As narratives often dominate price behavior in the short term, thematic investing offers a powerful mental model for analyzing opportunities. Looking through the end of the decade, two themes in particular stand out as fertile ground for investors: the reorganization of global supply chains and additive manufacturing (3D printing).

The following quote is from the introduction to the June 2, 2023 report “3D printing is a razor and blade opportunity”:

With post-Covid onshoring and regionalization of supply chains a clear and likely secular trend, one could postulate that it is a case of now or never for the additive manufacturing industry.

The next passage from the report speaks to the size and growth rate projections for the additive manufacturing industry:

The market size estimates provided by 3D Systems and Materialise are nearly identical, pegging the 3D market at $15 billion annually in 2021. Each company is forecasting industry sales in the 2026 to 2027 timeframe to be in the range of $43 billion to $50 billion… an annual sales growth rate of 22% for the industry. Looking through 2030, Materialise estimates the market size to be $85 billion in 2031, while Protolabs describes the market size as $100 billion plus.

Looking through the end of the decade, if the above estimates are even roughly in the ballpark, the reorganization of global supply chains and additive manufacturing represent two of the most prolific growth opportunities for investors.

Protolabs

As discussed in “3D printing is a razor and blade opportunity,” Protolabs and Materialise were identified as the top two opportunities in the additive manufacturing industry. Since the report, Protolabs has taken the pole position in the industry following its Q3 2023 earnings report on November 3, 2023. The following 6-month daily chart displays the bullish stock price reaction to Protolabs’ Q3 report.

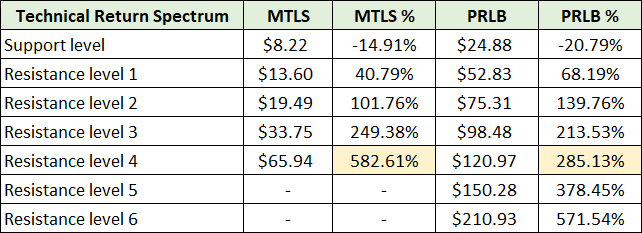

Please note that the grey line is the 200-period moving average and the gold line is the 50-period moving average. Since the November 3 earnings report, Protolabs is up nearly 50%. Prior to the report, the shares found support near $24, which was identified as the key support area in the following table from “3D printing is a razor and blade opportunity.”

Protolabs’ shares bottomed out at just above $23 and have now formed a large double bottom near this key support level, as can be seen in the following 2-year daily chart.

Turning to the upside technical price targets (resistance levels in the above table), each target remains unchanged and viable. The yellow highlighted cell for Protolabs remains my estimate of the most likely upside potential into the mid-decade timeframe.

While the shares are technically overextended to the upside in the short term, taking a longer view, the technical backdrop has turned decidedly bullish for Protolabs. This is an improvement compared to the June 2, 2023 technical backdrop, which I described as follows at the time: “Protolabs has gained initial, if tepid, upside momentum.”

Finally, the long-term monthly chart below displays Protolabs’ entire trading history and places the recent double bottom and upside technical targets in historical context.

The orange horizontal line displays the $121 technical target, which I estimate to be the most likely upside potential into mid-decade. Additionally, when considering fundamentals and valuation norms as discussed below, the technical target is well supported. Given the previous price spikes to $166 in 2018 and $212 in 2021, one should be prepared for material deviations from valuation norms.

In summary, the intermediate to long-term technical backdrop is now quite bullish for Protolabs, while the nearly 50% move since the November 3 earnings report is likely to correct somewhat. Of note in the short term, the price gap following the earnings report is in the $30 area compared to $34.70 today and $33 at the time of the June 2 report. The $30 area is also in the vicinity of the 200-day moving average.

Fundamentals

Turning to fundamentals, what is most notable about the additive manufacturing industry is that the expected growth rates have yet to materialize. In the case of Protolabs, the company has largely stagnated since 2018, as can be seen in the following image from Protolabs’ May 2023 investor presentation.

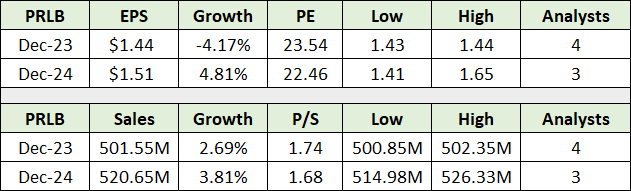

The trend toward stagnation and slow growth since 2018 is expected to continue in the near term. This can be seen in the following table which displays consensus earnings and sales growth estimates through 2024.

Growth is expected to resume for Protolabs in the low single digits this year and next. This is a far cry from the expected 22% growth rate for the additive manufacturing industry into the latter half of the decade.

Manufacturing

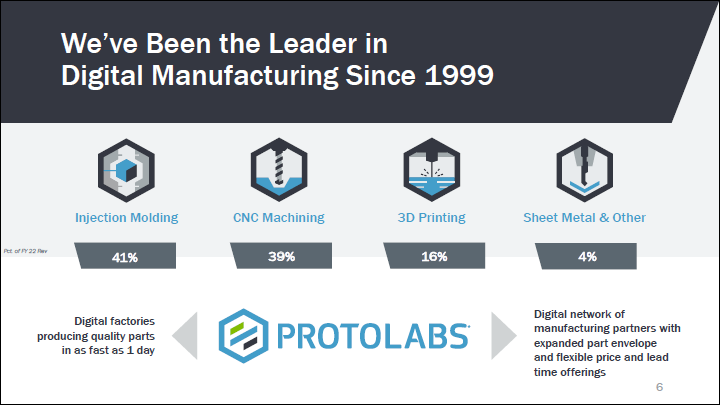

What is unique about Protolabs compared to the additive manufacturing group is that 3D printing comprises a relatively small percentage of Protolabs’ revenue. The company’s sales breakdown by service line for 2022 is as follows (from the May 2023 presentation):

In addition to service line diversification, Protolabs’ revenue is well diversified across industries, as can be seen below. The stagnation of sales since 2018 begins to make sense in light of the fact that 75% of revenue is coming from cyclical manufacturing industries:

- Health Care: 20% – 25%

- Electronics: 20% – 25%

- Aerospace: 10% – 15%

- Industrial: 5% – 10%

- Automotive: 5%

The following quote from “3D printing is a razor and blade opportunity” captures the unique nature of Protolabs in comparison to the additive manufacturing group:

Protolabs is highly leveraged to the manufacturing side of the additive manufacturing industry compared to its peers. While this is a negative for the business model over the long term, it could provide operational leverage under conditions of strong demand and tight supply… the manufacturing focus enhances the potential for upside surprises.

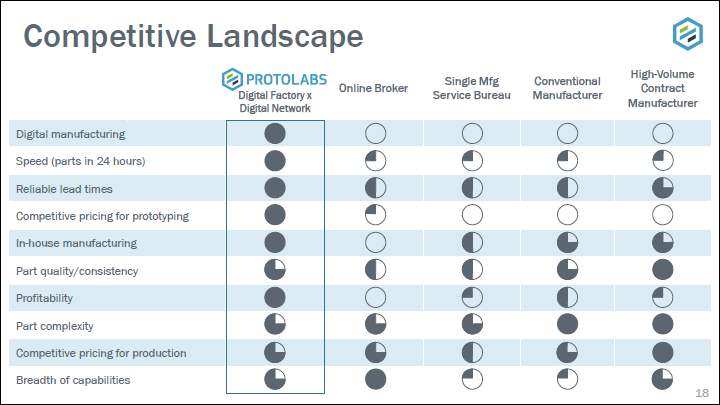

In fact, Protolabs is best viewed as a pure play manufacturing investment opportunity which conducts all of its business online. The company is quite literally a digital factory. Protolabs contrasts its capabilities with those of its manufacturing competitors in the following slide from the May 2023 presentation:

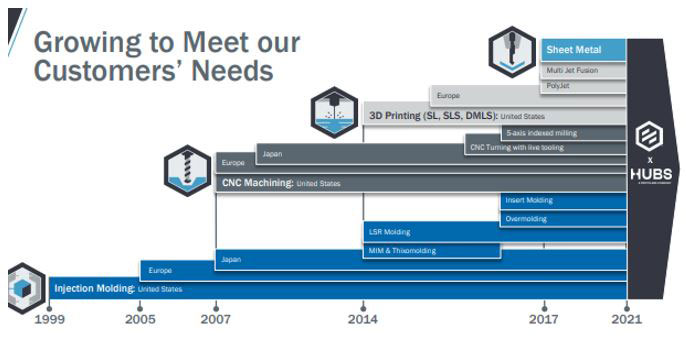

With the recent acquisition of Hubs and the coming rebranding to Protolabs Network in January 2024, the company is positioning itself as a one-stop digital manufacturing platform, including 3D printing and hundreds of global manufacturing partners. The following image from Protolabs’ 2022 annual report captures the evolution of Protolabs’ strategic positioning through time:

Rather than a 3D printing company, which was added to the mix in 2014, Protolabs is sculpting the entire digital manufacturing supply chain.

Outlook

With onshoring and regionalization of supply chains a clear and likely secular trend and Protolabs’ full suite of global digital manufacturing capabilities, there is a strong case to be made for growth to accelerate through mid-decade. This is especially the case given that recessionary conditions have been in effect for cyclical industries since Q3 2022, as first discussed in the September 15, 2022 report “The recession is here, filter the noise.”

A cyclical manufacturing upturn is likely to combine with secular growth trends to create highly favorable operating conditions for Protolabs through mid-decade and beyond. With 3D printing representing only 16% of sales, or roughly $100 million annualized, and expectations for the market to reach the $100 billion range, the secular growth opportunity creates the potential for extreme upside return asymmetry.

Valuation

If true, that cyclical growth is likely to accelerate into mid-decade and be amplified by secular growth opportunities in additive manufacturing and global supply chain reorganization, consensus sales and earnings estimates are likely to remain too conservative. As a result, the door is open to material upside surprises given the low single-digit growth expectations which are in place today.

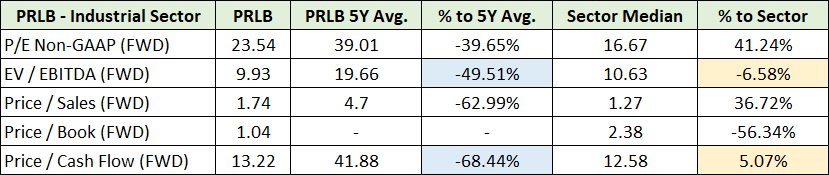

Additionally, as can be seen in the table below, the shares are trading well below historical valuation norms (highlighted in blue) and in line with the broader industrials sector (highlighted in yellow).

Given Protolabs’ superior growth prospects compared to the broad industrial sector, a significant valuation premium to the sector is likely to be warranted over time. The upside opportunity resulting from a valuation premium to the sector and a reversion toward Protolab’s historical valuation mean is captured in the EV/EBITDA cell above, which is highlighted in blue. Though 100% upside is possible, 50% is highly likely (an EV/EBITDA of 15x).

Summary

In terms of thematic investment opportunities, the reorganization of global supply chains and the adoption of additive manufacturing technologies are each powerful themes in their own right. As the price spikes in Protolabs’ trading history attest, narratives can be a powerful force in driving asset prices.

With the additive manufacturing market expected to grow to an annual revenue run rate near $100 billion, and Protolabs’ 3D printing revenue in the $100 million range today, the additive manufacturing opportunity is quite large.

In the intermediate term, 86% of Protolabs’ business is unrelated to 3D printing and likely near a cyclical upturn. A cyclical upturn alone should be sufficient to drive upside surprises into the mid-decade timeframe given low single-digit sales growth expectations.

Finally, the secular tailwind of global supply chain reorganization could lead to further and significant upside surprises. As the leading, fully digital manufacturing network with global reach and broad capabilities, the company is exceptionally well positioned to capture both cyclical and secular growth opportunities. Protolabs is sculpting the supply chain.

Protolabs Investor Relations website

Protolabs price as of this report $34.70