Risk/Reward Rating: Negative

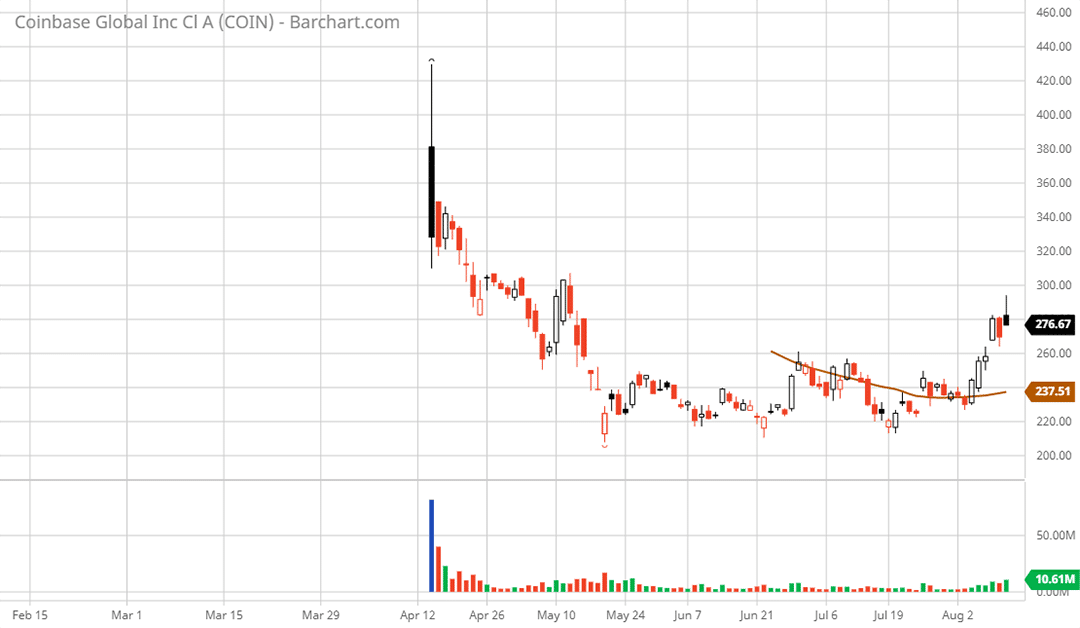

Coinbase stock was up over 7% this morning in response to its Q2 2021 earnings report which handily beat estimates. Furthermore, the stock was up 26% over just the past six trading days in anticipation of the results. Prior to this sprint upward, the stock had been testing its lowest trading range since the IPO in April of 2021.

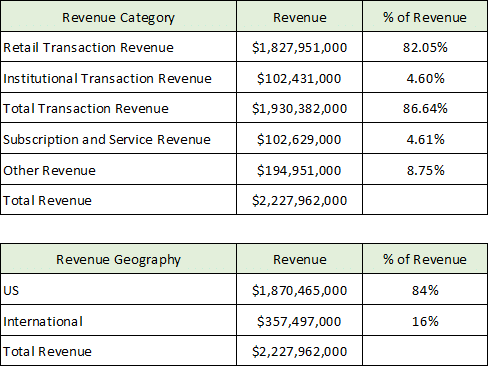

The company reported pre-tax earnings of $869 million in Q2 2021 and $1.865 billion for the first six months of the year. As a percentage of revenue, these are extraordinary margins of 39% and 46% respectively. The key to Coinbase’s elevated profitability is the US retail investor, as can be seen in the following tables.

The Coinbase business model is heavily dependent on US retail investors trading cryptocurrencies, with 82% of revenue coming from retail investors and 84% of revenue being generated in the US. This reliance on retail trading creates substantial risk for the business as retail trading volume in traditional markets (such as stocks and bonds) tends to evaporate during downward trending markets. As a result, if cryptocurrency prices continue to trend downward as they have since the peak in April 2021, the primary source of Coinbase’s revenue could dry up abruptly.

This risk may be materializing as the company is forecasting lower trading volumes in Q3 2021 compared to Q2. Additionally, client assets on Coinbase’s platform declined from $223 billion at the end of Q1 2021 to $180 billion at the end of Q2 2021. The company was attracting new users at a rapid clip in Q2 so the decline in customer assets is attributable to the crash in cryptocurrency prices in the second quarter. Many of their new customers are likely grappling with losses as things stand.

There are additional risks on the horizon for the Coinbase business model. As the retail brokerage industry has shown with Robinhood and $0 commissions, trading fees and commissions are likely to gravitate towards the institutional fee structure as competition intensifies for these highly profitable retail trades. This is amplified by the fact that the fintech industry is becoming one of the most crowded and competitive industries in the world not to mention the plethora of large, traditional financial institutions that are eyeing up the space.

Regulatory risk is now front and center as well. The cryptocurrency industry has been unregulated up to this point. Governments around the world have made it clear that regulation is coming which will place further pressure on the Coinbase business model. Based on regulation of the investment industry, the regulatory action is likely to be tilted toward protecting retail and unsophisticated investors. Since this segment accounts for the majority of Coinbase’s revenue, the risks to Coinbase’s outsized profits are material.

Turning to the valuation, Coinbase is trading at 32x 2021 earnings estimates and 52x 2022 estimates. The consensus estimates of a material decline in earnings in 2022 is likely due to the risks outlined above being factored into estimates. Annualizing the first half revenue run rate, Coinbase is trading at 9x sales using the diluted share count as of Q2. The valuation is not extraordinary when compared to growth companies today which warrants placing Coinbase on a potential buy watchlist. Once the cryptocurrency frenzy of the first six months of 2021 cools down and laws and regulations are enforced, Coinbase’s sustainable business model and growth trajectory will become more visible.

Red Flags

In Coinbase’s recently filed second quarter financial report (10-Q), the company stated that they have 68 million verified users as of Q2 2021. This is curious given that the CEO, Brian Armstrong, tweeted that the number of Americans that are involved in cryptocurrencies is somewhere between 10 and 50 million. The tweet was sent out in protest of the cryptocurrency provisions in the US infrastructure bill this past week. The broad language in the bill will allow the US government to crackdown on the opaque nature of the cryptocurrency industry and enforce compliance with laws and regulations with which all other economic sectors must comply.

The red flag in this instance revolves around what is known as KYC (Know Your Customer) in the financial industry. In general, what KYC means is that firms dealing in money management including the dealing and transferring of money, must know their customers’ identity in order to comply with laws and regulations. KYC is designed to prevent all manner of crimes such as tax avoidance, money laundering, drug trafficking, human trafficking, and the financing of terrorism to name a few.

If Coinbase has 68 million verified users, and if the company conducts KYC, the CEO should know their user’s identities and countries of origin. The CEO gave a range of 10 to 50 million Americans involved in cryptocurrency, in his response to US Senators regarding the infrastructure bill. This statement would imply that Coinbase can only verify a maximum of 10 million Americans on its platform. If it were a higher number, logically speaking, he would have stated it as his low estimate.

As mentioned above, the company receives 82% of its revenue from retail customers trading cryptocurrencies and 84% of its total revenue is derived from the United States. It should be noted that retail trading accounts for only 31% of trading volume. Institutions account for 69% of trading volume while contributing only 4.6% of total revenue. This raises the question, who are the other 50 million plus verified users on the Coinbase platform?

Another red flag involves the following statement in the company’s financial filings with the SEC: “In May 2020, the Company became a remote-first company. Accordingly, the Company does not maintain a headquarters.” When a company states it has no headquarters, that in and of itself is a red flag no matter the nature of its business.

Technicals

Technical backdrop: After reaching a high of $430 on the day of its IPO, April 14, 2021, Coinbase stock collapsed to a low of $208 on May 19, 2021. The stock then entered a sideways trading range for over two months before breaking out above resistance at $240 over the past six days, reaching a peak this morning at $294. As things stand, the stock is extended to the upside given this six-day burst with the 50-day moving average (brown line on the daily chart) standing at $237. Given the short trading history and highly uncertain business as discussed above, the technical picture is limited at this point.

Technical resistance: The $292 area should offer resistance as it was a brief support zone in the crash following the IPO. $320 would be the next similar level.

Technical support: The $255 area is the next lower support area followed by the $240 zone. The $220 area was the lowest weekly close and would be the final support area before a test of the all-time lows near $200.

Price as of report date 8-11-21: $289

Coinbase Global Investor Relations Website: Coinbase Global Investor Relations

All data in this report is compiled from the Coinbase Global investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.