Risk/Reward Rating: Positive

Polaris finds itself in the enviable position of selling the majority of its products prior to having the actual inventory to meet the demand. For those unfamiliar with the company, Polaris is a leader in the powersports market operating in six segments: Off Road Vehicles (ORV), Snowmobiles, Motorcycles, Global Adjacent Markets, Aftermarket, and Boats. The company is best known for its all-terrain, off-road vehicles as depicted in the main image. Many are familiar with the iconic Indian motorcycle brand.

This enviable position was created by the disruptions to global supply chains caused by COVID, which limited supply. The unexpected speed of the demand snap back was supported by direct government stimulus payments and central bank liquidity injections, which encouraged plentiful and cheap financing for consumers and businesses. While reduced inventory at their independent dealers creates some risk to demand, the entire industry and many others are in the same position, and it appears consumers have adjusted.

Polaris has the added benefit of being in attractive markets for today’s consumers, which are centered around outdoor activities and adventure. Similarly, their small utility vehicles meet many of the requirements of business verticals that require small, energy-efficient, and versatile vehicles for service and maintenance use cases.

In the recently reported second quarter, sales grew 19% over the same period in 2019. 2019 is a more appropriate comparison as the second quarter of 2020 was artificially depressed due to the initial shock of COVID. Average annual growth of 10% per year is well above the growth rate of the overall economy. For the full year in 2021, Polaris is projecting sales of $8.43 billion at the midpoint of the company’s guidance. This would represent growth of 20% compared to the depressed sales of 2020 and 24% compared to 2019. Averaging 12% per year sales growth is impressive for most companies and represents an acceleration from the Q2 growth rate.

With this type of growth one would expect an above average valuation. However, that is not the case. Polaris trades at 13.5x the midpoint of the company’s guidance for 2021. This is a 50% discount to the market averages which are in the 23x to 34x earnings estimates range. The current earnings estimate for 2022 reflects a healthy 9% growth rate over the 2021 company guidance. Finally, Polaris is currently valued at 0.97x estimated sales for 2021 which is inexpensive given the growth profile.

Polaris may offer the best of both worlds for investors looking for less extreme valuations than those present in much of today’s markets. High valuation, large cap ‘growth’ stocks have staged the best ten-year outperformance versus value stocks in modern times. As a result, value stocks are likely to do relatively well going forward with smaller cap value stocks even more so. Being a smaller company with a well below-average valuation and an above-average growth profile, Polaris offers the possibility of the best of both worlds, growth at a value price.

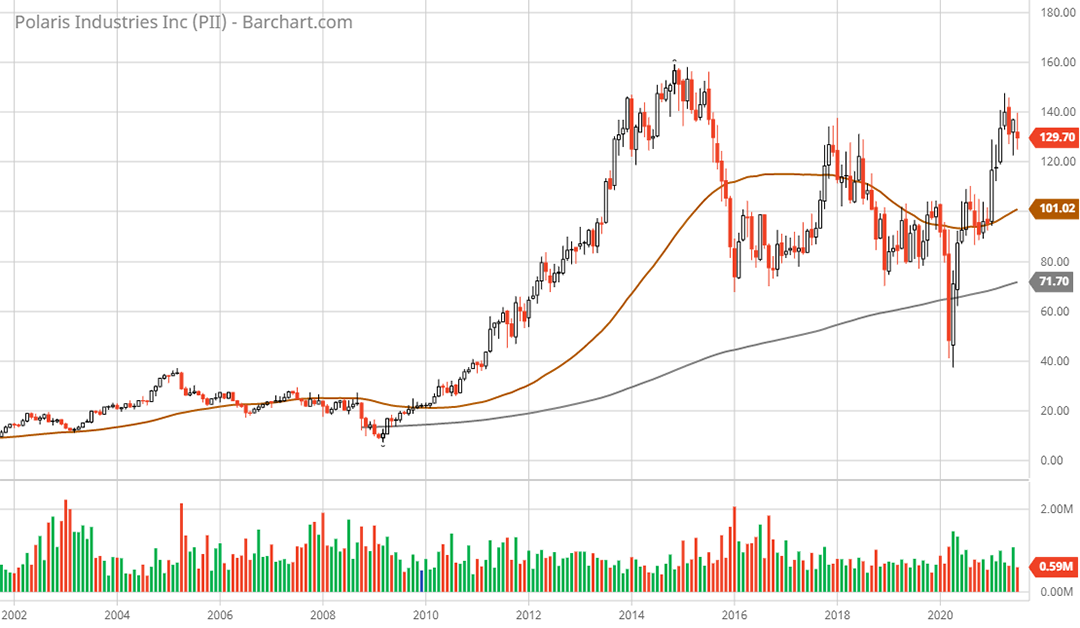

Technical backdrop: Polaris’s stock went on a parabolic run and peaked at $160 or 24x earnings in November 2014. That marked the transition phase in the last economic cycle to more muted economic growth and the beginning of traditional large ‘growth’ stocks outperforming. Since that time, the company has put in a large W shaped consolidation and bottom. The breakout from this pattern occurred in March of 2021 with a move above the $125 area which served as resistance in 2017 and 2018.

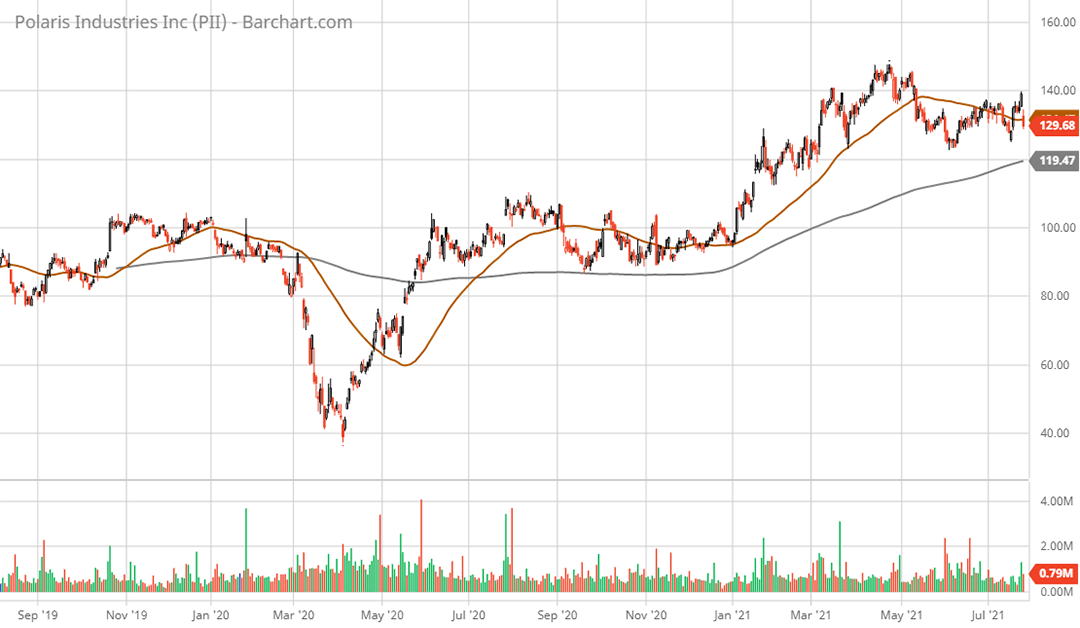

Looking at the 5-year weekly chart, Polaris has carved out a large inverse head and shoulders bottom. This was punctuated during the COVID crash in 2020 when the stock briefly fell to $40 before quickly retaking the $90 to $100 area, which is the shoulder zone where it spent much of 2019 and 2020. The 200-week moving average (grey line on the 5-year weekly chart) is currently in this area at $102 which should offer excellent support.

Zooming in to the daily 2-year chart, the weekly support area around $105 is clearly visible. The 50-day moving average is near the current price at $130 (brown line on the 2-year daily chart) and the 200-day moving average is $120 (grey line on the 2-year daily chart). Each of these levels offer natural support zones.

Technical resistance: The recent high near $150 in April 2021, which is near the all-time high of $160, should offer resistance. No resistance is visible after this level.

Technical support: The 200-day moving average at the $120 level should offer firm support. Next lower support is in the $105 area.

Price as of report date 7-27-21: $129

Polaris Investor Relations Website: Polaris Investor Relations

All data in this report is compiled from the Polaris investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.