Risk/Reward Rating: Negative

Datadog is a technology application monitoring, security, and analytics platform for developers, IT operations teams and business users. The stock became a highflyer in 2020 during the COVID lockdowns and the resulting speculative frenzy in the stock market. During the frenzy, the company’s share price rose 428% over just seven months to $120 per share. The incredible valuation of Datadog resulting from this rally had placed the stock in the doghouse since October of 2020. The company reported strong results for Q2 2021 yesterday unleashing the share price and sending it to new highs.

The company reported extraordinary revenue growth of 67% in Q2 2021 compared to Q2 2020. For the full year, Datadog estimates that revenue will grow 56% compared to 2020 and come in at $944 million. The new full year revenue guidance comes in 7% higher than what was expected based on Q1 trends. At the current share price and diluted share count guidance, the company is valued at $45.5 billion or 48x estimated sales for 2021. This is an extraordinary valuation in a historical market context. The current valuation has priced in excellent growth for the foreseeable future.

On the earnings front, Datadog is forecasting non-GAAP (generally accepted accounting principles) earnings per share of $.28 for the full year of 2021 resulting in a valuation of 473x earnings. On non-GAAP 2022 earnings estimates, the valuation is 357x earnings. The company is nearing breakeven on a GAAP earnings basis which includes employee stock-based compensation expense. The company generated $86.7 million of free cash flow from operations in the first six months of 2021, evenly split between Q1 and Q2. Annualizing this figure produces a valuation of 262x free cash flow.

It is no secret that Datadog is performing well on the business front. The stagnation of the share price since October of 2020 prior to yesterday’s earnings report is due to its extreme valuation. With the breakout to new all-time highs yesterday, the question remains one of valuation and whether a new uptrend for the shares can be supported given the elevated valuation.

To put this in context, the question is whether the 7% increase in 2021’s full year revenue guidance and the implications for the long-term sustainable growth rate of Datadog is enough to produce upward momentum with the stock trading at 48x sales. History would suggest a low probability of meaningful upward momentum in the share price from these levels accompanied by an extremely elevated level of risk.

Technicals

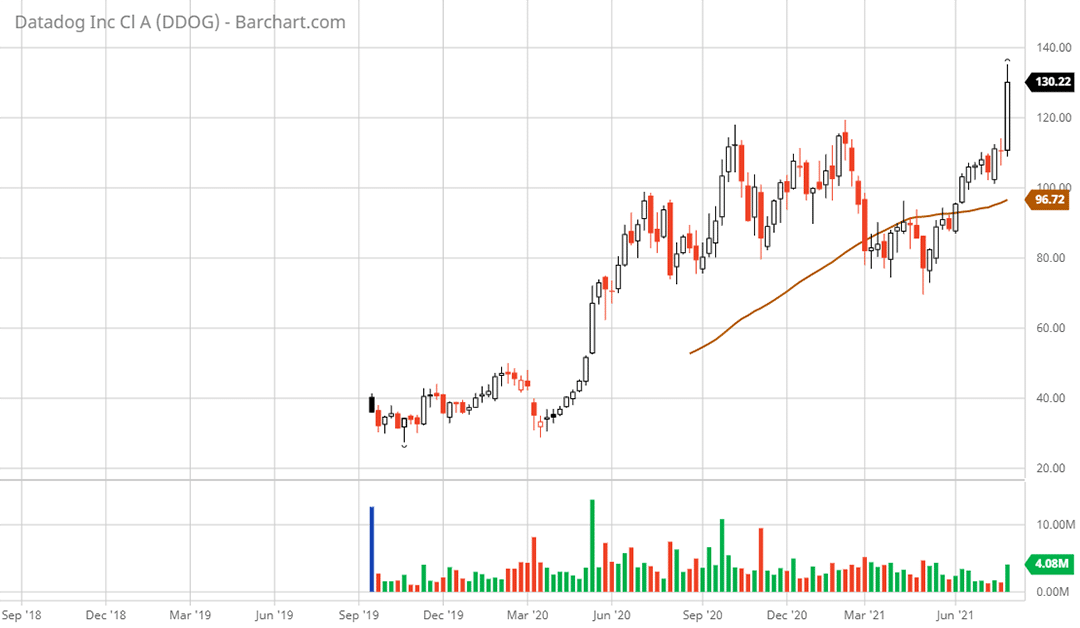

Technical backdrop: Datadog went public in September 2019 and therefore has a short trading history. The stock is breaking out to a new weekly closing high, surpassing the previous weekly high of $115 which was a double top level in October 2020 and February 2021. The 50-week moving average stands at $97 (brown line on the 3-year weekly chart) leaving the stock extended to the upside at current levels.

The prior weekly high of $115 is also the level of the gap higher on the Q2 earnings report as can be seen on the 1-year daily chart below. This is likely to serve as the first support level should the stock pull back. The 50-day moving average (brown line on the 1-year daily chart) is in the $104 area and the 200-day moving average (grey line on the 1-year daily chart) stands at $96. These levels have served as support zones during the sideways price movement following the October 2020 peak.

Technical resistance: There should be some resistance at the current level which is at an all-time high and was achieved on a large gap higher. Price gaps tend to get filled.

Technical support: $115, which is the prior weekly all-time high as well as the price at which the gap higher occurred. Next support levels are in the $100 to $105 range coinciding with the moving averages discussed above.

Price as of report date 8-6-21: $132

Datadog Investor Relations Website: Datadog Investor Relations

All data in this report is compiled from the Datadog investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.