I am assigning Pfizer (NYSE:PFE) a positive risk/reward rating based on the company’s attractive valuation and its successful transformation into a pure growth-oriented biopharmaceutical company. Pfizer’s impressive COVID vaccine execution was the culmination of a multi-year strategic business transformation. The company has successfully transitioned from a mature pharmaceutical company into an innovative, growth-focused company leveraging the cutting edge of biotechnology. Pfizer’s ability to respond at scale and speed to the COVID crisis highlights the asymmetric growth opportunities available to it in the biopharmaceutical industry. The opportunity set is further amplified by the incredible pace of advancement in biotechnology which is enabling innovation at speed and scale like never before.

Risk/Reward Rating: Positive

The completion of Pfizer’s business transformation significantly strengthened the company’s financial position and investment capacity prior to the COVID crisis. When this investment capacity and focus is combined with the financial success of the company’s COVID vaccine, an incredible growth opportunity is created.

Pfizer is best viewed as a biotech growth opportunity fund operating with a substantial capital base, existing infrastructure at scale, and rapidly growing free cash flow for reinvestment and shareholder distributions. The primary focus in monitoring Pfizer’s future success will be placed on the capital allocation and investment choices made with its substantial financial resources. In this article I deconstruct Pfizer’s underlying performance and business drivers thereby creating a framework for viewing the Pfizer investment case.

Revenue Growth

Pfizer posted incredible revenue growth of 92% in Q2 2021 and raised the top end of its earnings guidance for the full year from $3.65 per share to $4.05. With the company trading at $41.75 per share or 10x 2021 earnings estimates, the obvious question is why does Pfizer receive such a low valuation?

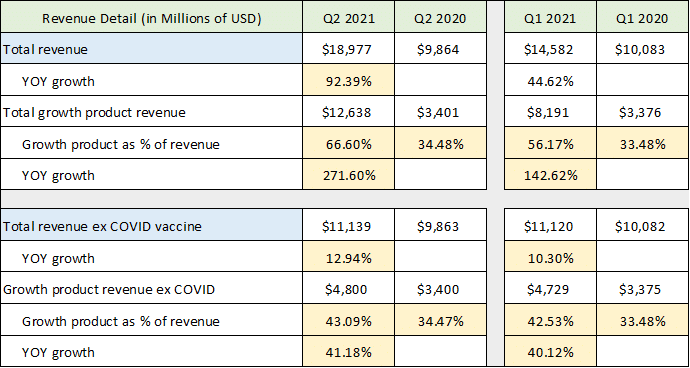

The primary concern for investors appears to be that the massive inflow of cash from the successful COVID vaccine will begin to recede. While this is certainly the case, the low valuation looks excessively pessimistic when viewed in light of Pfizer’s sustainable growth rate. The following table was compiled from Pfizer’s Q2 2021 10-Q filed with the SEC. It depicts the company’s total revenue growth, its revenue growth excluding the COVID vaccine, and the revenue growth of its growth products (those growing at 15%+ in the first half of 2021).

Source: Created by Brian Kapp, stoxdox

I have highlighted the key growth rates in yellow. With the COVID vaccine, 67% of Pfizer’s revenue is being produced by products growing at over 15%. The total growth product portfolio is growing at 272% compared to 2020. Excluding the COVID vaccine, Pfizer’s growth products are growing at 41% per year while contributing 43% of the total non-COVID vaccine revenue. This is exceptional growth by all standards, with and without the COVID vaccine. With growth products comprising only 43% of non-COVID sales, this portion of Pfizer’s drug portfolio is likely to trend materially higher over time.

Portfolio Detail

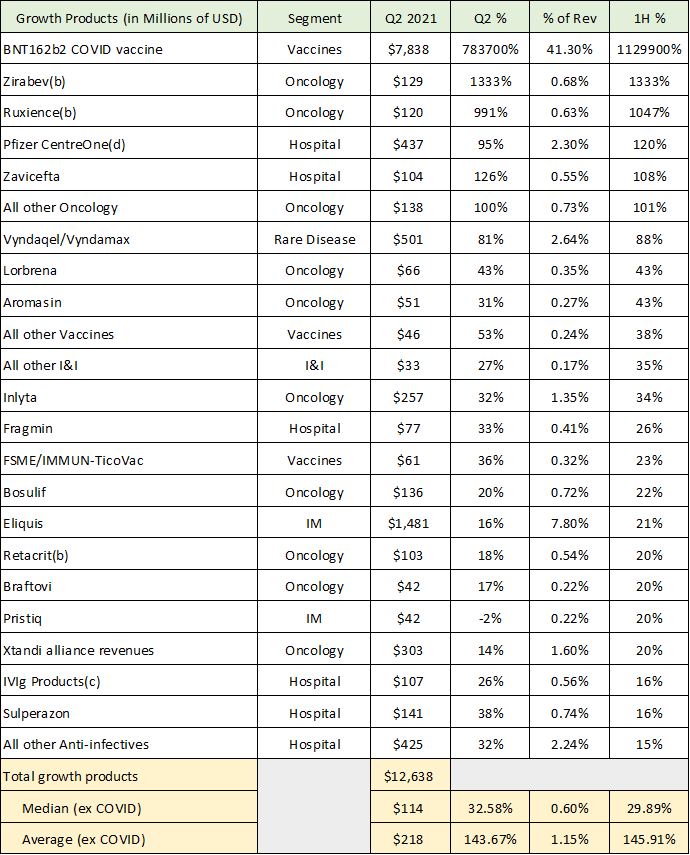

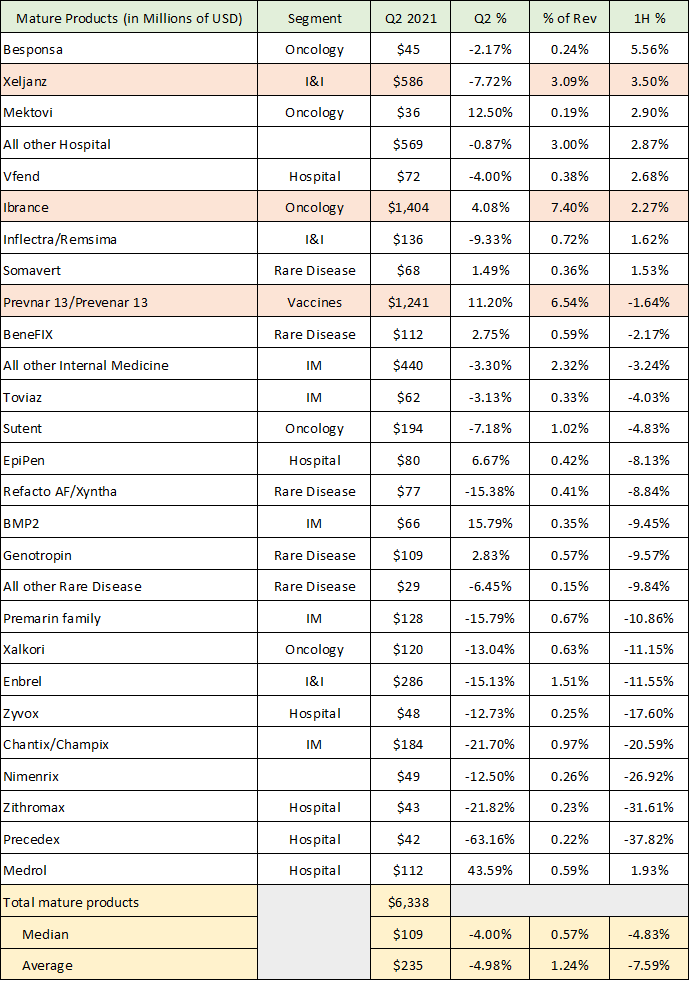

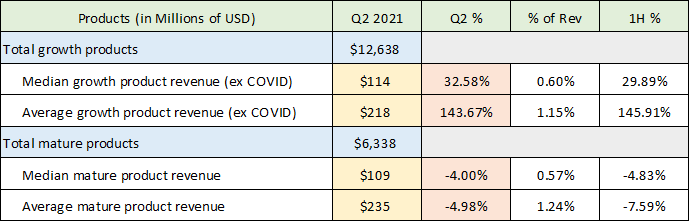

In the following three tables I breakdown Pfizer’s product sales into two categories: growth products and mature products. Growth products are those growing at over 15% per year during the first half of 2021, and mature products are all others. The product lists are provided below for reference. In the last table I summarize the product portfolio details and draw out the important characteristics of Pfizer’s current drug portfolio.

Source: Created by Brian Kapp, stoxdox

The most important characteristic of the overall portfolio is the diversification excluding the COVID vaccine (yellow highlighted cells in each table). Across the portfolio the average product only comprises 1.15% to 1.24% of total sales. The median product accounts for a mere 0.57% to 0.60% of Pfizer’s total sales. This raises the safety level of the portfolio overall. In light of this diversification, the median product size is substantial and is producing between $436 and $456 million of annualized sales (the yellow highlighted cells in the final table above x4 to annualize).

There are three sizeable mature products that comprise 17% of total sales which bear watching from a risk standpoint. I have highlighted them in orange in the mature product list. A material decline in these three products could constrict Pfizer’s growth rate in any given period. At 17% of total sales, the risk is confined to the possibility of a short-term growth slowdown rather than a larger systemic risk as is the case with more concentrated drug portfolios.

Adding to the diversification attraction, the growth products in the portfolio are growing much more rapidly than the mature products are declining (the orange highlighted cells in the final table above). The median growth product is growing at 33% annualized while the median mature product is declining by only 4%. This suggests that Pfizer will grow at a healthy organic clip excluding the COVID vaccine effects.

Geographic Growth Opportunities

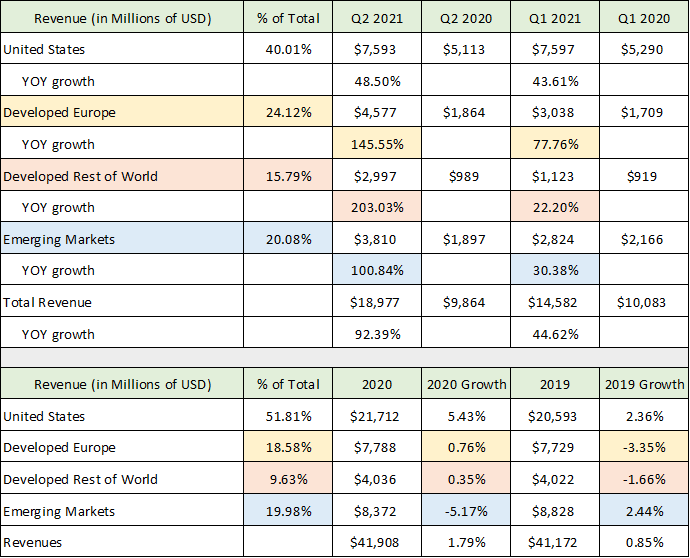

Pfizer’s incredible COVID vaccine success is likely to facilitate increased growth opportunities internationally. The following table was compiled from Pfizer’s Q2 2021 10-Q, and 2020 10-K filed with the SEC. The upper half of the table displays Pfizer’s sales by geography through the first half of 2021 and the lower half details the geographic sales breakdown for 2020 and 2019.

Source: Created by Brian Kapp, stoxdox

Prior to COVID Pfizer had a relatively low weighting of international revenue as a percentage of total sales at 48% (% of Total column in the lower half of the table). This suggests the company has under-penetrated the global market to date. The upper half of the table shows a rapid acceleration of international sales which carried them to 60% of total revenue in Q2 2021 (the highlighted cells). The international outperformance is being driven by COVID vaccine sales and should continue into 2022. Vaccine sales are likely to open the door to closer business ties internationally and accelerate non-COVID related sales in the future. A 60% international sales weighting is a more natural state for Pfizer’s geographic revenue breakdown when looking at the global markets and demographics longer term.

The accelerating international opportunity will amplify the mature product portfolio, the organic growth portfolio, and the asymmetric upside opportunities as evidenced by the COVID vaccine.

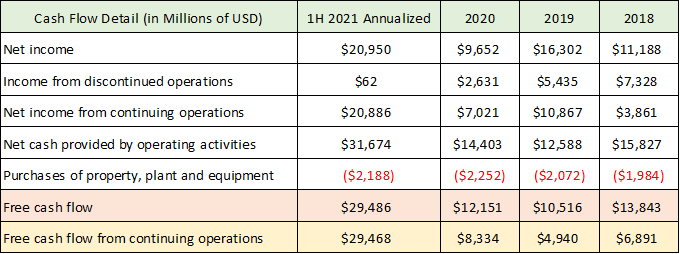

Cash Flow

The potential for amplified growth opportunities presents itself at an opportune time for Pfizer. The company historically has generated sizeable and steady free cash flow in the range of $10 billion to $14 billion per year (highlighted in orange in the following table). The cash flow data in the table below was compiled from Pfizer’s Q2 2021 10-Q and 2020 10-K filed with the SEC.

Source: Created by Brian Kapp, stoxdox

The final row highlighted in yellow is the most pertinent looking forward as it removes the discontinued operations that were spun-off as part of the recent business transformation. Annualizing Pfizer’s first half 2021 free cash flow produces a run rate of $29.5 billion for 2021. For reference, this is in the neighborhood of Amazon’s (NASDAQ: AMZN) all-time peak annual free cash flow level achieved in 2020 resulting from its COVID boom.

This is a staggering amount of free cash flow that should continue through 2022. Pfizer’s powerful existing cash position combined with its current extraordinary free cash flow generation will be reinvested across the biotech and biopharmaceutical opportunity set. The rapid advancement in technology is likely to open many doors to incredible speed and scale of discovery. Pfizer is in the enviable position of having the capital, the infrastructure, and the global scale to be the industry’s preferred partner in developing and delivering the most innovative drug candidates.

Balance Sheet Strength

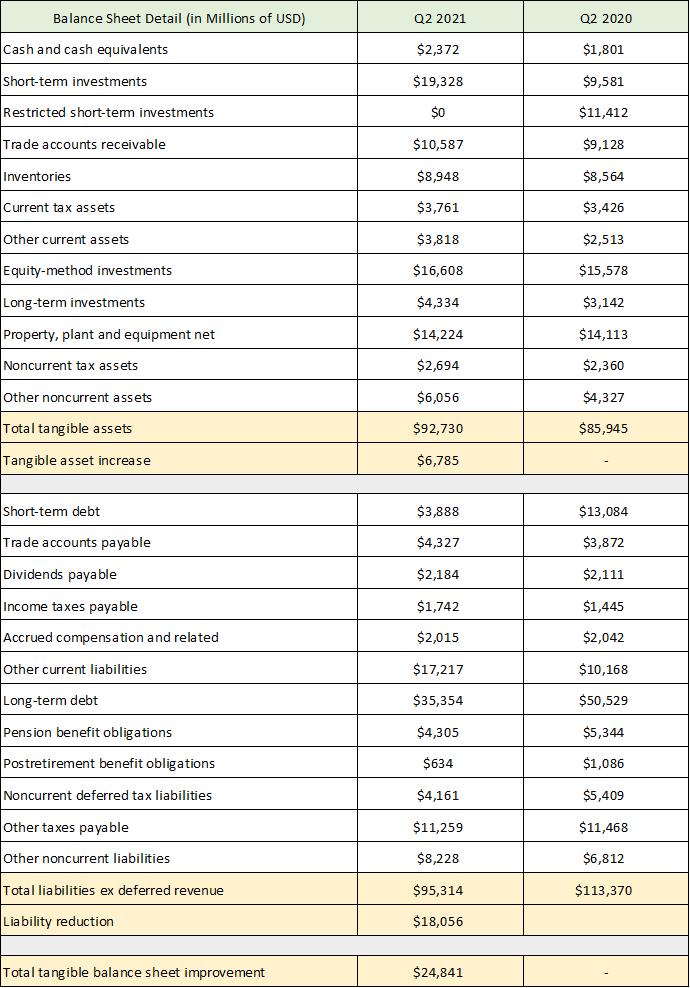

The staggering amounts of free cash flow are being added to a recently fortified financial position. As mentioned above, Pfizer’s recent business transformation materially strengthened its balance sheet. In the following table I have provided select balance sheet items from Pfizer’s Q2 2021 10-Q and Q2 2020 10-Q.

Source: Created by Brian Kapp, stoxdox

The details are for reference while the important summary data is highlighted in yellow. Over the past year Pfizer has improved its tangible balance sheet position by $25 billion. The company reduced its debt by $18 billion and increased its tangible assets by $7 billion. This significant financial capacity is now being fed by $30 billion of annualized free cash flow. Pfizer now possesses all the ingredients needed for an explosive growth investment cycle.

Financial Performance and Guidance

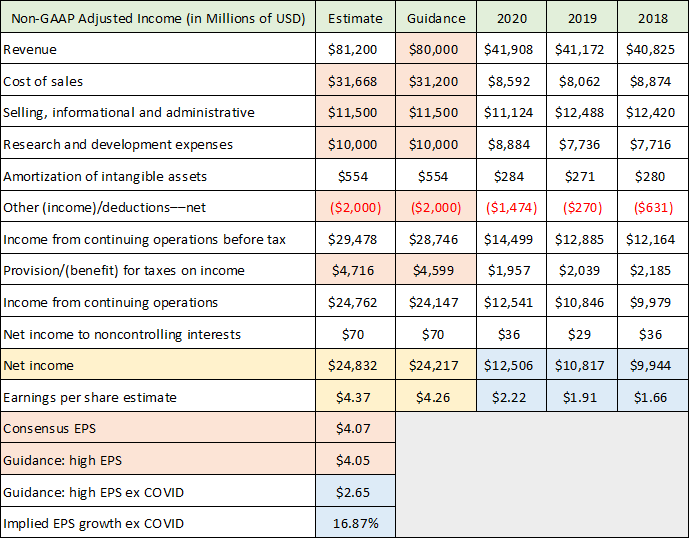

The extraordinary free cash flow generation and large established growth capital position in one of the most dynamic sectors of the future calls into question the low valuation multiple of 10x the 2021 consensus earnings estimate. The following table was compiled from the Q2 2021 8-K earnings release, the 2020 10-K, and Seeking Alpha. It displays Pfizer’s adjusted net income figures from 2018 through 2020, as well as projections for 2021 based on the company’s guidance and the consensus revenue estimate.

Sources: Seeking Alpha and SEC. Created by Brian Kapp, stoxdox

The high end of Pfizer’s official guidance for 2021 is for earnings of $4.05 per share while the consensus estimate is at $4.07 (final orange highlighted rows). I have highlighted my estimates in yellow based on the consensus revenue estimate for 2021 as well as the company’s revenue and expense guidance. The company-provided guidance is highlighted in orange in the top section of the table. Whether I use the company’s revenue guidance or the consensus revenue estimate, there is substantial room for Pfizer to surpass the consensus earnings estimate for 2021 (the yellow highlighted cells).

In addition, it is important to note Pfizer’s earnings excluding the COVID vaccine (the blue highlighted cells). In this case, Pfizer is growing earnings at 17% per year. At $41.75 per share Pfizer is trading at 16x earnings estimates for 2021 excluding the COVID vaccine in its entirety. In today’s low interest rate and hyper-valued growth stock environment, 16x earnings excluding the most explosive product launch ever looks to be excessively pessimistic.

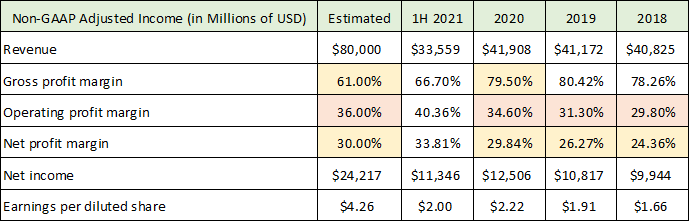

High Multiple Profit Margins

In fact, Pfizer’s profit margins are exceptional by all standards and suggest a premium valuation multiple on earnings is in order. The following table was compiled from Pfizer’s Q2 2021 8-K, Q2 2021 10-Q, and 2020 10-K filed with the SEC.

Source: Created by Brian Kapp, stoxdox

The final yellow highlighted row is the most important. Pfizer’s net profit margin (after taxes) is at 30% and has been trending higher in recent years. This is important as it displays the incredible operating leverage in the business model. Combining the outsized profit margins with the asymmetric revenue upside available in the Biotech industry should translate into an above-average valuation multiple on earnings. That said, Pfizer is trading at a decidedly below-average multiple on earnings hinting at significant upside potential for the shares.

Upside Revenue Surprise potential

While the low valuation on its own is enticing, Pfizer also offers upside surprise potential compared to the current consensus estimates underlying the share price. If Pfizer’s profit margins and business model point toward an above-average valuation multiple, and the company begins to beat revenue and earnings estimates, a perfect storm could be created for a materially higher share price.

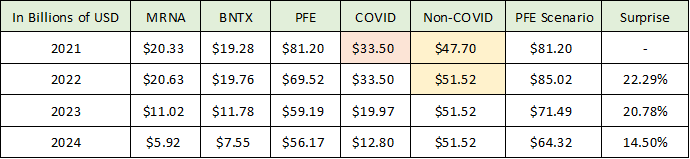

The following table was compiled from consensus revenue estimates provided by Seeking Alpha and speaks to the COVID vaccine sales embedded in Pfizer’s consensus revenue estimate. The table displays consensus revenue estimates in billions of dollars for Pfizer as well as for the pure COVID vaccine companies Moderna (NASDAQ: MRNA) and BioNTech (NASDAQ: BNTX).

Source: Seeking Alpha. Created by Brian Kapp, stoxdox

I have highlighted Pfizer’s guidance for COVID vaccine sales for 2021 in orange then modeled it to follow BioNTech’s expected sales through 2024 (COVID column). The sales trajectory expected for Moderna is remarkably similar to BioNTech’s trajectory, and BioNTech is Pfizer’s COVID vaccine partner. I then assume Pfizer’s non-COVID sales grow at 8% in 2022 (yellow highlighted cells) and then stagnate through 2024. The resulting revenue forecast based on these assumptions (PFE Scenario column) offers considerable upside surprise to current consensus estimates (PFE column). If this revenue scenario transpires, the upside surprise potential on the revenue front is material (final column).

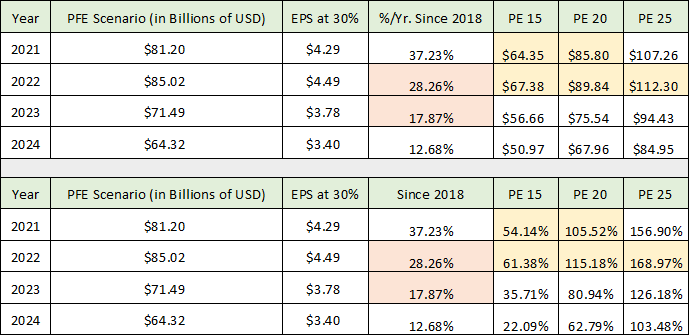

The Upside Scenario

In the following table I transform the Pfizer revenue scenario above into an estimate of earnings using the company’s 30% net income margin (EPS at 30% column). I then assume various potential PE ratios to get a sense of the upside return potential. Please note that if these earnings estimates are achieved in 2022 and 2023, Pfizer will be reporting 28% and 18% annual earnings growth respectively from continuing operations since 2018 (highlighted in orange). These growth rates would easily support each of the future PE scenarios outlined below.

Source: Created by Brian Kapp, stoxdox

The lower half of the table summarizes the return potential if Pfizer’s COVID sales follow the trajectory embedded in revenue expectations for BioNTech and Moderna, and if the company’s other products grow at 8% in 2022 then stagnate thereafter. I have highlighted the return potential in yellow. Under these conditions Pfizer offers 54% upside on the low end (PE 15 on 2021 EPS) and 169% upside on the high end (PE 25 on 2022 EPS). The return potential is substantial in the above scenario. Additionally, by assuming stagnant non-COVID sales after 2022, I am not assigning any value to the plethora of investment opportunities that will be available to Pfizer as a result of its coming growth investment cycle.

Valuation

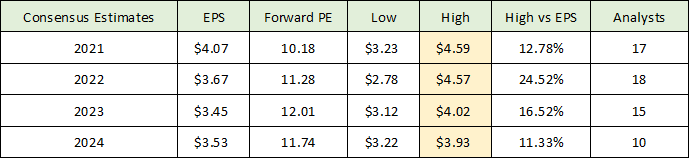

This is but one upside scenario to current consensus expectations. It is informative to look at these expectations to understand what is embedded in Pfizer’s current valuation. The following table was compiled from Seeking Alpha and displays current consensus expectations through 2024. I have highlighted the high earnings estimate column as it places the above scenario in the context of other analyst upside scenarios.

Source: Seeking Alpha. Created by Brian Kapp, stoxdox

Looking at the high estimate for Pfizer’s earnings through 2024, each of these estimates is above the earnings scenario I outlined in the previous table. This points toward my earnings surprise scenario being well within the boundary of current analyst estimates. It also hints at additional upside surprise potential once Pfizer’s coming growth investment cycle gains traction.

The High vs EPS column reflects the upside surprise potential that the high EPS estimate each year produces. Please note that the high estimate for each year is not that far removed from the consensus earnings estimate (EPS column). This further suggests that expectations are well-grounded and do not embed excessive levels of optimism regarding Pfizer’s growth potential. It is notable that the largest upside surprise for the high earnings estimate series above is in 2022. This aligns with the highest return potential in my upside scenario in the previous table at 169% (PE 25 on 2022 earnings).

In the event that Pfizer merely meets current earnings expectations through 2024, the Forward PE column provides the price being paid for this earnings stream. From a historical market perspective, 10x to 12x earnings is a low valuation. The low valuation implies exceptionally low expectations for growth. As a result, there is well-below-average risk in Pfizer’s current share price. This valuation is also extraordinarily low when compared to the current market averages which trade between 21x and 33x earnings estimates for 2021 (S&P 500: 21x, Nasdaq 100: 29x, and Russell 2000: 33x).

The well-below-average risk level implied by Pfizer’s current valuation receives strong confirmation from the charts when looking at Pfizer’s technical backdrop.

Technicals

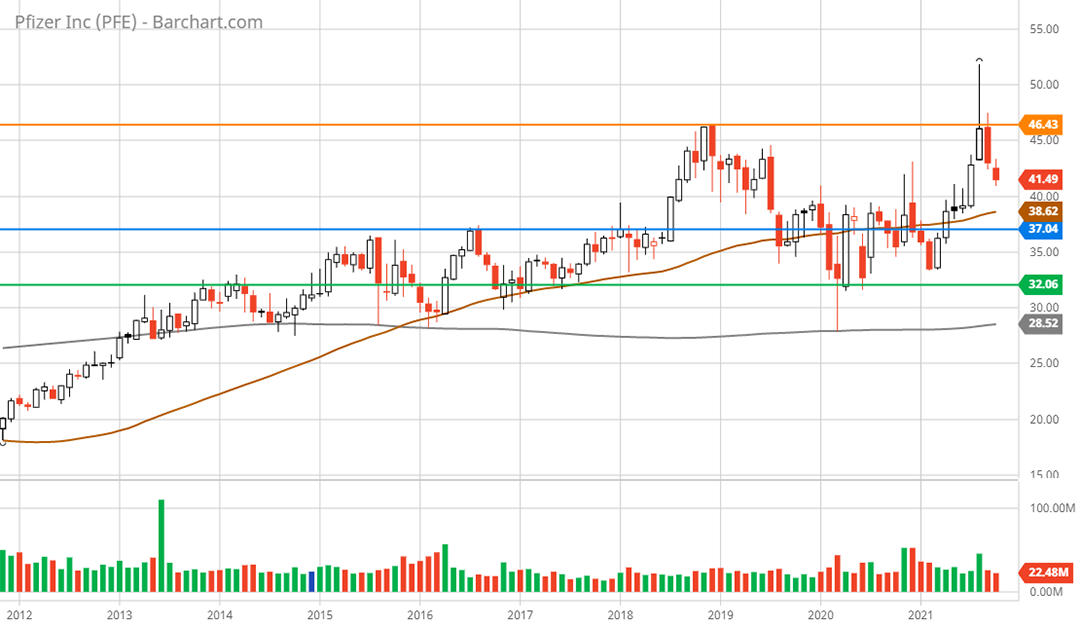

The technical backdrop for Pfizer speaks to the incredible stability of the shares and the building of a long-term support foundation. The support foundation is well defined by the blue and green horizontal lines on the following 20-year monthly chart. The upper resistance zone (the orange line), which has capped the trading range since 2018, represents all-time high resistance.

Pfizer 20-year monthly chart. Created by Brian Kapp using a chart from Barchart.com

The green line near $32 looks to be rock solid support and has served as such since 2013. The next higher support zone at $37 is also establishing itself as a very firm foundation. It has served as the midpoint of the sideways consolidation range since 2015. Each of these support levels represents minimal downside risk of between 10% and 22% (minimal risk in an individual stock context).

The 22% downside to lower support looks to be a worst-case scenario as things stand. The 10% downside to nearest support is the most likely near-term risk. The move above the orange line toward an all-time high in August 2021 suggests that Pfizer is beginning to probe an upside breakout from the general sideways consolidation since 2013. If this occurs, there is no visible resistance above the orange line. This would then set the stage for the upside price targets outlined previously.

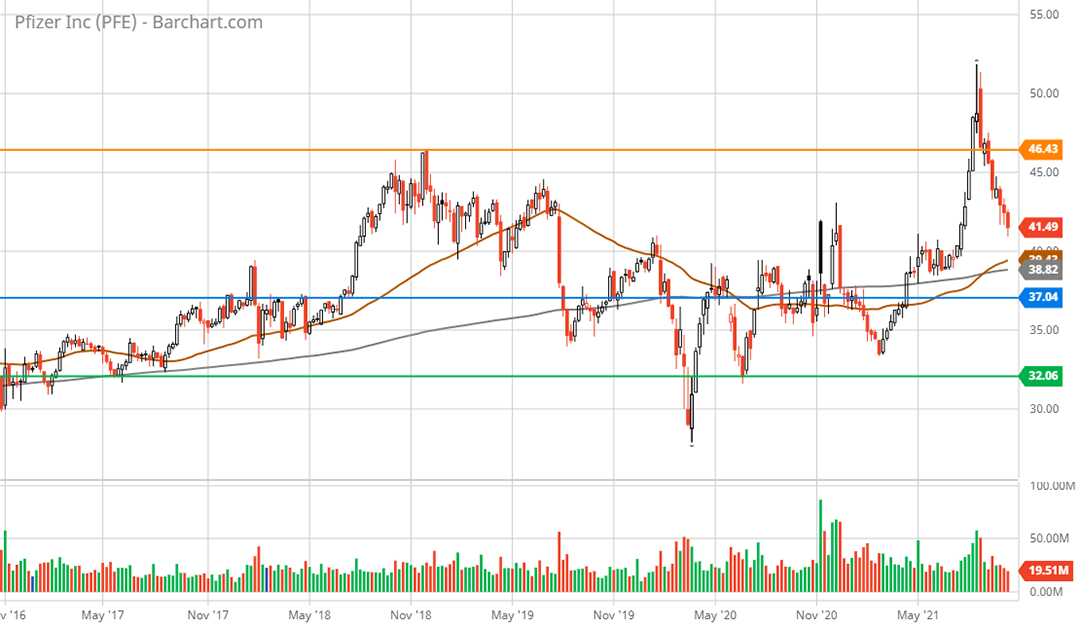

I have carried the critical support and resistance lines over to the following 10-year monthly chart to get a closer look at Pfizer’s primary trend.

Pfizer 10-year monthly chart. Created by Brian Kapp using a chart from Barchart.com

Viewing Pfizer over the past decade, a primary uptrend is visible even if it has been a subdued advance since 2013. The stock looks to be transitioning to a more vibrant period with the breakout attempts in 2018 and 2021. The more vibrant character change is clearly visible on the following 5-year weekly chart (I have carried over the long-term support and resistance lines).

Pfizer 5-year weekly chart. Created by Brian Kapp using a chart from Barchart.com

The recent rally attempt was a rapid vertical move from $39 to a high of $52 over the course of one month, representing a 33% surge. This type of share price vibrancy is out of character for Pfizer in recent years and points toward the buildup of upside energy.

The character change receives further color by zooming into the daily chart.

Pfizer 1-year daily chart. Created by Brian Kapp using a chart from Barchart.com

The 50-day moving average (the brown line) sliced through the 200-day moving average (the grey line) on May 12, 2021. Since this golden cross the 50-day moving average has established a powerful uptrend which has not occurred since the peak in 2018. The character change is very bullish and suggests an increasing probability of a budding bull market.

Since the all-time high run in August 2021, the shares have corrected two-thirds of the 33% spike and are now approaching the 200-day moving average near $40. This sits just above the long-term support zone in the $37 area (the blue line). The current share price offers an excellent entry point from a technical perspective on all time frames.

Summary

When combined with the upside potential outlined in the fundamental analysis, the near perfect technical setup across all time frames creates a compelling and timely investment case for Pfizer.

The upside potential for Pfizer is evidenced by the company’s speed and scale in delivering a successful COVID vaccine and its diversified growth portfolio. When one combines Pfizer’s incredible free cash flow generation and powerful balance sheet with the vast opportunity set on display in biotechnology, a compelling growth story emerges. Pfizer is on the cusp of a historic growth investment cycle.

Pfizer offers a rare asymmetric growth opportunity. The shares are unbounded to the upside while the downside is anchored by strong fundamentals, an incredibly low valuation, and long-term technical support.

Price as of this report: $41.75

Pfizer Investor Relations Website: Pfizer Investor Relations