This brief market update is in response to the CPI report for August which was released this morning. As I write, the Nasdaq 100 (NASDAQ:QQQ) is down 4% and the S&P 500 (NYSE:SPY) is down over 3%. Given the violent reaction, the question becomes is the August CPI report new information or noise?

The best place to start is with the paraphrase of Jerome Powell’s Jackson Hole speech from my prior market update on August 29, 2022: S&P 500: Where we go after Jackson Hole.

Today my focus is narrower… my message more direct… the overarching focus of the Fed is to get inflation back down to 2%… this will require using our tools forcefully.

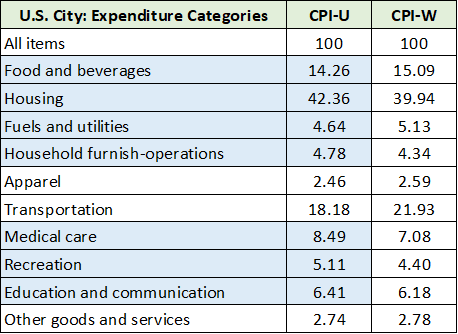

In reaction to Powell’s words at Jackson Hole, the S&P 500 fell a similar 3.38% and the Nasdaq 100 fell over 4% on August 26, 2022. Returning to the key question, is the CPI report information or noise? The following table compiled from the Bureau of Labor Statistics displays the weightings of each expense category that underlie the CPI report.

I have highlighted in blue those categories for which reported inflation looks to be rather sticky going forward. The primary reason for the stickiness is the lagging nature of the information and the disconnect from actual market or economic prices.

Given that housing accounts for over 42% of the CPI, I will focus on its meaning. I view inflation stickiness above the Fed’s 2% target as being self-evident for the remainder of the blue categories. What is most important for the housing component of the CPI is that it is not based on market prices.

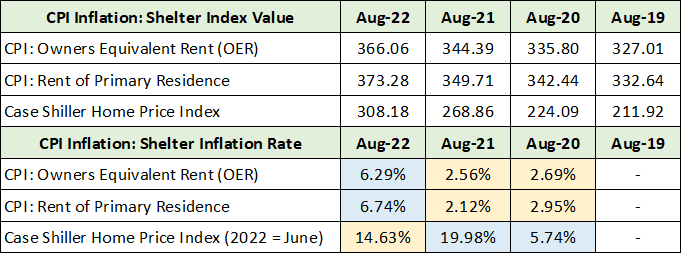

The computation is largely model driven and lags data that is closer to real time. The table below was compiled from the St. Louis Federal Reserve and displays inflation rates for major CPI housing components and the Case Shiller Home Price Index.

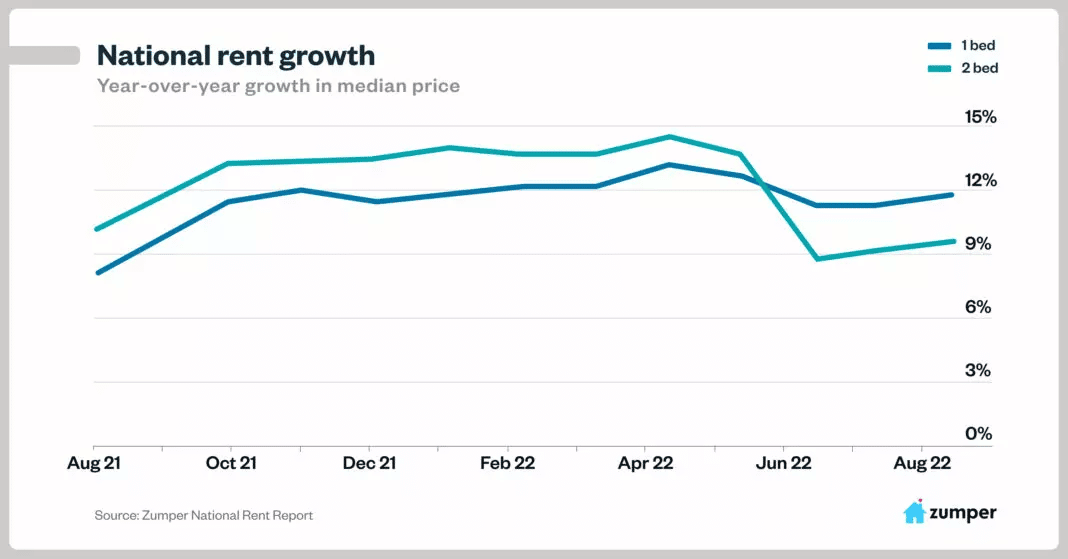

I have highlighted in yellow decelerating inflation rates and in blue accelerating inflation rates. Notice that when housing prices were accelerating most rapidly in 2021, the CPI’s major housing components were decelerating. Today, real-time housing inflation is decelerating rapidly with important sub-categories contracting. The CPI housing component today is lagging massively and recording rapid acceleration. Please keep in mind that the Case Shiller Home Price Index is also a lagging indicator to some degree. The following image from Zumper confirms the lagged nature of the CPI housing data.

Recall from the table above that in August 2021 the CPI housing components were registering inflation of between 2% to 2.5%. At the same time, from the above image, rental inflation was rising at double digit rates and approached the mid-teens.

A third and final confirmation of the lagging nature of the CPI comes from CoreLogic, which produces a single-family rental and home price index. Here, for example, rental inflation has been setting records since April 2021 and peaked at 14% in April 2022. The housing price inflation index peaked near 21% in April 2022, alongside rents. CoreLogic is forecasting 3.4% housing price inflation over the coming year.

Importantly, the CPI report has been drastically understating housing inflation for some time. For example, housing inflation was being reported near 2% at this time in 2021 when actual housing inflation was likely running closer to 20%. Now that housing inflation is decelerating rapidly, the CPI housing components are rapidly accelerating.

Summary

In response to the market’s reaction to the CPI report today, my colleague said the following: “It’s like reacting to something that happened 18 months ago.” Her statement gets to the heart of the matter and the answer to the initial question, is the CPI report new information or noise? In the August 29 market update I stated the following:

The downtrend looks likely to persist for the broad US equity indices. With the increasing dominance of index funds and passive investing in the markets, one would expect market inefficiencies to increase thus expanding the opportunity set long term.

Market inefficiencies are clearly broad-based and look to be structural. Meaning, if markets are pricing assets based on data that represents a reality that occurred roughly 18 months ago, as the above evidence supports, prices are incredibly inefficient.