Risk/Reward Rating: Neutral

3D Systems (3D) stock is up over 37% on its Q2 2021 earnings report and the continued turnaround execution under the new CEO, Dr. Jeffrey Graves. The company is a leader in additive manufacturing (3D printing). The industry has historically generated bouts of excitement followed by disappointment for investors as the real-world use cases for the technology have been slow to scale volume production and consistent growth. In the case of 3D Systems, under the new leadership the company has acknowledged these industry realities and is focusing its efforts on industry verticals that are more promising in the near term while offering pathways to sustainable growth.

The key to the turnaround plan is the reorganization of the company into a more focused industry-oriented business structure involving two business units: Healthcare and Industrial. While at the same time 3D has been selling off business units which are non-core to this higher margin, customer-oriented strategy. The divestitures include the sale of 3D’s On-Demand Parts business, which used a variety of manufacturing methods for more broad-based end markets, and Simbionix, a medical simulation business outside of the company’s core additive manufacturing focus. In each case, 3D faced more focused competitors and lower profit potential.

Once completed, the asset sales and renewed positive cash flow from operations are expected to create a strong financial position for 3D with $500 million of cash on the balance sheet and no debt. This strong financial position will provide the foundation for the next phase of the turnaround plan which is to invest in the future. Looking forward, the success of 3D Systems stock hinges on the capital allocation decisions that will be made with these funds. Based on the decisions and execution over the past year under the new CEO, there is reason for optimism.

Two recent acquisitions, Allevi and Additive Works, provide a taste for the capital reinvestment growth opportunities in front of 3D Systems. Allevi (in the Healthcare unit) has a market penetration in over 380 medical and pharmaceutical laboratories in more than forty countries and is a developer of bioprinting solutions including bioprinters, biomaterials, bioinks, and laboratory software. On the Industrial front, Additive Works provides manufacturing process optimization software which enables higher quality and efficiency in the 3D printing workflow.

Turning to the financials and valuation, things become trickier for 3D Systems stock. The company is currently trading at 88x 2021 non-GAAP (generally accepted accounting principles) earnings estimates and 92x 2022 non-GAAP estimates. These valuation multiples are extreme in a historical market context. It should be noted that the flat earnings expected in 2022 versus 2021 are impacted by the divestitures in 2021 discussed above and leave room for some upside surprise in 2022 if things go well. Excluding these divestiture effects, 92x earnings estimates remains extreme in an industry that is expected to grow 17% per year over the next five years. The industry growth rate may limit the size of any upside surprises in 2022 to compensate for the extraordinary valuation.

Given the improving fundamental outlook for 3D, opportunistically accumulating the shares would be the best approach for those wanting to participate in the growth of the 3D printing industry. The stock is incredibly volatile, as evidenced by the 37%+ spike today in response to the Q2 earnings report. This volatility creates difficulties but also works to the advantage of patient investors. Looking at the technical picture is required to formulate potential levels of opportunity.

Technicals

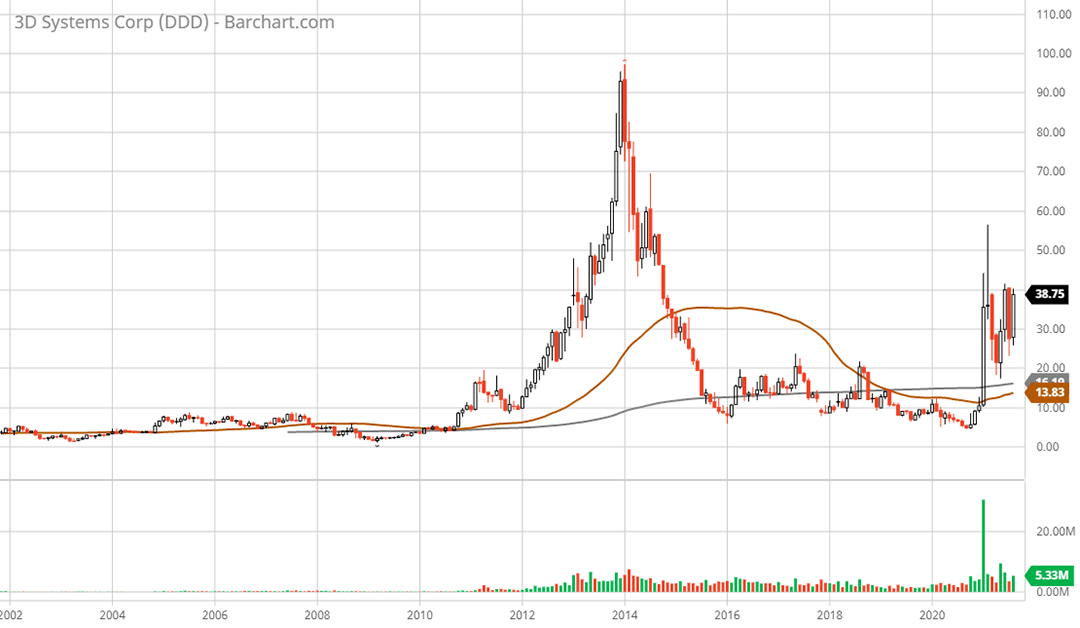

Technical backdrop: The long-term monthly chart below highlights the technical challenges that 3D Systems stock presents. The last major uptrend occurred from 2012 to 2014 culminating in a speculative blowoff top and subsequent crash, which erased all gains. The shares began the most recent uptrend in November of 2020 in the $5 area, with a speculative peak in February 2020 near $56. The reversals down from these speculative up moves are brutal and rapid. The selloff from this last peak ended at $17 in May 2020 which is near the 200-month moving average (grey line on the long-term monthly chart). Technical support is visible in the $29 area on the monthly chart.

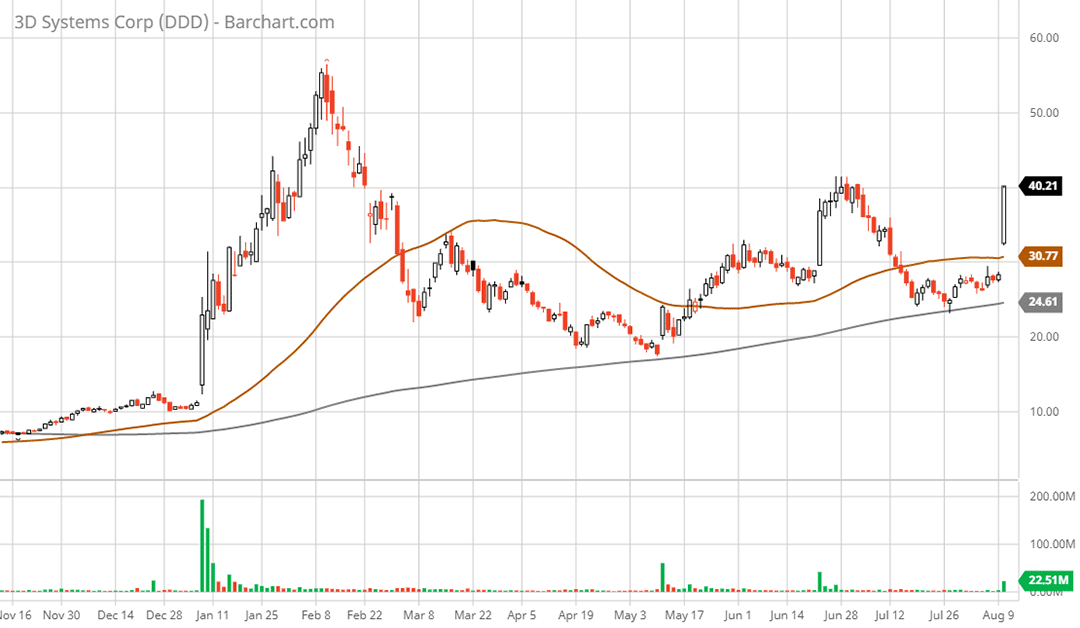

Zooming in to the daily chart, the bottom in May 2021 occurred at the 200-day moving average (grey line on the daily chart) which currently stands around $25. The 50-day moving average (brown line on the daily chart) is currently near $30 which aligns well with the support levels visible on the monthly chart. This level also aligns with the resistance level met in June of 2021. The zone near $30 appears to be a potential lower-risk entry point. The risk for 3D stock is that it follows the historic precedent of speculative blowoffs and crashes which would lower the support levels in another crash scenario. One must use the volatility to their advantage.

Technical resistance: $40 which is at current levels. This served as resistance at the top in June 2021. $50 would serve as next resistance which aligns with the peak in February 2021.

Technical support: The $30 to $32 range which aligns with several support levels outlined above and is in the area of the gap up on the open today after the Q2 earnings report. Next lower support is in the $25 area which is the 200-day moving average.

Price as of this report 8-10-21: $39.51

3D Systems Investor Relations Website: 3D Systems Investor Relations

All data in this report is compiled from the 3D Systems investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.