Risk/Reward Rating: Neutral

Clorox stock was down 11% this morning after reporting disappointing fourth quarter 2021 earnings (the 2021 fiscal year ended 6-30-21) and providing guidance for 2022 that is well below expectations. The guidance for the new fiscal 2022 year is for earnings to be in the range of $5.05 to $5.35 per share on a GAAP basis (generally accepted accounting principles) and $5.40 to $5.70 on a non-GAAP basis. This guidance is 26% below the current Wall Street non-GAAP earnings estimate of $7.49 per share.

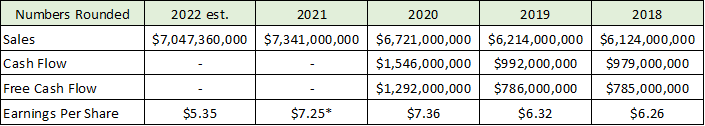

When looking at the new 2022 Clorox guidance, the $5.35 per share high-end GAAP earnings estimate is the best number to use when computing the price to earnings ratio. It is close to the low end of the non-GAAP guidance and should be achievable on a GAAP basis. The non-GAAP guidance excludes an increase in planned technology investments, which are best viewed as actual expenses. Given the speed of technology changes, it is more prudent to be conservative and assume the technology expenses are actual expenses rather than unusual one-off expenditures. The current valuation stands at 30x this $5.35 per share earnings estimate for 2022.

Given that the COVID pandemic caused extreme demand conditions throughout calendar year 2020 (fiscal years 2020 and 2021 for Clorox), it is best to use 2019 as the base year when viewing Clorox’s guidance for fiscal year 2022.

The 2021 cash flow detail is not yet available and the $7.25 earnings per share in 2021 is a non-GAAP figure which excluded a large one-time write-off (see table). The 2019 and 2018 cash flow and earnings figures are comparable and represent a good baseline. According to these figures, Clorox is valued at 26x 2019 earnings and free cash flow. The 2022 sales estimate represents a 13% increase over 2019 which is inline with the company’s long-term sales growth estimate of 3% to 5% per year. On a sales basis, the current valuation is just under 3x expected sales. Overall, the valuation is high compared to historical market norms.

The Clorox product lineup is broad and diversified across consumer staples. A sampling of the product range includes disinfectants, water filtration, trash bags, cat litter, salad dressing, and beauty products. As a result of this broad portfolio, Clorox will closely track general economic trends.

The primary driver of the reduced profitability is the rapid increase in operating expenses. These include increases in supply chain expenses such as transportation and raw materials. Other material increases include technology expenses which will amount to a $500 million increase over the next five years. Increasing labor expenses are another factor albeit smaller. The company is hopeful these pressures will begin to ease as we enter calendar year 2022. However, many of the inflationary expense trends appear to be stickier going forward, similar to the conditions in the first decade of the 2000’s (rising inflation and rising interest rates).

Technicals

Technical backdrop: Clorox stock has historically moved in decade-long trends. As can be seen on the long-term monthly chart, Clorox was in a strong uptrend in the 1990’s, peaking in 1999. The pattern of the 1990’s is similar to the most recent 10-year period with a blow-off peak in August of 2020 in the $240 area. Clorox did not surpass its prior high in 1999 until 2012 reflecting a painful decade for buy and hold investors. The stock is currently testing support at the 50-month moving average (brown line on the long-term monthly chart). This has provided support during long uptrends and has failed during corrective periods. The next lower monthly support is in the $140 area. The 200-month moving average (grey line on the long-term monthly chart) resides in the $100 area which is near the support levels found in 2016 and again in 2018.

Looking at the daily chart over the past two years, Clorox has been locked in a downtrend for the past year after the COVID rally into August of 2020. This was due to Clorox being a disinfectant demand play in addition to a low interest rate play as a result of its attractive dividend yield, currently at 2.86%. With the 11% gap lower today on the earnings report, Clorox broke beneath the 50-day moving average (brown line on the 2-year daily chart). This gap down from the $177 area is likely to provide stiff resistance going forward due to the reduced profitability and high valuation in place. $177 was also the failed support level in March 2021 and May of 2021. The $140 to $150 area is the next lower support level on the daily chart which aligns with levels that preceded the COVID-inspired rally.

Technical resistance: Current level up to $177

Technical support: $140 to $150. Next lower support is in the $115 area which can’t be ruled out.

Price as of report date 8-3-21: $163.24

Clorox Investor Relations Website: Clorox Investor Relations

All data in this report is compiled from the Clorox investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.