Dan Loeb, Chief Executive Officer and Chief Investment Officer of Third Point LLC, disclosed a roughly $1 billion stake in The Walt Disney Company (NYSE:DIS) in August 2022. Loeb became an activist investor seeking changes to arrest the company’s share price decline. On September 30, 2022, he succeeded in adding an independent member to Disney’s board of directors, Carolyn Everson. In response, Loeb signed a support agreement with Disney through 2024.

In the weeks following Everson’s appointment, Disney reported disappointing Q4 2022 results and guidance and saw its share price plunge to levels first reached in 2014. Within twelve days of the disappointing results, on November 20, 2022, the board of directors fired the company’s CEO, Bob Chapek. The speed with which the board acted to remove Chapek is a testament to the advanced stage of change within Disney which the Loeb activism signified.

In the weeks following Everson’s appointment, Disney reported disappointing Q4 2022 results and guidance and saw its share price plunge to levels first reached in 2014. Within twelve days of the disappointing results, on November 20, 2022, the board of directors fired the company’s CEO, Bob Chapek. The speed with which the board acted to remove Chapek is a testament to the advanced stage of change within Disney which the Loeb activism signified.

Bob Iger was reinstated in the top position. He served as the CEO from 2005 until Chapek’s appointment in February 2020. As a result, it is an excellent time to review the Disney investment case. This update builds on my November 16, 2021 report, “Disney battles to retain the content king crown,” which opened with the following:

I am assigning The Walt Disney Company (NYSE:DIS) a negative risk/reward rating based on its heightened risk of persistently lower profitability, intensifying competitive pressures, a rapid slowdown in streaming subscribers, and an elevated valuation.

Since the November 2021 report, shares of Disney have returned -41.75% compared to -16.22% for the S&P 500 index. The extraordinary underperformance of Disney over the past year has corrected a material amount of the elevated valuation risk at the time of the last report. While the price correction is welcome from a prospective investor viewpoint, the risks detailed above are materializing.

The key question today is whether the risk/reward asymmetry remains to the downside, is now neutral, or has it shifted to the upside given the extreme underperformance?

This is an important question for investors as Disney owns one of the most valuable collection of assets and brands in the entertainment industry. From the November 2021 report:

Disney remains the content king in the entertainment industry. If the company can fend off the competition while executing a successful offensive strategy across its streaming services, the future could once again belong to the magic kingdom.

A Sector View

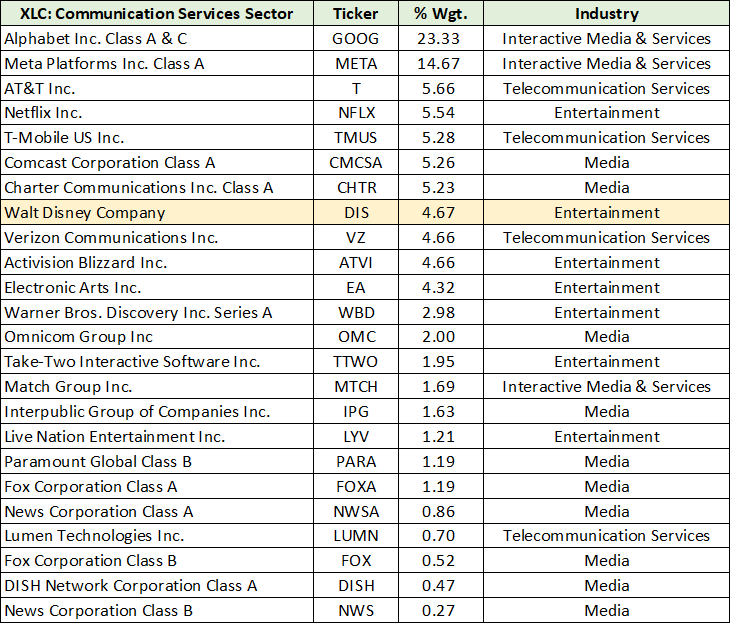

When viewing an investment case, a sector perspective provides a relative foundation and valuable context. The entertainment industry is a subset of the communication services sector, which has a 7.33% weighting in the S&P 500 index. Disney has a 4.67% weighting in the sector and is the eighth largest company according to The Communication Services Select Sector SPDR® Fund (NYSE:XLC), as can be seen in the following table compiled from State Street Corporation.

Competitive Pressures

While Disney is a rather unique company compared to many in its sector, they all inhabit the same ecosystem which is undergoing rapid change. The traditional lines of competition are becoming increasingly blurred. For example, much of Disney’s future value will be determined by its success in going directly to the consumer via streaming services. In this regard, Disney is competing with the entire sector, and much more, for a fixed amount of discretionary time available to consumers.

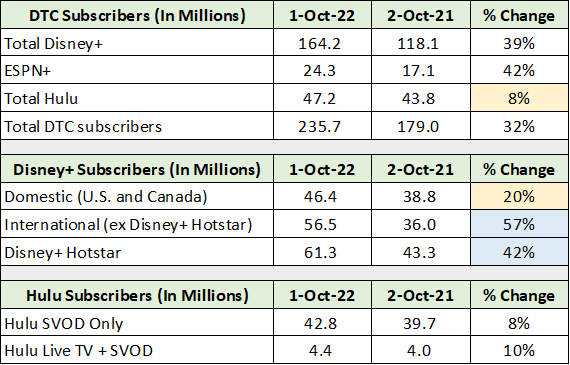

On the streaming front, Disney has undoubtedly proved successful in acquiring customers. The company grew its Disney+ subscribers from 0 in 2019 to over 164 million today. During the same time, ESPN+ grew from 3.5 million to over 24 million subscribers. The following table, compiled from Disney’s 2022 Annual Report, displays its 2022 DTC (Direct-to-Consumer) subscriber growth compared to year end 2021.

The upper section of the table is summary data for the company, and the lower two sections display category detail. I have highlighted in yellow those segments experiencing weak growth and in blue those reporting robust subscriber growth. Hulu looks to be mature while Disney+ growth is slowing rapidly in North America, with each nearing 50 million subscribers.

Subscriber growth is being led broadly by international markets at 57%, with membership now over 56 million. This is followed by Disney+ Hotstar, which is growing at 42% with over 61 million members and comprised of India and other Southeast Asia nations. ESPN+, while smaller at 24 million subscribers, grew by an impressive 42% in 2022.

At nearly 236 million total DTC subscribers, Disney is overtaking Netflix (NASDAQ:NFLX). What took Netflix nearly two decades to achieve was accomplished by Disney in roughly three years. The rapid market penetration by Disney was no doubt aided by entering the DTC market just before the onset of the COVID pandemic.

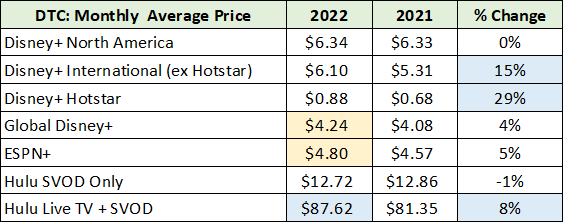

As a result of its rapid market penetration, Disney is highly likely to experience a material slowdown in subscriber growth over the coming years as it transitions to a more mature growth phase. As is the case with Netflix today, future success will become more dependent on pricing power. The following table displays Disney’s average monthly price for its direct-to-consumer services. It was compiled from the 2022 Annual Report.

I have highlighted in yellow what I view to be prices that have material upside potential. For reference, Netflix’s average price per subscriber is $16.37 in North America and roughly $8.50 internationally. The blended or global average price for Netflix is likely near the midpoint of the range or $12.50.

Given Disney’s deep and diverse content assets, attaining prices like those of Netflix should be a matter of content packaging, market segmentation, and execution. Meaning, the company is likely to control its own destiny. If this is correct, Disney should have strong pricing power for the foreseeable future.

Segment Sales

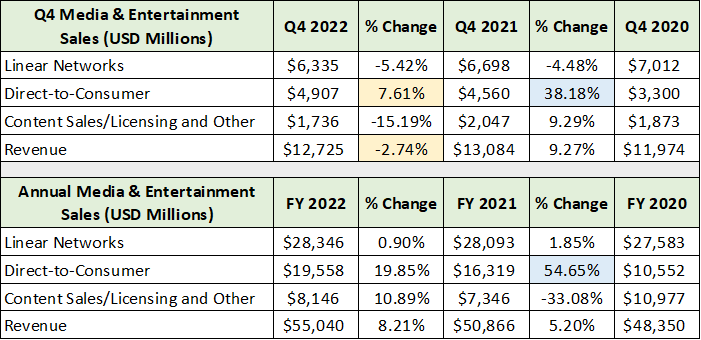

The importance of pricing power is on display in the following table compiled from Disney’s Q4 2022 earnings release. The Media and Entertainment Distribution segment is Disney’s largest by sales at $55 billion in 2022. This compares to its Parks, Experiences and Products segment which produced $28.7 billion of sales. The Media and Entertainment Distribution segment is reported in three categories below.

I have highlighted in yellow the areas of concern. The future growth engine of the company, DTC, slowed to under 8% sales growth in the just completed fourth quarter. Total segment sales declined by nearly 3%. Recent DTC sales growth rates are highlighted in blue. Sales growth has collapsed from over 50% for the full year in 2021 to just over 7% in the final quarter of 2022. Pricing power is becoming increasingly important if Disney is to reignite sales growth in this critical category.

The Linear Networks category is contracting following recent stagnation. Legacy distribution channels, such as cable and broadcast, are in a well-advanced structural decline. Going directly to the consumer via streaming should continue to put pressure on the Content Sales/Licensing category, though the results will remain volatile.

All things considered, mid-single-digit sales growth for Disney’s largest reporting segment over the intermediate term appears to be a reasonable assumption and is in line with the full year sales growth in 2021 and 2022. While mid-single-digit sales growth is not terribly attractive, there remains material upside potential if Disney can execute on subscriber and pricing growth in the DTC category.

Segment Summary

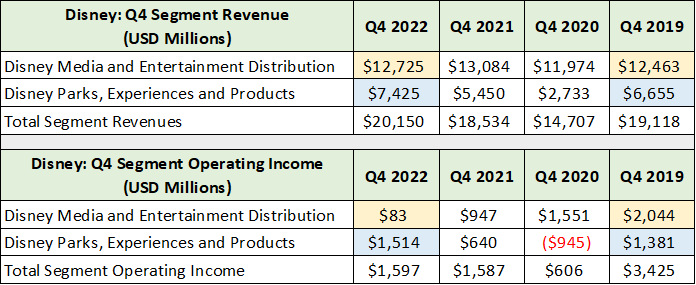

As things stand, sales growth and profitability are primary concerns for the Disney investment case. The following table was compiled from Disney’s Q4 2022 and Q4 2020 earnings releases filed with the SEC. It displays the sales and operating income results for the fourth quarter of each year using 2019 as the base year. With the COVID pandemic ravaging the company’s parks segment, Q4 2019 was the last normal quarter from which to measure Disney’s overall performance.

I have highlighted in yellow the media and entertainment segment and in blue the parks segment. Importantly, sales have stagnated since Q4 2019 in Disney’s most important segment while operating income has collapsed (the yellow cells).

With Disney investing heavily in the parks segment and bringing new assets online (such as cruise ships), sales have fully recovered and were up over 11% in Q4 2022 compared to 2019. This equates to roughly 3.5% annualized sales growth and is in the ballpark of my estimated mid-single-digit sales growth potential in the media and entertainment segment over the intermediate term. Operating income improved a similar amount in the parks segment.

Recall the opening quote from my November 2021 Disney report and the four primary risks: a heightened risk of persistently lower profitability, intensifying competitive pressures, a rapid slowdown in streaming subscribers, and an elevated valuation. Each of these risks is on display in the above table except for valuation.

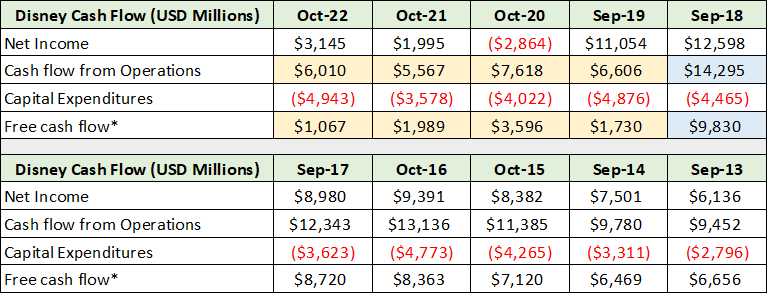

The following cash flow data illuminates the persistently lower profitability risk resulting from the competitive pressures and sales slowdown. The data was compiled from Disney’s annual reports filed with the SEC from 2013 through 2022.

I have highlighted in yellow the collapse in cash flow from operations since 2018 (which was Disney’s peak). Please note that my estimate of free cash flow subtracts capital expenditures from cash flow from operations. The driver of the cash flow collapse is Disney’s losses in launching its DTC services in 2019. The operating loss in the DTC category reached over $4 billion in 2022.

Keep in mind that 2022 featured a full recovery in the parks segment which generated operating income of $7.9 billion for the full year. This segment was a major drag on cash flow during the 2020 and 2021 COVID disruptions. It is telling that Disney’s cash flow from operations remains below that achieved in 2019, and under half that attained in 2018. With management forecasting profitability to be reached sometime in 2024 for Disney’s DTC business, the road back to the results achieved in 2018 (highlighted in blue) looks to be rather long.

In the mid-decade timeframe, Disney estimates that it will reach 230 to 260 million Disney+ subscribers. Adding Hulu and ESPN+, total DTC subscribers are likely to approach 300 to 350 million globally by mid-decade. As these estimates appear achievable, pricing will be a key indicator going forward.

Consensus Estimates

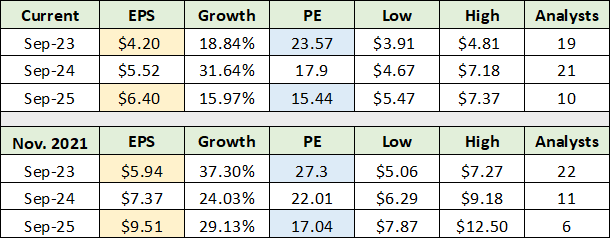

Looking out to mid-decade, the consensus earnings estimates have fallen by roughly 30% per year through 2025 compared to estimates as of the November 2021 Disney report. The following table was compiled from Seeking Alpha and displays consensus earnings estimates today in comparison to those as of November 2021. I have highlighted in yellow the change in earnings estimates and in blue the valuation changes since my last report.

Earnings estimates for the next three years have been reduced by approximately 30% per year (the yellow cells) while Disney’s valuation on those estimates has fallen by roughly 10% (the blue cells). In terms of correcting the heightened valuation risk as of the November 2021 report, a PE near 24x 2023 estimates is not materially different than 27x. Similarly, 15.4x 2025 estimates is not much different than 17x.

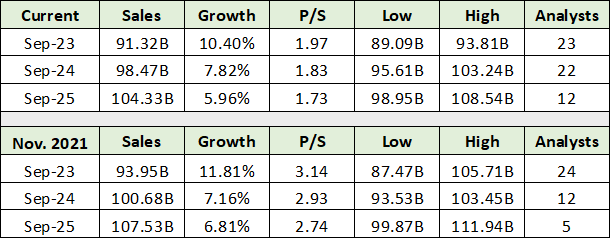

As a result, there remains further valuation compression risk in the absence of earnings surprising to the upside. Interestingly, sales estimates have also been reduced but the change is not material at just under a 3% reduction for each year. The following table compares consensus sales estimates today to those as of November 2021 and was also compiled from Seeking Alpha.

The Disney investment case rests squarely on its future profitability, which remains highly uncertain. From the November 2021 report:

Adjusted earnings peaked in 2018 at $7.08 per share. The central earnings tendency around this peak was in the $5.70 range in 2017 and 2019.

Current consensus estimates have Disney reaching the $5.70 per share earnings tendency, previously achieved between 2017 and 2019, in the 2024-to-2025 timeframe. While this should be achievable, Disney reported only $3.53 per share in adjusted earnings in 2022.

To meet consensus estimates in the mid-decade timeframe Disney must achieve profitability in its DTC category. This is especially true given the muted revenue growth potential in its other categories, including structural declines in its legacy distribution businesses. The DTC category generated -$2.19 per share of operating losses in 2022. A reversal of this loss should be sufficient to meet consensus estimates in 2024.

In summary, Disney’s consensus earnings hurdle rate in the mid-decade timeframe should be achievable with upside surprise potential. Given the prolonged period of reduced cash flow and profitability since 2018, the question turns to Disney’s valuation.

Valuation

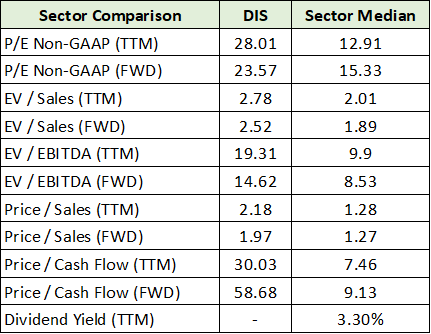

Disney is trading at 24x the consensus earnings estimate for 2023 and 15x the estimate for 2025. With the S&P 500 index trading at 18x 2023 estimates, Disney’s valuation premium continues to create a heightened risk of multiple compression. The following table compares Disney’s valuation to that of the sector. It was compiled from Seeking Alpha.

Disney’s valuation premium to the communication services sector is pronounced across all measures, confirming the heightened multiple contraction risk. Growth in the DTC category takes on added importance as a result. Of note, the sector valuation comparison hints at the multitude of attractive opportunities in the communication services sector, which will be covered in my next reports.

Summary

The material valuation correction since the November 2021 Disney report tilts the risk/reward rating away from negative to a neutral rating. While the valuation premium presents risk, the inherent brand value in Disney’s assets is supportive, as is the technical backdrop. The technical backdrop from the November report:

$93 represents the next lower support level which was near the COVID crash lows. This appears to be a worst-case scenario as things stand and represents downside risk of -42%. This happens to align very well with the downside risk estimate arrived at by applying the current forward market PE to Disney’s forward earnings estimate.

Disney is now testing this key technical support zone. The significant reduction in profitability estimates since November 2021 has opened the door to tests below the low $90s.

While Disney does not present as an especially asymmetric risk/reward opportunity at this time, signs of growth and improving profitability would tilt the scales positively. The return of Bob Iger along with a reinvigorated board are additional catalysts which appear to offer upside surprise potential.

In the meantime, as hinted at in the valuation comparison, the communication services sector offers many asymmetric risk/reward opportunities today. I will cover several of these opportunities while updating Netflix and Meta in coming reports. They are being produced in parallel with this Disney update to provide a broad overview of the sector opportunities.

Price as of report date: $97.49

Disney Investor Relations Website