I am assigning BWX Technologies (NYSE:BWXT) a positive risk/reward rating based on its wide competitive moat, its visibility into the future as a mission critical supplier, its discounted valuation, and its leading position at the forefront of nuclear technology.

Risk/Reward Rating: Positive

BWX Technologies, commonly referred to as BWXT, offers an enticing long-term investment in many of the most exciting growth opportunities while operating behind a wide competitive moat. The opportunity set ranges from zero-emissions distributed energy solutions and nuclear propulsion to nuclear medicine. Nuclear energy is a foundational technology and a prerequisite for achieving sustainable and reliable decarbonization at scale on earth over the long term.

Looking to space, nuclear energy and propulsion are the most realistic and reliable solution to achieve permanent human settlement throughout the solar system. In the healthcare realm, nuclear medicine enables unprecedented diagnostic capabilities and personalized therapeutics. BWXT’s nuclear expertise opens the door to creating and supplying sophisticated and disruptive targeted therapeutics.

The Moat: Nuclear Operations Group

BWXT is a specialty manufacturer of nuclear components, a developer of nuclear technologies, and a nuclear service provider with an operating history of more than 100 years. The company’s largest business segment designs, engineers, and manufactures precision naval nuclear components, reactors, and nuclear fuel for the US government. In fact, BWXT is the only manufacturer of nuclear reactors and fuel for the US Navy. As a result, BWX Technologies is a mission critical company for the US government. The following images are from BWXT’s investor day presentation on November 16, 2021. They demonstrate the visibility into long-term demand resulting from this mission critical, sole supplier status. Please note that all similar images throughout this article are from the same investor day presentation.

Source: BWXT’s investor day presentation

In the first image, you will notice that BWXT has demand visibility out to 2049 for its three active Navy shipbuilding platforms. The number of companies in the world with this type of visibility is exceedingly small. While Navy schedules are not etched in stone, the above timeline is highly likely to be a good approximation of the future given the planning horizons involved, which is displayed in the second image. Please note that the build time for each ship is between five and eight years. Additionally, these programs are critical to national security which supports a high confidence level in the visible demand. This segment accounts for 76% of total revenue.

There is additional naval nuclear upside potential with US allies that is not currently factored into BWXT’s financial forecasts. For example, AUKUS is a trilateral security pact between Australia, the United Kingdom, and the United States for the Indo-Pacific region. The agreement was announced on September 15, 2021, and entails the US and the UK working with Australia to acquire nuclear-powered submarines. This agreement aligns perfectly with BWXT’s core US naval capabilities and may lead to upside surprises in its core business through the end of the decade. Given the unfolding multipolar world and the increasing tension and competition with China and Russia, BWXT’s prospects for long-term growth in its core defense business look excellent.

The Moat: Nuclear Power Group

On the commercial front, BWX Technologies is a leading supplier of nuclear fuel, fuel handling systems, tooling delivery systems, nuclear-grade materials, precisely machined components, and related services for CANDU nuclear power plants. CANDU stands for Canada Deuterium Uranium and is a nuclear reactor design used in Canada since the 1950s. Ontario Power Generation and Bruce Power are BWXT’s customers in this market.

The moat in the CANDU market emanates from BWXT being the only North American designer and manufacturer of large component nuclear equipment. Like the US Navy example, BWXT is the sole supplier of important components and know-how to the CANDU market and is the number one supplier overall. Additionally, BWXT is one of only two manufacturers of fuel in the Canadian market. These historical moats are likely to grow wider over time as a result of increasing global supply chain constraints, growing global demand for nuclear components, and national security concerns. The following slide breaks out the CANDU market opportunity.

Source: BWXT’s investor day presentation

The two revenue categories in the CANDU market are recurring revenue and life extension work. Here again BWXT has excellent sales visibility with 40+ years of recurring revenue and 10+ years for power plant life extension projects. This segment produces 19% of total revenue or roughly $400 million, with the CANDU market accounting for 88% of the segment total. The remaining 12% of sales in this segment is produced by the rapidly growing nuclear medicine group which remains in its infancy.

It should be noted that the Canadian government plans to have the first advanced SMR or Small Modular Reactor connected to the grid by 2028. Small modular reactors are one of the most exciting growth areas for BWXT looking into the future. The company’s expertise and 60 years of experience in the Canadian nuclear power industry are likely to serve it well when competing for next-generation commercial nuclear power growth opportunities.

The BWXT Investment Case

Before turning to BWXT’s exciting growth opportunities, it is essential to establish the baseline performance of the core BWXT business. This is important because the investment case for BWXT revolves around two axes. On the first axis is the value of BWXT’s core, wide-moat businesses outlined above.

The second axis is the incredible long-term opportunity set of disruptive growth vectors in the broad application of nuclear technology. Given the intense regulation and government oversight surrounding nuclear technology, the growth opportunities available to BWXT are by definition exceptionally long cycle in nature. What I mean by this is that the seeds of disruption are planted decades in advance of harvesting the growth opportunities.

The longer timeline for nuclear technology is a disadvantage compared to many disruptive growth investment opportunities today. For example, the plethora of information technology companies that have captured the attention of today’s growth investors are capable of materializing growth in a condensed period of time. As a result, growth investors have the potential for a rapid return on their investment. This rapid return has been on full display in recent years as the prices of these investment opportunities have skyrocketed taking their valuations to historically extreme levels.

While this is a material advantage from a short-term investment perspective, it is also a long-term weakness. This is because a true competitive moat surrounding much of today’s popular growth investments simply does not exist. What many growth investors view as a competitive moat is more often than not a first-mover advantage or some other short-term tactical advantage. Due to this, the rapid growth experienced by most companies is quickly competed away as new entrants easily enter the market. The lack of a true competitive moat combined with extreme valuations transform many of today’s perceived secular growth opportunities into pure trading opportunities.

BWXT is a unique disruptive growth opportunity in that the disadvantage of exceedingly long innovation cycles with heavy regulation and intellectual capital requirements is also the greatest advantage long term. As a result, the nuclear technology industry is conducive to sustainable competitive advantages with an unusually wide moat.

Core Financial Performance

The core business of BWXT can be thought of as a utility in many respects. In this sense, it is both a defense and energy utility with 70% of its revenue coming from the highest quality customer in the world, the US government. Canadian utility customers supply the majority of the remaining revenue. The mission critical nature of BWXT’s business combined with incredibly high-quality customers renders it a utility-like investment with unusually attractive call options on disruptive growth.

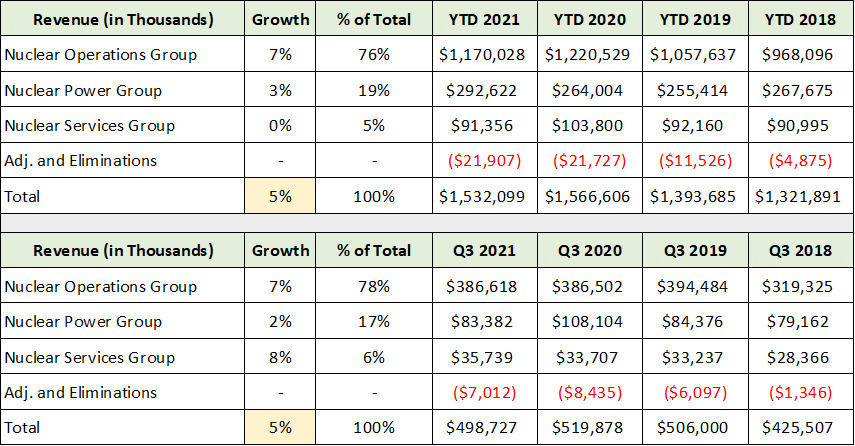

In fact, the financial performance of the core business resembles that of a utility. The following table was compiled from BWXT’s Q3 2021 10-Q and Q3 2019 10-Q filed with the SEC. The top section displays the total sales performance through the first nine months of each year while the lower section depicts the Q3 performance for each year.

Source: Created by Brian Kapp, stoxdox

I have highlighted in yellow the 3-year annualized growth rate for the year-to-date performance through Q3 2021 as well as the growth rate in Q3. The revenue growth rate of BWXT is steady at 5%. While there is some volatility from one quarter to the next in each segment, it smooths out quickly given the utility-like products and services provided by BWXT.

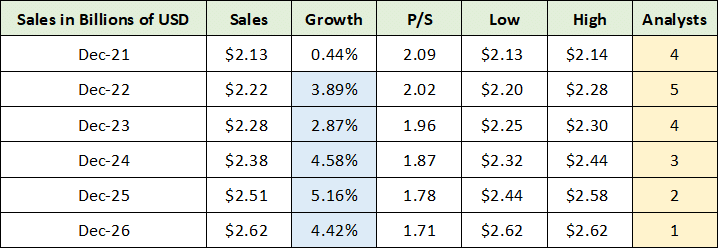

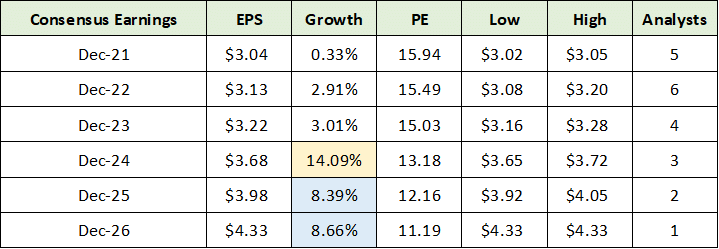

It should be noted that the consensus analyst forecast is for 4% annual sales growth for the five years through 2026. This is in line with recent history and largely reflects a continuation of the existing trajectory for the company’s current business lines. These estimates are in line with the company’s guidance and are shown in the table below compiled from Seeking Alpha.

Source: Seeking Alpha. Created by Brian Kapp, stoxdox

Please note the consistent revenue growth forecast highlighted in blue. These forecasts are very much utility-like. Also note that the high and low forecasts for each year are in an incredibly tight range. The historical performance and the expected future performance reflect little volatility. Like a utility, BWXT’s business lends itself to well-above average confidence levels in forecasting the future. A high degree of confidence opens the door to a high valuation multiple.

I have highlighted in yellow the number of analysts covering BWXT. This is important in that the company is not widely followed and is relatively unknown to most investors. The lack of coverage is a risk from the perspective of investor interest, trading volumes, and potential momentum. The upside is that the lack of coverage and market interest fosters potential mispricing in the shares and creates incredible upside potential should interest in the company begin to pick up. The small market value and share count (94 million shares) of BWXT could create an explosive supply and demand imbalance.

Valuation of the Core Business

BWXT consistently produces excellent profitability which behaves similar to its revenue performance. Much of this has to do with the long-term contract nature of its work and especially its work with the US government. The contracts contain inflation adjustments and cost-sharing which helps to smooth BWXT’s profitability long term. Again, BWXT has similar characteristics to a regulated utility on the profitability front in this regard.

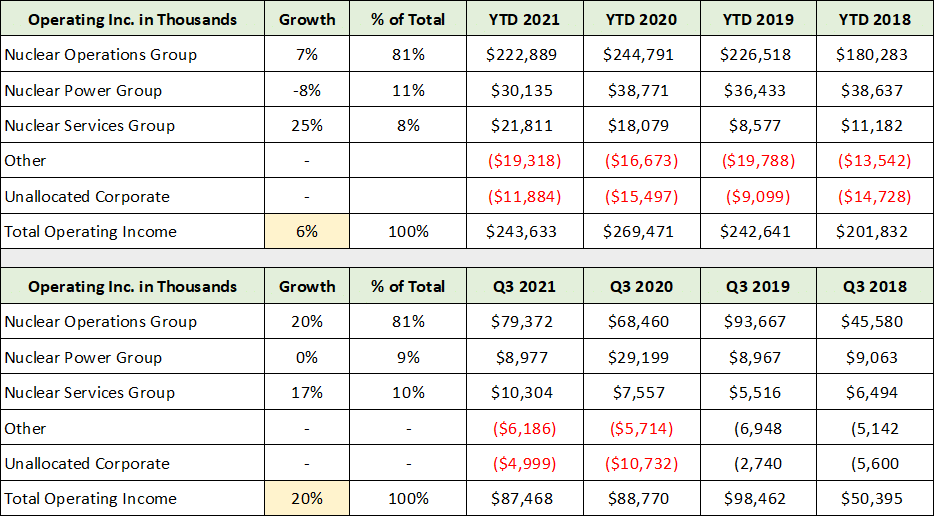

The following table was compiled from BWXT’s Q3 2021 10-Q and Q3 2019 10-Q filed with the SEC. The top section displays BWXT’s operating income through the first nine months of each year while the lower section depicts the Q3 operating income for each year.

Source: Created by Brian Kapp, stoxdox

BWXT’s operating income growth has averaged 6% since 2018 through the first nine months of 2021 (highlighted in yellow). Please note that operating income is more volatile from one period to the next as can be seen by the 20% annual growth rate for Q3 alone since 2018 (highlighted in yellow). This is not unusual given the long-term contract nature of BWXT’s work and the accounting complexities that arise as a result. The 6% annual growth rate is similar to the revenue growth rate. I see no reason for this not to be the case across longer time frames going forward. The following table was compiled from Seeking Alpha and displays the consensus earnings estimates for BWXT.

Source: Seeking Alpha. Created by Brian Kapp, stoxdox

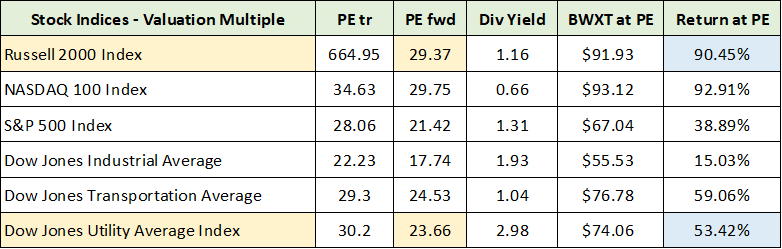

The estimates overall look to be realistic given past performance, current trends, and the company’s guidance. I have highlighted in yellow the year that may be too high of an estimate based on the company’s investor day presentation. I do not view this as a material risk. It is likely due to not fully capturing the depreciation expense kicking in for the company’s current buildout of its nuclear medicine infrastructure. The current PE ratio of 15 is well below the average valuation multiple in the market as can be seen in the following table compiled from the Wall Street Journal on December 8, 2021 (tr = trailing twelve months, fwd = forward twelve months).

Source: Wall Street Journal. Created by Brian Kapp, stoxdox

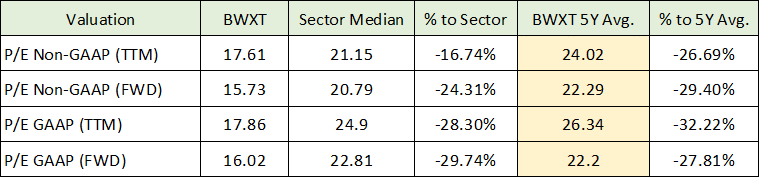

If BWXT were to be valued at these averages, the upside potential is between 15% and 90%. I have highlighted the most directly comparable market averages to BWXT in blue. The utility average index is the most economically similar group of stocks to BWXT’s business today. Due to this, I view the 53% upside return potential as the most reasonable estimate in the near term. This expectation is supported by BWXT’s historical valuation multiples as shown in the table below which was compiled from Seeking Alpha.

Source: Seeking Alpha. Created by Brian Kapp, stoxdox

I have highlighted in yellow BWXT’s 5-year average valuation multiple on various measures. These historical valuation multiples are in line with the current utility average price-to-earnings multiple of 23.66 which lends further credence to the 53% upside target.

Growth Opportunities: Nuclear Medicine

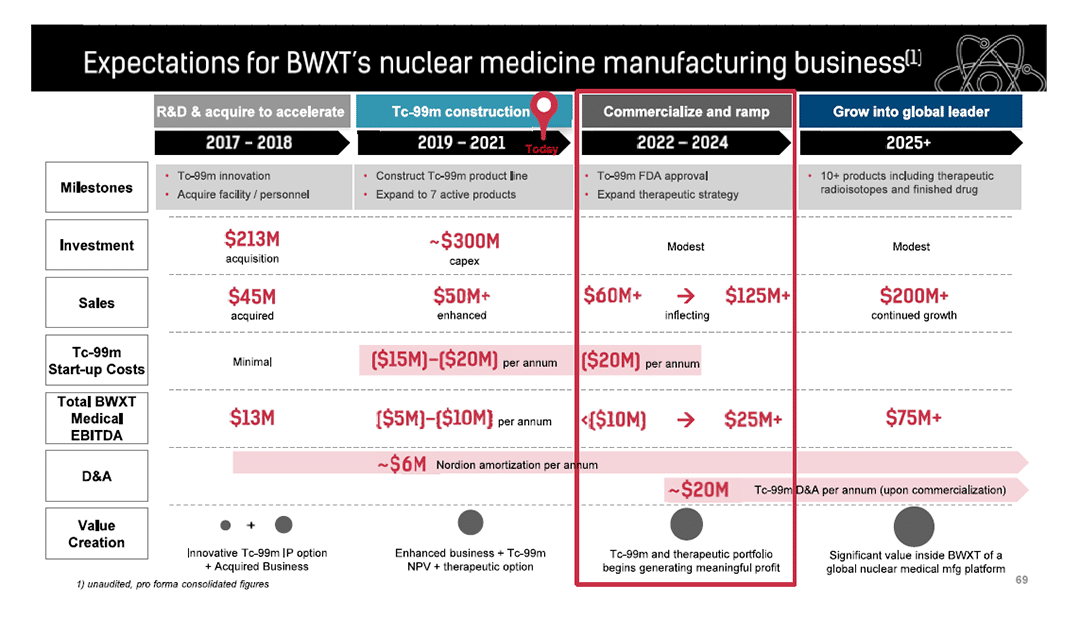

It should be noted that the earnings estimates through 2026 capture little of the growth opportunities in BWXT’s pipeline. The nuclear medicine growth opportunity is the most advanced with an estimated $50 million of revenue expected in 2021 or only 2% of total sales. The nuclear medicine group is expected to produce losses out to 2025 before producing strong profitability thereafter with economies of scale. Sales are expected to reach $125 million by 2025 which would register 36% annualized growth. The company then projects this to reach $200 million soon thereafter and become a powerful earnings contributor. The following slide from the recent investor presentation summarizes BWXT’s expectation through mid-decade.

Source: BWXT’s investor day presentation

The earnings growth outlook from 2025 onward looks to be well above BWXT’s historic growth rate with the nuclear medicine group hitting its stride in 2025. This is likely just the beginning of an excellent growth trajectory for the nuclear medicine business. The industry is expected to reach $30 billion by 2030. The expectations for the industry are summarized below.

Source: BWXT’s investor day presentation

BWXT estimates that the total addressable market opportunity is 20% to 30% of the total market or from $6 to $9 billion annually. With total company sales expected to be in the $2 billion area in 2021, this opportunity alone is over 3x the current size of the company. If BWXT reaches its target of $200 million in annual sales around the 2026 timeframe, it will have only scratched the surface.

Nuclear Medicine Detail

BWXT expects to generate EBITDA (earnings before interest, taxes, depreciation, and amortization) of $75 million from the nuclear medicine group when it reaches the $200 million sales target. This is $.80 per share on the current share count in the 2026 timeframe and is likely to grow at a rapid clip thereafter.

I view the 33% CAGR expected for the therapeutics side of the market to be a realistic growth expectation for BWXT’s nuclear medicine business in the second half of the decade. If this growth can be achieved, BWXT’s nuclear medicine business could reach $832 million in sales by 2030 and could produce $3.30 per share of EBITDA. This is substantial compared to BWXT’s current earnings power. The consensus estimate of $4.33 per share for 2026 is reasonable if not conservative in this light. There looks to be excellent visibility into reaching this 2026 milestone. The following slides provide further color around the company’s growth visibility.

Source: BWXT’s investor day presentation

Boston Scientific’s (NYSE:BSX) TheraSphere product shown in the top slide is an excellent example of the future growth opportunities in front of BWXT. The TheraSphere product highlights the potential of applying nuclear technology for targeted, personalized medical solutions. Nuclear technology applied to medicine creates an incredibly dynamic opportunity set.

In the next slide, BWXT’s Mo-99/Tc-99m process highlights the growth potential inherent in BWXT’s intellectual property. The following is how BWXT’s Mo-99/Tc-99m process breakthrough was described on May 8, 2018, by World Nuclear News:

Featuring a patent-pending neutron capture process, BWXT’s technology produces Mo-99, the parent isotope of technetium-99m (Tc-99m), which is used globally in more than 30 million medical procedures each year. BWXT’s process will produce Mo-99 from natural molybdenum, rather than enriched uranium targets, which the company says eliminates fission waste, reduces environmental impacts and eliminates proliferation risk.

These slides highlight how BWXT is leveraging its core competitive moat to expand into large commercial market opportunities. In 2021 alone, BWXT announced the Boston Scientific and Bayer agreements shown on the top slide, as well as a joint venture agreement to penetrate the Asian nuclear medicine market.

Growth Opportunities: Advanced Nuclear Technology

The largest long-term growth opportunities can be found in advanced nuclear technology. These include small modular reactors, mobile microreactors, earth and space nuclear propulsion, and advanced nuclear fuel. I’ll begin with a direct quote from the US Department of Energy in the article “TRISO Particles: The Most Robust Nuclear Fuel on Earth” (July 9, 2019):

There’s a lot of buzz around advanced nuclear.

These technologies are going to completely change the way we think about nuclear reactors.

More than 70 projects are underway in the United States with new designs that are expected to be more economical to build and operate.

Some of them will require a new fuel that’s tough enough handle the higher operating temperatures of these advanced reactors.

Enter TRISO fuel—the most robust nuclear fuel on earth.

On the advanced nuclear fuel front, BWXT is the sole large-scale, volume manufacturer of TRISO fuel in North America. Again, from the Department of Energy article on TRISO:

TRISO fuel testing is gaining a lot of interest from the advanced reactor community. Some reactor vendors such as X-energy and Kairos Power, along with the Department of Defense, are planning to use TRISO fuel for their designs—including some small modular and micro-reactor concepts.

I would encourage everyone interested in the future of energy to read to the entire DOE article. BWXT is in the pole position when it comes to advanced nuclear fuel design and manufacturing. This looks to be a step change in nuclear fuel safety, performance, and versatility, which opens the door to an explosion (no pun intended) of government and commercial use cases. While estimates are unavailable as to the potential size of the advanced fuel market, it is certainly quite large in relation to BWXT’s current $2.13 billion annual sales run rate. In July of 2020, BWXT received its most recent contract to expand TRISO nuclear fuel production.

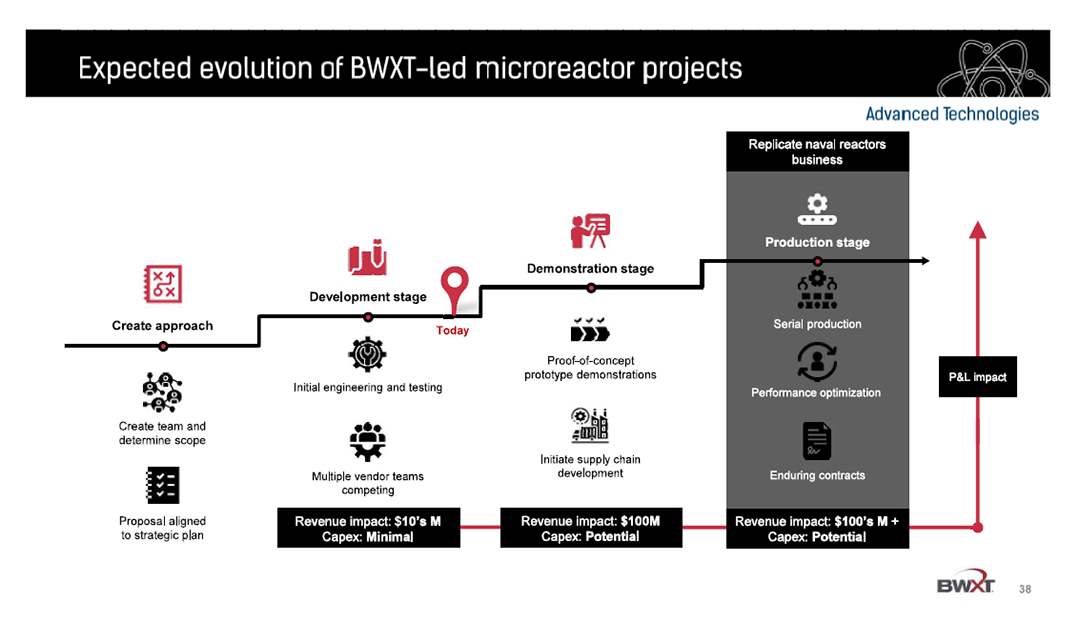

In addition to advanced fuel, BWXT is also competing across the entire advanced nuclear technology opportunity set. The following image presents the estimated timeline and stage of advancement for many of these opportunities. The most advanced opportunity resides in the design and manufacturing of mobile microreactors which are nearing the demonstration phase (the first opportunity in the slide below). All indications point toward a high likelihood of reaching volume production. BWXT estimates production could begin around 2027.

Source: BWXT’s investor day presentation

BWXT can win in this opportunity set as a fuel provider as well as in the design and manufacturing of the microreactors and components. Please note the “Potential # of units” column in the above slide. The mobile microreactor opportunity is the largest by volume of the four opportunities outlined above. It is critical to note that nothing in the above table is factored into BWXT’s financial forecasts.

One can easily envision the microreactor market becoming exceptionally large. The US government is slated to be the initial large customer well before commercial availability, based on pure national security grounds. BWXT’s competitive moat in the government market includes its credentials, security clearances, history, relationships, and capacity to execute at scale safely and competently in the field of nuclear materials and technology. These factors place BWXT at the front of the pack and should serve it well as the programs progress. The following slide provides greater detail on the microreactor opportunity.

Source: BWXT’s investor day presentation

BWXT is nearing the development stage of microreactors. If it secures wins for design and manufacturing in the microreactor market, $100’s of millions of revenue potential will be on the table around 2027. This one opportunity could quickly become similar to the size of the nuclear medicine opportunity that will be hitting full stride in 2025. The potential for contract wins in this realm in the near term could serve as a material catalyst for BWXT shares. For those interested, the most recent wins include: Department of Energy microreactor design project 12-23-20 and Department of Defense mobile reactor award 3-25-21.

Small Modular Reactors

The fourth opportunity listed in the first slide above, “Other applications,” includes SMR or Small Modular Reactors. This opportunity set is likely to be extraordinary as it will enable advanced utility-scale nuclear power nearly anywhere in the world. Safe and reliable modular reactors are a perfect fit for de-carbonizing the world’s electrical grid.

For example, TRISO fuel removes the nuclear meltdown threat while the new modular designs enable customization of size to meet the varying regional requirements. As mentioned in the CANDU discussion, Canada aims to have the first SMR connected to its grid by 2028. While the unit volume opportunity is smaller than the microreactor opportunity, the ultimate revenue potential from the SMR market is likely substantial in comparison due to the much larger size of each unit. BWXT’s industry position and competitive moat once again should serve it well.

The opportunity here is multifaceted featuring fuel, reactor and component design, and manufacturing. A notable example of the multifaceted opportunity set is BWXT’s breakthrough in additive manufacturing (3D printing) which could lower production costs while expanding BWXT’s product capabilities and the size of its market opportunity.

Space Propulsion and Power

The middle two opportunities in the first slide above include space propulsion and power. While these are smaller revenue opportunities in this decade, they are incredible long-term opportunities. From my perspective, it is self-evident that nuclear energy is required if humanity is to thoroughly explore and colonize the solar system. The energy-to-mass ratio is far superior to all other options thereby overcoming the gravitational constraints to widescale space exploration and settlement imposed by competing energy technologies. Nuclear energy’s reliability and longevity provide a perfect fit for space-based use cases.

The revenue opportunity in the space realm is unknown but could be extraordinary looking long term. It is highly likely that small production volumes will be achieved in the second half of the 2020’s if BWXT secures contract wins. There is potential for such announcements in the near term which could serve as a catalyst for the shares. One need only view the private valuation of SpaceX for confirmation of the ultimate value creation potential. For those interested, BWXT’s most recent contract win was announced in the following press release on April 1, 2021: “BWXT Awarded Additional Nuclear Thermal Propulsion Work for NASA.”

Technicals

BWXT’s investment case is well supported by its discounted valuation, the long-term visibility of its core business, and its excellent growth outlook for the second half of the decade. The primary challenge to the positive investment outlook for BWXT is the timeline of its growth pipeline. With growth scheduled to kick in from 2025 onward, BWXT’s financial performance over the next several years is highly likely to resemble that of a utility and therefore be unexciting.

This presents the risk that the shares do not price in the growth opportunities until we get closer to 2023 or 2024. On the other hand, much of today’s growth stock universe trades at extraordinary valuation multiples. As a result, there is a high probability that the market rotates toward value stocks, which would favor BWXT.

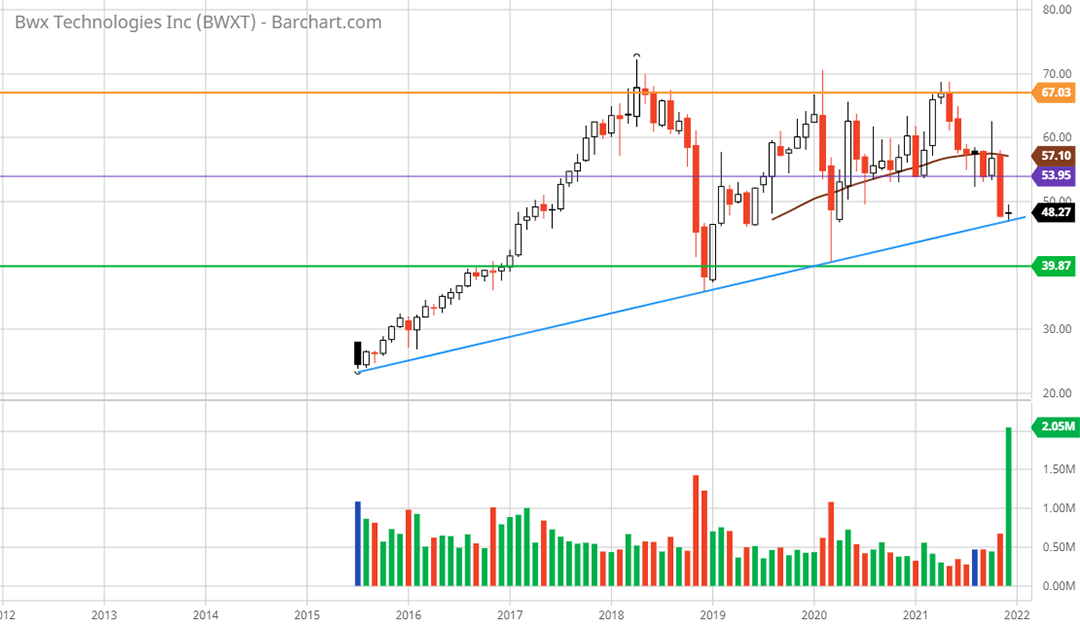

Technical analysis should provide valuable information regarding the timing of an investment in BWXT. The 10-year monthly chart below provides a bird’s eye view of BWXT’s technical situation. I have highlighted the primary support and resistance zones with horizontal lines.

BWX Technologies 10-year monthly chart. Created by Brian Kapp using a chart from Barchart.com

BWXT came public in 2015 when it was spun out of Babcock & Wilcox (NYSE:BW), which was founded in 1867. After the initial 3-year bull market into 2018, the shares entered what is now a nearly 4-year consolidation phase. The consolidation range has been capped near $70 on the upside (the orange line) with a bottom near $40 (the green line). At $48, the shares are trading in the lower third of this trading range and are sitting on the long-term uptrend line shown in blue.

It should be noted that the $48 area is near the monthly closing low during the COVID market crash in March of 2020. Additionally, the shares closed beneath $48 on a monthly basis on only one occasion during the current consolidation phase, in late 2018. In light of this historical monthly valuation bottom near $48, the case for accumulating BWXT shares around the current level is well supported by the technical backdrop.

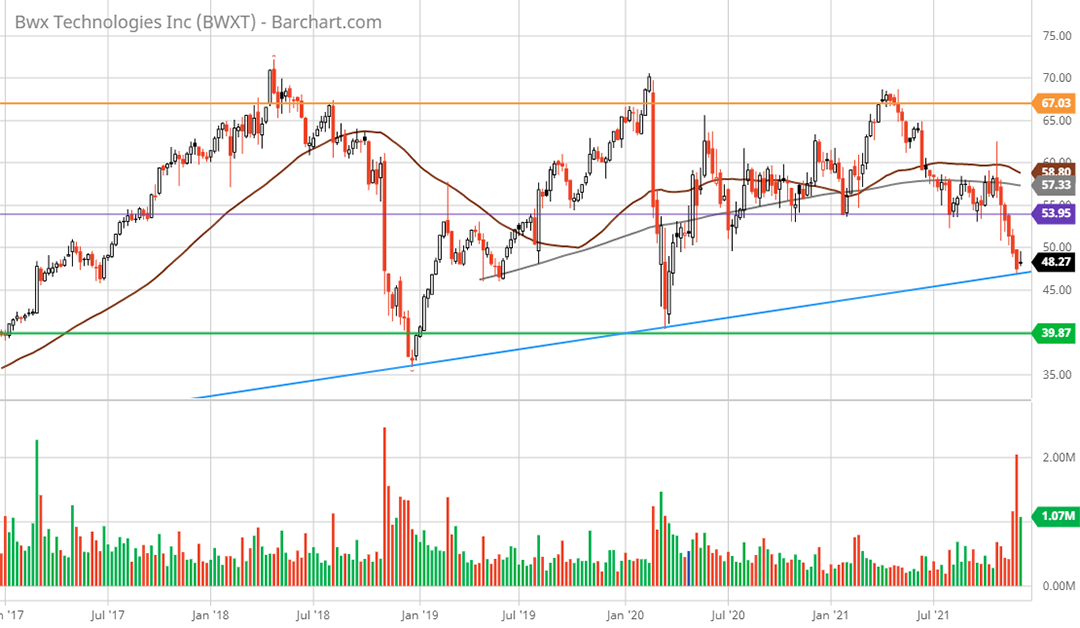

The purple line near $54 looks to be the central tendency of the consolidation phase and is likely to offer some degree of resistance. This resistance level is likely to be mild. Heavier resistance resides at the orange line near $67 which represents all-time high resistance. This area offers 40% upside which would coincide with BWXT trading at the same price-to-earnings ratio as the S&P 500. The following 5-year weekly chart provides a closer look at the key levels.

BWX Technologies 5-year weekly chart. Created by Brian Kapp using a chart from Barchart.com

Looking at the 5-year weekly chart, the BWXT consolidation phase has characteristics of an ascending triangle in technical analysis terminology. The blue line represents the ascending trend line. Ascending triangles carry a bullish interpretation which lends further technical support for accumulating the shares. The mild upward slope also suggests that patience is in order as a potential upside breakout does not look to be a threat in the short term. The solid technical case for $40 as a low-end target (the green line) supports a positive risk/reward rating as this would represent 17% downside potential. The most likely nearer term upside potential of 53% is quite attractive in comparison.

Summary

The positive risk/reward asymmetry for BWXT’s shares gives no consideration to the multitude of growth opportunities outlined above. The visible growth opportunities represent many multiples of BWXT’s current business which points toward significantly larger upside potential than what is estimated here. Furthermore, the visible growth opportunities do not capture the full upside potential as the innovation spectrum in nuclear technology is vast and dynamic. BWXT offers a unique investment opportunity. The investment case is supported on the downside by its wide moat, utility-like core business. While the upside is unbounded due to BWXT’s leadership position at the forefront of the nuclear technology renaissance.

Price as of report date 12-7-21: $48.27

BWX Technologies Investor Relations Website: BWX Technologies Investor Relations