What I find most interesting about today’s market environment is that the vast majority of economists, investors, and commentators are still debating the timing of a possible recession. The consensus appears to be that one could occur sometime in 2023. In fact, this week Goldman Sachs placed the probability of recession at 35%. The interesting aspect of this market debate is that a recession is in fact in progress for many key sectors of the economy, including economic bellwethers.

FedEx and the Economy

If there is one sector in the economy that serves as an economic bellwether it is transportation. The reasoning is straightforward, no physical good transaction occurs without it first being transported. By extension, transportation firms are an ideal real-time indicator of the current state of the economy.

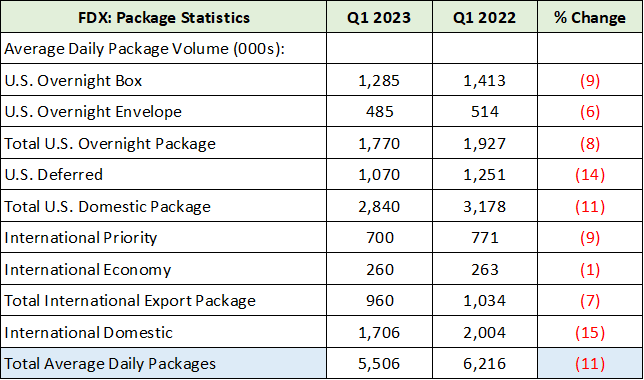

The following table summarizes FedEx’s package volume for the quarter ended August 31, 2022 (Q1 fiscal 2023) and compares it to the to the same period in 2021 (Q1 fiscal 2022). I have highlighted in blue the total package percentage decline. The data was compiled from the company’s Q1 2023 earnings report filed with the SEC.

Notice that all categories and regions except one witnessed a material volume decline during the three months ending August 31, 2022. Total company volumes were down 11%. FedEx entered a recession last quarter. In a CNBC article by Krystal Hur following the earnings report, FedEx CEO says he expects the economy to enter a ‘worldwide recession,’ FedEx’s CEO summarizes the situation as follows:

We are a reflection of everybody else’s business, especially the high-value economy in the world… We’re seeing that volume decline in every segment around the world, and so you know, we’ve just started our second quarter… The weekly numbers are not looking so good, so we just assume at this point that the economic conditions are not really good.

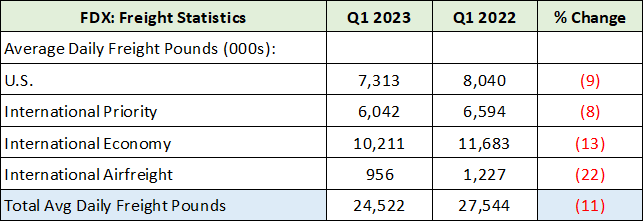

The recessionary conditions are confirmed by FedEx’s Freight division. Here, we can estimate volume declines by comparing total pounds shipped this year versus last. The data in the table below is from FedEx’s Q1 2023 earnings release. I have highlighted in blue the percentage volume decline last quarter which is identical to its package volume contraction of 11%.

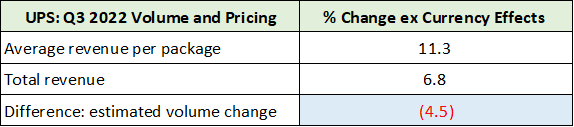

While FedEx is facing increasing competition, it is highly unlikely that competition alone is enough to erode volumes to this extent. The following table from UPS’s (NYSE:UPS) Q3 2022 earnings report for the quarter ended September 30, 2022 corroborates the recessionary conditions in the shipping industry. While UPS did not break out volume details, we can infer volume changes by comparing the average sales per package (pricing) to the total change in revenue during the period. I have highlighted in blue the estimated decline in UPS’s volumes last quarter.

With material volume declines across the leading shipping firms, the question turns to why is there debate about a potential recession in 2023 when one appears to have started last quarter?

Inflation

The current recession is much different than those in recent times. One has to go back to the 1970s to find the last inflationary economic contraction. Few market participants today experienced those conditions, including me. As a result, it makes sense that there is much uncertainty in the markets today.

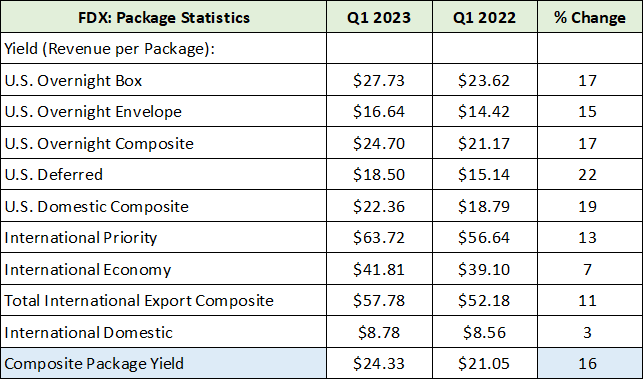

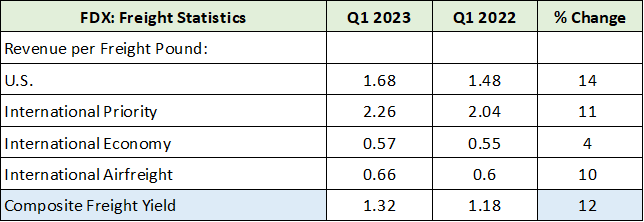

The inflationary conditions are masking a real-world recession. It is real in terms of actual economic activity but not in terms of dollar amounts. This is on full display when turning to FedEx’s revenue and pricing data last quarter. The following tables were compiled from FedEx’s Q1 2023 earnings release. I have highlighted in blue FedEx’s estimated price increase for Packages (first table) and Freight (second table).

FedEx raised prices by an estimated 12% to 16% across its divisions. This is generally in line with the 11% increase estimated for UPS in the above table. The effect of price increases on total sales was greater than the effect of volume declines. FedEx reported a total sales increase of 6% against a volume decline of approximately 11% last quarter.

Those looking to sales will not find a recession even though real economic activity declined substantially. FedEx has announced a further price increase of 7% beginning in January 2023 as it experienced even greater inflation in its cost structure than it received via price increases. The cost inflation is visible in FedEx’s earnings per share declining by 19%. The inflationary pulse is still rippling outward, however, 7% is a material decline from the recent mid-teens inflation that was passed along to shipping customers.

Recession

When the shipping industry conditions outlined here are combined with my September 15, 2022 market update, “The recession is here filter the noise,” a recessionary mosaic takes shape. The recent high profile stock price declines in response to earnings reports from the leading technology firms confirms the breadth of the unfolding recession. In Corning’s Q3 2022 earnings report, Wendell P. Weeks, chairman and chief executive officer, provides a taste of the broad-based contraction via the largest technology hardware markets.

…display panel maker utilization reached its lowest level since 2008; smartphone, tablet, and notebook retail unit sales declined significantly…

In summary, we are in a recession. The most important question for investors is, what is already priced into the market?

Technicals

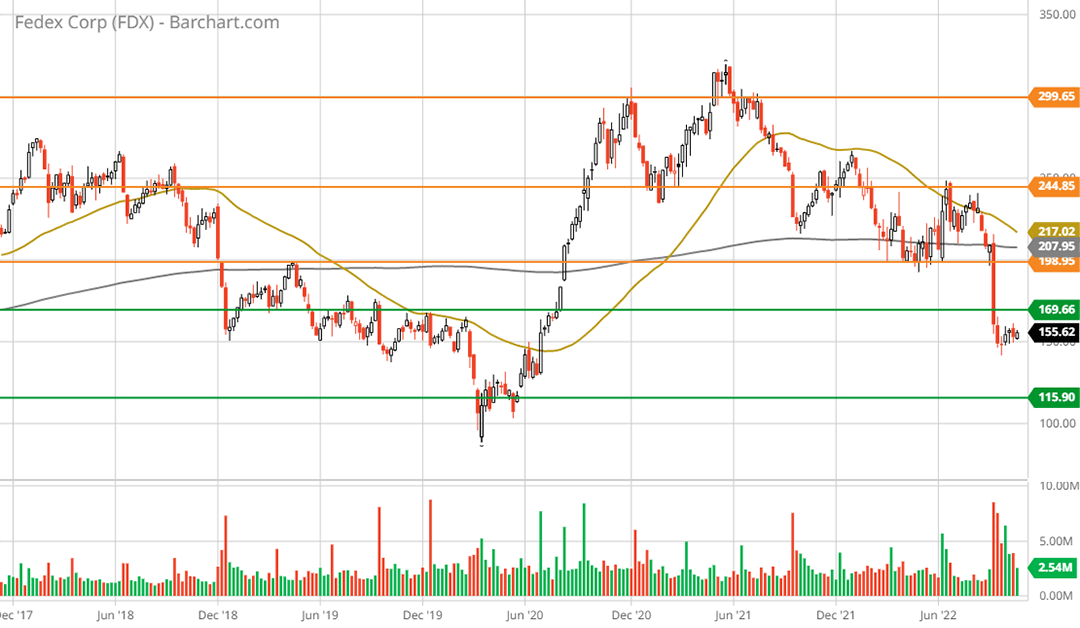

In fact, the market has been pricing a recession into FedEx’s stock price since the shares peaked near $318 in May 2021. At roughly $157 today, following an 18-month downtrend, much has been priced into FedEx’s shares. The following 5-year weekly chart provides a look at the downtrend.

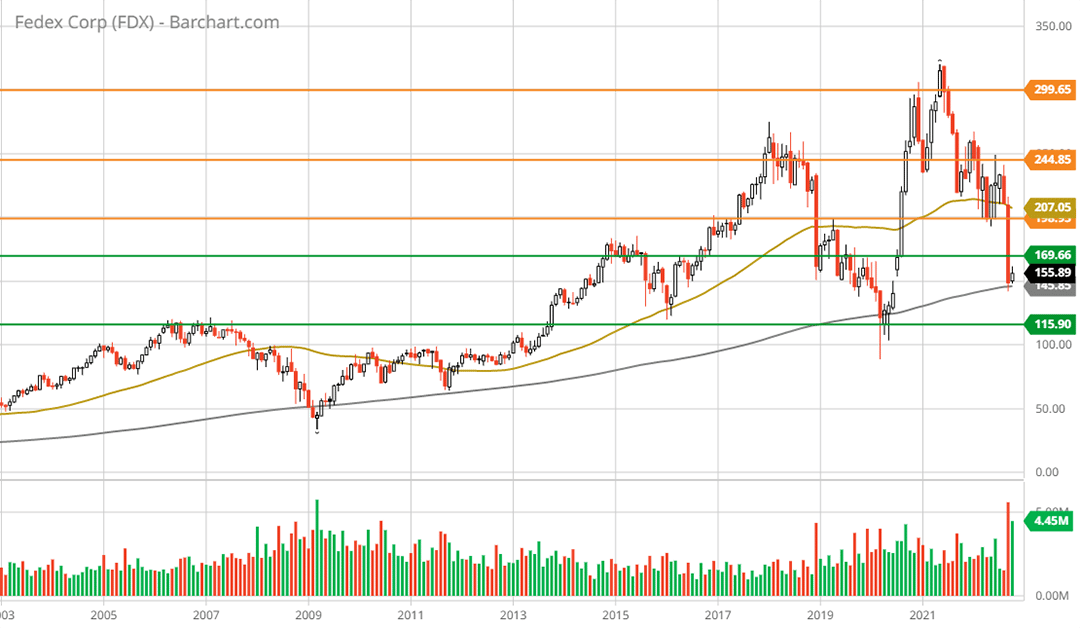

Please note that the orange horizontal lines represent primary resistance levels and the green lines are primary support levels. FedEx is now testing the middle of a major support zone. It is bracketed by the COVID-panic lows on the bottom and prior resistance during 2018 and 2019 on the top. The following 20-year monthly chart places the past five years in the context of FedEx’s long-term trend.

Note that the shares are sitting on the grey trendline which is the 200-month moving average. This has proved to be support during the prior two panic lows of 2008 and COVID. With the shares trading at 11x the consensus earnings estimate for the current fiscal year, which is projected to decline by 30%, FedEx is near material support both technically and fundamentally. A well-above average dividend yield of 3% offers further downside support.

Summary

While the unfolding recession has yet to be widely accepted, FedEx’s share price has been pricing it in for 18 months. The downtrend is likely nearing a phase transition as the bottoming process completes and the stage is set for a resumption of the long-term uptrend. Fundamentally, FedEx is trading at a discounted valuation on a material earnings reduction of -30%. With the shares trading near long-term technical support at the 200-month moving average, the risk/reward asymmetry for FedEx is decidedly positive.

Price as of this report: $156.91

FedEx Investor Relations Website: FedEx Investor Relations