Risk/Reward Rating: Positive

Chesapeake Energy stock exited bankruptcy in February of 2021. The primary risk in the energy sector has been excessive debt levels combined with weak energy prices. New Chesapeake shareholders will find that each of these risks are in the rearview mirror.

The bankruptcy process has placed Chesapeake’s balance sheet as one of the least risky and strongest in the industry. Debt levels have been wiped out and the company now has net debt of only 0.6x EBITDAX (earnings before Interest, taxes, depreciation (or depletion), amortization, and exploration expense).

The company is projecting free cash flow generation of $3 billion over the next five years. This would equate to a 52% yield over five years or 10% per year on average at the current share price. With a 2.5% dividend yield, there is ample room to increase the dividend payout or reinvest for growth. In the current low interest rate environment, featuring 10-year US Treasury bonds at 1.5% and junk bonds below 4%, this 10% yield and low financial risk is an attractive alternative.

Chesapeake’s oil & gas assets are high quality within leading US shale basins and are heavily weighted towards natural gas. Many years of industry volatility and undisciplined investment appear solidly in the past setting up for a brighter future. The natural gas outlook is particularly bright as the electrification of transportation increases demand from utilities as does the onshoring of industrial activity and supply chains. The trend toward extreme weather should also support natural gas prices via baseload heating and cooling needs.

Valuation: 8.19x 2021 earnings estimates and 12.44x 2022 earnings estimates. The valuation is in line with the sector and is a fraction of the current stock and bond market averages. The low relative valuation suggests there is little optimism priced into the shares leaving room for positive upside surprises.

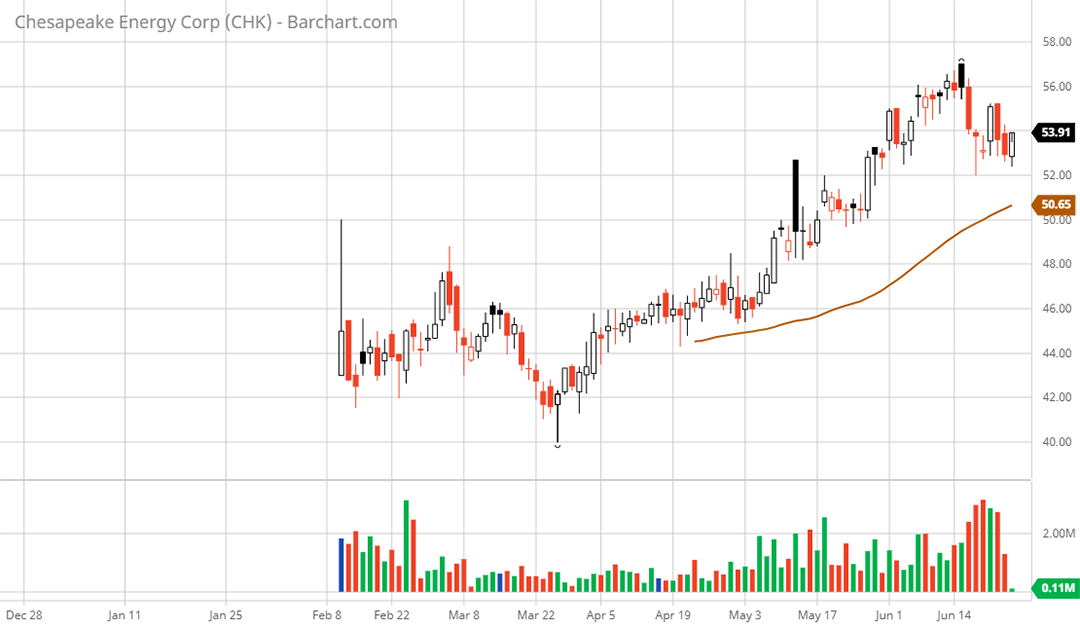

Technical resistance: None visible given the short trading history post-bankruptcy.

Technical support: $46 to $48 area.

Price as of report date 6-24-21: $53

Chesapeake Energy Investor Relations Website: Chesapeake Energy Investor Relations