I am assigning Coinbase Global Inc. (NASDAQ: COIN) a negative risk/reward rating based on the volatility of its primary revenue source, near term regulatory risk, and red flags surrounding corporate governance. That being said, Coinbase should be on the watchlist of all growth investors given the large unquantifiable upside potential. In this article I outline the primary risks by walking through the company’s recent financial reports while highlighting potential opportunities.

Risk/Reward Rating: Negative

Coinbase posted its second consecutive quarter of over $1 billion of adjusted EBITDA (earnings before interest taxes depreciation and amortization) in Q2 2021 on August 11. The second blowout quarter in a row sent the shares up 10% intraday before reversing the majority of the gains and closing up 3.7%. The stock was up 26% over the six days preceding the report in anticipation of the strong numbers.

The first half of 2021 was a breakout period for Coinbase as it cashed in on US retail investors’ renewed interest in cryptocurrencies as prices skyrocketed. Sales grew an incredible 916% in the first half of 2021 compared to the same period in 2020. The spike in retail interest is following a well-worn road in the history of investment markets. When prices rise substantially over a short period of time, retail investor demand tends to follow prices into the peak. In fact, Coinbase’s dependence on retail cryptocurrency trading for the majority of its revenue is cause for much consternation. It remains the primary issue facing prospective Coinbase investors.

Revenue Concentration

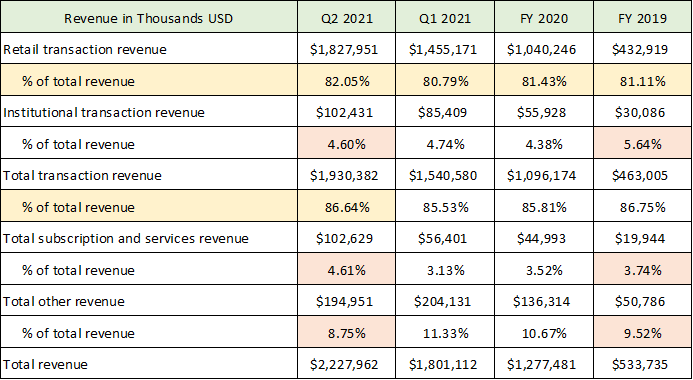

The Coinbase business model is heavily dependent on cryptocurrency trading volume and the US retail investor in particular, as can be seen in the following table. The table breaks out Coinbase’s revenue reporting segments for the first two quarters of 2021 and the full year of 2020 and 2019. The data was compiled from the company’s Q2 2021-10Q, Q1 2021 10-Q, and S-1 filed with the SEC (FY = full year).

Source: Created by Brian Kapp, stoxdox

I have highlighted the essential information. Coinbase received 82% of its total revenue in Q2 2021 from retail investor transactions in cryptocurrency (first yellow shaded row). This is in line with its historical business model with retail trading accounting for over 80% of revenue in all periods. When institutional trading is added, 87% of Coinbase’s total revenue is dependent on cryptocurrency trading volumes, which have historically been very volatile.

Given the extreme volatility in cryptocurrency trading volumes and Coinbase’s reliance on them, the company’s valuation potential will be heavily dependent on its ability to diversify away from this revenue model. The key revenue category to track going forward is the subscription and services category which includes the majority of the non-trading revenue. This segment accounts for only 4.6% of sales and is little changed over the years. The category also includes lower margin non-subscription revenue. As a result, the most important revenue stream for Coinbase in the future is less than 4.6% of its total revenue today.

Transaction-Based Business Model

This reliance on retail trading creates substantial risk for the Coinbase business model as retail trading volume in traditional markets (such as stocks and bonds) tends to evaporate during downward trending markets. If cryptocurrency prices continue to trend downward as they have since the peak in April 2021, the primary source of Coinbase’s revenue could dry up abruptly.

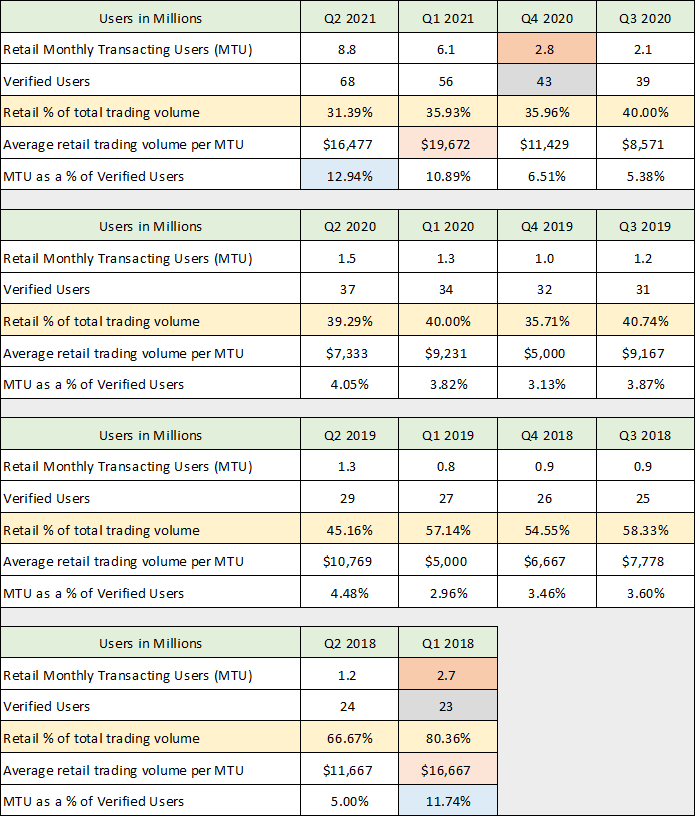

The fragility of the transaction-based revenue model is evident in looking back at Coinbase’s key performance indicators in recent years. I will focus on the retail activity levels since they account for 82% of total sales (institutional transaction revenue accounts for only 4.6% of sales). The following table was compiled from the same three SEC documents noted above.

Source: Created by Brian Kapp, stoxdox

I have used several highlighting colors to make it easier to compare data across time given we are covering fourteen quarters of information. The most important data point for retail trading activity is Monthly Transacting Users (MTU) as this is the best measure of retail engagement on the Coinbase platform each quarter. The two dark orange highlighted cells compare the number of transacting retail users on the Coinbase platform in Q1 2018 and Q4 2020. Q4 2020 is the first quarter that the number of MTU surpassed the Q1 2018 number of 2.7 million, with 2.8 million users. In fact, it took the frenzied cryptocurrency price moves of Q1 2021 for the number of users to grow materially since Q1 2018. It should be noted that Q4 2017 into Q1 2018 was the prior cryptocurrency price peak which was followed by a 70%+ price crash across the space.

The average retail trading volume per MTU in Q1 2018 was not surpassed until Q1 2021 (light orange shaded cells). This metric is the total quarterly retail trading volume (not shown above) divided by the number of MTU in the quarter. While not perfect, it is a rough approximation of the average trading volume per user each quarter.

Of particular note is the number of Verified Users on the Coinbase platform over these fourteen quarters. Coinbase describes Verified Users as the top of its sales funnel in SEC filings. Verified Users have not had their identity verified necessarily. Many have just provided Coinbase information such as an email address or a phone number to establish an account on the platform. This number grew from 23 million in Q1 2018 to 43 million in Q4 2020 (dark grey shaded cells). At the same time, Monthly Transacting Users were largely unchanged near 2.7 million as discussed above. This suggests caution in interpreting the value of Coinbase’s reported Verified Users.

It is interesting that the Monthly Transacting Users as a percentage of Verified Users in Q1 2018 at 11.74% was finally surpassed in Q2 2021 at 12.94% (blue highlighted cells). This will be an important data point to track as it speaks to the value of the Verified Users sales pipeline. It may also be a good indicator of the percentage of the active investor population that will materially engage and trade in the cryptocurrency market.

An important trend for Coinbase is retail trading volume as a percentage of total trading volume. I have highlighted this information in yellow across all time frames. Note that it has been trending materially lower consistently over time. Retail trading has declined from 80% of the total in Q1 2018 to only 31% in Q2 2021 (a new low).

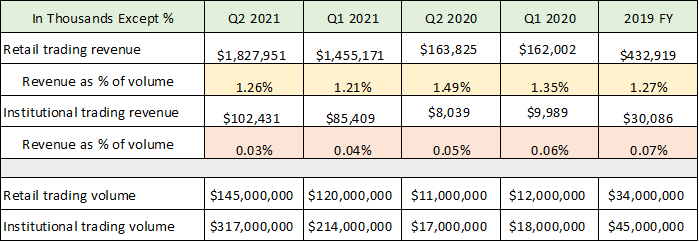

The dynamic at play is that institutional trading volume has come to dominate the platform, while the retail client base continues to provide over 80% of the company’s revenue. This highlights a potential risk for Coinbase’s business model as the information asymmetry and pricing differential between retail and institutional investors is highly skewed in favor of institutional investors. The pricing trend for the two client groups is highlighted in the following table compiled from the same three SEC filings noted earlier.

Source: Created by Brian Kapp, stoxdox

Coinbase charged retail traders 1.26% of their transaction volume on average in Q2 2021 (yellow shaded row). This is down from 1.49% in Q2 2020 but little changed from 2019. The institutional side of the business pays next to nothing to trade and is down materially from 0.07% in 2019 to 0.03% of transaction volume in Q2 2021. A key risk factor to monitor going forward is the take rate that Coinbase extracts from retail trading volumes. As competition intensifies for these high margin retail trades, Coinbase may face increasing pricing pressure in this key client segment.

Profitability

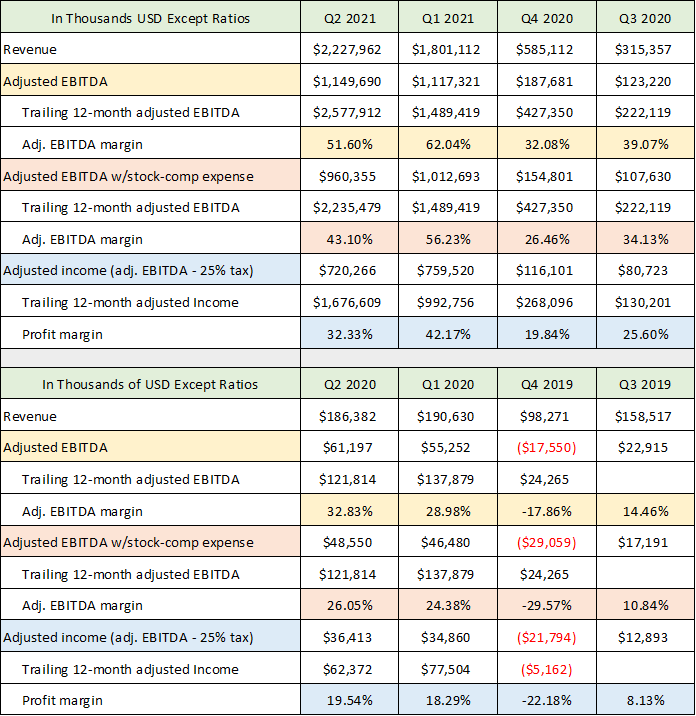

Coinbase has been able to generate terrific operating leverage on the rapid revenue growth generated from retail investors. The company reports adjusted EBITDA as an approximation of its operating earnings before tax. In the case of Coinbase, I believe this is a good measure of the company’s earnings power, with the possible exception of stock-based compensation expense (which I add back in a scenario below). The table was compiled from the three SEC filings with which we have been working.

Source: Created by Brian Kapp, stoxdox

The company reported adjusted EBITDA is highlighted in yellow. I then add back stock-based compensation expense as it is an expense just paid for with stock rather than cash (orange highlighted rows). Finally, I adjust this figure to arrive at an adjusted net income estimate by subtracting a 25% tax rate (shaded in blue). The key rows have been fully highlighted.

Coinbase is generating incredible operating margins. In Q2 2021, the profit margin ranged from 32% after tax (blue highlighted row) to 52% on an adjusted EBITDA basis (yellow highlighted row). These are extraordinary numbers. Under a more stable revenue generation business model, Coinbase’s profit margins would engender a high-end premium valuation. Using the data in the above table, I will now turn to the valuation of Coinbase.

Valuation

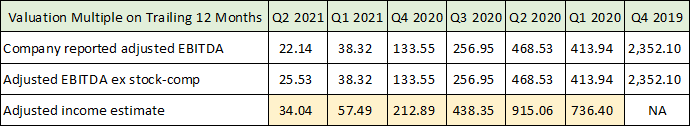

Coinbase has two opposing forces tugging at its valuation. The negative force (lower valuation) is the volatility of the company’s primary revenue source, retail cryptocurrency trading volume. On the positive side (higher valuation) is the incredible operating leverage and profit margins Coinbase has generated on this trading activity. The following table displays Coinbase’s current valuation on the three measurements of profitability from the previous table, using the trailing 12-month profitability figures for each.

Source: Created by Brian Kapp, stoxdox

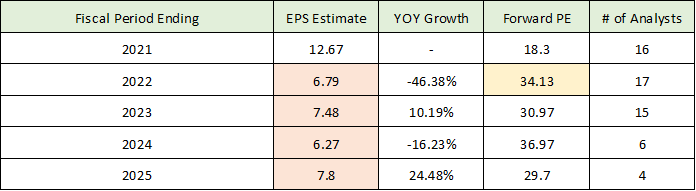

I have elected to focus on the adjusted income estimate (yellow highlighted row). This is the company’s adjusted EBITDA figure with stock-based compensation expense added back then applying a 25% tax rate. The company is currently trading at 34x this estimate. This is near the current range of the market averages which trade from 22x to 32x 2021 earnings estimates. Given that Coinbase has been growing much more rapidly than most, the price reflects the markets view that the recent retail trading activity is not sustainable. The following consensus earnings estimates from Seeking Alpha support this view as the forecasts are for a 46% earnings decline in 2022 followed by stagnation out to 2025.

Source: Created by Brian Kapp, stoxdox

Please note that there is a large upward distortion in Coinbase’s 2021 earnings due to a one-time tax benefit. The 2022 consensus estimate (the first cell highlighted in orange) is in line with the trailing 12-month adjusted income estimate as of Q2 2021 from the preceding two tables. I have highlighted the 2022 PE (price-to-earnings) in yellow as it confirms this and aligns very well with the adjusted income multiple as of Q2 2021 (highlighted in the previous table). On an earnings multiple basis, Coinbase is reasonably valued. On a price-to-sales basis, Coinbase is trading 12x trailing twelve-month sales. This is elevated from a historical market perspective. The key question remains: what is a sustainable level of sales going forward given the April 2021 blowoff top in the cryptocurrency markets? Retail traders have historically traded less in most financial markets when large downside volatility becomes the trend.

Sales Risk

The near-term risk of a revenue slowdown may be materializing. As per Coinbase’s recent earning release and conference call, the company is forecasting lower trading volumes in Q3 2021 compared to Q2 2021. Additionally, client assets on Coinbase’s platform declined from $223 billion at the end of Q1 2021 to $180 billion at the end of Q2 2021. The company was attracting new users and assets at a rapid clip in Q2. As a result, the decline in customer assets is likely attributable to the crash in cryptocurrency prices in the second quarter. Many new customers are likely grappling with losses.

There are additional risks on the horizon for the Coinbase business model. As the retail brokerage industry has shown with Robinhood (NASDAQ:HOOD) and $0 commissions, trading fees and commissions are likely to gravitate towards the institutional fee structure as competition intensifies for these highly profitable retail trades. In fact, more retail traders transacted in cryptocurrency on Robinhood’s platform in Q2 2021 than on the Coinbase platform (based on its Monthly Transacting Users statistics).

The revenue risk is amplified by the fact that the fintech industry is becoming one of the most crowded and competitive industries in the world. Not to mention the plethora of large, traditional financial institutions that are eyeing up the space. Economic history suggests that Coinbase’s outsized retail trading profits will be competed away to some extent, thus placing additional pressure on sales.

Regulatory Risk

Regulatory risk is now front and center as well. The cryptocurrency industry has been unregulated up to this point. Governments around the world have made it clear that regulation is coming which will place further pressure on the Coinbase business model. Based on regulation of the investment industry, the regulatory action is likely to be tilted toward protecting retail and unsophisticated investors. Since this segment accounts for the majority of Coinbase’s revenue, the risks to Coinbase’s outsized profits are material.

The intensifying regulatory risk was evidenced by the 8-K SEC filing on September 8, 2021 in which Coinbase announced that it received a “Wells Notice” from the Staff at the SEC. The notice was to inform Coinbase that the Staff would recommend enforcement action against Coinbase’s Lend program which the company announced on June 29, 2021. Essentially, many things in the crypto industry qualify as securities and will need to be properly registered and regulated as such. This is only the beginning of the regulatory crackdown which is a substantial risk to Coinbase’s business model, cost structure, and elevated profit margins.

Red Flags

As covered earlier, Coinbase claims 68 million Verified Users as of Q2 2021. CEO, Brian Armstrong, recently tweeted that the number of Americans that are involved in cryptocurrencies is somewhere between 10 and 50 million. The tweet was sent out in protest of the cryptocurrency provisions in the recent US infrastructure bill. The broad language in the bill would allow the US government to crackdown on the opaque nature of the cryptocurrency industry and enforce compliance with laws and regulations with which all other economic sectors must comply.

The red flag in this instance revolves around what is known as KYC (Know Your Customer) in the financial industry. In general, what KYC means is that firms dealing in money management including the dealing and transferring of money, must know their customers’ identity in order to comply with laws and regulations. KYC is designed to prevent all manner of crimes such as tax avoidance, money laundering, drug trafficking, human trafficking, and the financing of terrorism to name a few.

With 68 million Verified Users and 8.8 million Monthly Transacting Users, if the company conducts KYC, Coinbase should know their user’s identities and countries of origin. The CEO’s range of 10 million to 50 million Americans involved in cryptocurrencies implies Coinbase can identify up to 10 million Americans on its platform. Otherwise, the low end of his estimate would have been higher. This raises the question: who are the other 58 million plus Verified Users on the Coinbase platform?

Another red flag involves the following statement in the company’s financial filings with the SEC: “In May 2020, the Company became a remote-first company. Accordingly, the Company does not maintain a headquarters.” When a company states it has no headquarters, that in and of itself is a red flag no matter the nature of its business.

Technicals

Coinbase came public on April 14, 2021 and reached a high of $430 on its first day. The stock then collapsed 52% to a low of $208 on May 19, 2021. Ever since the stock has been trying to find a bottom and build a base. While the short trading history limits the use of technical analysis, the sideways trading action to date has carved out three distinct support and resistance levels as shown by the horizontal lines on the following chart.

Coinbase 6-month daily chart. Created by Brian Kapp using a chart from Barchart.com

The blue line at $280 has served as a rejection level on each rally attempt and is likely to continue to be stiff resistance. Another resistance zone has formed at the purple line near $258. This too is likely to offer more resistance going forward. At the moment, Coinbase is closing in on a key support area near the green line at $220. This has held as the lower support zone for Coinbase’s short trading history and should be firm support down to the all-time low area near $200. A break beneath $200 would be worrisome.

Summary

Coinbase should be placed high on the watchlist of all growth investors. While the valuation is quite reasonable relative to most of the ultra-high valuation growth stocks today, the risks are substantial in the near term. The unfolding slowdown in cryptocurrency trading volumes could be material which would put incredible pressure on Coinbase’s revenue and profitability. This pressure would then be amplified in 2022 as Coinbase will face very tough comparisons to the 916% revenue growth achieved so far in 2021. The intensifying competition and regulatory crackdown add an additional layer of unquantifiable risk to the equation. Until there is more clarity on the sustainability of recent revenue trends, the $200 area looks to be the beginning of an accumulation zone.

Price as of report date 9-29-21: $230

Coinbase Global Investor Relations Website: Coinbase Global Investor Relations