing end consumers to the Peloton brand and products. In essence, it may end up being an expensive form of marketing as it raises the fixed and recurring cost structure of Peloton.

The next largest acquisition was Aiqudo for $57.7 million in order to bolster product research and development capabilities. The primary area of expertise appears to be voice assistant/recognition capabilities. This acquisition is in alignment with the subscription focused business model and could play into the quality and stickiness of the Peloton software subscription business over time.

Note on Peloton’s definition of adjusted EBITDA

We calculate Adjusted EBITDA as net (loss) income adjusted to exclude: other expense (income), net; income tax (benefit) expense; depreciation and amortization expense; stock-based compensation expense; transaction and integration costs; certain litigation expenses, consisting of legal settlements and related fees for specific proceedings that arise outside of the ordinary course of our business; product recall costs; specific non-recurring costs associated with COVID-19; short-term purchase accounting adjustments; impairment charges for fixed assets; and restructuring costs.