Risk/Reward Rating: Negative

Etsy operates two-sided online marketplaces making it one of the big winners when the COVID lockdowns created heavy demand for online shopping. The surge in demand has created difficulties looking forward. Growth crested in Q1 of 2021 with 140% revenue growth over last year. The forecast for the current quarter is for much more subdued yet respectable revenue growth of 15-25%.

Catering to sellers of unique and creative goods has allowed the company to carve out a niche in the retail landscape which has been supplemented by acquisitions. For example, Reverb, was acquired in 2019 and is a marketplace for used and vintage musical instruments. These unique products may be susceptible to greater volatility as life returns to normal post COVID. A recent acquisition raises some concern given what it may signal about current demand and visibility after a bumper year.

The company recently announced the acquisition of Depop, an online marketplace for used clothing, for $1.625 billion. Depop generated $70 million of sales in 2020 which were likely inflated by the COVID lockdowns. Paying 23x sales for a retail clothing marketplace with questionable long-term prospects and the possibility of inflated revenues due to COVID is worrisome. The huge premium to sales is extraordinary compared to historical sales multiple valuations for clothing retailers. This suggests that Etsy is willing to pay a huge premium for revenue growth which would be unlikely if organic growth visibility were strong.

Subsequently, the company announced a debt sale of $1 billion to replenish cash used for the acquisition and to repurchase $180 million of its own stock from the bond buyers. The company has likely depleted its current share buyback authorization in recent weeks.

Valuation: 55x 2021 earnings estimates, 44x 2022 earnings estimates, and 14.3x last year’s sales. These are high valuation multiples for a retailer of any sort.

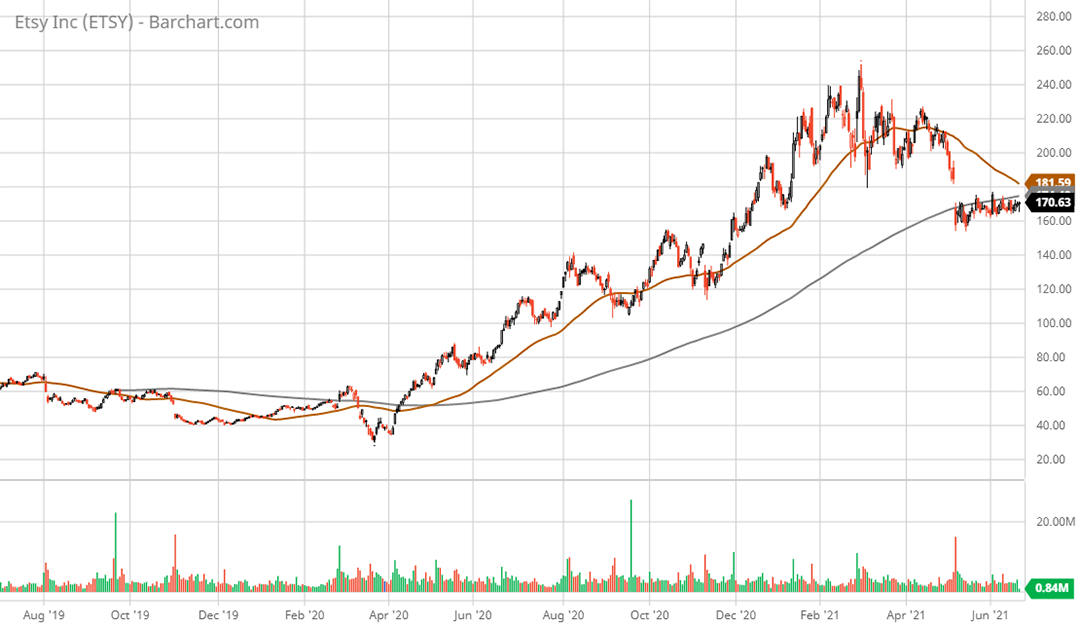

Technical resistance: $174 is the 200-day moving average which has provided a ceiling for the stock for the past 6 weeks. $200 is prior support during the first five months of 2021, resistance will be heavy up to $200 given the gap lower at $185.

Technical support levels: $140 to $155 then $115 and $85.

Price as of report date 6-21-21: $170.51

Etsy Investor Relations Website: Etsy Investor Relations