Risk/Reward Rating: Negative

Lemonade reported increasing losses in Q2 2021 on August 4. The net loss grew 165% versus Q2 of 2020 to $55.6 million while revenue declined 5% versus 2020. The stock price has declined 17% since our last update on June 20, 2021.

For those unfamiliar with the story, Lemonade is an insurance company that started by specializing in renters insurance and is now expanding into homeowners, pet, and life insurance primarily in the United States. The company has additional near-term expansion plans to enter the auto insurance market and a regional push across business lines into the European market. The current business mix is 50% renters insurance, 30% homeowners, 13% pet, and 1% life insurance.

The company is unprofitable and is expected to remain so for the foreseeable future. Current consensus estimates for 2021 and 2022 are for Lemonade to lose $3.78 and $3.73 per share, respectively. The company prefers to use adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) to gauge its performance. On this measure, the company’s guidance for the full year 2021 has worsened since the Q1 projection to negative $171 million of adjusted EBITDA from the previous estimate of negative $168 million of adjusted EBITDA.

Given the current and projected losses from operations, a valuation for Lemonade must rely on other measures. In the insurance industry, book value is a meaningful measure as insurance firms are financial companies with balance sheets dominated by financial assets and liabilities rather than physical assets such as property, plant, and equipment, which have more uncertain values. Looking at the book value (assets – liabilities), Lemonade is valued at 4.8x book value. It should be noted that the book value is declining each quarter due to operating losses, and declined by over $42 million from Q1 to Q2 2021. Furthermore, the book value is inflated by recent stock sales which raised a substantial amount of cash, and it will continue to decline for the foreseeable future assuming the projected losses materialize.

Turning to sales, Lemonade estimates total 2021 revenue of $124 million which is a $5.5 million increase from the guidance provided at the end of Q1. As mentioned above, the adjusted EBITDA loss guidance increased by $3 million along with the $5.5 million increase in estimated revenue suggesting negative operating leverage. The valuation stands at over 42x estimates sales. This is an extraordinary valuation in a historical market context. For comparison, Progressive trades at 1.27x 2020 revenue and is highly profitable. Additionally, Progressive trades at 3x book value which is growing as a result of its profitable operations.

There are some operational risks that should be noted. The company is expanding into many insurance business lines and geographical regions before it will establish a profitable foothold in any market. Given that each type of insurance and each region have unique risks and market dynamics, it does raise concerns over the business model and whether profitability can be achieved. Additionally, the company is transitioning toward carrying a greater percentage of policy holder claim risk on its own balance sheet as the ability to offload the risk via reinsurance has been reduced. This creates a more capital-intensive business model for Lemonade and could place further pressure on its balance sheet and thus book value if insurance claims and underwriting losses begin to bite.

All told, Lemonade stock carries an elevated level of risk with low visibility as to potential reward. First, the valuation is extreme on all measurements. Second, there is substantial business execution risk given the rapid expansion into multiple business lines and geographies prior to profitability, and each carries unique risks. Finally, Lemonade is competing against well capitalized, blue chip insurance companies which are also competing for market share in Lemonade’s historic renters insurance sweet spot while operating highly profitable insurance operations in the markets Lemonade is now trying to enter. The pricing pressure they can exert will create challenges for Lemonade to reach profitability.

Of particular concern is that the company has marketed its stock directly to retail investors. Please refer to the prior Lemonade review dated June 20, 2020. This decision could leave a sour taste with investors as insiders control one-third of the company’s shares and retail investors own one-third of the shares. If things turn south for Lemonade’s stock price, the backlash from retail investors, who may also be Lemonade insurance customers, could create a negative feedback loop between the company’s share price, its business results, and management credibility.

Technicals

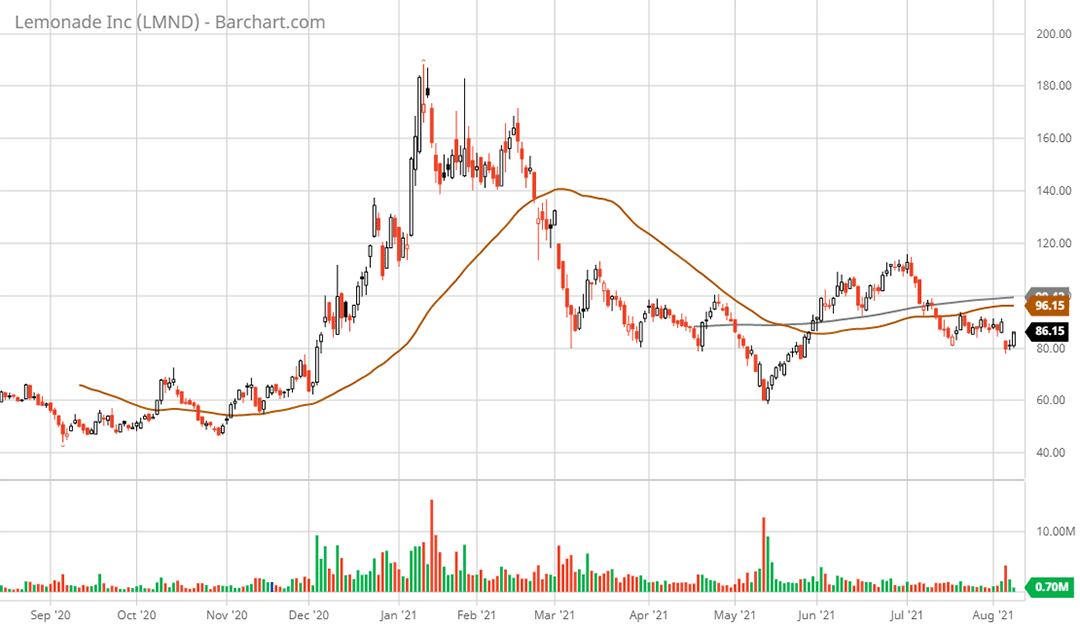

Technical backdrop: Lemonade came public in June 2020 peaking out at $69 per share in its first week of trading (see weekly chart below). The subsequent selloff reached a low of $45 four weeks later before a speculative blowoff took the shares as high as $165 on a weekly closing basis in Q1 2021. Since this speculative frenzy, the shares are struggling against a limited fundamental support backdrop. Support has been found in the $80 range on many occasions, however, with each repeated test the likelihood of breaking lower from this level increases. Next lower weekly support is in the $60 area and then all-time lows near $45.

Turning to the daily chart, Lemonade is beneath its 50-day moving average at $96 (brown line on the daily chart) and its 200-day moving average near $100 (grey line on the daily chart). The 50-day moving average is also beneath the 200-day moving average confirming the primary downtrend currently. The $96 to $100 area of the moving averages should offer stiff resistance. The $80 area, similar to the weekly chart, has offered repeated support which increases the likelihood of a break lower. $60 was support at the lows in May 2021 as was suggested by the weekly chart. A test of all-time lows would be the next visible support area and can’t be ruled out given the valuation and fundamental backdrop.

Technical Resistance: $96 to $100

Technical support: $80 is near-term support, followed by $60 and then the $45 area.

Price as of this report 8-9-21: $86

Lemonade Investor Relations Website: Lemonade Investor Relations

All data in this report is compiled from the Lemonade investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.