Risk/Reward Rating: Neutral

Lyft stock was down 8% this morning after reporting a loss of $252 million in the second quarter. The company was devastated last year by the COVID pandemic as lockdowns and work from home reduced demand for rides on Lyft’s network. For example, the number of riders in Q2 2020 fell 60% compared to 2019. As a result, comparing 2021 results to 2020 has little meaning and 2019 serves as a more realistic gauge of the trends in Lyft’s business.

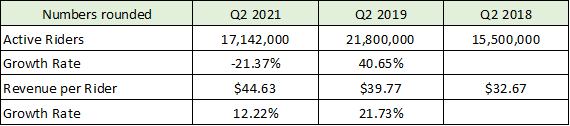

As can be seen in the table below, the number of active riders remains over 21% lower than in 2019. Price increases offset some of the reduced customer demand with an increase of over 12%. Given the recent resurgence of COVID mutations and extended work from home policies, it remains unclear when a full recovery will take place. Adding additional uncertainty is the question of whether consumer habits have changed in regard to Lyft’s services as work from home becomes normalized and people prefer to reduce interactions with strangers in enclosed spaces.

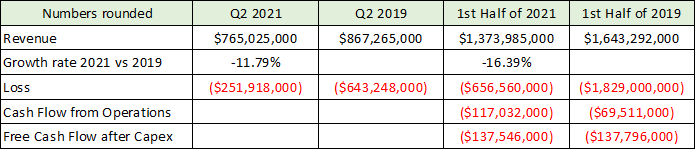

Lyft has generated substantial losses historically and that remains the case through the first six months of 2021 as can be seen in the table below. Sales are beginning to recover but remained lower in Q2 2021 versus 2019 by nearly 12% and lower in the first half of 2021 compared to 2019 by over 16%. Losses were reduced by 60% in Q2 of 2021 compared to 2019 but remain substantial at $252 million. Cash flow from operations remained negative and actually worsened by 70% in the first half of 2021 compared to 2019. Free cash flow after capital expenditures remained unchanged at negative $137 million.

Given the lack of cash flow and profitability, the valuation of Lyft remains challenging. At the current revenue run rate, the company is valued at 5.5x sales. Lyft is not expected to be profitable in 2021, however, current expectations are for non-GAAP (generally accepted accounting principles) profitability to be achieved in 2022. On the 2022 non-GAAP estimates, Lyft is valued at 80x earnings. These estimates ignore substantial stock-based compensation expenses which were $365 million through the first six months of 2021. This valuation is extreme from a historical market perspective.

On the bright side for the business model, Lyft has historically spent heavily on research and development. One would expect this to moderate over time which would provide the company operating leverage and increased profitability. However, research and development expenses are still growing, and consumer demand remains highly uncertain in the current environment. Additionally, the company faces intense competition from the likes of Uber and local players, as well as traditional service providers.

There are also structural headwinds to contend with such as the categorization of drivers as employees in many jurisdictions, which will increase the cost structure. Additionally, labor supply is tight and supply chain inflation is picking up throughout the service and goods side of the transportation ecosystem. These trends will add further cost pressures and quality of service issues which may require price increases and could further reduce demand.

Technicals

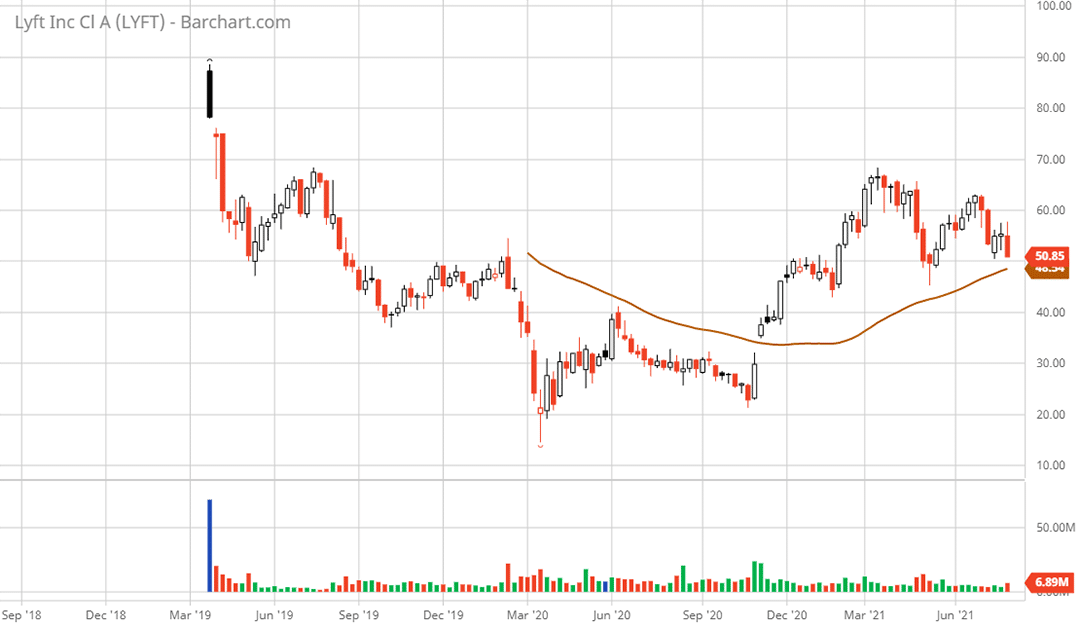

Technical backdrop: Lyft is currently testing weekly support in the $50 area. As can be seen on the 3-year weekly chart, this level served as support in May of 2019 after the IPO excitement and then served as resistance in 2019 and again in 2020. The 50-week moving average (brown line on the 3-year weekly chart) currently resides just beneath this level at $46.

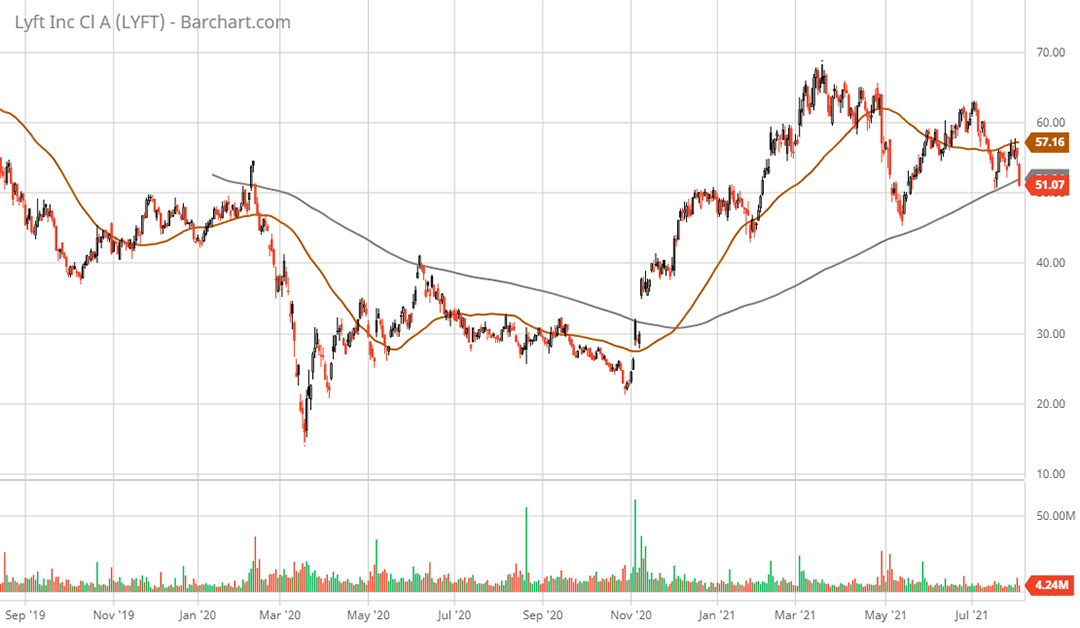

On the daily chart, Lyft is currently testing support at the 200-day moving average (grey line on the 2-year daily chart) which is at the $51 level. Next lower support is at $40 on both the daily and weekly charts. If the fundamental outlook improves, this lower support area may offer a better entry point.

Technical resistance: $55 then $60.

Technical support: $50 followed by stronger support in the $40 area. Next lower support is $30.

Price as of this report 8-4-21: $51

Lyft Investor Relations Website: Lyft Investor Relations

All data in this report is compiled from the Lyft investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.