Risk/Reward Rating: Negative

NVIDIA pioneered GPU (graphics processing unit) accelerated computing and it is paying dividends. The driver of the GPU advantage is that CPUs (central processing units) are no longer keeping up with computing power demand as Moore’s law has ended (Moore’s law states that the number of transistors in a dense integrated circuit doubles about every two years).

The company has demonstrated foresight by transforming itself into a computing platform company from a pure chip vendor. This platform approach has positioned NVIDIA to capture higher value business across their customers’ technology stack, such a software. The higher value business garners a higher valuation versus commoditized semiconductor suppliers.

NVIDIA’s valuation is extraordinary and fully reflects its leadership position. The company is trading at 119x fiscal year 2021 (year ended 1-31-21) GAAP earnings (generally accepted accounting principles). The price to free cash flow for 2021 is 111x which is similar to the 119x GAAP earnings.

Looking forward, the company is valued at 75x 2022 GAAP earnings estimates and 52x 2022 non-GAAP earnings estimates (assuming the 2021 GAAP to non-GAAP ratio holds). Stock based compensation expense, which is a material expense, is ignored in the non-GAAP earnings numbers. Expected earnings for 2023 suggest a significant slowdown in the growth rate to only 9%. This growth rate is not what one would expect when paying 75x or 52x earnings estimates for a stock.

Competition is one reason for the expected slowdown in NVIDIA’s growth rate. Intel recently announced that it will introduce high performance GPUs, embedded SOCs, and other accelerated, AI computing processor products to compete more directly with NVIDIA for the higher value business.

Supply chain limitations are another reason for an expected slowdown. NVIDIA is a fabless semiconductor company. This means that they do not manufacture their own products and are reliant on third parties. The COVID supply chain disruptions and the resulting semiconductor shortages has highlighted this soft spot in NVIDIA’s business model. The company forecasts being supply constrained in the second half of the current fiscal year (2022).

Historically, fabless semiconductor companies have traded at premium valuations because they could avoid the heavy expenses and capital outlays required for manufacturing. This is reflected in NVIDIA’s higher profit margins and higher valuation multiple versus industry manufacturers which trade at low-teen price-to-earnings ratios. Going forward, the manufacturing supply chain is likely to have more pricing power given supply constraints. This pricing pressure when combined with more intense competition will threaten NVIDIA’s high profit margins.

In the first quarter of fiscal 2022, NVIDIA’s gross profit margins remained flat at 66% of sales while its operating margins increased from 39% to 45%, representing a substantial increase. The operating margins are likely not sustainable at this elevated level. For comparison, Intel’s gross margin was 55% in the most recent quarter and its operating margin was 19%. Intel and others will be coming for NVIDIA’s excess margins over the coming years.

It should be noted that NVIDIA received a sizeable revenue and profit contribution from the cryptocurrency industry in recent quarters. Crypto mining relies on brute computing power making NVIDIA’s chips ideal for this use case. The company felt the need to call out the crypto market in the last quarter lumping it in with gaming-related revenues which were up 106% over last year. As the crypto mining industry throttles back from its parabolic growth spurt, this material contributor could become a drag on revenue growth adding to the reduced growth expectations for 2023.

On the business front, the future looks bright outside of the current valuation. Key growth drivers over the coming decade will be gaming, augmented/virtual reality, artificial intelligence, and self-driving cars. The current business is composed of gaming (49% of revenue), data centers (36%), professional visualization (7%), automotive (3%), and other (5%). Gaming and data centers have experienced tremendous growth in recent times and are likely to decelerate from their torrid pace reinforcing the 2023 slowdown projected in earnings estimates.

Finally, NVIDIA is attempting to acquire ARM for $40 billion. ARM is a leading chip designer and intellectual property company based in the UK with large exposure to the mobile device market. The CPU focus would further diversify and expand NVIDIA’s capabilities. The acquisition is facing intense scrutiny by U.S., UK., European and Chinese regulators as it would concentrate market power further in the global semiconductor space.

All told, a bright future puts NVIDIA on the watch list for potential purchase. The extreme valuation has priced in much of the foreseeable growth leaving little return and elevated risk on the table. On substantial price corrections, the shares could be an excellent purchase.

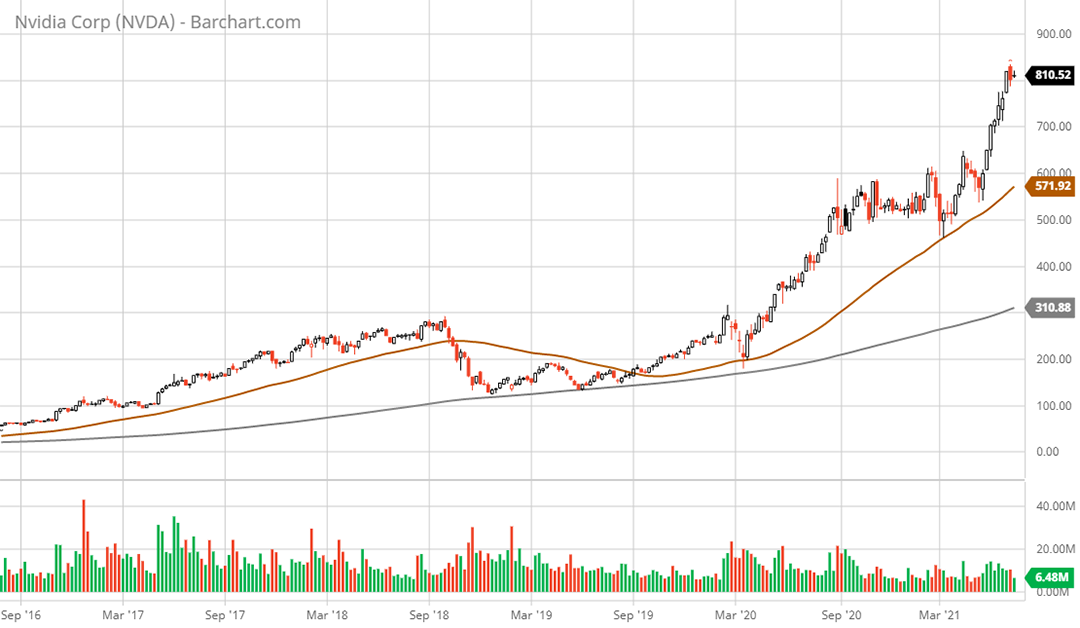

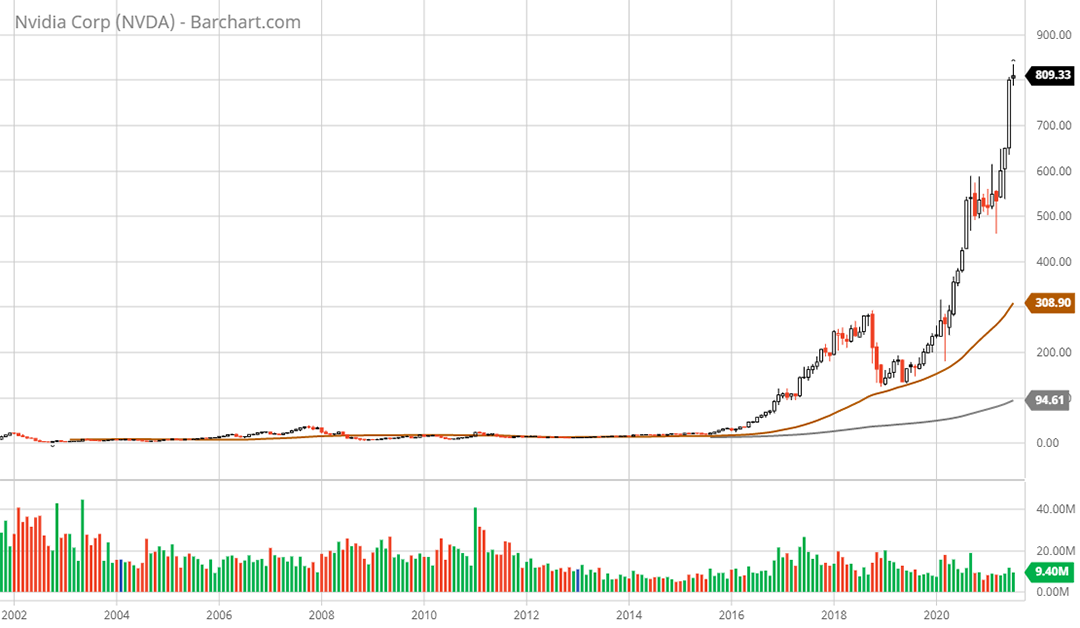

Technical backdrop: NVIDIA had been confined to a sideways trading range after the 2000 dotcom bubble. This finally started to change in 2016 as non-PC related market growth came into focus with expanded use cases for GPU accelerated computing. Since then, the stock price has gone parabolic from the $30 range to the $821 area today. As a result, the stock is overextended to the upside on all time frames.

Technical resistance: current level which is near the all-time high at $833.

Technical support: $570 area which is the 50-week moving average (brown line on 5-year weekly chart) and also the 200-day moving average (not shown). Next lower support is in the $300 area which was the pre-COVID crash high and the 50-month moving average (brown line on 20-year monthly chart).

Price as of report date 7-13-21: $821

NVIDIA Investor Relations Website: NVIDIA Investor Relations

All data in this report is compiled from the NVIDIA investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.