I am assigning Palantir (NASDAQ: PLTR) a positive risk/reward rating based on the vast nature of its long-term opportunity set, its increasingly attractive valuation, and its deeply oversold technical position. In my prior Palantir report from February 3, 2022, I made the following observation of the likely downside potential for Palantir:

To estimate downside potential beneath $10, I apply an earnings multiple of 40x the 2022 non-GAAP consensus earnings estimate… would place Palantir shares at $8… If the 39% consensus earnings estimate for 2022 is too high, further downside from $8 is in the realm of possibility… I apply the same 40x non-GAAP earnings to my estimate of Palantir’s current annual run rate… If earnings growth comes in at 25% for 2022 (my estimate of adjusted gross profit growth as of Q3 2021)… the shares could trade down to $6.

In fact, the shares touched a low of $6.44 on May 12, 2022, punctuating a vicious -32% selloff following the company’s Q1 2022 earnings release. Interestingly, consensus earnings growth estimates are now aligned with my previous 25% earnings growth estimate for 2022. The extraordinary volatility is a reminder that Palantir is for those seeking exceptional growth potential with the associated risk.

Nonetheless, the shares are testing a reasonable valuation zone, as outlined in my prior report. Additionally, Palantir’s stock is down roughly 87% from its all-time high reached in 2021. As a result, it is fair to say that a significant amount of risk has already materialized and thus has been removed from Palantir’s share price.

Risk/Reward Rating: Positive

While taking notes during Palantir’s Q1 2022 earnings conference call, one line in particular stood out and captures the essence of the Palantir investment case. The following is a paraphrase of my notes from the call: “What AWS was to the last decade, Foundry will be to the next.”

Foundry is one of three primary platforms offered by Palantir. This type of vision speaks to the upside opportunity that many envision for Palantir’s future. Most investors attribute the majority of Amazon’s (NASDAQ: AMZN) $1.2 trillion market value to its AWS division. As a result, even a fraction of an AWS-like opportunity represents extraordinary growth potential for Palantir and its shareholders. Palantir’s current valuation is near $18 billion (using the fully diluted share count) and trending lower.

Growth Trajectory

In terms of its growth potential, Palantir continues to guide investors to 30% revenue growth per year through 2025. The 32% selloff in the shares following the reiteration of this guidance speaks to the challenge facing Palantir’s stock in the near term. The market has clearly signaled that it doubts whether management’s 30% growth guidance can be achieved. I spoke to the high likelihood that growth would disappoint in my February report after breaking down Palantir’s growth by customer cohort (emphasis added):

Similar to the Scale cohort growth rate annualizing at 20% in 2021, the new customer sales growth rate is annualizing at 22% through Q3 2021… As a result, Palantir appears to be trending toward an underlying sales growth rate closer to 20% than the company’s 30% sales growth guidance through mid-decade.

Now that the risk of disappointment has materialized, the market is increasingly uncertain about the sustainable growth trajectory for Palantir. To tackle this question, I compiled Palantir’s segment sales performance for Q1 2022 and the full year of 2021 to construct a picture of the near-term growth trajectory. The following two tables were compiled from Palantir’s Q1 2022 10-Q and 2021 10-K filed with the SEC. The first table displays Q1 2022 and the second displays 2021. Please note that I have color coded the related cells for comparison within and between the tables.

Before adding the 2021 table for comparison, note that Palantir grew its revenue by just over 19% in Q1 2022, excluding revenue from Investees (the lower blue highlighted cell). Please compare the 19% growth in Q1 2022 to the blue highlighted cells in the table below for 2021. The growth deceleration is material excluding Investee revenue.

I would highly recommend reading my prior report for a detailed discussion of the Investee situation. A summary of the current Investees is included at the end of this article for those interested. In essence, investing in companies in return for software sales to those same companies is not a sustainable customer acquisition strategy.

As a result, I and many others exclude sales to Investees from view when trying to determine Palantir’s sustainable growth trajectory. Interestingly, Palantir stated on the Q1 2022 conference call that they have discontinued the Investee program thus removing a major red flag going forward.

Notice that total sales grew nearly 37% excluding Investees in 2021 (the lower blue highlighted cell). It should be noted that the growth rate in Q3 2021 was 29% and in Q4 2021 it was 25% (not shown here). The 19% growth posted in Q1 2022 is a substantial deceleration, however, it is generally in line with what one would expect given the preexisting slowdown in Palantir’s growth trajectory.

I have highlighted in yellow the total dollar growth of revenue for Q1 2022 and the full year of 2021 (excluding sales to Investees). The $66 million of revenue growth in Q1 2022 annualizes at $264 million, in comparison to the $401 million of revenue growth posted in 2021. While Palantir experiences some cyclicality, with the potential for stronger sales in the second half of the year, the Q1 2022 sales figure looks quite weak.

In fact, in Q1 2021, Palantir grew sales by $112 million (not shown here) which annualized at $448 million compared to the actual sales growth achieved in 2021 of $401 million (excluding Investee revenue). As a result, the Q1 2022 sales growth figure, which annualizes at $264 million, is worrisome when compared to 2021 and the company’s 30% sales growth guidance.

If sales growth were to come in at $264 million for all of 2022 (excluding Investees), Palantir would grow at 17%. With 19% growth in Q1 2022, down from 37% in 2021, 17% growth would represent a stabilization of the existing downtrend rather than a continuation of Palantir’s growth deceleration.

Growth stabilization looks to be a possibility as the following paraphrase from my Q1 2022 conference call notes highlights. The paraphrase pertains to management’s discussion of Palantir’s near-term sales guidance which disappointed investors (emphasis added): “We have visibility into the upside, and the upside is quite large.”

Upside Visibility

The bolded text in the above quote inspired the title for this report. It also captures the increasing upside visibility available to investors as Palantir’s share price continues to fall. In terms of what could drive Palantir’s revenue upside, management believes that US government sales will reaccelerate as 2022 unfolds. The 16% growth posted in Q1 2022 is well below the historical Government segment growth rate of 30% per year. This segment could certainly stabilize Palantir’s growth rate as it represents 54% of sales as of Q1.

With Commercial segment sales growth stable in 2021 and Q1 2022 near 24% per year (excluding Investee revenue), the Government segment trending back towards its historical growth rate of 30% would return Palantir to the ballpark of its 30% annual sales growth guidance.

The following table highlights another Government segment growth vector that could open up given the extreme level of geopolitical instability and the structural ripple effects into the Commercial segment. These ripple effects are most clearly visible in the widespread failure of supply chains in recent times. The table was compiled from Palantir’s Q1 2022 10-Q filed with the SEC. I have highlighted the additional Government growth vector.

The US government represented 42% of Palantir’s total sales in Q1 2022 or approximately $187 million. The UK is a large government customer as well, with the Royal Navy and NHS being notable Palantir customers. I estimate that the US and UK governments account for approximately 92% of Palantir’s total Government segment sales. As a result, the vast majority of rest of world sales in the above table represents Commercial segment sales. I estimate commercial sales comprise 84% of Palantir’s rest of world revenue.

There is extraordinary upside potential for Palantir in the Government segment globally at only 16% of rest of world sales. With the US and UK governments serving as early adopters, other governments are likely to be incentivized to explore Palantir’s capabilities.

Greater integration with the US and UK should become increasingly attractive for the rest of the world category. This is especially true given the geopolitical situation and associated commercial disruptions. The possibility that this could become a growth vector for Palantir is highlighted by the following two paraphrases from my Q1 2022 conference call notes: “The nuclear threat is much higher than is believed or than is being portrayed in the media.”

The underappreciated risk of nuclear events, while at the extreme end of the risk spectrum that Palantir’s products help address, serves to accentuate the opportunity set for Palantir. There are an unlimited number of geopolitical risk vectors for the Government segment with direct ripple effects into the Commercial segment. These risks are now on the front burner for the world’s governments and enterprises alike.

The second paraphrase from my notes pertains to the spillover of geopolitical tensions into the commercial realm and the disruption of supply chains in particular: “Literally every function of every business is breaking.”

In essence, Palantir believes that the rapid escalation of geopolitical risks (Russia and China in particular) and the spill over into the commercial sector represents an ideal backdrop for Palantir to sell into, given the company’s deep roots in national security and mission critical operations. I tend to agree overall with this positive competitive assessment for the coming years. These dynamics could very well lead to nearer-term growth opportunities that could surprise to the upside once the current growth disappointment dissipates and expectations are fully reset.

Consensus Growth Estimates

Interestingly, consensus revenue growth estimates remain unchanged since my February report. As evidenced by Palantir’s collapsing share price, the market has sent a clear signal of no confidence in Palantir achieving 30% sales growth. That said, consensus growth estimates continue to embed the company’s 30% sales growth guidance. Please note that consensus sales estimates include Investee revenue which should account for 6% of total sales in 2022. The following tables were compiled from Seeking Alpha and my prior article and display consensus estimates as of 5-15-22 compared to 2-2-22.

I have highlighted 2022 and 2023 for ease of comparison. Based on the underlying 17% to 19% sales growth trajectory as of Q1 2022 discussed above, the likelihood of missing estimates in 2022 and 2023 is elevated. This is especially true for sales in light of the termination of the Investee customer acquisition strategy. While consensus revenue estimates remain unchanged and at risk, earnings estimates have ratcheted lower since my last report as can be seen in the following table.

I have highlighted in yellow the consensus earnings estimates for 2022 and 2023 which have declined by -20% and -14%, respectively, since February 2. Additionally, notice that the valuation multiple has contracted by 18%, from 62x to 51x the 2022 consensus estimate (highlighted in blue). The valuation multiple contracted 22%, from 45x to 35x the 2023 consensus earnings estimate. Please note that these are non-GAAP earnings estimates as Palantir currently operates at a loss on a GAAP basis.

Nonetheless, when earnings and valuation multiples are moving in the same direction, amplified price volatility is the end result. As investors, we are looking for situations in which earnings estimates and valuation multiples are moving up together, creating amplified upside opportunity. Palantir is clearly undergoing the opposite at the moment.

Profitability Trends

There remains further risk to consensus earnings estimates for 2022 and 2023 as is evidenced by the company’s various profitability measures. When reviewing the underlying trend in Palantir’s profitability measures, consensus estimates for 25% and 47% growth in 2022 and 2023, respectively, appear to be at risk. The following table was compiled from Palantir’s Q1 2022 10-Q filed with the SEC and displays the company’s adjusted operating income growth (highlighted in yellow).

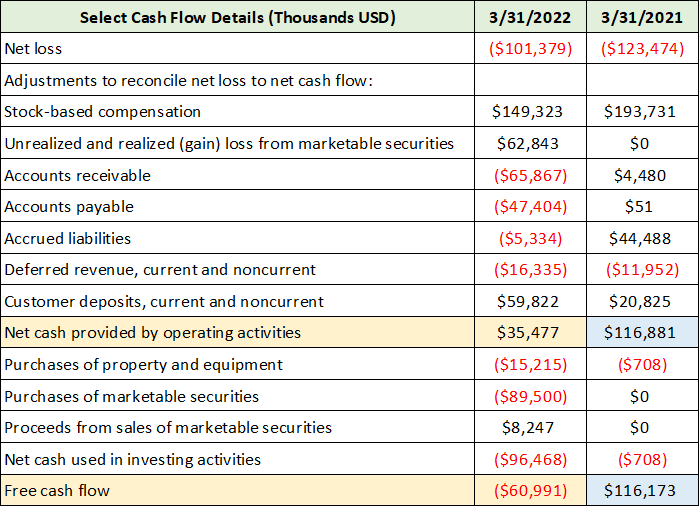

While Palantir’s GAAP income is improving from -$114 million to -$39 million, its adjusted operating income has stagnated for all intents and purposes. The signs of profitability stagnation are also evident in Palantir’s cash flow statement below (compiled from the same 10-Q). I have highlighted the key data points.

Importantly, Palantir’s Q1 cash flow from operations declined by 70% to $35 million in Q1 2022, while free cash flow turned decidedly negative (the yellow highlighted cells versus the blue highlighted cells). I have included Palantir’s investments in Investees in my free cash flow estimation. This amounted to $89.5 million in Q1 and was recently discontinued. Regardless, Palantir’s declining cash flows fully support the message from its stagnant adjusted income. The consensus earnings estimates of 25% for 2022 and 47% for 2023 are clearly at risk.

Key Business Measure

Palantir utilizes a KPI or Key Performance Indicator for allocating resources internally, which is closely related to the concept of gross profit margin, called Contribution Margin. For a more detailed discussion of this metric, please see my February report. The underlying trajectory of this KPI is similar to the adjusted income and cash flow trends above, if less extreme.

The following tables display Palantir’s Contribution Margin and were compiled from the company’s Q1 2022 10-Q and my previous Palantir report. The first table displays Q1 2022 and the second displays the trend through Q3 2021. Please note that I have color coded the related cells for comparison within and between the tables.

Before displaying the 2021 data, please note that the Contribution Margin grew 24% in Q1 2022 (highlighted in yellow). The growth through Q3 2021 is displayed below and is also highlighted in yellow. Through the first three quarters of 2021, Contribution Margin grew by 64%, however, it slowed dramatically to 37% in Q3 2021 and 27% in Q4 2021 (not shown below). The research and development expense stagnation highlighted in blue, both above and below, will shed some light on the dynamics at play.

While the Contribution Margin is in a similar deceleration trend as most of Palantir’s business metrics, at 24% growth in Q1 2022, the growth rate remains above all other metrics. The higher growth rate of Palantir’s Contribution Margin in the face of stagnating adjusted income and declining cash flows is likely an artifact of the Investee program that was active through Q1 2022 and which was recently terminated.

In essence, Palantir invested in companies (Investees) in return for software sales commitments. Sales to such customers accounted for $39 million of Q1 2022 total sales. Notice in the first table that the 24% Contribution Margin growth in Q1 2022 equates to an increase of $48 million compared to Q1 2021. The Investee sales likely required little in the way of research and development or general and administrative expenses. Palantir acquired and implemented the relationships via an investment agreement.

As a result, the Contribution Margin growth of 24% in Q1 2022 is likely inflated by up to $39 million. Removing this would result in Contribution Margin growth of just 4%, which is more in line with the adjusted income stagnation and cash flow contraction. The stagnation of research and development expenses from Q3 2021 to Q1 2022 (highlighted in blue in the above tables) suggests that this is the correct inference regarding the inflated growth of Palantir’s Contribution Margin compared to its other performance metrics.

Research and Development

In my February report, I highlighted the rapid slowdown of research and development expenses as a likely negative signal. The reason for this is Palantir’s unique sales cycle compared to standard enterprise software companies. I covered the details of Palantir’s unique sales cycle and customer cohorts in the prior report. The essence is captured by the following quote from the February article:

The research and development investment slowdown could be a negative read through for sales growth as R&D is an integral part of the sales process. Research and development expenses should track the sales cycle through the three customer phases: Acquire, Expand, and Scale… This does not appear to be happening at the moment.

The following passage from Palantir’s 2021 10-K supports my interpretation of the signal being sent by Palantir’s stagnant research and development investment.

We believe that in order to fully address the most complex and valuable challenges that our customers face, we must experience and understand their problems firsthand… we embed with our users. Our research and development function is responsible for the design, development, testing, validation, and refinement of our platforms, and embedding with our users allows us to identify research and development opportunities…

In summary, all profit growth measures look to be on a stagnating trajectory at minimum and point to an elevated risk of disappointment in regard to consensus earnings growth estimates. As a result, a primary challenge in evaluating the timing of an investment in Palantir is inferring what is priced into the shares on the sales and earnings growth front. With consensus growth estimates and the underlying trends in hand, we can begin to construct Palantir’s potential return spectrum.

Technicals

The technical backdrop provides an excellent bird’s eye view of Palantir’s upside return potential, while fundamental measures will dominate the downside return potential given that Palantir is testing new all-time lows. The following 2-year daily chart captures Palantir’s IPO and the essence of the technical backdrop. I have highlighted the key resistance levels (technical upside targets) with orange lines.

Given the recent break to all-time lows, there are no visible technical support levels. The 1-year daily chart below provides a closer look.

Please note that the gold line represents the 50-day moving average and the grey line denotes the 200-day moving average. At roughly $8 per share, Palantir is deeply oversold as is evidenced by it being 128% away from its 200-day moving average. The 200-day moving average happens to coincide with the second resistance level. This is likely to be a very heavy resistance zone as it served as the primary support level during Q2 and Q4 of 2021.

Before testing the upper resistance levels, Palantir will first have to clear the first resistance level near the IPO price of $10. The following 6-month daily chart zooms in on this first resistance level.

Notice that trading volume is dropping off following the two-day rally off the recent all-time low. This suggests that Palantir is likely to retest the all-time lows toward $6. A retest of the lows and the need for more extensive base building is well supported by the fundamental deterioration discussed above, as well as in my February report. This interpretation is also supported by the fact that Palantir still trades at an elevated valuation of 8.5x the 2022 consensus sales estimate and 51x the consensus non-GAAP EPS estimate.

Potential Return Spectrum

The upside return potential to each of the technical resistance levels is summarized in the table below. I have estimated the downside return potential using various comparable company valuations in the software industry: Salesforce (NYSE: CRM), Workday (NASDAQ: WDAY), and Splunk (NASDQ: SPLK). These comparables are a good representation of current valuations throughout the software sector. The lowest downside return estimate is arrived at by applying the market multiple to Palantir’s 2022 EPS estimate.

I have highlighted in yellow what I view as the most likely nearer-term return spectrum of -30% to +128%. The blue highlighted cells represent my estimation of the nearer-term (1-3 years) extremes of the potential return spectrum, which ranges from -44% to +239%.

The -60% downside potential cannot be ruled out if Palantir’s growth disappointment persists, however, I view this as a low probability level even with further disappointment. On the upside, assuming Palantir begins to gain material traction in the Commercial segment, all-time highs within a 5-year time frame are a reasonable possibility. If so, the upside opportunity is extraordinary at +463%.

Summary

All told, Palantir’s risk/reward asymmetry is heavily skewed to the upside. The vast nature of its long-term opportunity combined with its well-advanced valuation correction should bring all secular growth investors to attention. With the stock highly likely to retest recent lows or lower while building a base, the time is now to plan and execute an accumulation strategy for those seeking exceptional return potential.

If Palantir can execute on its growth plan and become some version of what AWS was to the last decade, the upside potential is truly vast. In conclusion, my prior quote captures the essence of the Palantir investment case, from the perspective of the company and its business as well as that of an investor: “We have visibility into the upside, and the upside is quite large.”

Investee Details

Price as of report date: $8

Palantir Investor Relations Website: Palantir Investor Relations